The crypto market has been buzzing, including the event on the Sui-Walrus (WAL) project. Walrus has shown significant growth after its Airdrop and TGE, sparking discussions about whether the SUI ecosystem is a new hot topic for crypto investors. Apart from that, other projects on SUI are also attracting and have several promising air conditioning opportunities.

Walrus soared nearly 100% after launch

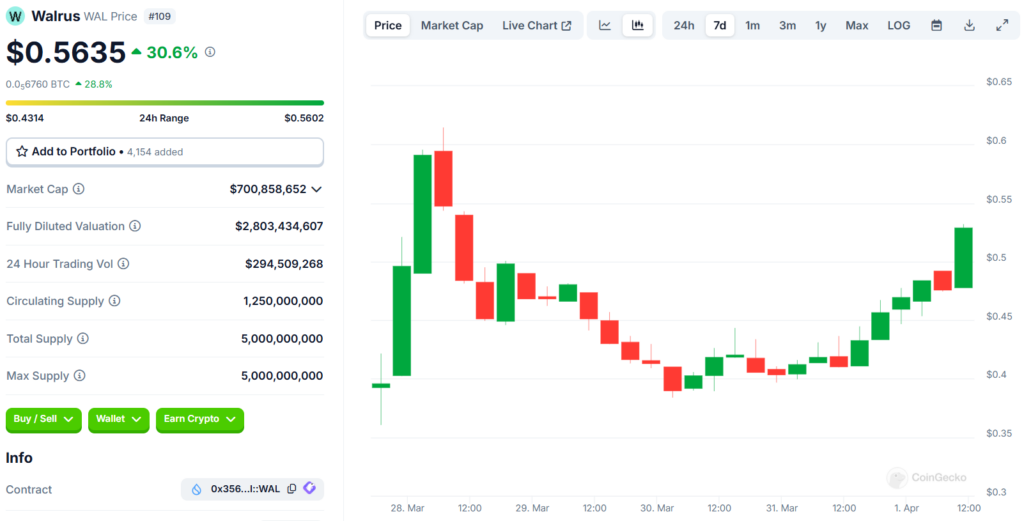

Walrus (WAL) is a token associated with the pioneering storage network on the SUI blockchain, and its TGE has risen rapidly since March 27, 2025. So far, Wal’s price has reached $0.56, up 30% in the past 24 hours. What’s even more impressive is that this figure has increased by nearly 100% compared to the price of TGE in just a few days. This rapid growth has enabled walruses to boost a market capitalization of nearly $700 million, an important milestone for a relatively new token.

Source: Coingecko

WAL’s 24-hour trading volume was also very large, reaching US$123.6 million, reflecting strong market interest. This performance underscores growing confidence in Walrus’ unique value proposition, the first storage network capable of handling on-chain data of any size, a feature that could revolutionize how Web3 manages data through smart contracts.

Walrus is a decentralized storage network on the SUI blockchain that provides scalable, cost-effective and resilient data storage for Web3 applications. Developed by Mysten Labs, it utilizes erase encoding to ensure speed and reliability, enabling users to publish, deliver and program data on the chain. The network’s local token WAL plays a crucial role in governance, staking and incentivizing node operators.

Additionally, the protocol recently received more than $140 million in funding under the A16Z cryptocurrency and standard cryptocurrency to support its decentralized storage expansion and the planned launch of Mainnet on March 27. The move offers prospects for Walrus and offers more opportunities for Walrus supporters.

SUI ecosystem is better than other layer 1 blockchains

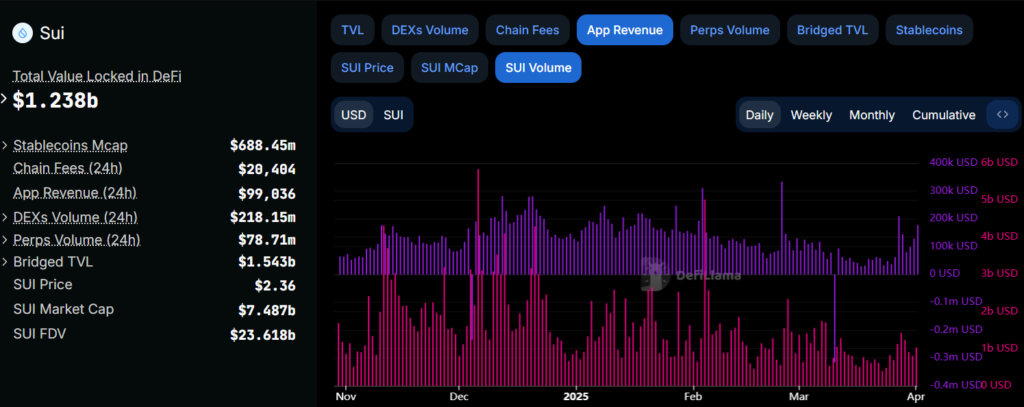

Amid the market downturn, the SUI ecosystem has shown stable performance compared to other Layer 1 blockchains in terms of capital inflows and transaction activities. SUI has been recording stable transaction volumes, with an average of more than $1 billion a day. At its peak in December 2024 and February 2025, the ecosystem’s trade volume surged to $5 billion in a day, demonstrating its growing popularity among traders and investors.

