Cryptocurrencies have become very popular over the past few years, so the decentralized financial (DEFI) space has exploded. What aggravates this explosion in the main way is the principle of eliminating intermediaries and authorizing individual users to borrow, borrow, trade and even earning yields directly on the blockchain network.

However, to access these protocols and the Defi platform that powers them, you need a safe and reliable Defi wallet. This is a professional tool that connects you to smart contracts. This may sound complicated, but we will make sure it is easy to digest. You get the answer to “What is a Defi wallet?” And learn how they manage your crypto assets.

What is a Defi wallet?

Defi Wallet is a self-customer wallet that stores your private keys, whether in software or hardware, and acts as a Web3 provider in compatible applications. this Different from A custodial wallet or Exchange Wallet, because the Defi Wallet application gives you full control of the keys, you are the only person who can authorize or deny transactions connected to that wallet.

Most of these wallets are simple browser extensions (one of the most popular metamails), mobile apps like Coinbase Wallet and hardware wallets like Ledger and Trezor.

When you visit the Defi platform or interact with decentralized applications in the Defi ecosystem, such as a loan agreement, decentralized exchange or income farm, your wallet will prompt you to view and sign (authorize) transactions directly on the chain. This direct instant connection with smart contracts allows you to quickly move assets, provide liquidity and earn rewards without relying on centralized intermediaries.

How does a Defi wallet work?

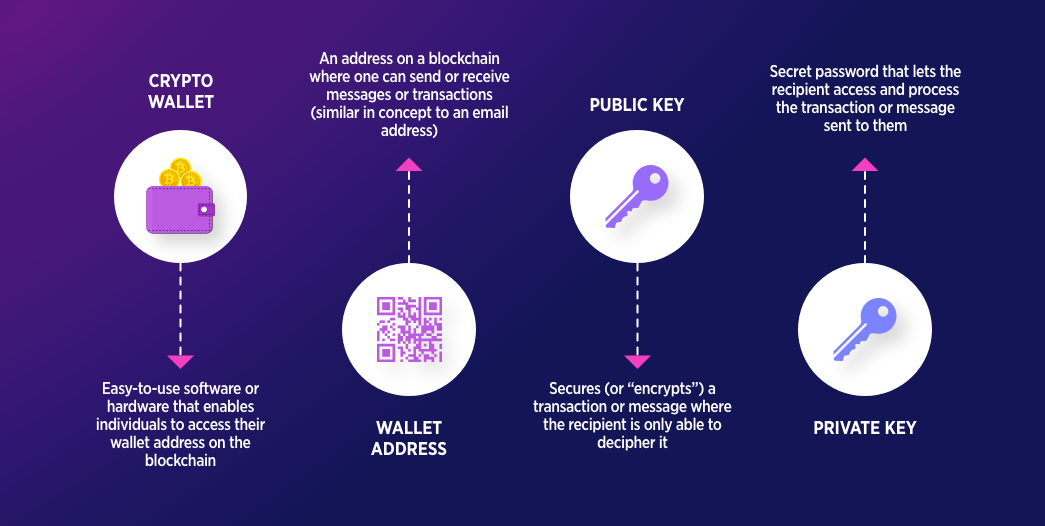

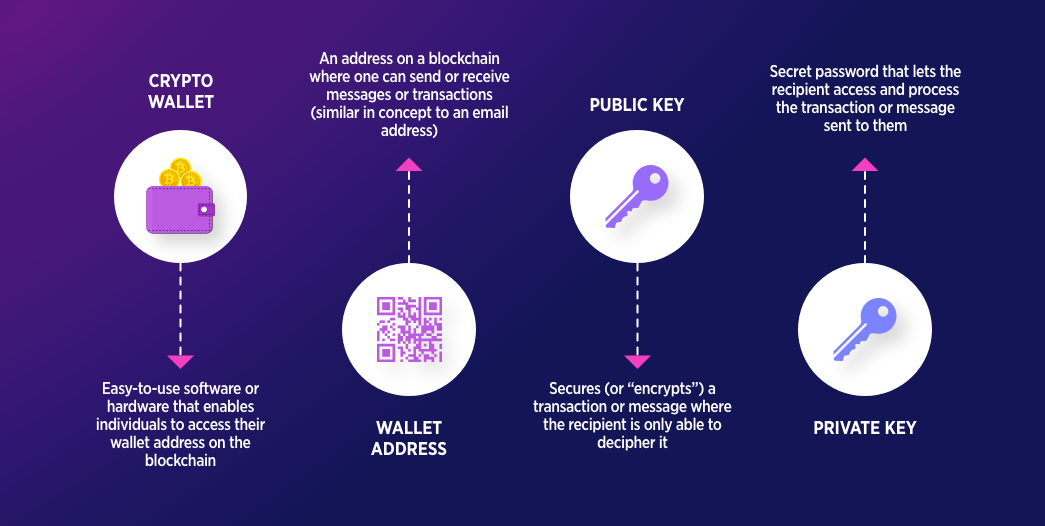

The Defi Wallet app works more or less the same as any other crypto wallet. It manages a pair of password “keys”, your public key, i.e. your wallet address and your private key, which are your signature permissions.

