Ethereum (eth) Through market value, the world’s second largest cryptocurrency has once again made headlines.

As of May 30, 2025, the closure of Ethereum (ETH) was approximately $2,676.27, an increase of 45% from the previous 30 days. Trading volume soared to $27 billion, according to Coingecko data.

Despite strong fundamentals, Ethereum retreats to $2,676

The callback, while notable, was worth more than 45% in just 30 days, following a multi-week rally. This short-term correction is not uncommon during a quick appreciation period and may indicate health benefits more than a reversal of the trend.

This decline also coincides with a wider cooling in the cryptocurrency market as the month-end rebalancing activity of institutional funding and has increased volatility ahead of the upcoming U.S. jobs and inflation data releases. However, unlike previous declines, triggered by regulatory uncertainty or systemic risk, this recent tendency for ETH seems to be more technical than the basic one.

It is also worth noting that extended upward momentum often leads to a temporary slowdown as traders begin to lock in profits. These pauses are sometimes considered setbacks, but can be part of a healthy market cycle that supports long-term stable.

Source: Coingecko

What makes this decline particularly noteworthy is that it occurs against the backdrop of the unusually strong structural growth of Ethereum. Institutional demand, engagement and on-chain metrics are all remaining robust – a signal indicating confidence in Ethereum’s long-term trajectory. Some market analysts even have potential accumulation opportunities, especially for investors who missed the recent surge, DIP is even composed.

Furthermore, Ethereum’s role as a load-bearing asset is growing – the gradual integration of its traditional financial system through staking and through ETF and derivative products is reshaping its market profile.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Peak of institutional interest

After the SEC approved spot ETFs, institutional interest in Ethereum emerged. Trading desks for companies such as Galaxy Digital and Bybit institutions reported a significant increase in large transactions, indicating coordinated buying activities by professional investors seeking ETH exposure in spot and derivatives markets.

