Polymarket allows users to bet on the future using blockchain technology. As the platform continues to grow rapidly – trading volumes exceed $13 billion by early 2025, it is redefining how the market can leverage collective intelligence. This article explores how Polmoarket works, the mechanisms behind the market, and why it has become the focus of traders and local crypto-enabled forecasters.

What is the polymer market?

Polymarket is a fragmented forecasting market that specifies actual events by trading results share – from elections and sports to macroeconomic indicators. The platform was originally built on a polygonal network and now expands to Solana, leveraging smart contracts and Oracle to facilitate trustless transparent transactions without KYC.

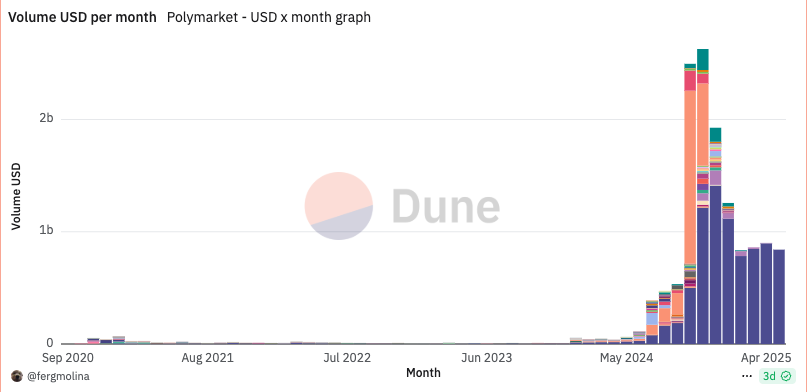

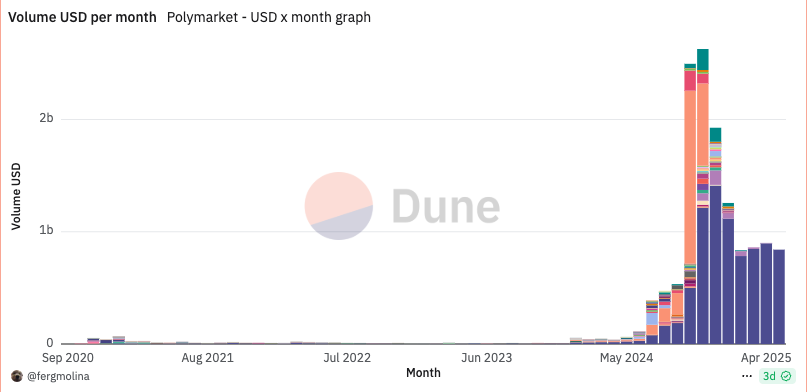

The platform is rising rapidly. By March 2025, it had processed over $13.25 billion in cumulative transaction volume. Monthly active users reached 450,000 in January, a 91% increase from a few months ago.

Source: Sand Dunes

This growth is partly due to its expansion to Solana, which reduces transaction fees and improves user experience. Although it has maintained its highest volume month ($2.63 billion) since November 2024, the ongoing user onboarding and market diversity suggests that Polymarket is still strong.

This combination of transparency, market liquidity and speculative attraction makes Polymarket the main force in the dispersed information market.

Basics of Forecasting Markets

Before specializing in Polymarket, it is important to understand what the forecast market is. Essentially, a forecasting market is a market where participants can trade share representing the results of the activity.