When you launch or interact with a Defi application such as exchange, the wallet creates a transaction payload and then prompts you to sign with the key. This is usually just a click or tap, making it very easy, but also introduces some risks.

This signature is a blockchain proof that you own the transaction and have authorized it without revealing your private key. The wallet then broadcasts the authorized transaction to the network, where the nodes verify it and execute the corresponding smart contract.

Once the transaction is verified, the wallet updates your balance and location. Beneath this process, is a vast array of Web3 libraries and providers that help your wallet bridge to Defi applications.

What is the Defi wallet used?

- Exchange tokens on dexs: Transactions immediately between cryptocurrencies on platforms like Uniswap, Sushiswap or Pancakeswap without KYC or order books.

- Provide liquidity: Pair the tokens into the liquidity pool to earn fees and governance tokens to power automated market makers (called AMMs).

- Produce farming and accumulation: Lock assets in a protocol or share local token to secure the network and earn passive income or interest.

- Loans and borrowing: Collateralize cryptocurrencies at competitive rates to borrow other assets or lend your shares to earn a rate of return.

- Governance participation: Use the governance token to vote on agreement proposals directly from your wallet, affecting escalation and fiscal partial allocation.

- NFT interactions: Mint, buy, sell, sell and manage non-feeling tokens across markets while retaining full custody of your assets.

Types of Defi wallets

Software wallet

The software wallet stores the private key locally on the connected device, giving you immediate access to the DEFI protocol.

- Browser extensions like metamask Coinbase Wallet injects Web3 provider into your browser, allowing you to access the DAPP and click Apply for a transaction.

- Mobile Apps For example, trust the wallet and crypto.com Defi Wallet extends this convenience to your phone, often integrating WalletConnect for seamless cross-app interactions.