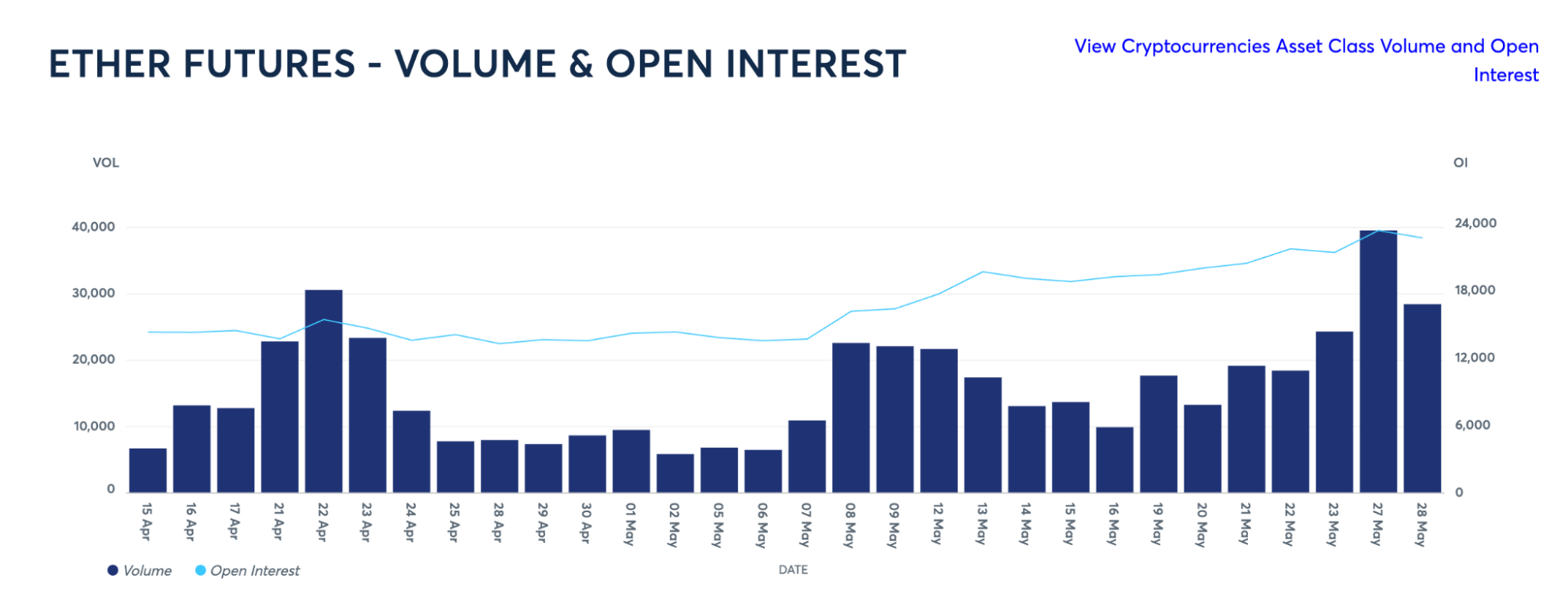

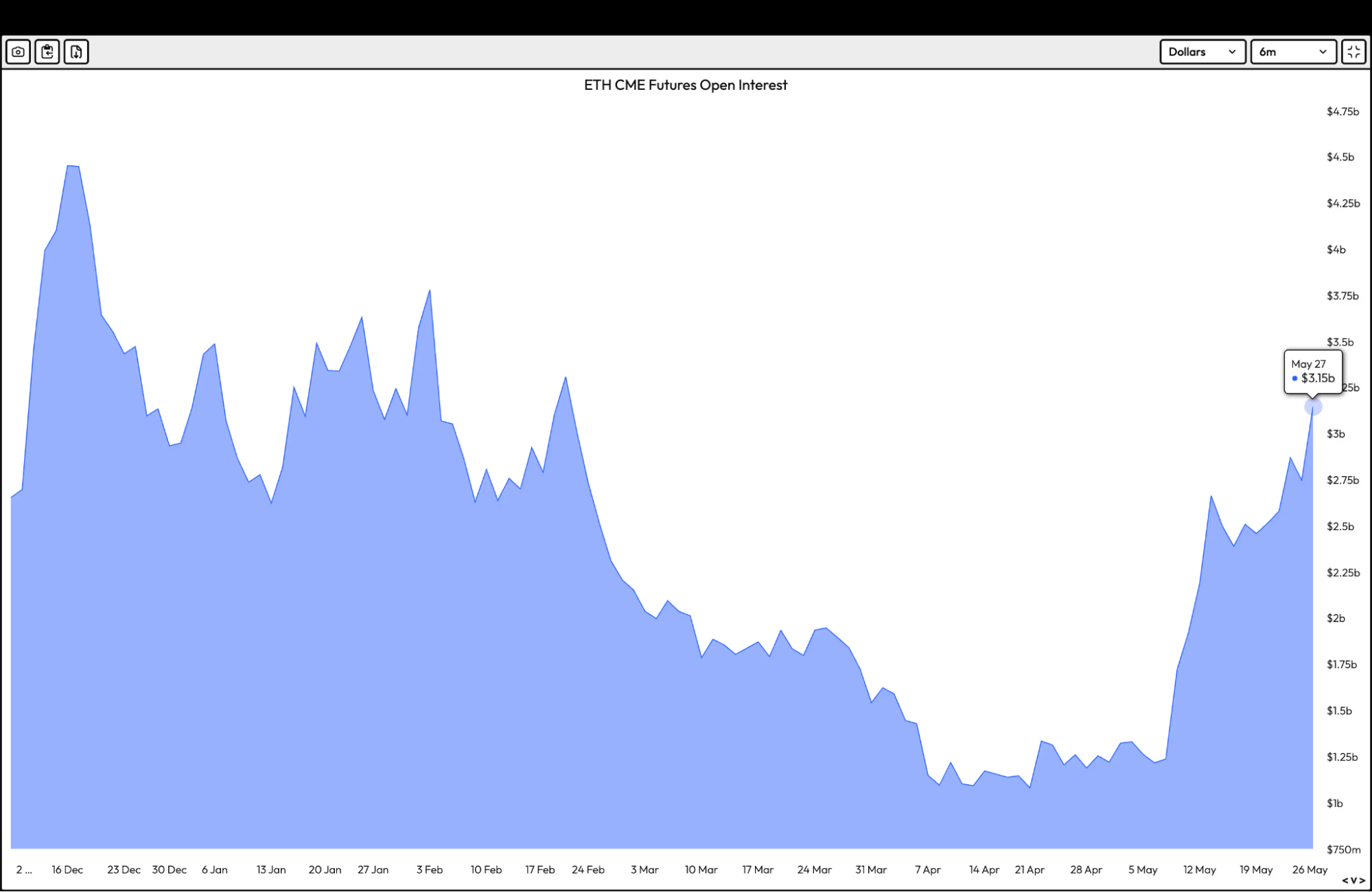

Public interest on Ethereum futures contracts listed on the Chicago Mercantile Exchange (CME) has soared to an all-time high of $3.15 billion – an increase of 186% since early April. This increase underscores the rising demand for institutional traders who are deploying ETH derivatives to integrate speculative positioning and structured hedging.

Source: CME Group

Although no clear confirmation of the transfer to Contango on the CME ETH futures curve was found, the rapid growth of futures activity and the rapid growth of open interest suggest that market participants are expected to appreciate further.

This coincides with the broader narrative of Ethereum, which matures into programmable and surrendered digital assets favored by long-term institutional capital.

Ethereum’s points and production indicators are strengthened

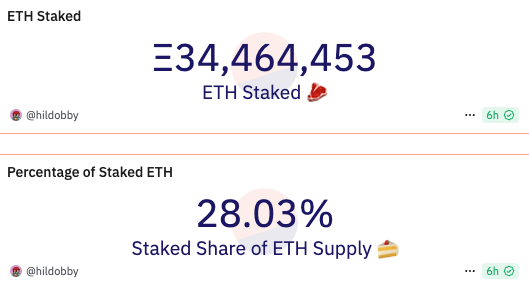