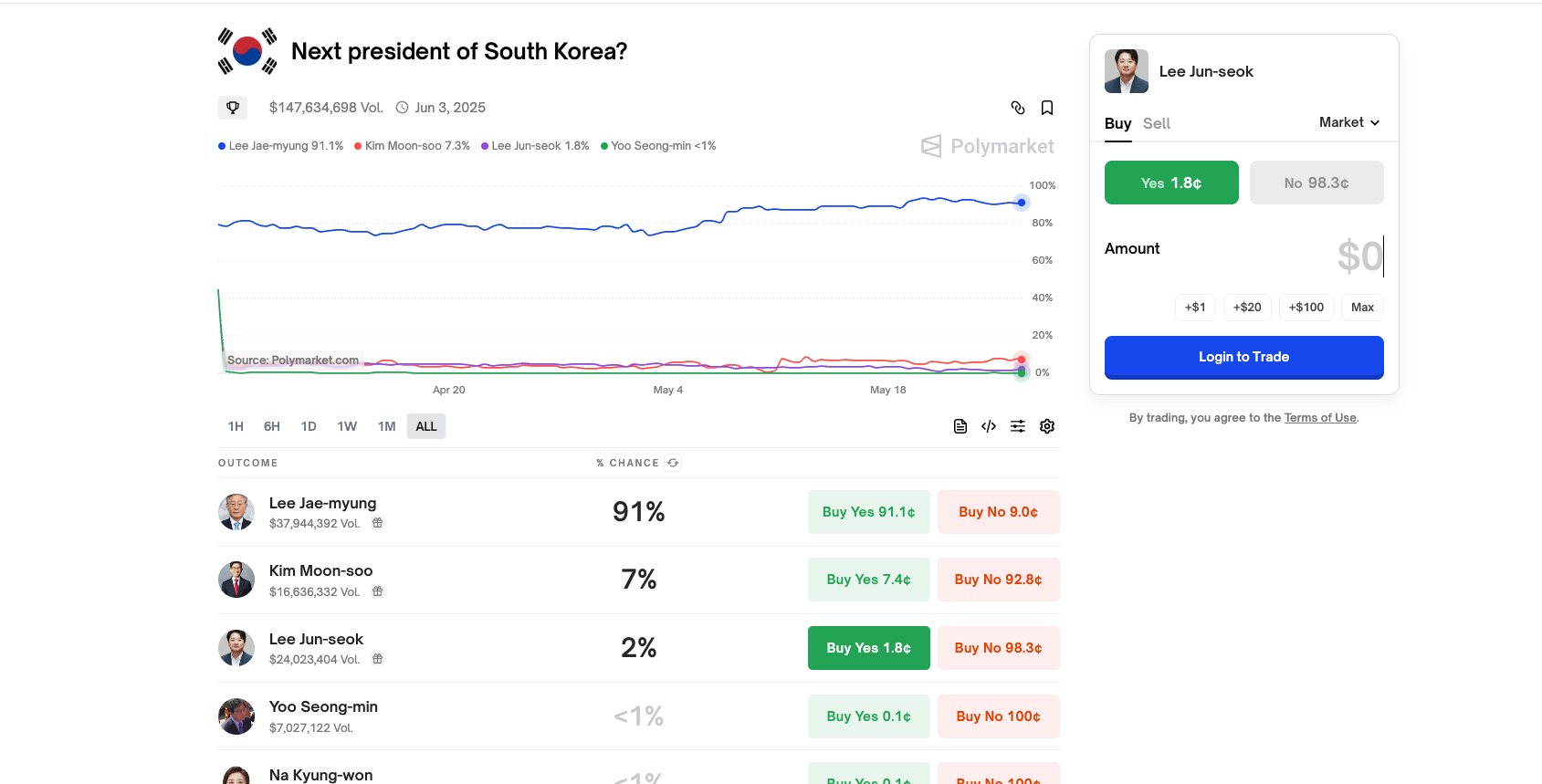

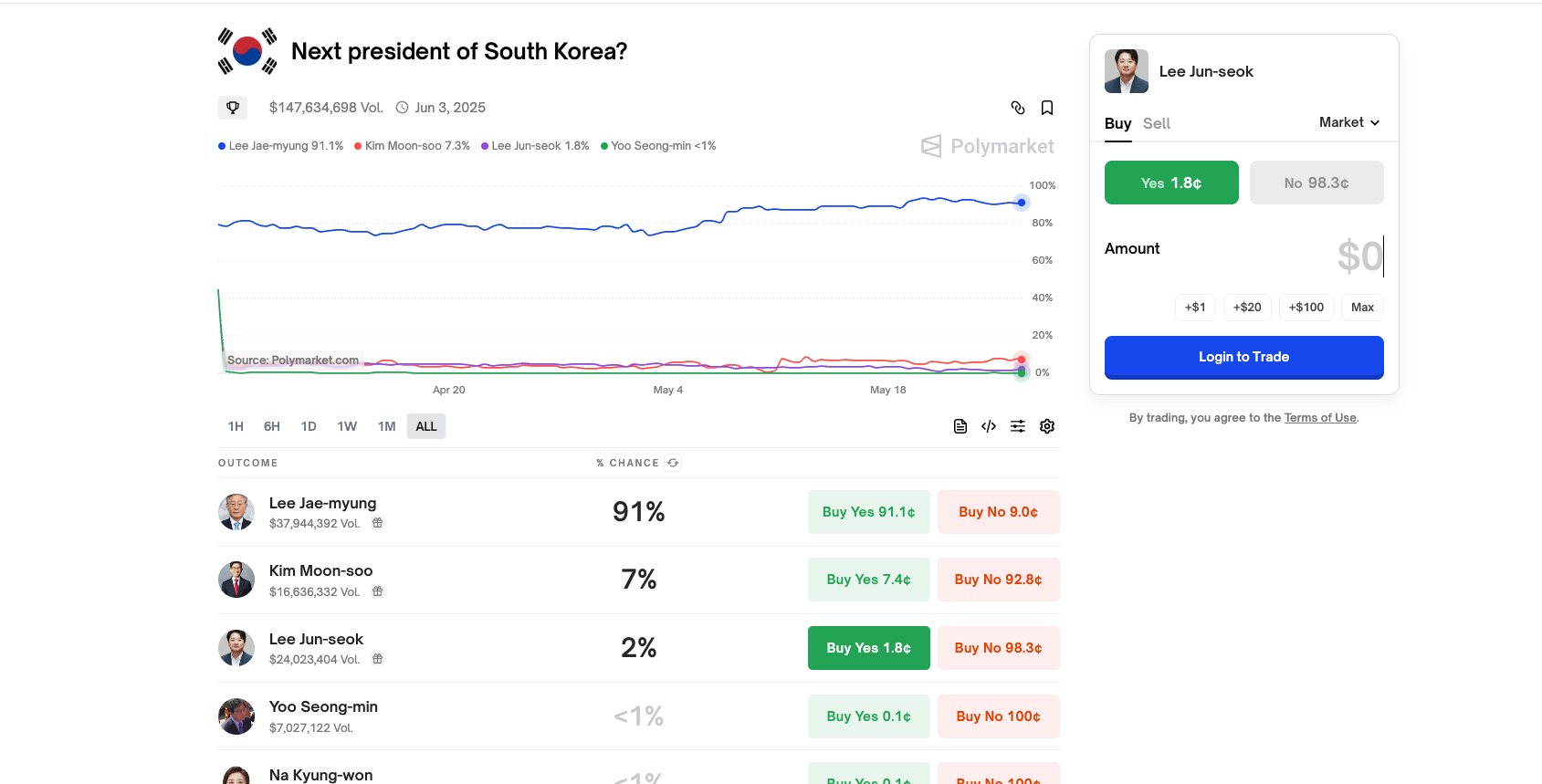

The price of each share reflects the trader’s collective belief in the possibility of a particular outcome. For example, if the shares representing “candidates win elections” trade at $0.70, the market indicates a 70% chance of outcome.

Predictive markets are often praised for their ability to aggregate information more effectively than traditional polls or expert analysis. Because participants all have accurate economic incentives, these markets tend to reflect the best available information about future events.

