The cryptocurrency market is experiencing extensive rally today, with Bitcoin currently trading at about $109,413, up 3.76% on the day, while Ethereum hovers around $2,675, up 7.6% daily. Altcoins such as Solana ($158, +5.3%) and XRP ($0.64, +2.3%) are also climbing steadily, indicating widespread participation throughout the digital asset space.

As Bitcoin breaks past key resistance levels, analysts believe the market may be entering a new bullish phase, shaped by growing institutional engagement and changing global sentiment.

Institutional capital return

One of the most obvious catalysts behind today’s earnings is the recovery of institutional capital to crypto markets.

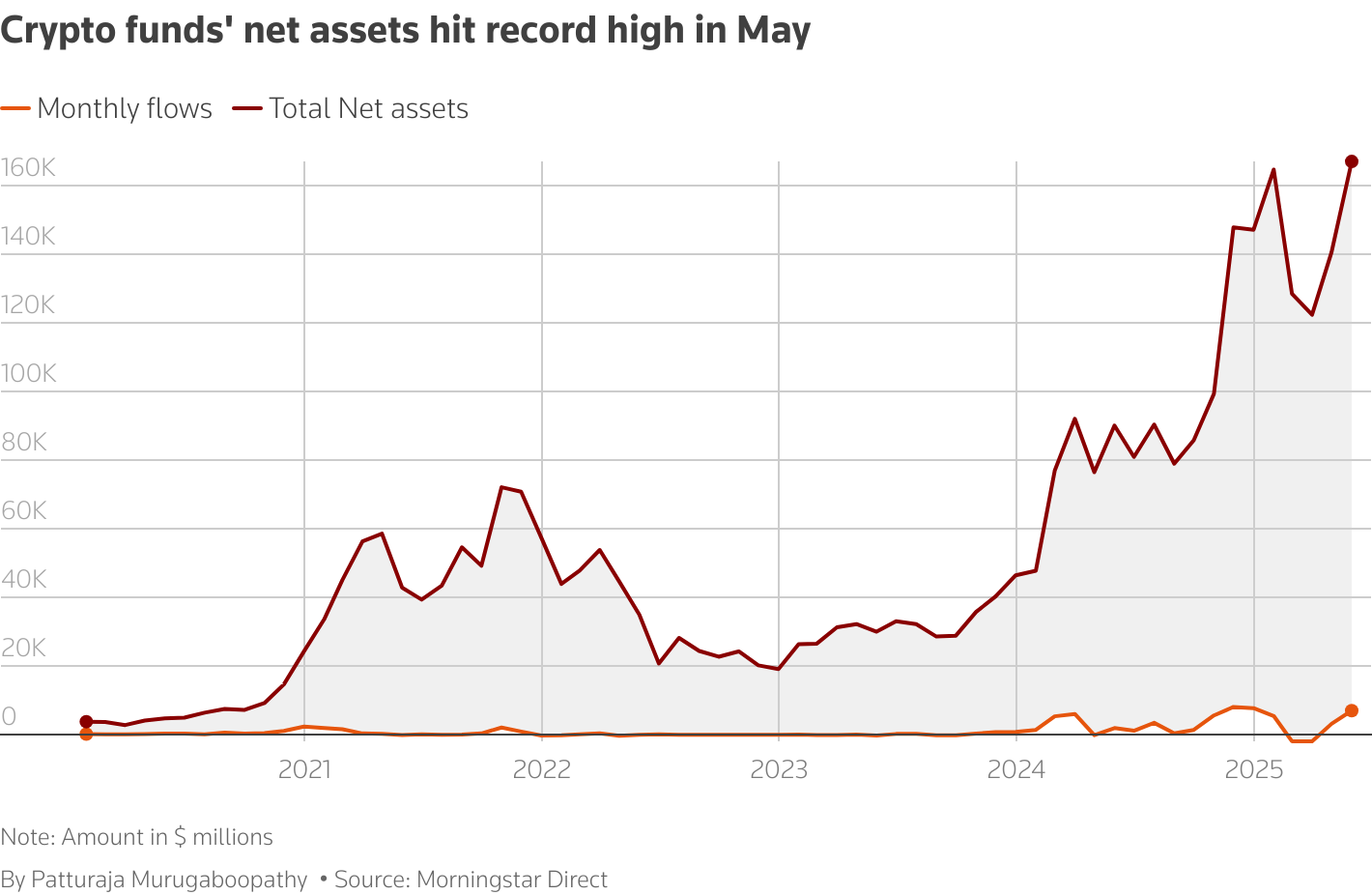

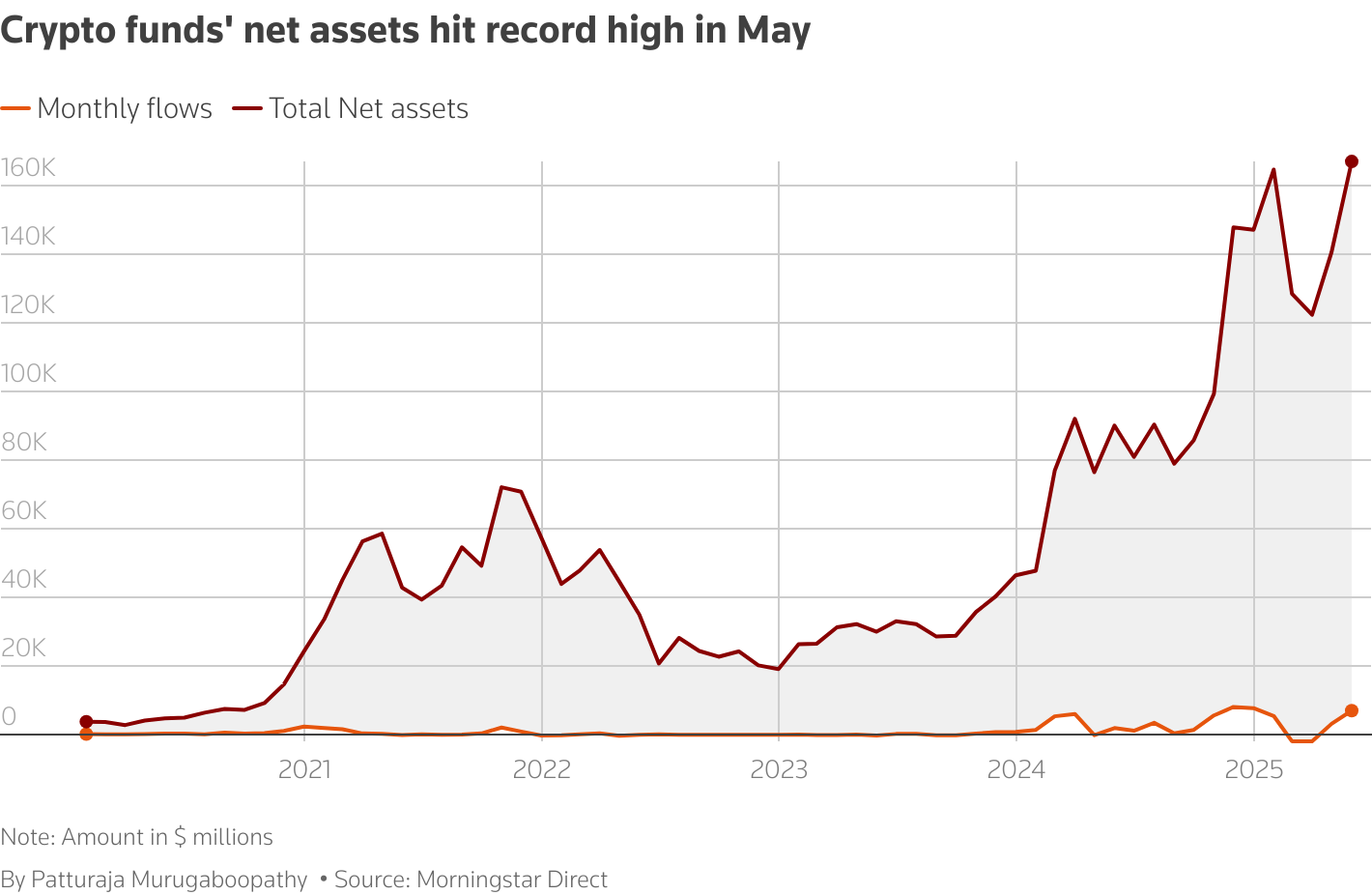

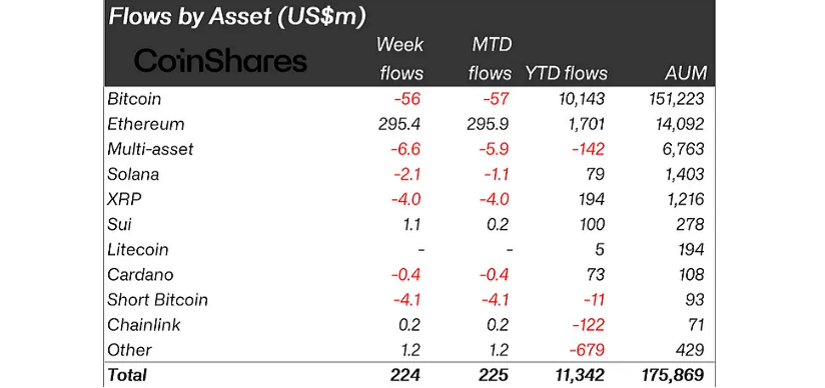

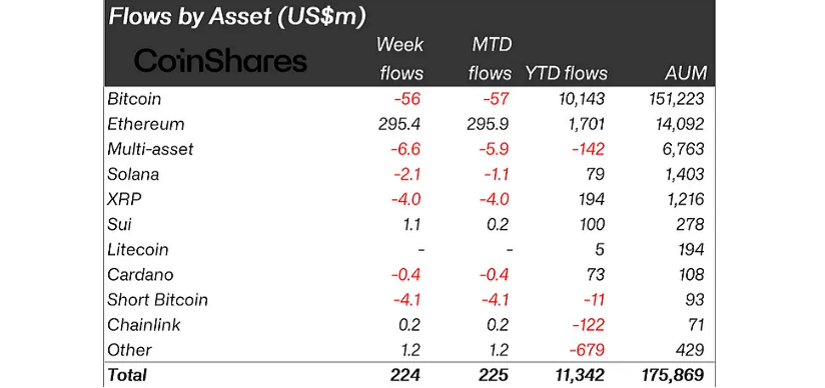

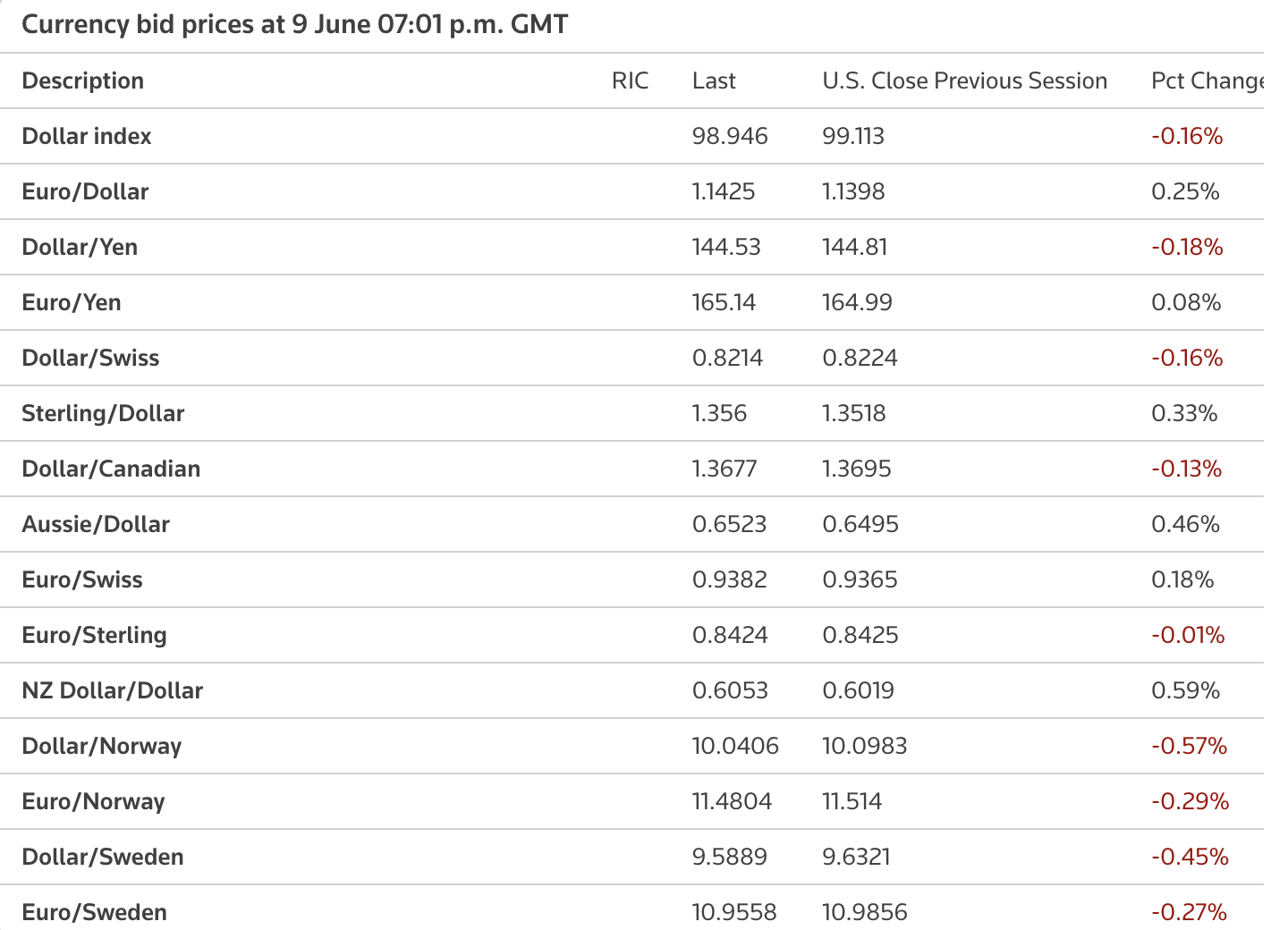

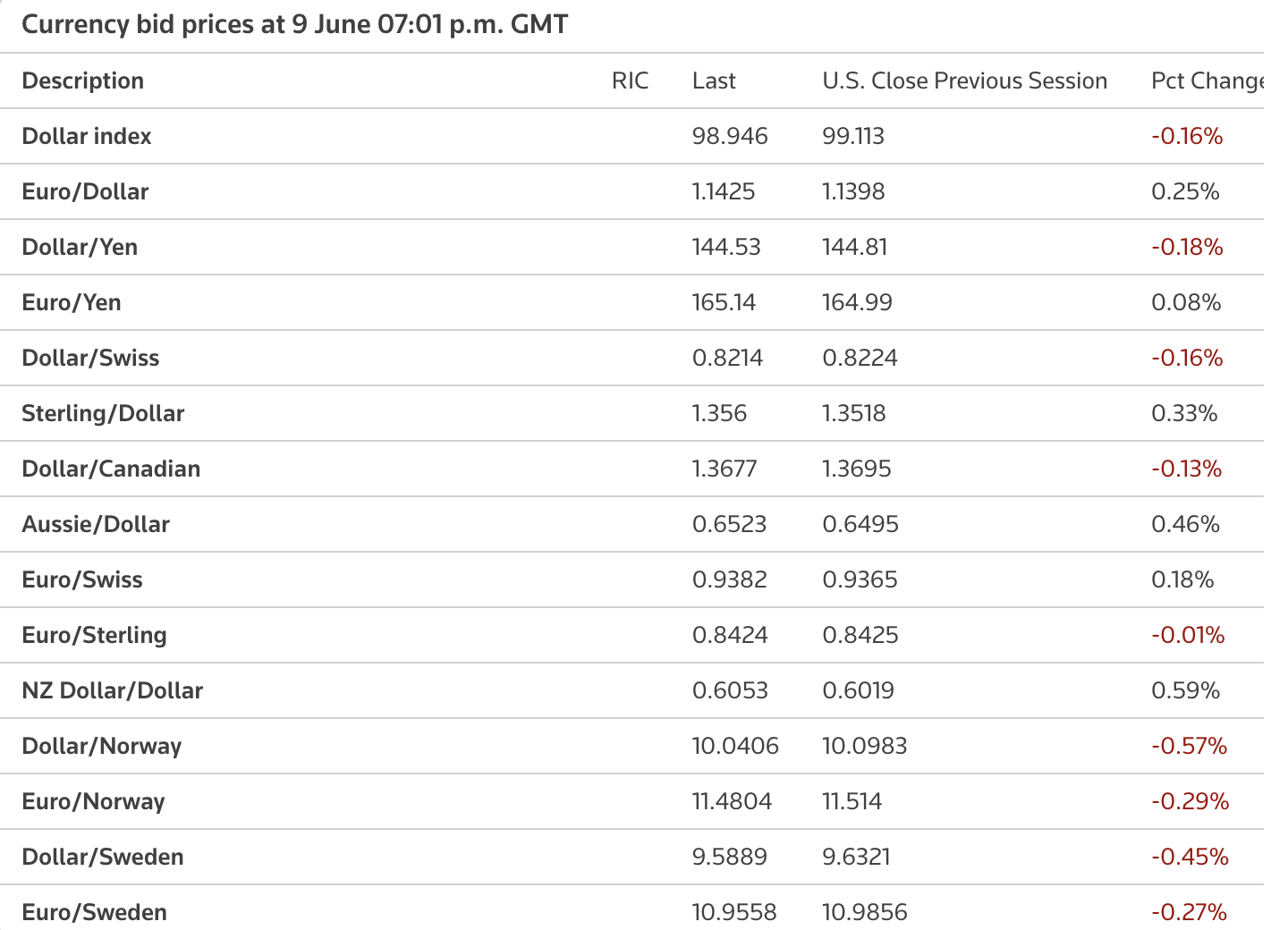

According to Reuters, assets managed by cryptocurrency funds soared to a record $167 billion in May 2025, due to net inflows of $7.05 billion, the strongest monthly inflows since the end of 2023.

Source: Morningstar Direct

Bitcoin-focused funds were in charge of $5.5 billion inflows, while Ethereum-based funds attracted $890 million. These inflows are largely attributed to the U.S. acceptance of on-site