Discharge activity on Ethereum is still expanding despite recent data suggesting the need to adjust early assumptions. According to data from Chain Analysis, as of late May 2025, about 34.46 million ETH (about 28% of the total supply) have been locked in contracts.

This still represents a powerful signal of confidence among long-term holders who see Sting as a double benefit: contributing to Ethereum’s cybersecurity while earning passive income.

Source: Sand Dunes

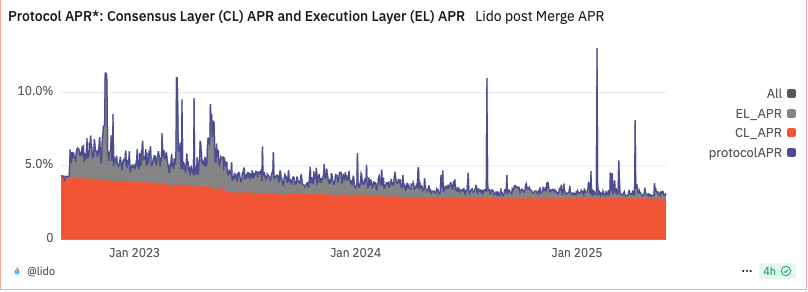

The current annualized points reward currently hovers around 3.0%, and in a softening of the global interest rate environment, ETH becomes an attractive option for investors seeking.

A decentralized put-in protocol remains at the heart of that growth. Lido Finance leads the market under its platform with over 9 million ETH, while Rocket Pool continues to gain momentum by offering decentralized and permissionless accumulating alternatives, expanding access to smaller holders.