Market structure and trading mechanism

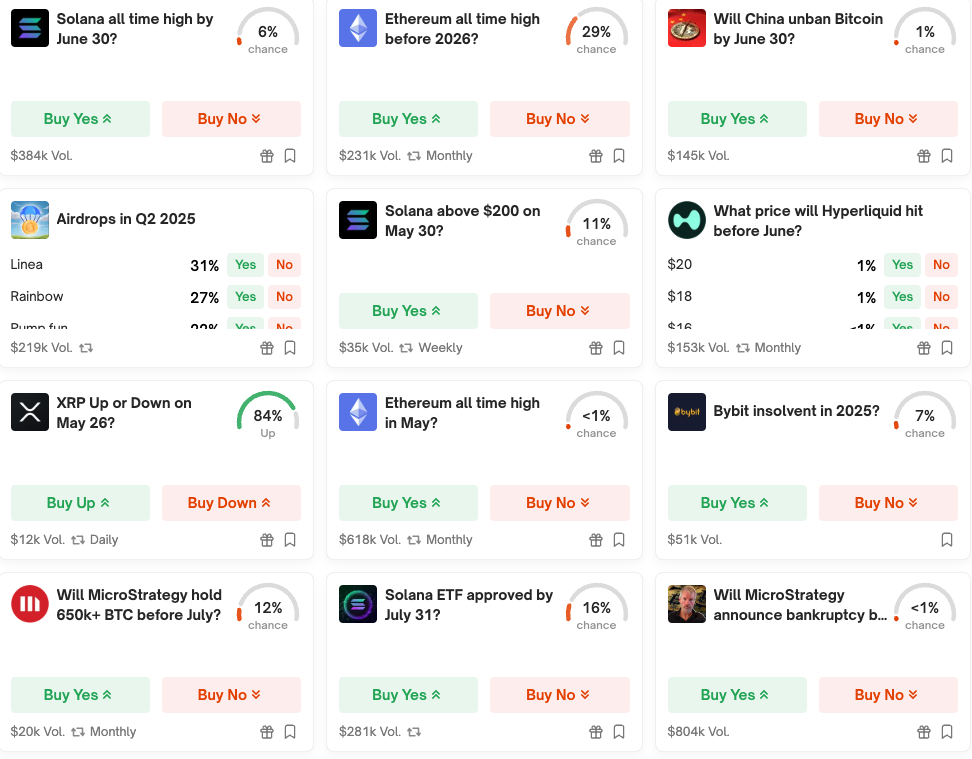

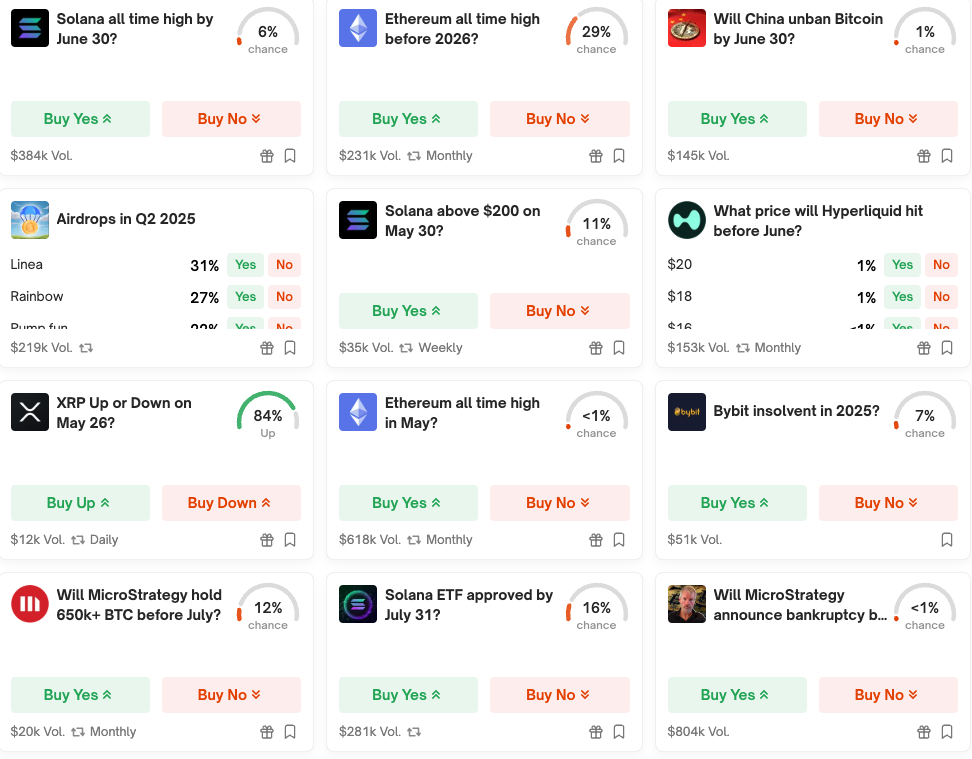

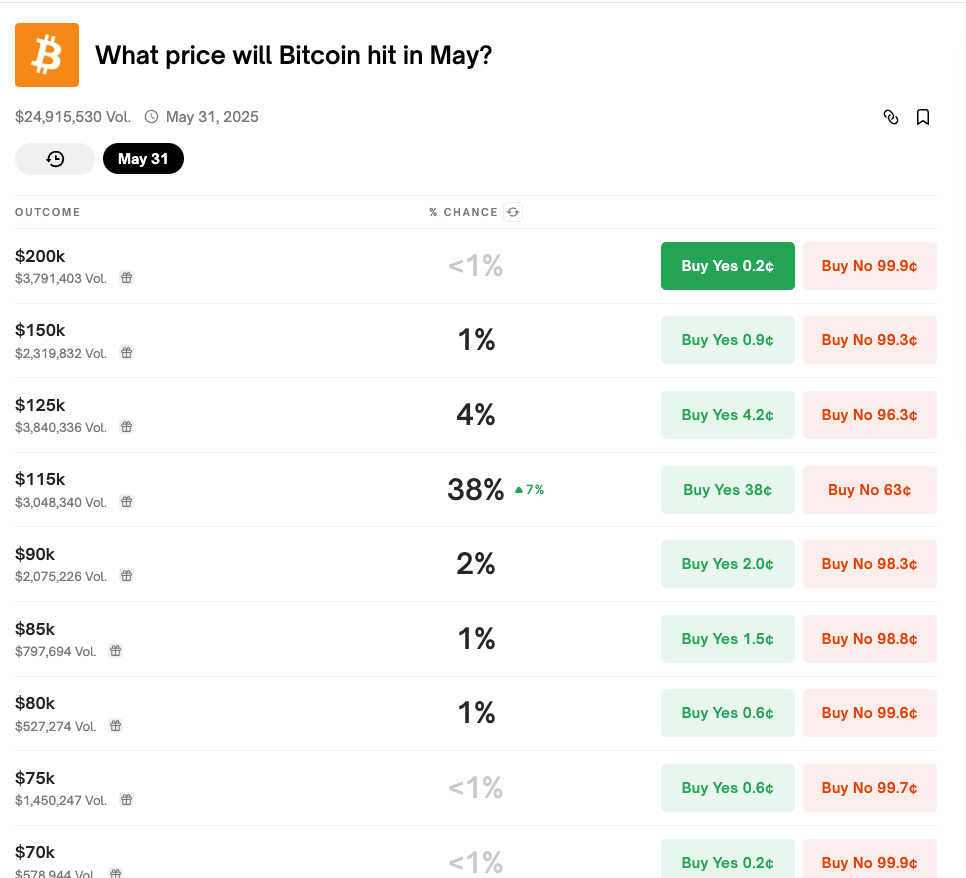

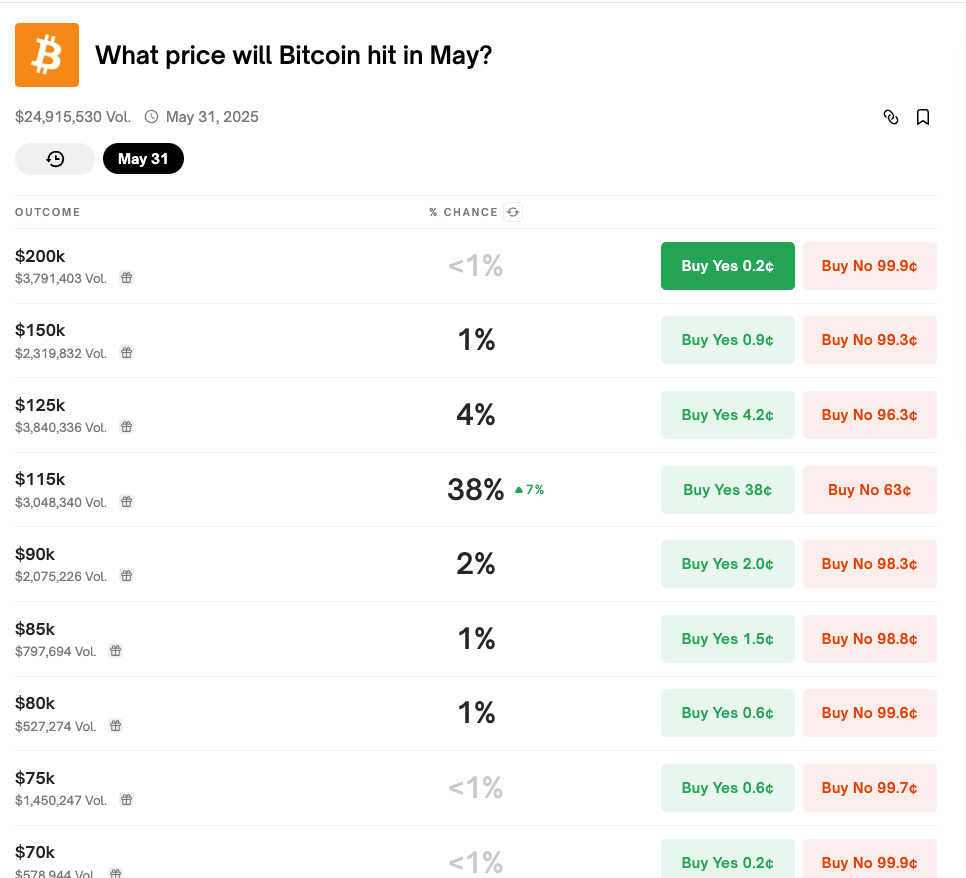

Polymarket supports binary and scalar markets, each catering to different types of event predictions:

- Binary Markets: These are the most common and direct markets. Each market has two possible outcomes – “yes” or “no”. Users can buy stocks in two results, and if correct, each winning stock is worth $1 at market resolution.

Example: Will Bitcoin exceed $130,000 on June 30? These two results are “yes” and “no”. If you buy a stake in “yes” for $0.65, you expect a 65% chance of this happening. If it is correct, you will lose shares if it is not correct.

- Scalar Markets: These markets enable traders to bet on numerical results within a range. Instead of simply yes/no, users can hold positions on variables such as inflation rate, unemployment numbers, or temperature predictions.

Example: What will the CPI inflation rate be in May 2025? Options may include ranges such as 3.0%–3.4%, 3.5%–3.9%. Each range is considered a separate result, and the correct range will be determined as $1.