Bitcoin and Ethereum ETFs, providing traditional institutions with regulated vehicles to acquire cryptocurrencies.

Capital locked in ETF and institutional funds is usually more stable, reducing volatility and supporting price elasticity. The re-engagement of large capital allocators helps to increase sentiment and price floors of major crypto assets.

Technical signals confirm bullish momentum

Bitcoin climbed decisively $108,000, marking a technological breakthrough in which its analysts turned bullish. After a brief correction to the $100,000 range, BTC took back the key moving average, including its 10-day, 21-day and 50-day exponential moving average (EMAS).

Mudrex analysts pointed out that “high volume confirmation and liquidation-driven volatility” is a sign of structural sound rally. Before BTC rebounded sharply, the 106,500-level companies supported the company’s support.

At the same time, it is pointed out that negative capital rates, increased demand in spot markets and the bottom price model indicate that buyers have high beliefs.

Breakthroughs in the merged area often lead to momentum-driven purchases. The path seems clearer as the leverage ratio rushes out of earlier corrections, especially when macroscopic conditions are still favorable.

Easing trade tensions and inflation

Today’s market strength is also consistent with improving global macro conditions. The U.S.-China trade negotiations have made a positive shift, thus reducing risk sentiment in the financial markets. In addition, cooling inflation data alleviates concerns about a positive currency tightening.

These conditions support risky assets, including cryptocurrencies, by encouraging investors to enjoy higher yields, higher volatile tools.

Several major crypto infrastructure players are making headlines. Circle, the issuer of USDC, saw its New York Stock Exchange debut triple, highlighting investor enthusiasm. Meanwhile, Gemini secretly proposed its IPO and expressed continued corporate confidence.

