$USUAL: The integration of yield and governance opens a new era of token economics

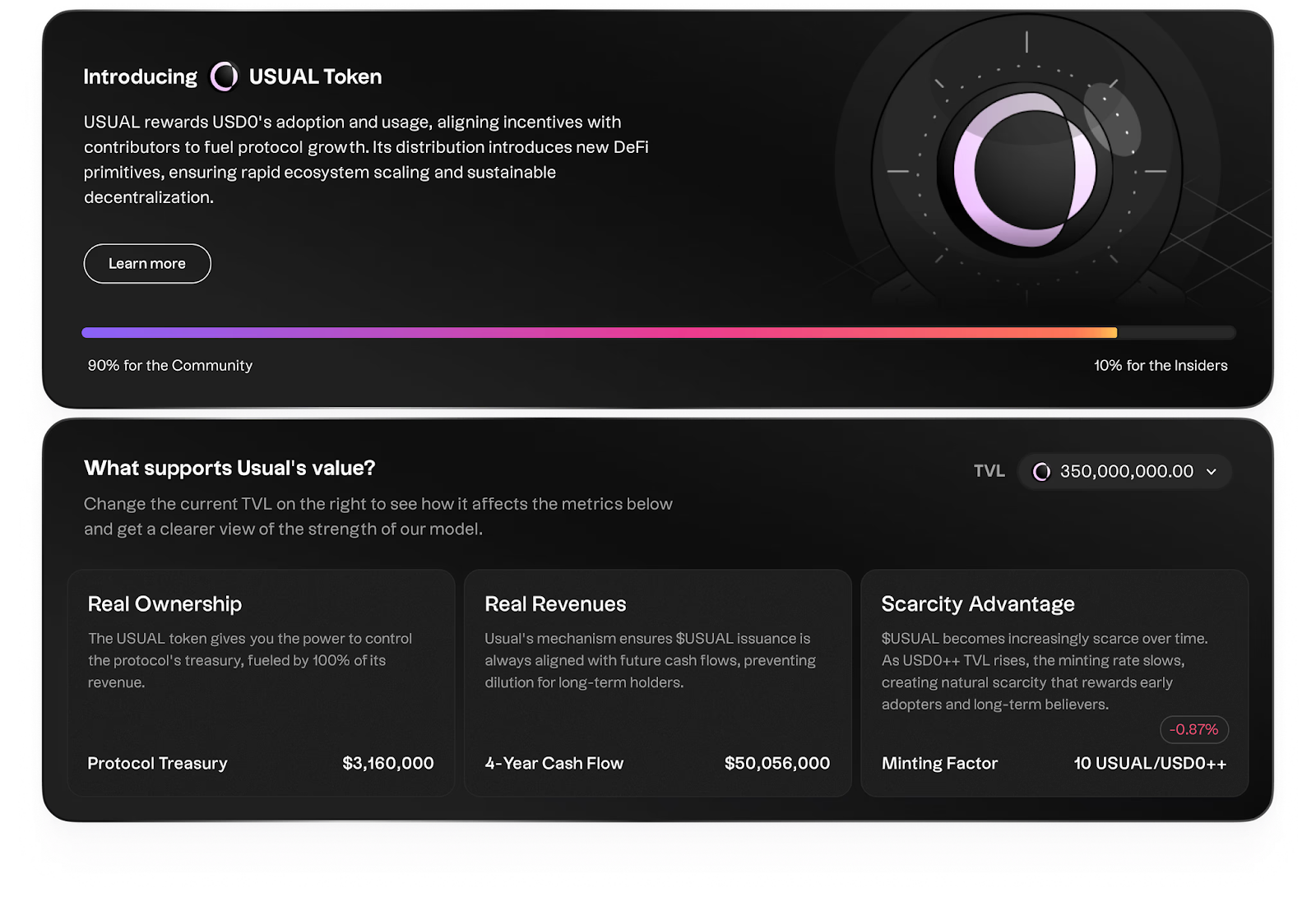

generally Introducing a refreshing governance token that bridges the often uneven balance between revenue generation and ecosystem growth. Powered by real cash flow and community-focused distribution, it provides users with the twin benefits that many governance tokens cannot offer – stable returns and long-term value.