Source: Sand Dunes

The continued development of the Ethereum stacking landscape illustrates how the generation of generation has become a pillar of the ETH value proposition – complementing its role in Defi, NFTS and infrastructure and enhancing the broader institutional appeal of assets.

Read more: ETH price forecast after Pectra upgrade in May

Reduce the speculation of macroeconomic signals

Ethereum’s latest price rallies will benefit from a more favorable global macroeconomic outlook. The U.S. Consumer Price Index (CPI) in April 2025 – the most recent available readings were 2.3%, down significantly from 2.3% year-on-year, down from 2.4% in March, lower than analysts’ expectations.

Although the core CPI, which excludes volatility food and energy prices, remained at 2.8%, widespread relief of inflation improved risk sentiment across the financial market.

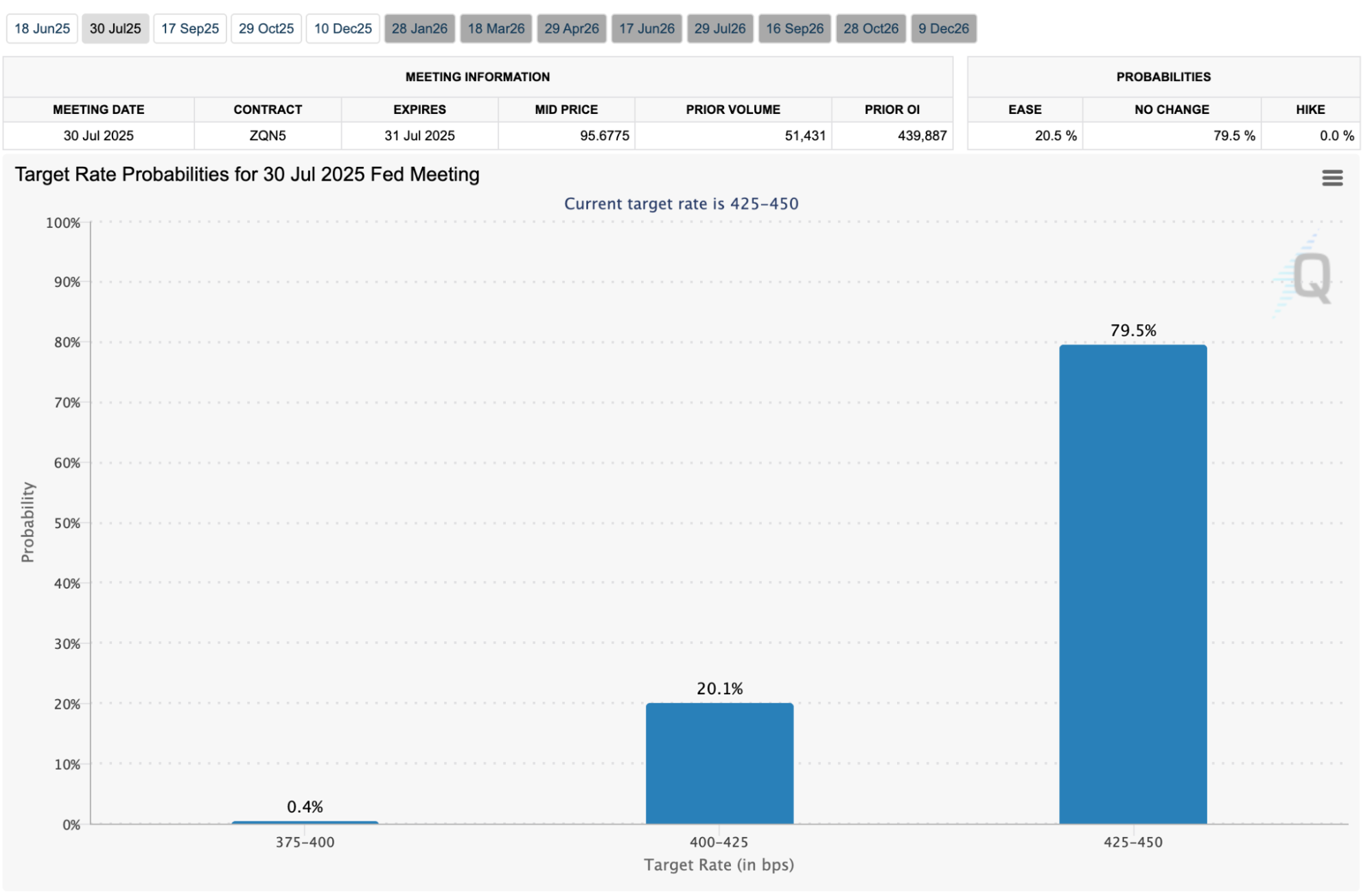

This cooling inflation has sparked speculation that the U.S. Federal Reserve may consider lowering interest rates later this year.

Although the Fed kept its benchmark rate in the 4.25% to 4.5% range during its early May meeting, several market participants are expected to have loose policies in the third or fourth quarter if dissolution continues and the labor market becomes softer. This expectation is a bullish on crypto assets that tend to thrive in a low-yield, liquid-driven environment.