Source: metamask.io

Hardware wallet

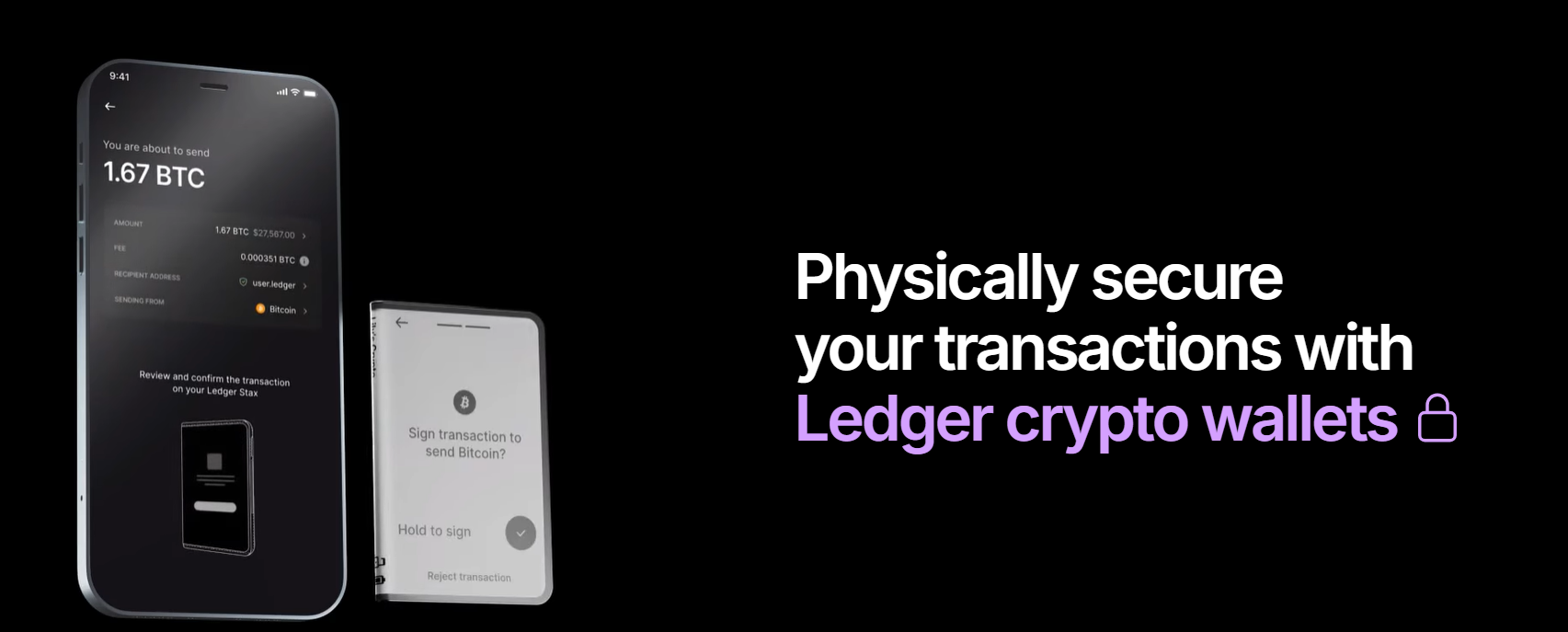

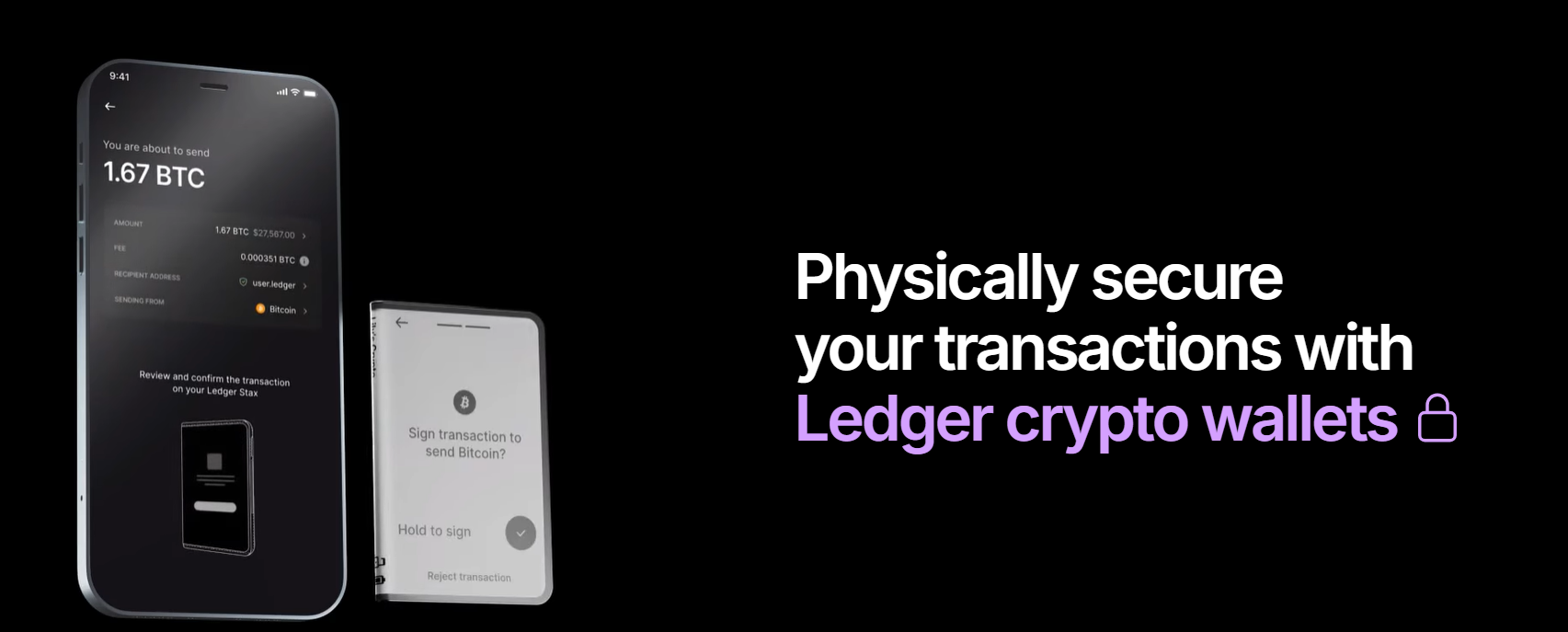

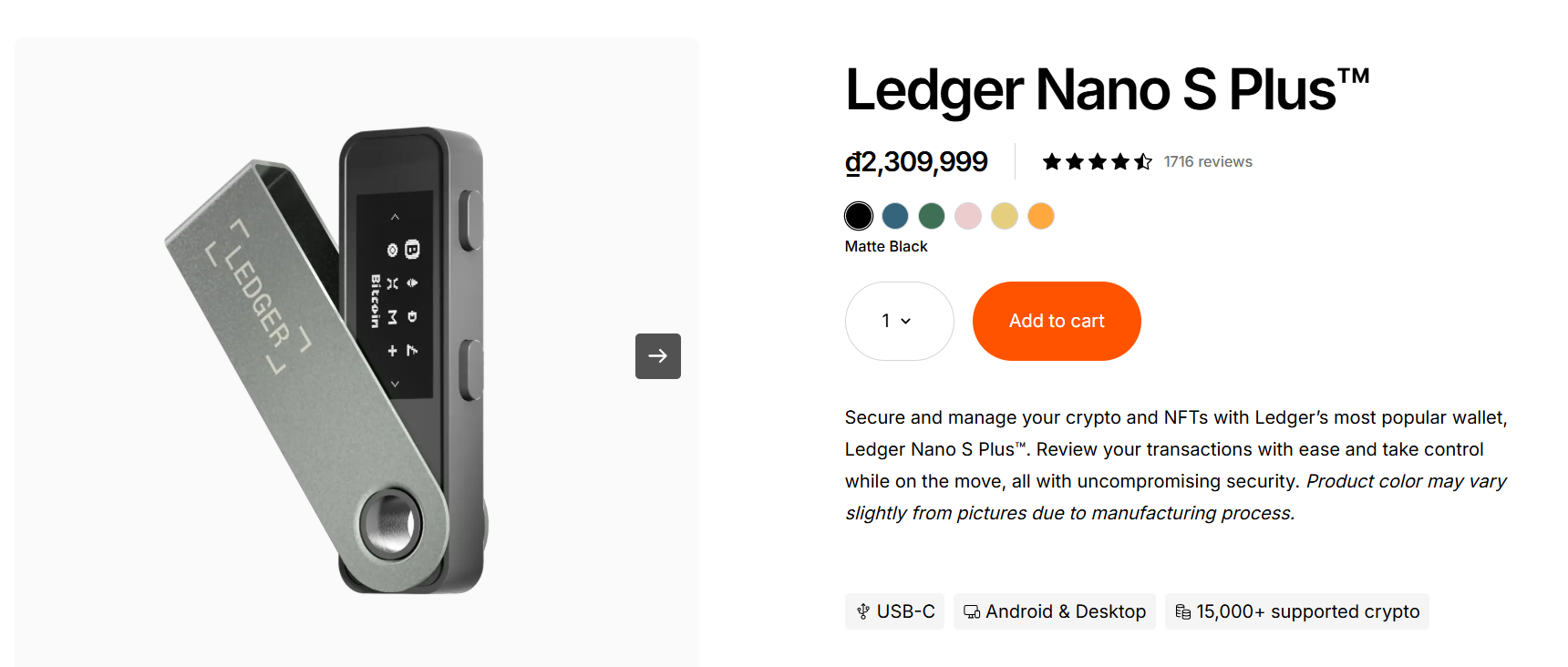

Hardware wallet Ledger Nano s Plus and Trezor Model One Store private keys offer the highest level in tamper-proof offline devices to prevent hackers and malware.

When you need to perform DEFI transactions, you connect your hardware wallet to a Web3 interface and sign the transaction directly on the device to ensure that the key never leaves the security element.

Although hardware wallets introduce additional steps compared to software solutions, they do outstandingly in maintaining large balances and long-term holdings.

Defi wallet vs CEFI wallet: Key differences

| defi wallet | CEFI wallet | |

| custody | User control private key | Exchange represents your key |

| Opponent risk | Minimal – Self-custody | Higher – swap hacks or freeze |

| Right to use | Sign a smart contract directly | Through the exchange interface |

| KYC/AML requirements | Usually no | Mandatory authentication |

| cost | Chain inflation fee | Transaction and withdrawal fees |

| Service Availability | 24/7, no permission | Continuous exchange hours and policies |

benefit defi wallet

Defi wallet gives you complete control over the private key, which completely eliminates any adversary risks and creates a true self-concept. They allow no access to imaginable 24/7 financial services so that anyone, anywhere, can buy, sell or exchange tokens without the hassle of KYC or the privacy impact of the intermediary.

