Bitcoin continues to hover above $100,000, and capital inflows to ETFs are also surging. At the moment, the biggest question in the crypto market is: “Will the Altcoin season really begin?”

The AltCoin season is defined as the period when AltCoins is superior to Bitcoin. Historically, the major Altcoin seasons took place in 2017 and 2021, which coincided with ICOS, DEFI, NFTS and Tier 2 solutions. Forbes.

At this stage, investment capital often shifts from Bitcoin to Altcoins, triggering price increases, especially for sales of large and medium-sized goats – as well as surges in trading volume and FOMO growth.

Bitcoin Advantages: Key Indicators

One of the most important indicators to determine the start of the Altcoin season is the Bitcoin Advantage Index (BTC.D), which reflects the market value of Bitcoin relative to the entire crypto market.

According to TradingView, BTC.D peaked at 57.8% in late April 2025, and then slightly retreated to about 55.2% in mid-May. As of now, TradingView reports that Bitcoin has a 63% advantage, significantly higher than the 51% level recorded in November 2024.

Source: TradingView

Benjamin Cowen, a well-known cycle analyst, said if BTC.D drops below 52%, “This may be a confirmation signal that the Altcoin season is ongoing.”

However, Cowan also warned:

“Not every step of the BTC advantage leads to the ALT season. What matters is new capital flowing into AltCoins, not just internal rotation.”

Capital flows and market sentiment

Coinshares data shows that investment funds have invested more than $14 billion in Bitcoin ETFs since the beginning of 2025. However, inflow eth Other AltCoins are still significantly lower, accounting for only 8% of total capital, reflecting the defensive mindset of institutional investors, who continue to prioritize it as the safest asset in the cryptocurrency space.

At present, the ETH/BTC pair is still in a long-term downward trend, which began at the end of 2021 with a grade of 0.065 antidepressant. This threshold is seen as a “confidence trigger”, which is the point where the market may begin to believe that Altcoins is ready to enter a strong upward cycle.

Without a decisive breakthrough above this level, confirmed by strong volumes and wider market traffic, even the rise in Bitcoin prices may not be enough to ignite the true Altcoin season. Essentially, Arte season requires more than just bullish sentiment BTCit needs Ethereum to lead the charges.

As of May 14, ETH/BTC hovered around 0.02 – well below the threshold required to confirm a trend reversal.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Source: TradingView