Real yields on U.S. Treasury bonds have also been lowered, prompting institutional investors to seek higher returns in alternative asset classes. In this macro environment, Ethereum is regarded as a high-criminal for its local points production and its fundamental role in Defi and Web3. ETH’s production components and its programmable infrastructure make it an attractive to resist the stagnation of traditional fixed income instruments.

Globally, allegorical adjustments from central banks in Europe and Asia are strengthening a synchronous shift to a looser financial situation. This coordinated background improves the appetite for overall risk and leads to a strong inflow of crypto markets. Ethereum in particular has benefited from this macro tailwind, with increased ETF inflows and increased retail interest.

Whale accumulation, exchange flow and chain emotions

Glass Festival and Nansen analysis showed that whales had a sharp increase in accumulation. In the past two weeks alone, the number of wallets with over 10,000 ETH has increased by about 4%, with 13 new whale wallets appearing in a 24-hour window – an unusually aggressive spike. This shows that the strategic positioning of large holders expects further market upside potential.

At the same time, the net ETH exchange flow is decisively negative. Over $380 million in ETH has been withdrawn from centralized exchanges over the past week, the largest outflow in nearly two years.

This behavior reflects the firm belief of long-term investors as assets move towards cold wallets or storage agreements rather than retaining liquids for transactions.