The synthetic nature of DEFI means you can seamlessly combine features (disk, loan and governance) in a single wallet interface. This allows you, as a consumer, to put some of the most complex and effective financial strategies directly into your hands.

risk defi wallet

Defi wallets may be able to unlock powerful financial tools, but they also present some considerable risks for those who are not ready.

Smart contract vulnerabilities can lead to exploitation, which can immediately drain funds from your wallet during the interaction. Phishing attacks and malicious DAPPs can trick you into signing transactions that automatically transfer assets to attackers and will never be recovered.

If you store private keys or seed phrases incorrectly or insecurely as in digital files or cloud storage, you can be stolen by a certain attacker. Transaction errors, just like you can cause irreversible losses when you send funds to the wrong address or even the wrong network.

Awareness of these risks is crucial for anyone entering or engaging in the bias space.

Key factors in choosing the best Defi wallet

1. Safety

- Local encryption of private keys

- Recover phrase options

- Biometric or pin lock on mobile apps

- Refrigerated hardware compatibility

2. Compatibility and interoperability

- Support your favorite blockchain

- Integrate with Defi protocol

- WalletConnect or similar features for cross-app connections

3. User-friendly

- Intuitive interface with clear tips

- Easily navigate between swaps, points and loans

- Transaction preview shows gas costs and slips

4. Function

- Built-in token swaps and hiding dashboard

- Portfolio tracking and analysis

- NFT management and governance voting

5. Reputation and Team

- Established a transparent audit development team

- Positive community support

- Smooth, regular update process without crashing or rolling back

- Good track record of security and reliability

6. privacy

- No mandatory KYC or personal data collection

- Non-customer design retains anonymity

- A clear privacy policy regarding usage metrics

7. Community feedback

- A dedicated community that generally supports wallets

- Positive user comments on forums and social media

- Reports of smooth performance and minimal errors

- Responsive support channels for troubleshooting

How to protect your Defi wallet?

The best way to keep your Defi wallet safe is universal security best practices, so staying educated and alert will go a long way.

First, protect your seed phrase by writing it somewhere that is protected from floods and fires. Make sure to keep a large amount of cryptocurrency offline on the refrigerated device.

Make sure you have 2FA enabled and verify all URLs, links and DAPP requests. Keep your wallet apps and devices updated and patched, and regularly view your tokens to approve and revoke old permissions.