- Multi-result market: Some events have more than two possibilities. These usually include political primary elections (e.g., “Who will win the Republican nomination?”) or awards ceremony (“Who will win the best picture?”).

Users can purchase stocks in one or more candidates/outcomes. The total price of all results may not total $1, creating an arbitrage opportunity.

All transactions on PolyMarket are completed using USDC, a stable deal pegged to the US dollar. This provides price stability and avoids crypto volatility.

The market is open until the event occurs or is logically determined (e.g., eliminating mathematical teams from the tournament).

Trading is executed through an automated market maker (AMM), which means:

- Prices are adjusted according to the demand for each result.

- The more people buy “yes”, the higher the price.

- AMM ensures continuous liquidity, allowing users to enter and exit positions at any time.

The system avoids ordering books and counterparty matching, making it quickly without permission.

After the event is over, the results will be verified by the scattered oracle bones, and:

- The winning stock can be exchanged for $1.

- Losing stocks becomes worthless.

- Users can withdraw their USDC or reinvest in other markets.

By combining flexible market types, real-time pricing and decentralized settlements, Polymarket provides a strong infrastructure for cross-domain forecasting activities – from politics, economics to sports and pop culture.

Fees and incentives

Polymarket charges small fees for transactions, which helps fund platform development and Oracle costs. Unlike traditional dealers or centralized prediction platforms, Polymarket does not spread or act as a counterparty to the transaction. This means that users are essentially betting on each other and the platform only facilitates transactions.

Incentives also appear in the form of liquidity mining activities and trading competitions, which Polymarket has launched user activities and reward participation this time in the past. These incentives help ensure adequate quantity and open interest in major markets, especially around high-profile events.