Quantitative indicators and on-chain data

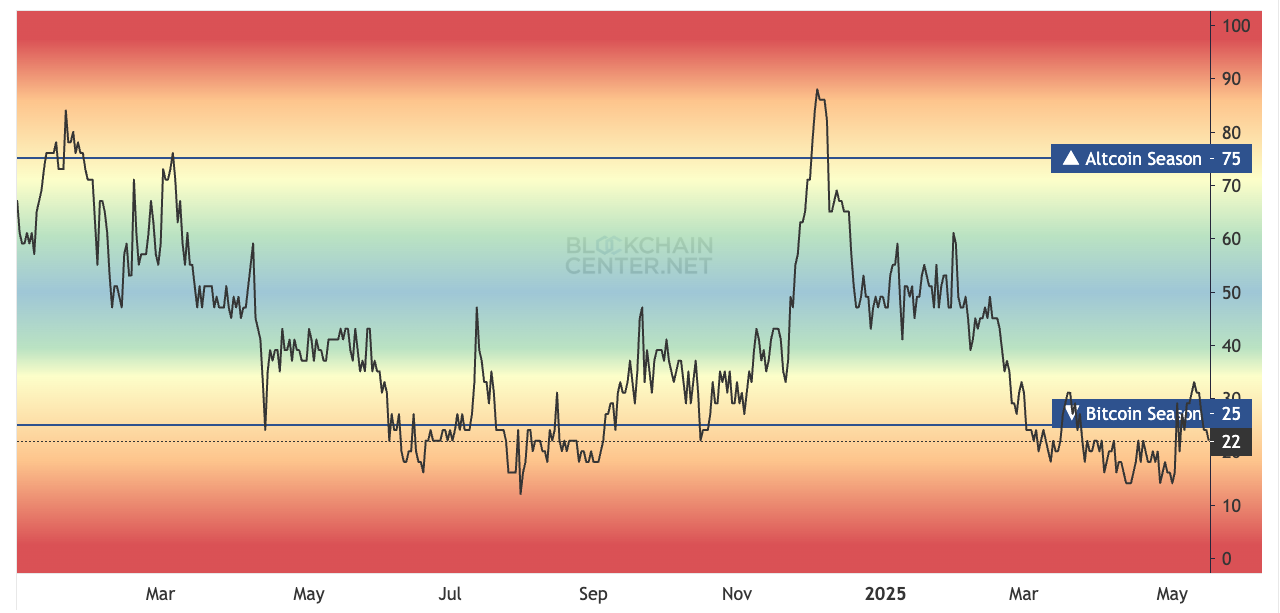

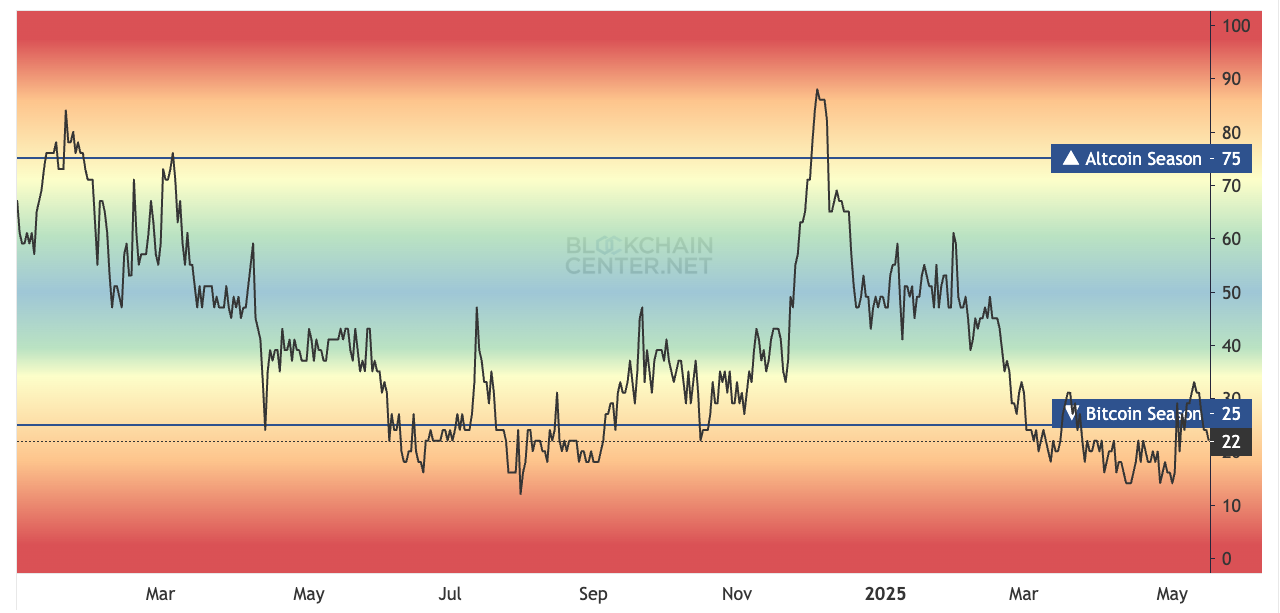

The AltCoin season index is currently 24, marking the “bitcoin season”. The AltCoin monthly index is 57, while the Altcoin annual index is 27 – all below the 75-point threshold that is usually used to confirm the AltCoin season.

Note that these metrics are based on the performance of the top 50 coins of Bitcoin over the past 90 days (excluding Stablecoins and asset-backed tokens).