Top wallet

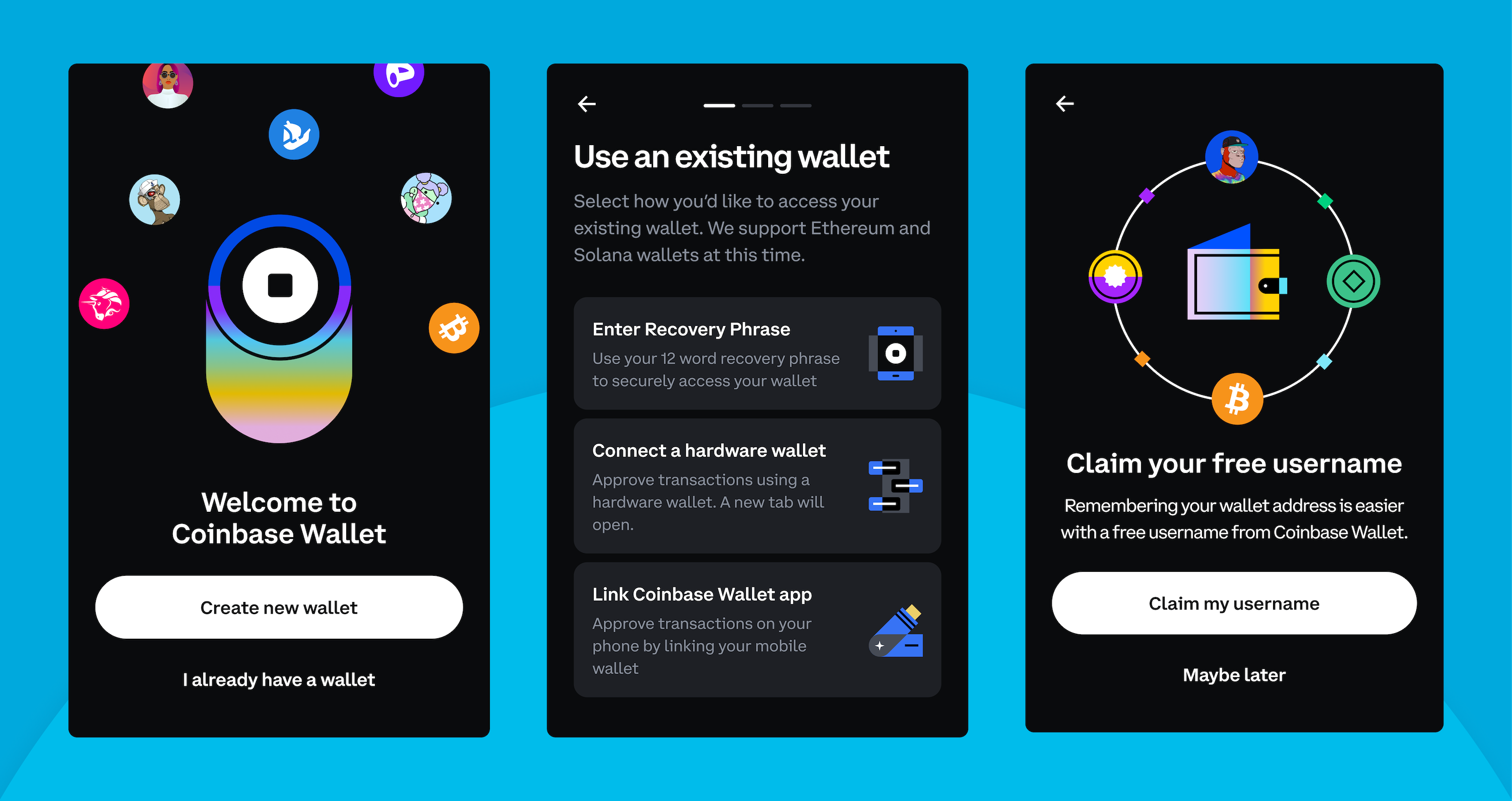

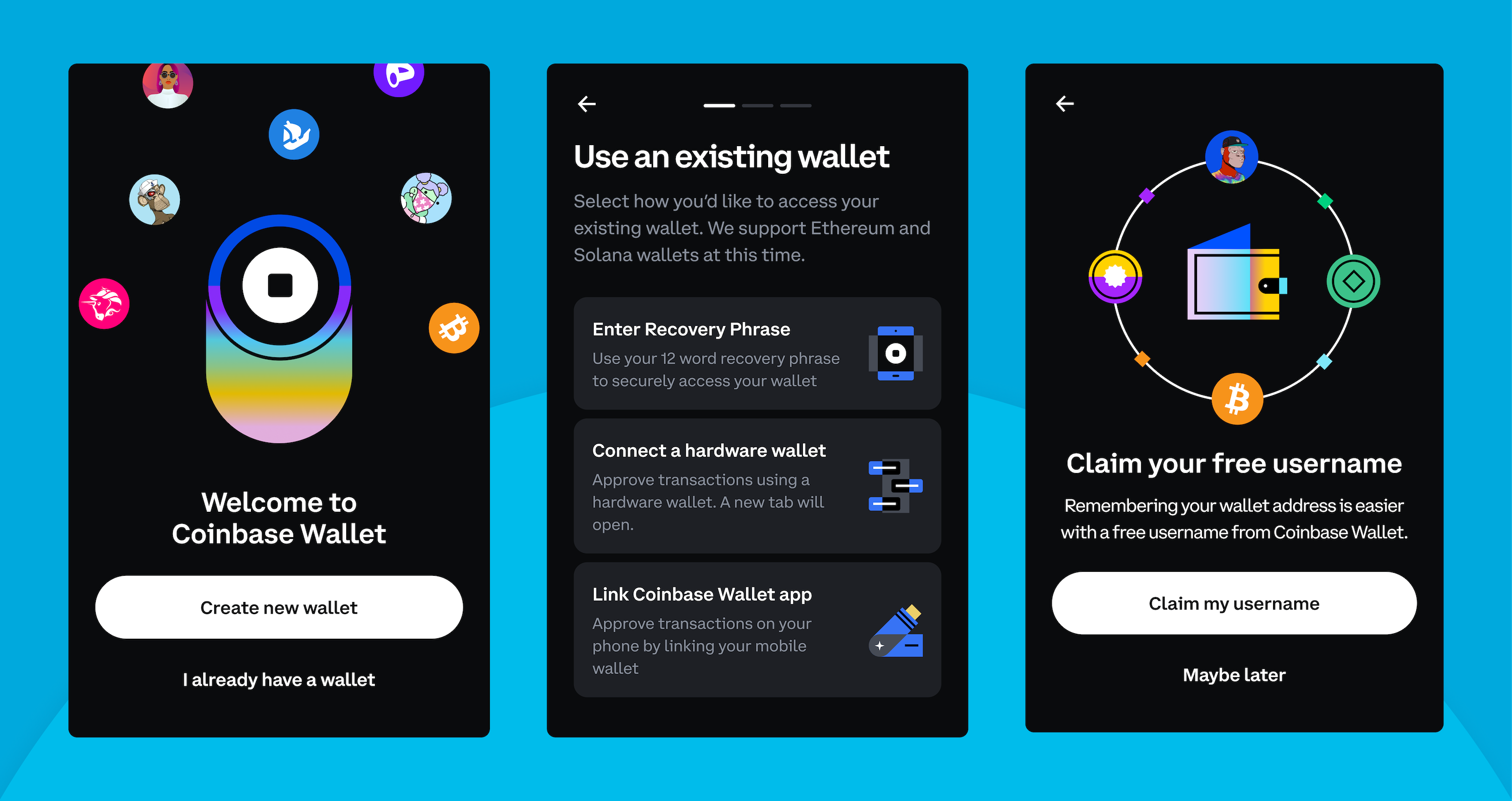

1. Coinbase wallet

Coinbase Wallet is a mobile, non-customer wallet that supports multiple chains. Its main features include In-App Dex interchange, NFT gallery, and direct integration with Coinbase Exchange.

