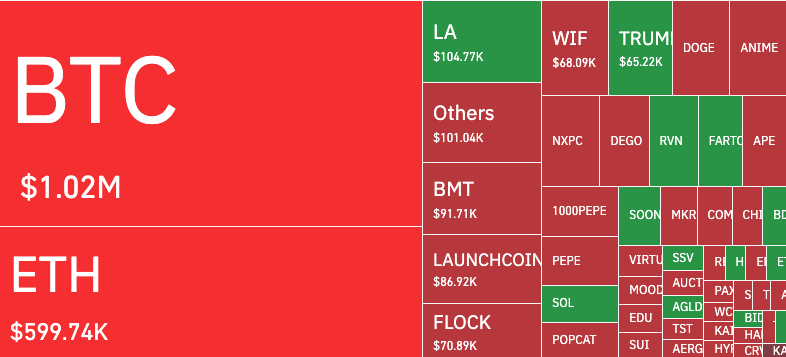

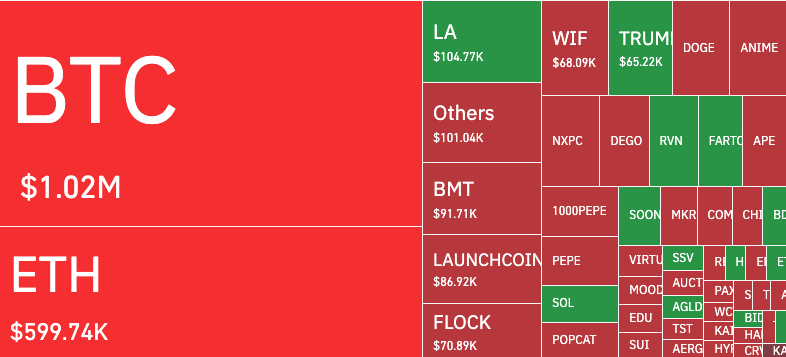

During early trading hours today, the cryptocurrency market faced a sharp decline, with Bitcoin (BTC) retreating to the $101,000 level and dragging the broader digital asset industry into the red. The core of the sell-off is the combination of political disputes, macroeconomic uncertainty and a wave of liquidation across leverage positions.

More than $308 million in cryptocurrency longs have been liquidated in the past 24 hours, one of the steepest liquidation events since April, according to Coinglass.

Bitcoin accounts for about $91 million of this figure, followed by Ethereum (ETH), with clearing volume of about $78 million.

Source: Xiaodian

Trump and Musk add fuel to fire

Market sentiment took a hit after an unexpected war of words between former U.S. President Donald Trump and Tesla CEO Elon Musk. During the Phoenix campaign, Trump criticized Musk for allegedly withdrawing from his previous political commitments. The tech tycoon responded quickly on X, calling Trump “unreliable and selfish.”

Although spitting may seem superficial on the surface, analysts believe that confrontation may complicate the political dynamics surrounding cryptocurrency regulation.

Both Trump and Musk have had a huge impact on the cryptocurrency market in recent years, and any instability in their relationship has brought uncertainty to investors.

“The market doesn’t like uncertainty, and the rift of Trump-Musk, especially both, could affect future crypto policies, which adds to the noise that investors are trying to price,” Adam Cochran, a partner at cinneamhain Ventures, said in an article on X.

Macro background and weak dollar strength

What increases bearishness is macroeconomic pressure. On Friday, U.S. employment data were stronger than expected, sparking concerns that the Fed could have longer interest rates. The dollar index (DXY) climbed to a one-month high, indicating a distance from risky assets such as cryptocurrencies.

“The dollar, BTC is weaker – this anticorrelation is going on as expected,” notes Noelle Acheson, author of the “Crypto Is Macro Now” newsletter. “We also have Treasury earnings climbs, which reduces the attractiveness of speculative assets.”

Source: TradingView

Traders are now preparing for next week’s Consumer Price Index (CPI) release and Federal Open Market Committee (FOMC) meeting, which could further determine the short-term trajectory of digital assets.