In the UK, the Financial Conduct Authority (FCA) is reportedly reviewing its ban on cryptocurrency ETNs for retail investors.

These developments reflect a broader trend in crypto-systems and their integration into traditional financial systems.

Public lists of regulatory recognition, infrastructure growth and success help legalize cryptocurrencies and encourage more conservative capital participation.

Gold has also rebounded strongly this year – more than 25% year-to-date and is currently trading nearly $3,330. This reinforces Bitcoin’s value narrative, especially as the rolling correlation between the two assets tightens. Although gold has attracted institutional capital seeking security, it has also historically coincided with new cryptocurrencies inflows, especially Bitcoin and high-stock Goat Mountain Coin.

Geopolitical tensions continue to have a shadow on global markets, with the Israel-Palestine conflict and the ongoing Russian-Ukrainian war exacerbating intermittent risk aversion.

The developments of these combinations – from macro headwinds to institutional dynamics – indicate increasing legitimacy and resilience in crypto ecosystems, even in occasional political and market volatility.

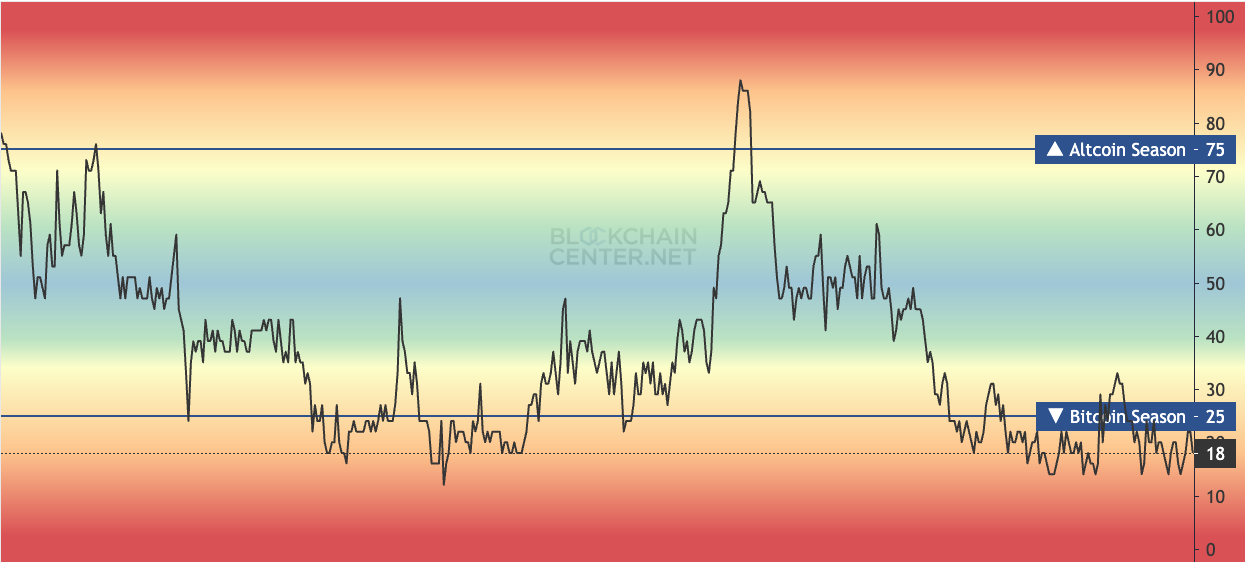

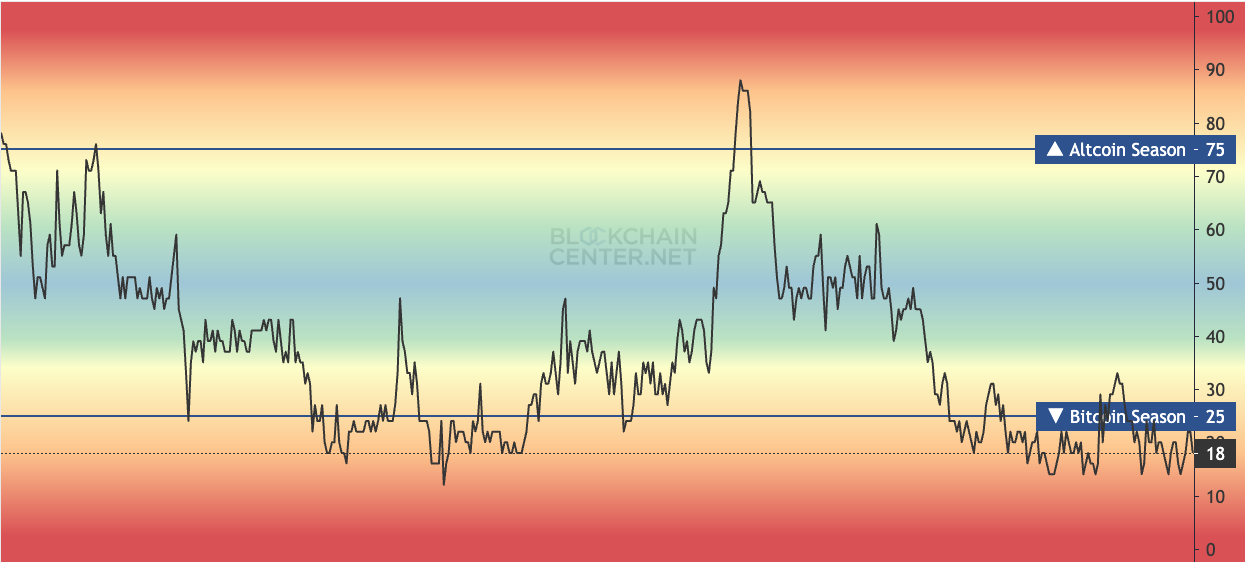

The return of high coin power and “altseason”

Altcoins are in the momentum as Bitcoin orders headlines. Solana rose more than 5% today, with Ethereum and XRP also making huge gains.

Historically, liquidity tends to flow into altcoins when Bitcoin stabilizes after a major move – a phenomenon commonly known as “Altseason.”