advantage

- Easy to set up

- Strong brand trust

- Built-in Fiat style

shortcoming

- Collect some user data

- Less advanced DEFI analysis

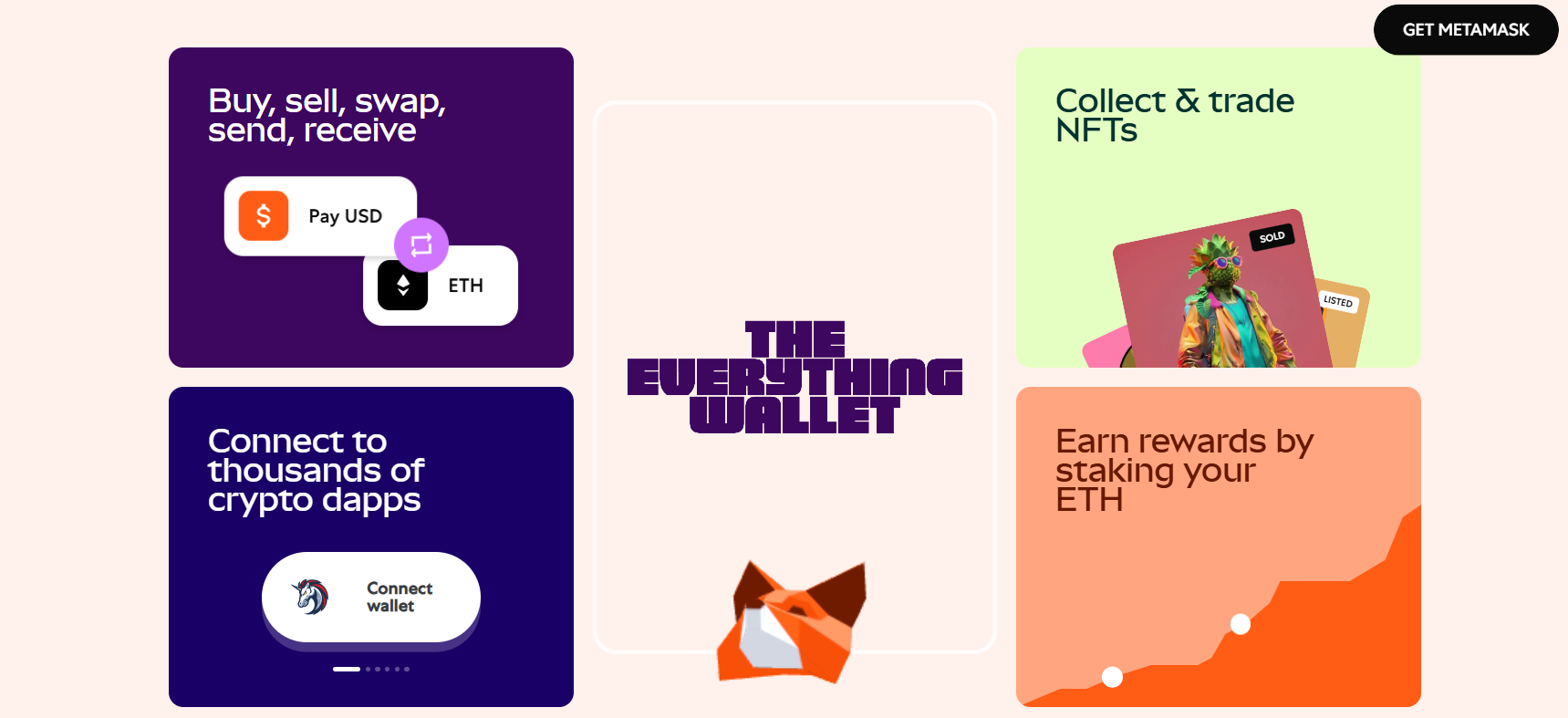

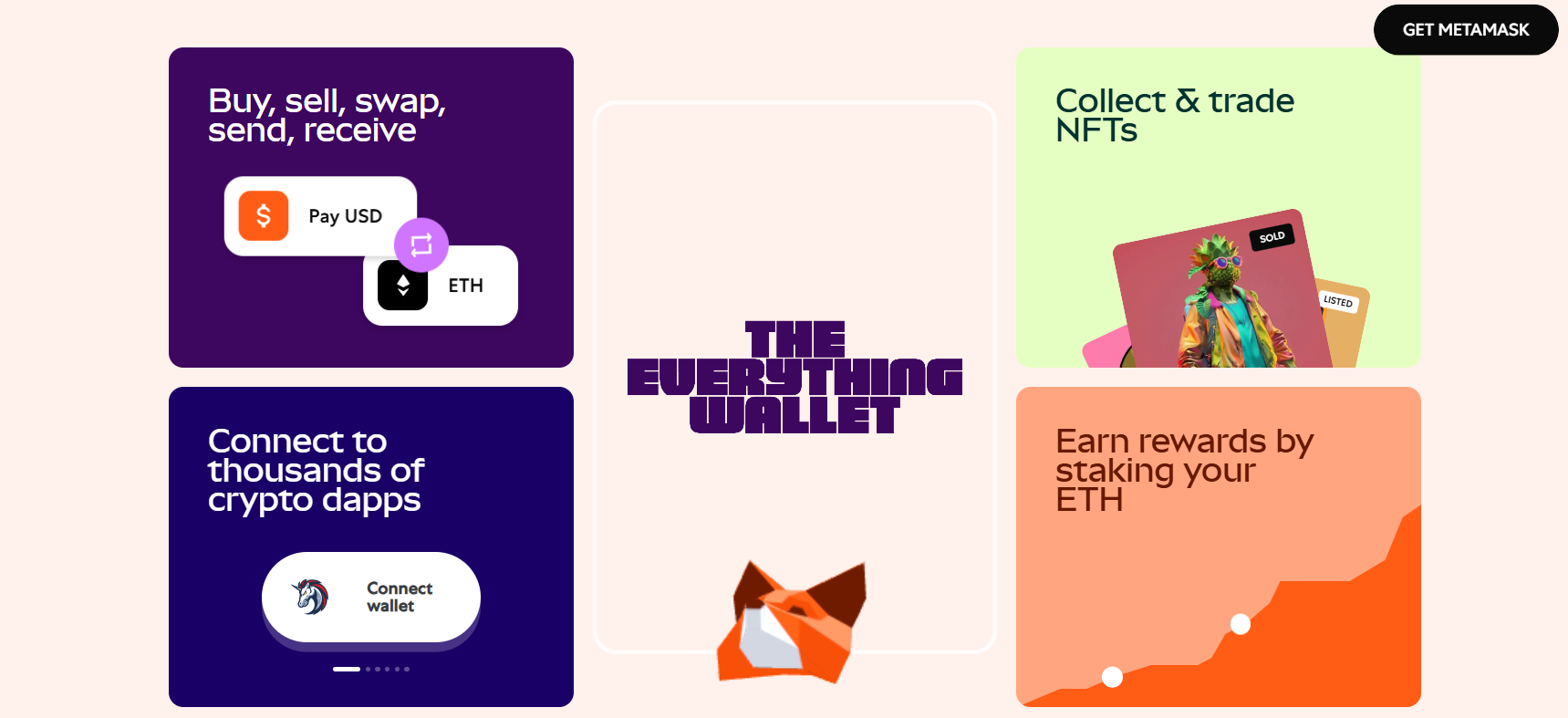

2. metamask wallet

MetAmask has browser extensions and mobile applications for Ethereum and EVM chains. It provides deep Fefi integration, custom networking and hardware – WALLET support.

advantage

- The ubiquitous Web3 standard

- Extensive plug-in ecosystem

shortcoming

- Limited to EVM compatible chain

- If you are not careful, phishing risks

3. LEDGER NANO S PLUS

The Ledger Nano S Plus is a hardware wallet with a security element chip. It pairs with Ledger Live and MetAmask for refrigerated Defi deals.