Source: Blockchain

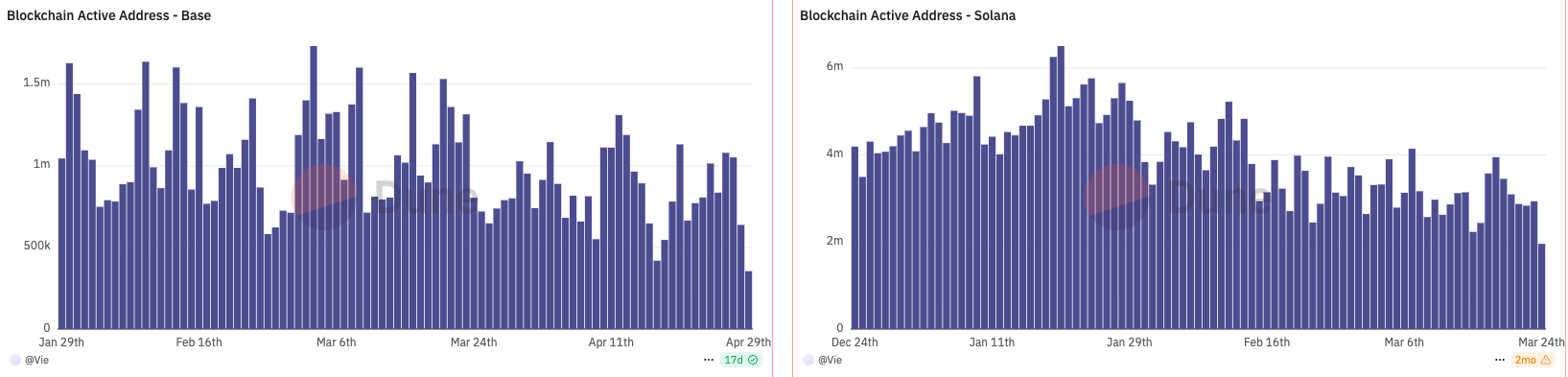

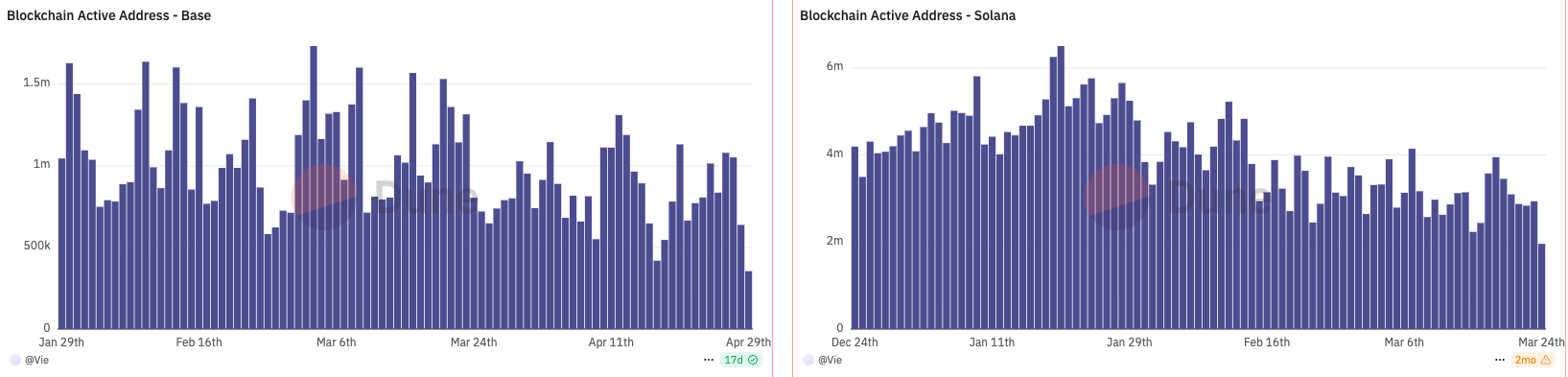

The second is Dune Analytics, with the number of new active wallets on chains such as Solana and Base rising again. Meanwhile, Ethereum gas charges are still below 30 GWEI, indicating that the market has not overheated yet, but also suggests enough room for future growth.

Source: Dune Analysis

Currently, there are obvious differences in the forecast for the 2025 Altcoin season:

From a bullish perspective, the Altcoin season may have begun as Altcoin market cap hits $18.9 trillion, surpassing its November 2021 peak of $1.79 trillion. Additionally, according to the Blockchain Center, the Alternative Token Season Index exceeded 75% on December 2, 2024 and stayed at the full week level for the whole week.

However, more cautious views (e.g., Benjamin Cowen) suggest that the Altcoin season may be delayed as BTC’s advantage remains high (60%) and monetary policy uncertainty persists. Cowen warned that a lack of new capital and unsustainable performance could lead to market stagnation.

From the perspective of selective prospects, CryptoQuant CEO Ki Young Ju believes that only altcoins with a strong foundation, real income and ETF potential may outperform performance in this cycle. “It’s all over,” he said, suggesting a more mature and selective market environment.

Read more: CryptoQuant CEO: “A new era of Bitcoin has begun”

The main drivers behind the Altcoin season

Institutional capital remains the main force in the cryptocurrency market. As of May 2025, spot Bitcoin ETFs have attracted more than $65 billion in net inflows, enhancing BTC’s security profile. However, this trend also gives Bitcoin an advantage above 55%, delaying capital rotation to altcoins, often thriving in risky environments.

Emerging sectors such as AI, RWA and DEPIN are attracting investors’ interest. The leading AI agent project, $Virtual, soared 249 times, while RWA tokens grew at a whopping 717%. Major institutions such as Blackrock and JP Morgan are actively driving token assets. However, earnings are still concentrated in some tokens, not enough to improve the wider altcoin market.

Despite the rising narrative hype, the real season won’t begin unless the allegations are made by Ethereum and Solana. The ETH/BTC ratio is still stuck below 0.065, indicating a weaker appetite with a weak risk. Despite Solana’s strong user traction, its ecosystem alone has not pushed the Altseason index to a critical breakthrough level. Without a strong ETH rally, the momentum based on the wide range of AltCoin remains limited.

U.S. interest rates fell from year-on-year to 4.19%. If the Fed lowers the rates further in the third quarter, it could trigger a new appetite for risky assets. Meanwhile, political proposals like the U.S. Treasury Department may acquire 200,000 BTC annually (if enacted), which will greatly enhance market sentiment and may promote capital inflows into Altcoins.

Read more: Is XRP a good investment in 2025? A comprehensive guide for investors

Source: CME Group

in conclusion

Taking into account technical indicators, capital flows, macroeconomic factors and market sentiment, it is obvious that the Altcoin season has not officially begun, but the underlying basis for potential breakthroughs has gradually formed. BTC advantages, stable ETH/BTC ratios, whales accumulation and a slight decline in the emergence of leading narrative tokens are all encouraging signs.

However, the market still needs further confirmation signals: clear capital rotation from BTC to Altcoins, the return of retail participation, and the rise in FOMO-driven sentiment. Second Half 2025 – If the Fed lowers interest rates and Ethereum breaks by more than $3,000, it can mark an ideal time for the Altcoin season.

Read more: 15+ Best Encrypted Signal Telegram Groups in 2025