It is worth noting that the total crypto municipal cap, excluding Bitcoin and Ethereum (Ethereum), is currently forming the basis of a few-month low, suggesting that AltCoins may be in the early stages of a new upward cycle.

This “underground” structure, which combines BTC’s dominance and improved sentiment, enhances potential playoff cases in the coming weeks, especially as capital begins to spin to medium and low-cap tokens.

Source: TradingView

That is, despite the encouraging signs of current, such as increased inflows of altcoins and the growing growth in retail participation, the rally is still dominated by bitcoin. Mature alternatives will often see AltCoins beat BTC locally over a long period of time.

Source: Blockscholes

What drives this rotation is a broader theme: inflation hedging, institutional diversification, and investor rotation into high beta assets.

These factors are creating early momentum, but confirming the ongoing altcoin cycle will require a broader breakthrough behavior between medium and small tokens.

Currently, strong Altcoin performance is a signal to improve emotional and speculative appetite, but investors are still cautious about the announcement of the formal Altseason.

The key storyline that emerges in today’s rally is a shift in investors’ perceptions of cryptocurrencies. It is increasingly seen as a high-risk bet and also a portfolio component of diversification, inflation protection and long-term growth.

- ETF and regulatory clarity are providing a safer entry point.

- Infrastructure providers’ IPOs provide exposure without direct token risk.

- The adoption of Bitcoin and stablecoins by the Ministry of Finance is increasing.

These changes indicate a shift from hype to structured capital flows, shaping the next market cycle.