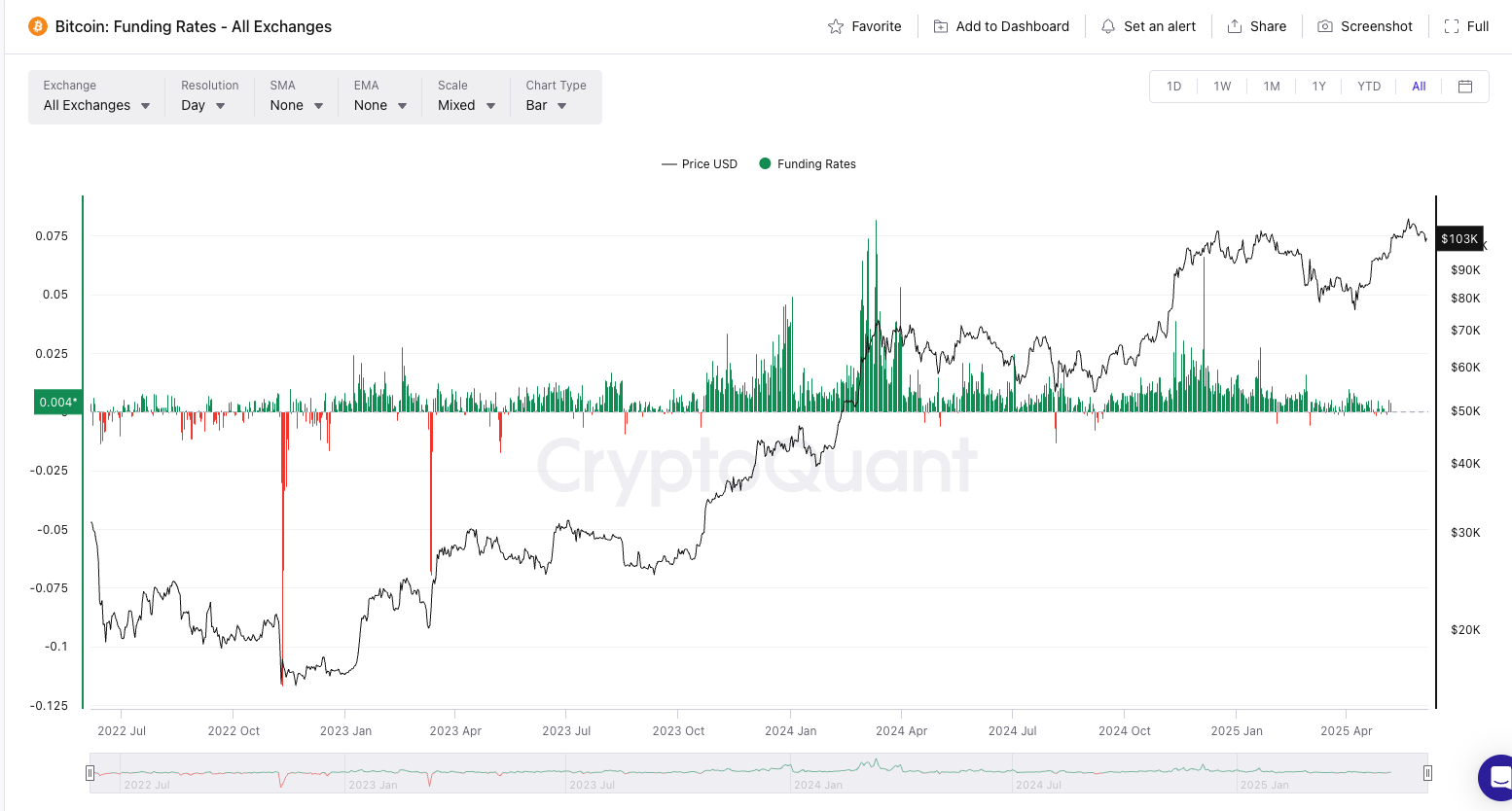

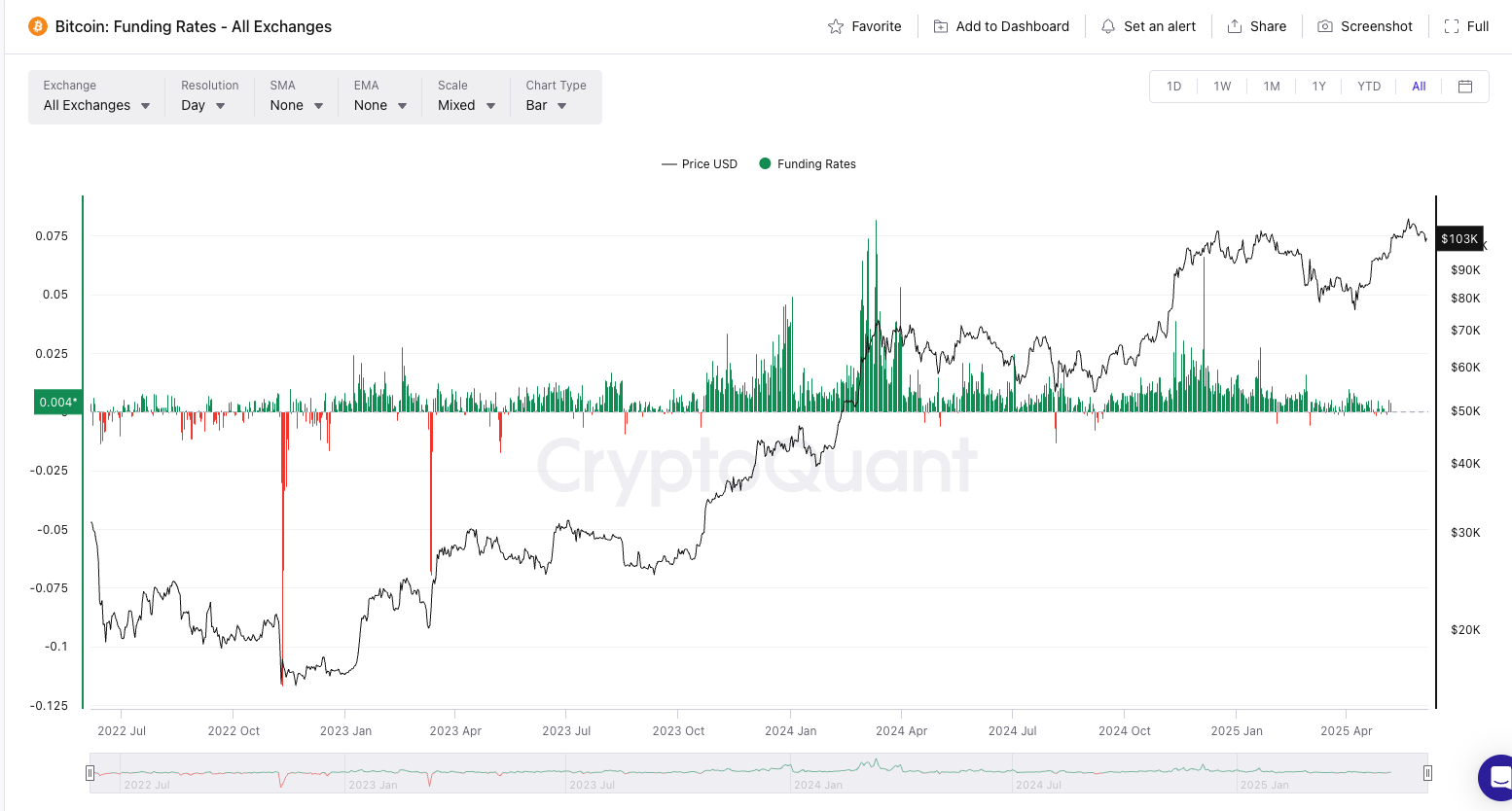

Bitcoin’s downturn also exposed the fragility of over-leveraged markets. Over the past week, the financing rate for permanent futures has been hovering unusually high, suggesting that bullish merchants are paying huge premiums to maintain long positions.

As prices drop to key support levels, cascading liquidation triggers additional selling pressure. The surge in forced relaxation positions, especially in Altcoins such as Solana (Sol), Dogecoin (Doge) and Pepe, all of which have dropped by double digits.

“When the funding rate remains higher and is ecstatic, even a slight shock can cause large fluctuations,” explained James Lavish, managing partner of Bitcoin Opportunity Fund.

Despite today’s shrinkage, some market players see corrections as healthy in the wider Bull cycle.

“It’s a shock, not a malfunction,” said CryptoQuant CEO Ki Young Ju. “We’re still seeing strong chain accumulation, no signs of exchange inflows from long-term holders.”

Source: Encryption

Others urged caution as volatility is expected to remain high by mid-June. Traders view $104,000 as support; analysts say breaking it could push BTC to $100,000-$98,000.

BTC Market Update

Technical analysts highlighted the $101,700 level as a key support area for Bitcoin. Earlier today, BTC decisively closed an 8-hour candle below this threshold, indicating a potential shift to a deeper correction phase.

After yesterday’s sharp drop, Bitcoin may try to recover to the $103,000 to $103,500 range in the short term. However, such a rebound could serve as a setting for new sales pressure, setting the next major support zone targets at $98,295, $96,250 and $93,350.

