As of May 21, 2025, XRP was trading at $2.35. Tokens have soared more than 300% since November 2024, making it one of the best performing altcoins in 2025. However, recent price action has shown slight volatility, with XRP fluctuating between $2.30 and $2.40 in a narrow range.

The positive development of XRP on 5/2025

May 2025 brought a wave of favorable news for Ripple and XRP tokens. The Securities and Exchange Commission (SEC) agreed to reduce Ripple’s fine from $125 million to $50 million, formally concluding the lawsuit that began in 2020 and confirms that XRP is not considered safe in the United States.

The legal solution removes the major pending of tokens, restores investor confidence and paves the way for new investment products related to XRP.

After the announcement, market commentators immediately speculated when the launch of XRP-based ETFs is now, especially when it is effective, especially when the green light of valid identification is available. It is worth noting that financial giant Blackrock has held a meeting with the SEC on XRP ETF application.

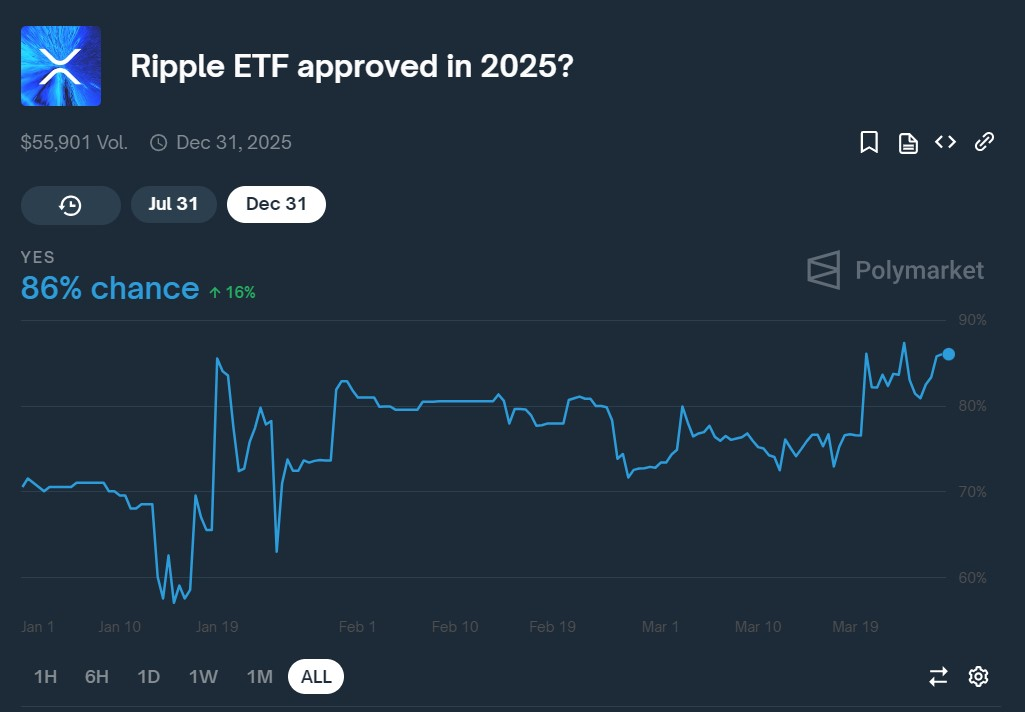

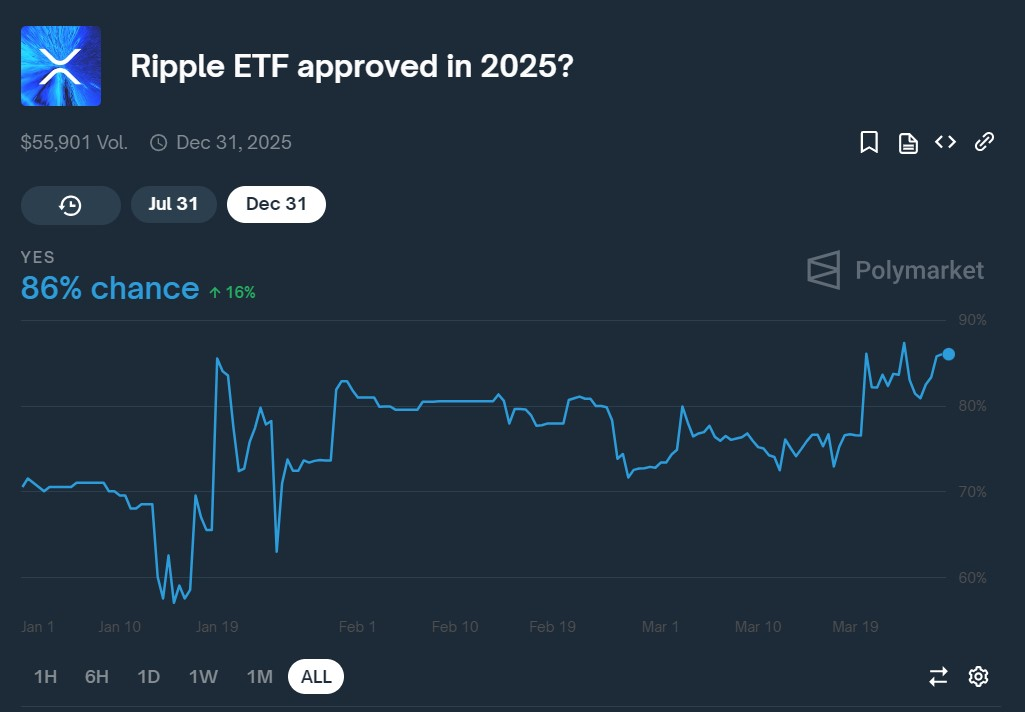

Some XRP ETF proposals have appeared in major institutions such as Franklin Templeton, Bitwise and 21shares. Current market sentiment shows that at least 80% of these applications will be approved in 2025.

Source: Polymarket

Meanwhile, Ripple’s global ecosystem continues to expand. In March 2025, Ripple partnered with Chipper Cash, a leading fintech company in Africa, to incorporate ripple payments into its remittance infrastructure, making cross-border transactions across Africa faster and more affordable.

By mid-May, Ripple has teamed up with Digital Bank Zand Bank and Fintech Company Mamo to announce a new blockchain-based payment service in the UAE.

Read more: Trading with free encrypted signals in the Evening Trader Channel

To sum up, the combination of legal clarity, institutional interests and real-world adoption has laid a solid foundation for XRP’s recent price rally.