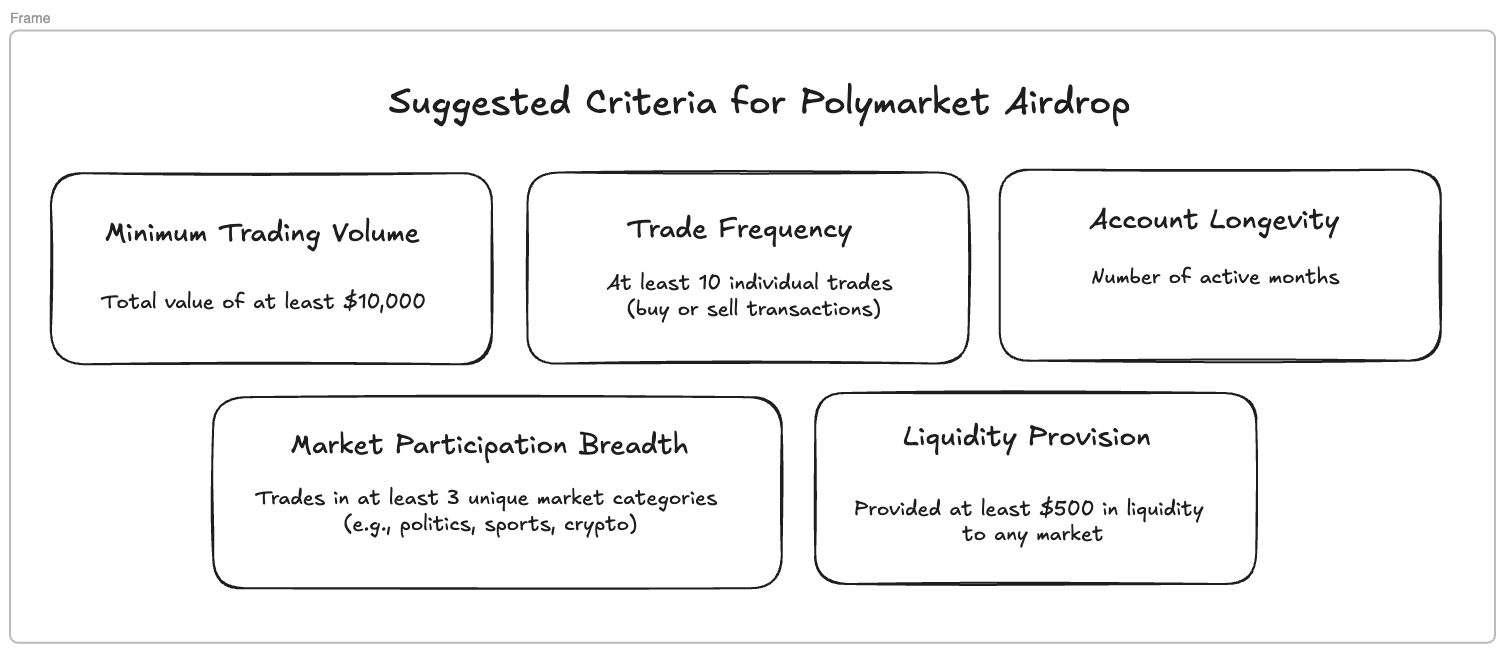

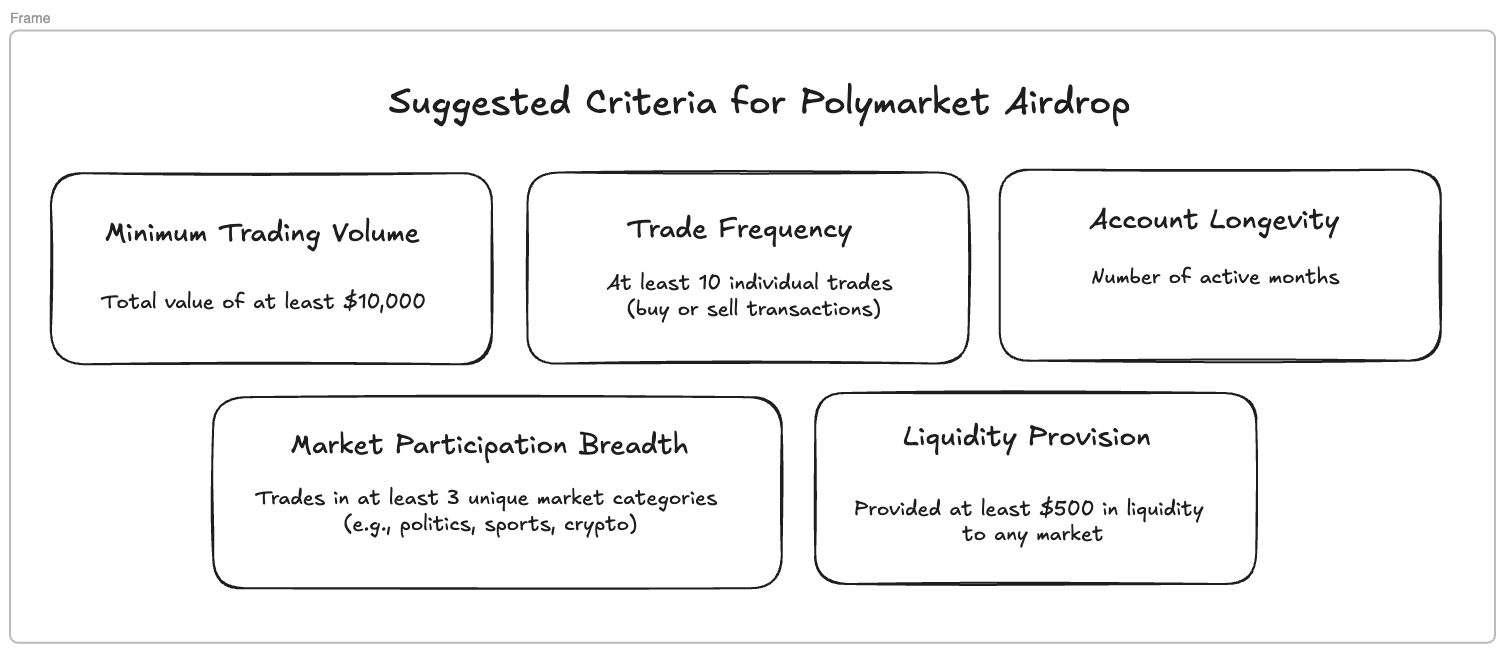

Importantly, there is growing speculation that Polmoarket may launch local tokens in the near future. Although no official announcement has been announced, many industry observers believe that chain activities such as implementing transactions, providing liquidity or interacting with large markets can be rewarded retrospectively through AIRDROP.

Therefore, users who are early and active participants on the platform can benefit not only from trading profits, but also from potential future token allocations. This possibility further promotes Polymarket’s growing user base and transaction volume.

Polmarket’s infrastructure

Polymarket is built on Polygon, a layer 2 scaling solution for Ethereum. This makes low-cost high-speed trading crucial for predicting frequent trading and liquidity in the market. The use of blockchain also means that anyone can be transparent and prove all marketing activities, helping to ensure integrity and trust in the platform.

Users interact with Polymarket through a web-based interface where they can browse open markets, place transactions and monitor their portfolios.

The platform does not require users to complete a KYC (Know Your Customer) check, which allows global audiences to access it while also enhancing its patience. However, the United States is currently banned from participating due to regulatory restrictions.

Resolution and carapace