Meanwhile, Bitcoin Advantage (BTC.D) continues to climb and approach resistance at 65% levels – a historically cautious point for altcoin investors. The broader market index also shows signs of structural weakening.

The total market capitalization of cryptocurrencies is below the key level at $3.22 trillion. Analysts recommend backtesting at this level before dropping to $3.0 trillion and $2.86 trillion.

Similarly, a total of 2 (excluding Bitcoin) has dropped to its key support for $11.6 trillion. A brief retest could drop to $1.07 trillion, $1.04 trillion or even $1.00 trillion. Total 3, excluding BTC and ETH, are moving towards a critical support level of approximately $794.23 billion.

While some rebound may occur, analysts warn that it may offer only brief relief and caution to avoid taking a longer position in the current environment.

in conclusion

Today, the sharp decline in cryptocurrency markets emphasizes emotional vulnerability in an over-leveraged environment where a mix of political drama, macroeconomic pressures and cascading liquidation can quickly uncover bullish momentum. Trump-Musk’s conflict, while seemingly peripheral, is upset by investors at a time when regulatory and political narratives remain vital to the direction of the market.

Meanwhile, rising yields in the U.S. dollar and treasury continue to increase to weaken risk appetite. Technically, Bitcoin’s support signal potential below $101,700 is more in-depth correction, with the focus now around $98,000.

Read more: Trading with free encrypted signals in the Evening Trader Channel