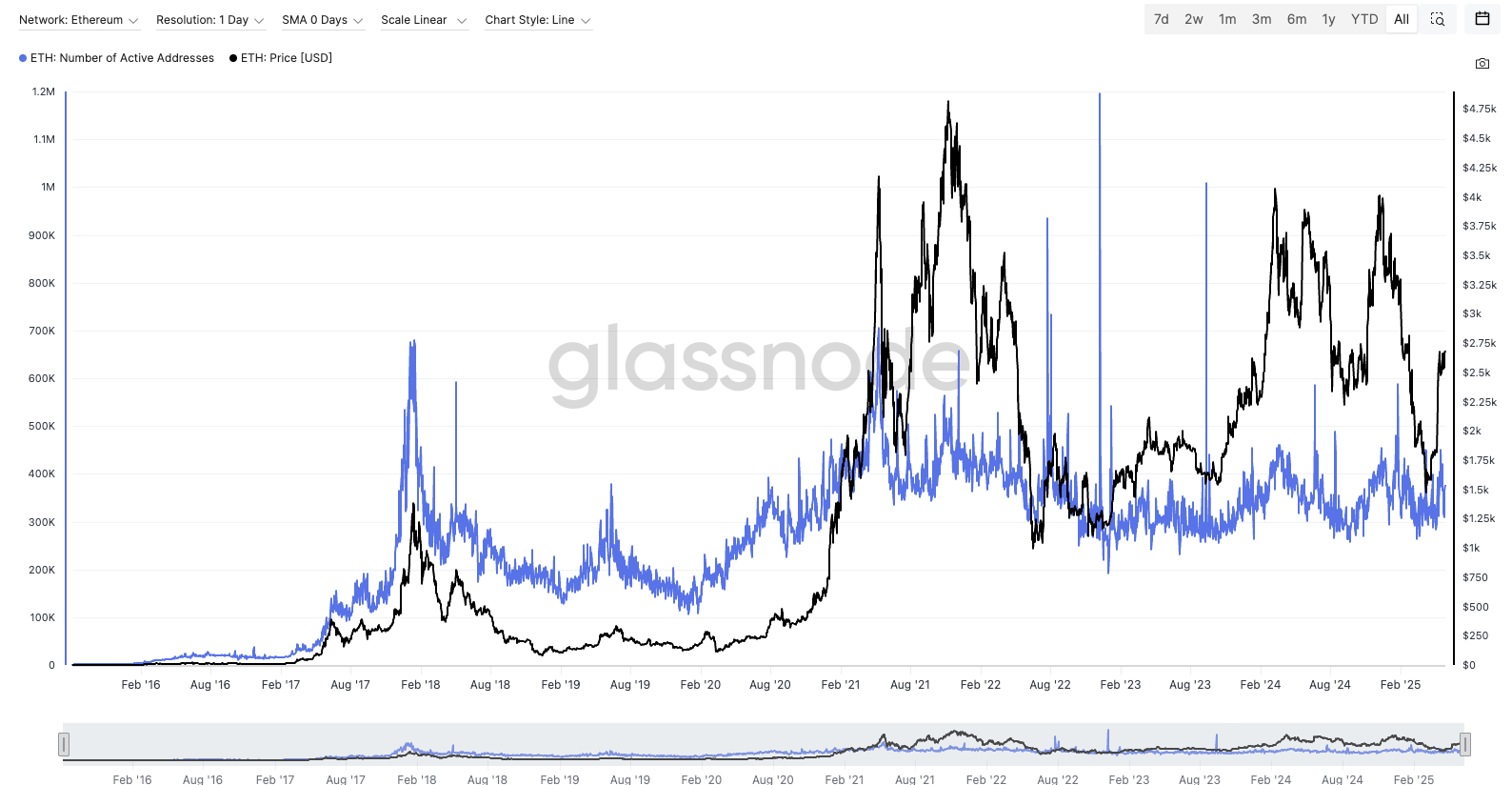

Chain activity has also accelerated. Daily active addresses soared to a 24-month high, reaching around 650,000 on May 17, 2025. The use of natural gas is also rising, indicating the growing demand for block space and interaction with smart contracts.

In addition, Ethereum now has more than 27 million addresses, with the remaining balance being non-zero, which is evidence of expanding network participation.

Overall, these signals form a bullish chain background. Capital inflows, increasing user participation and large-scale accumulation to enhance Ethereum’s upward momentum and market elasticity.

in conclusion

Ethereum’s current rally draws strength from several powerful drivers: regulators clarify ETF guidelines, institutions increase their inflows, chain-chain metrics show consistent growth, macro trends supporting risky assets, and developers accelerating innovation across the ecosystem. Unlike previous speculative rally, today’s growth narrative of ETH seems to be based on fundamentals.

Although some short-term volatility may occur as traders digest growth, Ethereum’s long-term outlook is becoming more and more optimistic. As traditional finance continues to merge with decentralized platforms, ETH remains the underlying asset for the next stage of digital financing.

Read more: ETH has not reached its peak yet: Signal missing before ETH really breaks out

Why did Ed drop today? First appeared on NFT night.