Macro Analysis: Market liquidity and policy trends support bullish XRP prospects

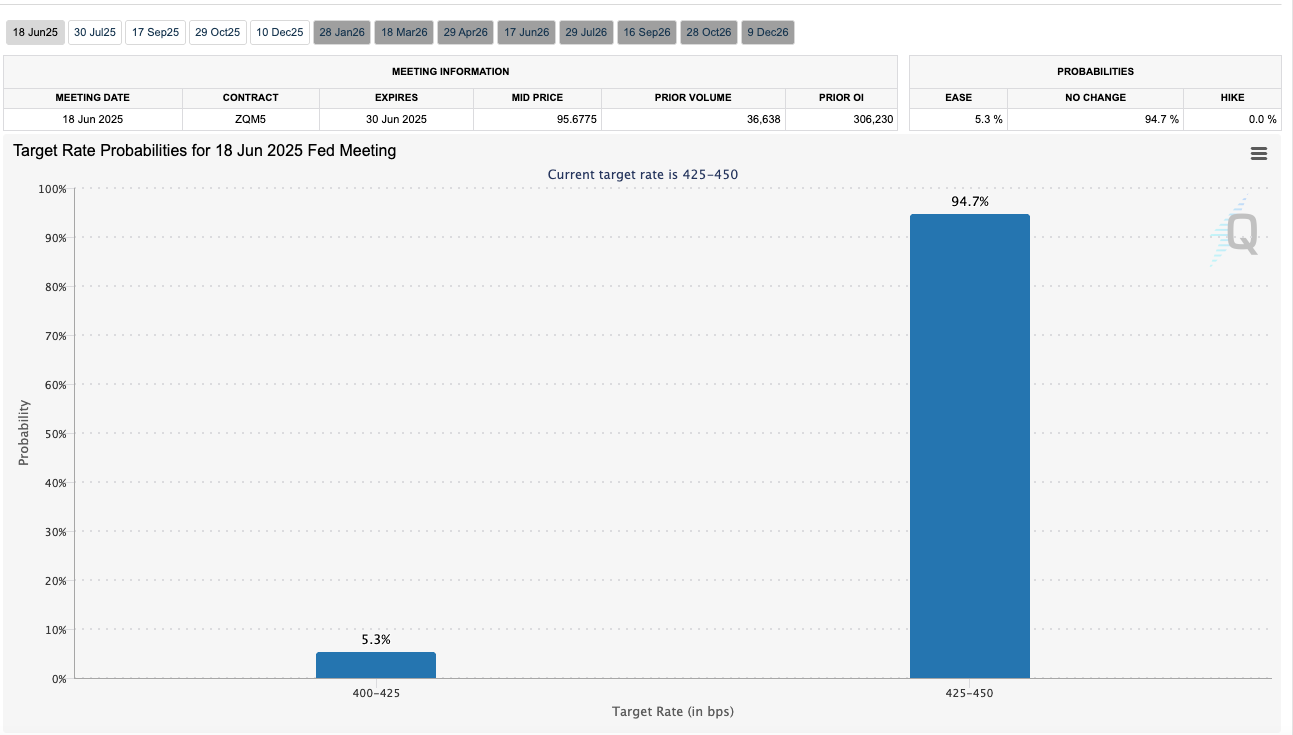

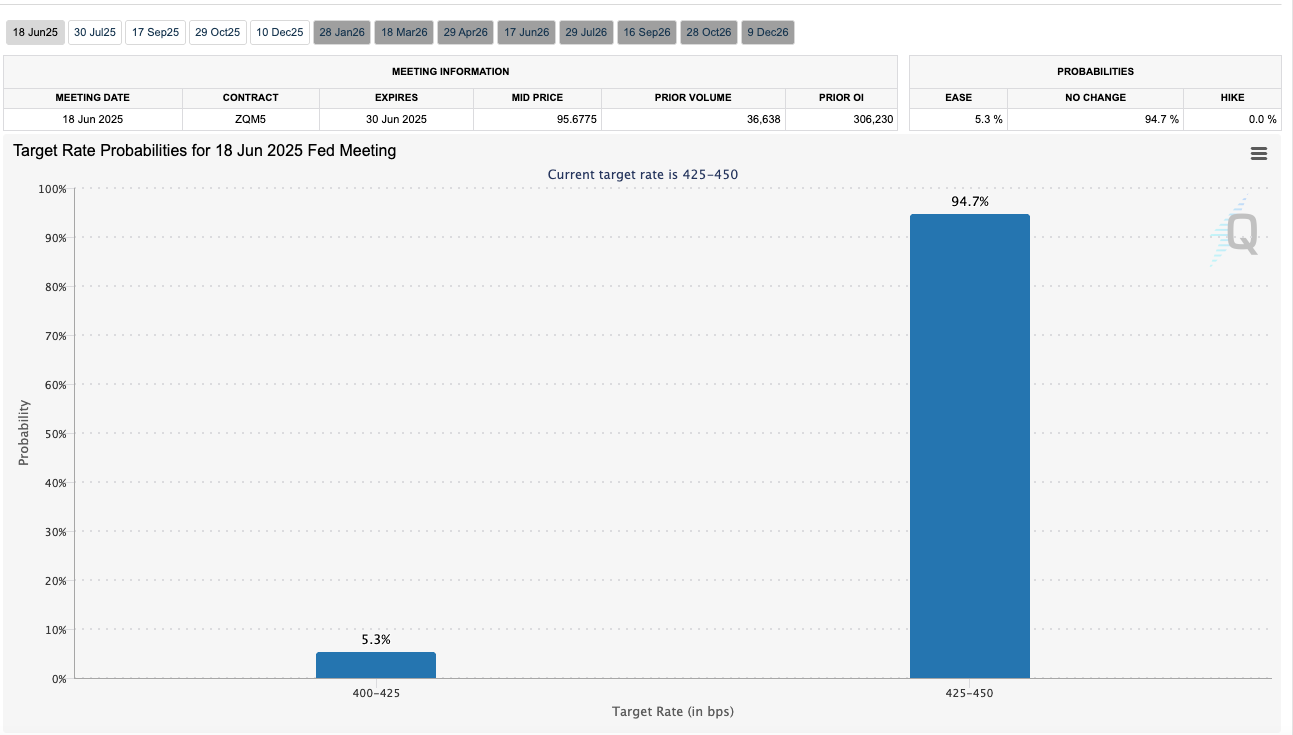

The current macroeconomic landscape is creating a favorable environment for the entire cryptocurrency market, especially XRP. In the United States, monetary policy is significantly less restrictive than the 2022-2023 tightening cycle. At the May 2025 meeting, the Fed decided to stabilize interest rates at 4.25%–4.50%, marking a “to be seen” approach rather than continuing to continue to grow.