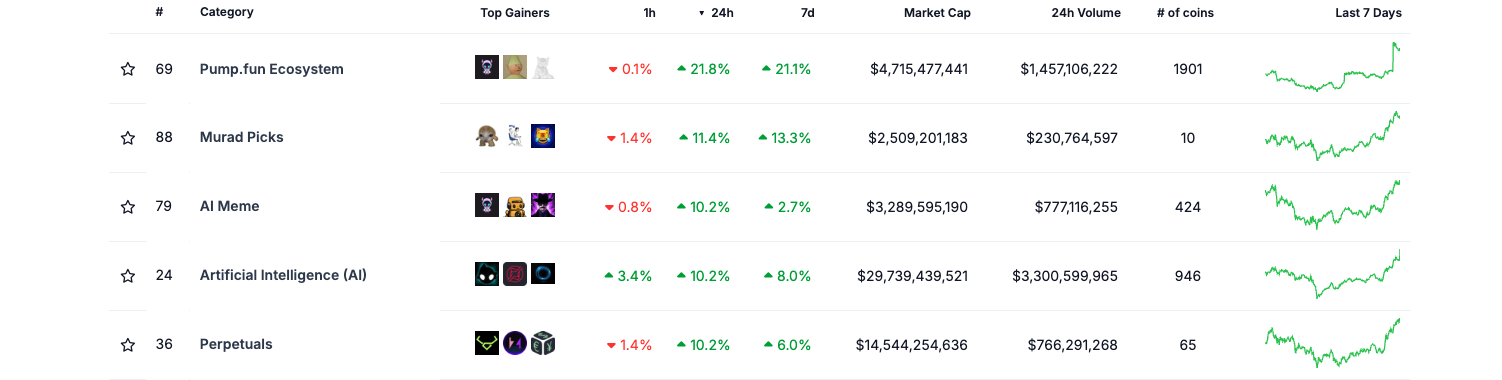

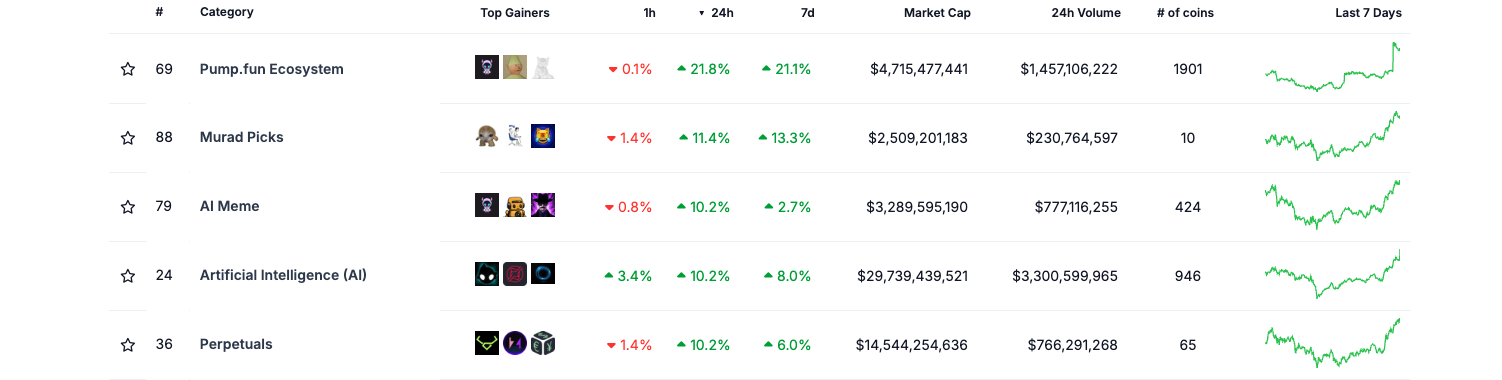

Narrative in Focus: Meme coins dominate, eternal steam

The outstanding narrative in today’s rally is the revival of meme coins. Overall, the tokens for the theme released double-digit growth in 24 hours, with strong trading volume and clear momentum. This performance reflects a new appetite for highly volatile, community-driven assets – driven by social media hype and viral trends.

Source: Coingecko

Despite its speculative nature, meme coins continue to be used as an early indicator of retail risk appetite. Their strong rebound this week suggests retail investors are re-entering the market in search of a fast upward opportunity.

Meanwhile, permanent narrative centered on a scattered derivatives platform also shows signs of power.

While less explosive than meme coins, the tokens in this field benefit from ongoing trader activity, increasing liquidity, and biased users’ attention.

This contrast highlights the market’s enthusiasm for balancing speculativeness with the adoption of infrastructure, providing short-term volatility and more solid long-term protests.

Read more: The Rise of People with Load-bearing Stable: Earn Passive Income