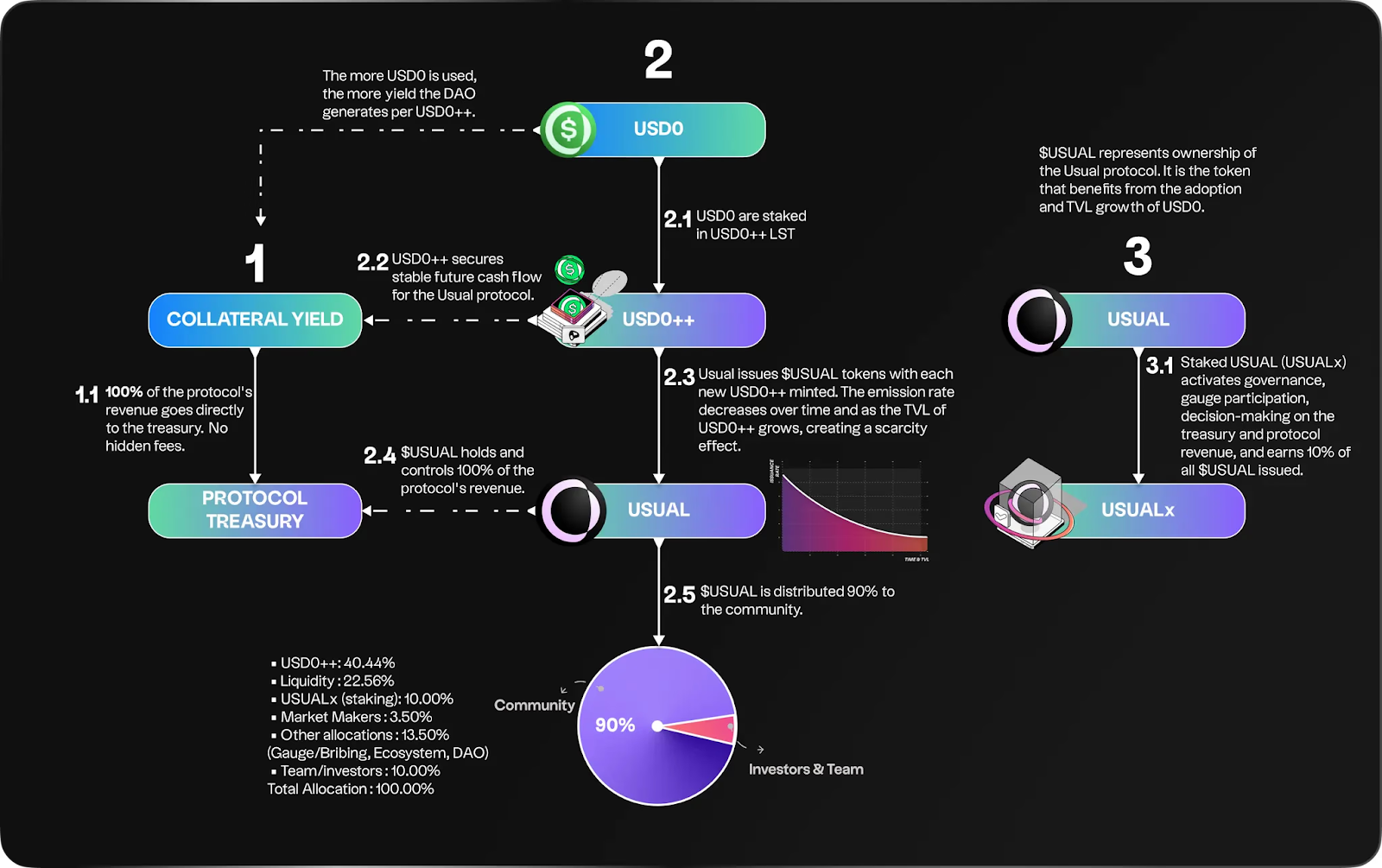

USUAL positions itself as both a governance token and a utility token whose functionality is designed to evolve alongside the protocol. It’s not just a governance token in name only; it’s a governance token as well. USUAL grants holders the opportunity to receive 100% of the protocol’s revenue, basing it on actual cash flow. Unlike tokens that rely solely on speculation or short-term incentives, USUAL combines its incentives with protocol revenue, making it a dynamic and valuable long-term asset.

Source: usual

Scarcity is a big part of USUAL’s appeal. USUAL’s emission rate decreases as deposits in the agreement increase. This deflationary issuance means that the token supply does not dilute over time, but grows in tandem with the total value locked (TVL). As a result, the value of each token scales as the protocol grows, creating a stable foundation for holders.

USUAL’s allocation model ensures that the community remains the primary beneficiary of the protocol’s success. 90% of USUAL tokens are allocated to the community, with only 10% allocated to team members and early investors. This distribution protects users from excessive internal influence, creating a fairer and more equitable structure that promotes continued participation and ecosystem trust.

USUAL’s utility extends beyond governance through its staking feature, where holders can activate governance rights and earn a share of newly issued USUAL tokens. Staking incentives, as well as measurement mechanisms that help optimize liquidity distribution, encourage holders to actively participate in the protocol, thereby enhancing long-term stability.

Source: usual

In Q1 2025, USUAL will enable a new feature that allows users to burn a portion of their tokens to unlock staked USD0 (USD0++), thereby enhancing stakers’ liquidity and flexibility. This option extends the utility of USUAL while balancing supply and demand dynamics within the agreement.

USUAL’s design addresses shortcomings common in most governance tokens. Unlike many tokens that mimic existing models, USUAL’s value is directly tied to protocol revenue growth. Its issuance model is carefully calibrated to keep inflation below revenue growth, tying token value to tangible cash flow. This structure delivers meaningful, ongoing value to those invested in the protocol’s long-term vision.