advantage

- Safety in the industry

- Bluetooth for mobile use

shortcoming

- Early equipment cost

- Requires external interface for DAPP

4. Three-type model

Open-source hardware wallet connected via USB. Compatible with MetAmask and other Web3 applications for Defi access.

advantage

- Transparent firmware

- Durable build

shortcoming

- No security element chip

- Smaller screen

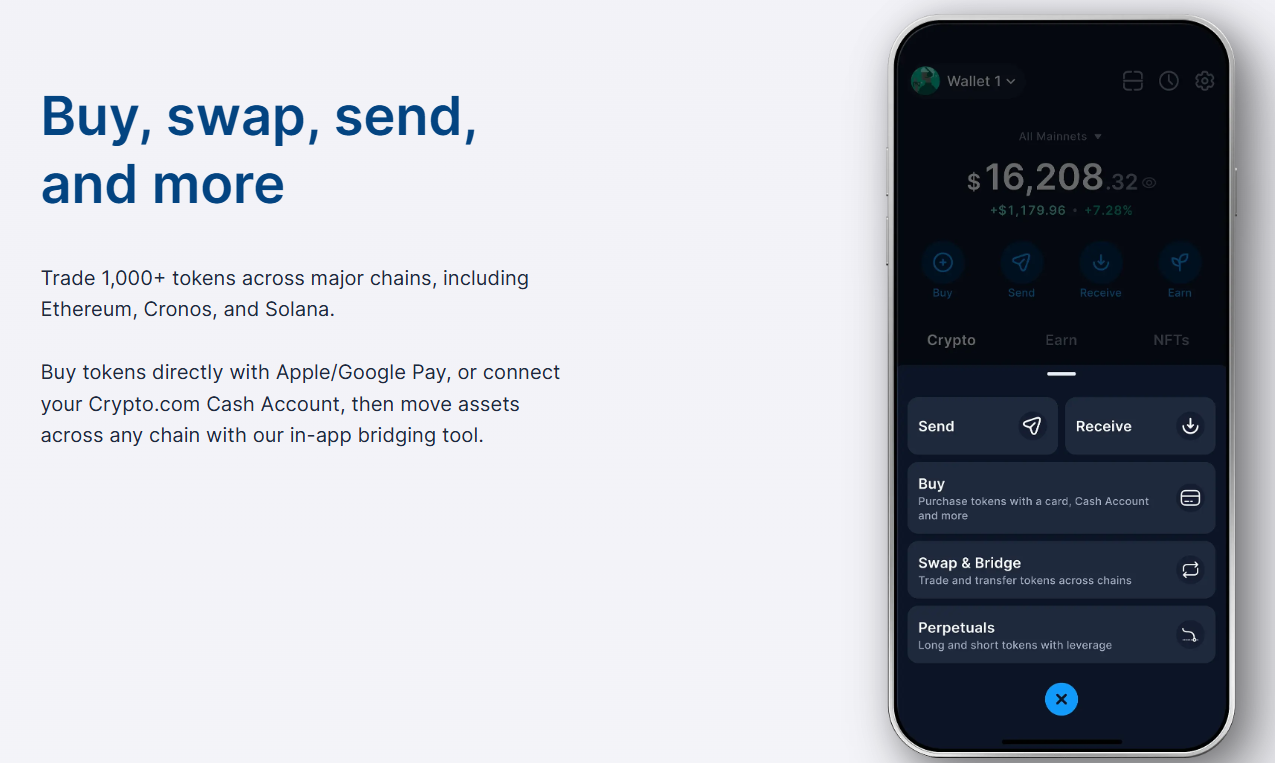

5. crypto.com defi wallet

Crypto.com Defi Wallet integrates an easy-to-run ecosystem with the Crypto.com ecosystem and is a non-customer mobile wallet with fefi exchange, hiding and aggregator capabilities.

advantage

- Competitive deviation rate

- Inside yield polymerizer

shortcoming

- and crypto.com brand

- Occasional UI complexity

in conclusion

Defi Wallet is an important tool for interacting with Web3 applications and accessing the Defi space through smart contracts. Now that you understand what a wallet is and how it works, you can safely exchange, bet, borrow, and win interest on the wider defi ecosystem.

Make sure to put security first, store seed phrases offline, use hardware wallets for large balances, and stay protected from phishing attacks. That is, with the Right Wallet, you can browse the world of permissionless smart contracts at lightning speed.

FAQ

Is Defi wallet safe?

If you follow typical security best practices, a DEFI wallet is secure. Store your seed phrases offline, use hardware wallets in refrigeration in bulk, enable any available 2FA, whitelist approved addresses, and connect to trusted DAPP only.

How to get my money from Defi wallet?

To cash out your Defi wallet, you need to send assets from the wallet to a centralized exchange of your choice or fiat forest questions. From there, sell the fiat currency you need and then withdraw your bank account or card.

Can I use multiple Defi wallets at the same time?

Yes, there is nothing to stop you from managing multiple wallets for different purposes, one for daily transactions and one for points. Just import multiple seeds or connect several browser extensions.

How do I recover my Defi wallet if I lose my phone or device?

The main way to restore a Defi wallet after you get a new phone or computer is to use seed phrases. This is usually a 12 or 24-word phrase for a random word and can restore your public and private keys, so keep a secure backup.