Source: Defillama

Compared to other prominent layer 1 blockchains like Ethereum and Solana (Sol), SUI performance is particularly noteworthy. While Ethereum continues to struggle with scalability issues and high gas fees, SUI has an average transaction speed of 50,000 transactions per second, with a finalization time of only 2.3 seconds. Solana, commonly known as the “Ethereum Killer,” has established itself as a high-throughput blockchain with low fees, but Sui focuses on decentralized financing (DEFI) applications (DEFI) applications with a competitive advantage.

This has attracted a large amount of capital inflows, especially from investors looking for the next big opportunity in the Defi space.

Tokens in the SUI ecosystem that have not yet been listed in major exchanges like Binance are seeing the biggest gains. The sea is like a good example, showing strong price momentum along with other tokens such as Deep and Navx.

Next is the air conditioning opportunity in the ecosystem?

Soon after, several projects are currently raising potential rewards from the SUI ecosystem. Some promising projects will soon offer airdrop opportunities:

- Lombardy Financing:Lombard Finance allows users to store Bitcoin (BTC) and receive LBTC on the SUI blockchain. To participate, users can access the project’s website, connect their wallets and pin their BTC.

- Suilend: Suilend is a loan and borrowing program on SUI. Users can deposit assets, borrow other assets and repeat the process regularly to increase their eligible airdrop opportunities. The protocol’s user-friendly interface and active community engagement make it the biggest competitor.

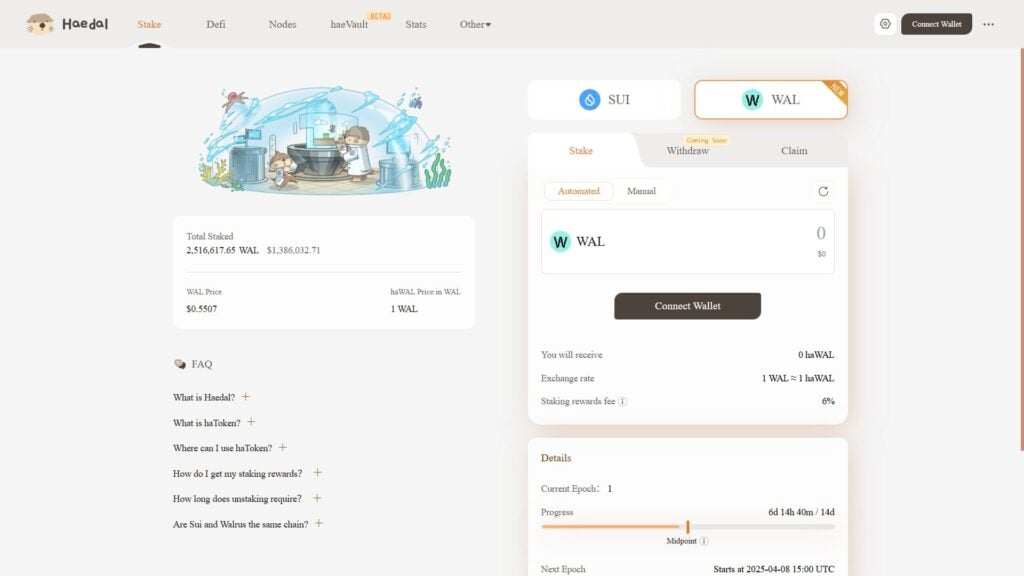

- Heidal: Haedal is a liquid putting protocol where users can use SUI tokens to earn Hasui rewards, which can then be used in various Defi applications in the SUI ecosystem. Stereotyping on Haedal is simple – connect your wallet, choose assets and shares. Although air conditioning has not been confirmed, the structure of the project suggests that rewards from early participants are likely.

Source: Haida

Crypto investors find the SUI ecosystem fertile, as evidenced by the impressive post-launch growth of projects like Walrus. Currently, everyone is focused on SUI as it continues to build itself in the fiercely competitive field of blockchain technology.

Walrus (WAL) Postal paert-airdrop: Does money flow to Sue? First appeared on NFT night.