Source: CME Group

As inflation cools and economic growth shows signs of slowing down, if that key economic indicator remains consistent, it is clear that the Fed may start to lower interest rates in the second half of 2025.

The cryptocurrency market has responded positively to the pause of rising rates. Risk appetite has remained intact, supporting the widespread recovery of digital assets. Bitcoin’s breakthrough has surpassed the historic 100,000 mark, coupled with the renewed enthusiasm around Ethereum, triggering what many call the new “Altcoin season” trend is storing a large amount of capital into leading Altcoin such as XRP.

Capital inflows XRP and other leading Altcoins – Source: Coingecko

In addition to interest rate and liquidity conditions, the crypto-global regulatory environment is becoming increasingly clear and constructive. Several jurisdictions in the Asia-Pacific and Middle East, such as Singapore, the UAE and Hong Kong – have introduced clear regulatory frameworks or publicly welcomed crypto businesses. This regulatory clarity is increasing institutional confidence and legalizing widespread participation with digital assets.

Especially for ripple, the shift to legal clarity is the main catalyst. It allows partner banks and payment providers to adopt and integrate XRP solutions without having to worry about legal risks. As a result, institutional capital inflows into XRP are on the rise, and many investors see it as a high-potential altcoin in the ever-changing macroeconomic and regulatory landscape.

Technical Analysis: Bullish Signals on XRP Chart

XRP demonstrated impressive technical strength throughout May 2025. As of mid-May, XRP’s binary trading was around $2.60, up more than 20% from last month’s growth and reached its highest level in a few months.

XRP decisively crossed the key resistance zone of $2.40, a breakthrough that was determined by XRP, which was previously the main upper limit for the price rally. The move, which exceeded $2.40, sparked strong buying activity backed by massive growth in trading volumes and confirmed the start of a new bullish trend.

There are now several technical indicators that support the bullish outlook:

- Support and Resistance: XRP currently remains above the critical support level. The latest support is $2.40, as the level has recently shifted from resistors to support. More powerful support will be close to $2.00, a key psychological place to stay within the wider market correction range. On the plus side, $3.00 is becoming the next psychological barrier, and a successful breakthrough could set the stage for a retest of the $3.40 phase. The move at the end of April exceeded $2.50, confirming the end of the last downtrend and opening the door for higher targets.

- Trading Volume: The market liquidity of XRP has increased significantly in recent courses. Every time XRP breaks down at a significant resistance level, trading volumes are well above average, indicating strong demand and growing investor confidence in bullish narratives. Open interest in XRP derivatives is also rising, indicating that new capital is entering the market in a bid to rise further.

- Moving Average (MA): The medium-term trend has become positive, as the 50-day moving average of XRP exceeds the 200-day moving average, which is the classic “Golden Cross” signal. XRP trades over 50-day and 200-day MAS, confirming a strong bullish momentum.

Source: TradingView

XRP price forecast in Q2/2025

Unless any unexpected adverse development occurs, the bullish momentum of XRP may extend into the coming weeks. By early June, the token could hit a price of $2.80-3.00, and soon thereafter it is $3.30 – $3.40 – which will bring it close to the annual highs seen earlier than 2025.

This projected price forecast range represents the current level of growth of approximately 25%–60%, which is a realistic goal when the convergence of legal developments, supportive macroeconomic trends and powerful technical signals. In the most optimistic case, XRP could even try to move towards a $4.50 cost, a key long-term resistance level.

Overall, the short-term outlook for XRP remains optimistic. Positive regulatory consistency, improved macro conditions, and bullish technical indicators position XRP as one of the most closely watched digital assets for the quarter.

Read more: SUI Price Forecast: Short-term Outlook