The $USUAL issuance model is particularly strategic and aims to control token issuance based on TVL growth and interest rates on assets supporting $0. This structure minimizes inflation and protects early adopters from dilution while preserving value for long-term holders. By limiting emissions and adjusting the issuance rate based on TVL growth, USUAL maintains intrinsic value, ensuring that each token accounts for a growing share of the protocol’s revenue.

This model ultimately benefits users who contribute to the development of the protocol and emphasizes USUAL’s commitment to fair value distribution. Emissions are significantly lower than fiscal growth, preventing excessive inflation and aligning incentives within the ecosystem.

USUAL’s governance model enables holders to control finances and collateral management, which differentiates it from many governance tokens that offer limited utility beyond token holding. Through staking, USUAL holders can influence key financial decisions and ensure financial management is consistent with the community’s vision. This level of transparency and control fosters a sense of ownership and long-term commitment among users.

The protocol’s roadmap includes scaling utility, and future implementations will provide holders with greater opportunities to earn per-token returns. As TVL increases, the token value will naturally rise, which is directly related to the financial success of the protocol. The USUAL model is designed to attract long-term players and encourage sustainable growth rather than incentivize short-term gains.

USUAL’s tokenomics model reflects a sustainable approach where growth in token supply is closely tied to ecosystem expansion. This prevents excessive inflation and ensures a balanced distribution of rewards to those who drive the success of the protocol. By aligning governance and utility functionality, USUAL’s framework supports a stable ecosystem of growth and collaboration.

Through USUAL, holders have the opportunity to participate in a governance model that rewards commitment to the development of the protocol and provides real, ongoing value. This is a community-centric model that prioritizes users over insiders, setting a new standard for governance tokens.