A key component of any forecasting market is the solution process. That is, how the platform determines the actual result of the event. In the case of Polymarket, the resolution is managed by an independent Oracle system called UMA’s optimistic Oracle. After the event ends, the platform submits the result data to Oracle. If no one raises an objection within the specified time window, the result will be final.

The use of UMA Oracle provides a dispersed hygiene method to determine the results. However, if a dispute arises (for example, someone challenges the accuracy of the result, the system will enter the dispute resolution phase where the token holder can hold and vote to resolve the conflict. This mechanism ensures integrity while minimizing the center point of the failure.

Tips and strategies for using multi-market effectively

To make the most of the multi-market, users can benefit from understanding some of the advanced tips and strategic approaches that some experienced traders often use:

One useful strategy is to identify markets with multiple choices or fragmented liquidity, especially in non-binary markets. When a market has more than two outcomes (e.g., “Who will win a Republican nomination?”), the price may not always be as high as $1.

This opens up arbitrage opportunities. If the total amount is less than $1, the trader can buy low-priced stocks on all options, or sell stocks, and if the total amount of the stock exceeds $1, the guaranteed profit can be locked in when the market resolves.

Another strategic insight involves timing trading based on public sentiment fluctuations. The multi-market market often responds in real time to news or viral social media moments. Traders who can expect emotional shifts or take quick new information actions can buy stocks before the market adjusts.

Read more: What is Infofi? How to Make Money with Infofi