Since its launch in January 2025, Trump tokens have quickly become the focus of crypto investment, raising interest and doubt in the market. With its highly volatile price movement and strong political undertones, the key question remains: Can this token responsible for politics maintain its appeal and achieve long-term growth?

Now, trump card The deal was around $8, down more than 90% from its all-time high of about $75, when its market cap briefly approached $30 billion.

As of the end of April 2025, its market value had dropped significantly to about US$1.67 billion. This dramatic decline has raised serious questions about the long-term viability of tokens, reinvigorating debate on whether Trump is a short-lived political bubble or a high-risk, high-return long-term investment opportunity.

Trump Token: Unpredictable Journey

One of the biggest factors that influence the value of Trump’s tokens is the policy direction of Donald Trump’s new administration related to crypto. The loose regulations and pro-chain innovative stance provide positive emotions for the U.S. cryptocurrency market, especially Trump.

However, since its launch, the token has been highly sensitive to macroeconomic development, especially the Trump administration’s tariff and fiscal policy decisions.

For example, according to CoinMarketCap, Trump’s token soared from about 48 hours to more than 48 hours on January 14, 2025, days after Trump’s inauguration and the announcement of 145% tariffs on Chinese goods. The rally is driven by speculation that tokens will benefit from the new “America First” rhetoric and the occupation of protectionist agenda in American politics.

Source: Coingecko

But the rally did not last. By early February, Trump’s token fell below $6 after China retaliated against 125% of its anti-election program and global markets began to correct. This price drop underscores the extreme sensitivity of tokens to geopolitical news and its increasing role as a proxy for political sentiment rather than utility-based crypto assets.

Later, when the U.S. House passed a $5.3 trillion corporate tax reform budget over the next decade, the Trump token jumped to nearly $14 again, and then recorrected it to around $8. These volatility reflects the speculative nature of the token, closely related to Trump’s speech and headlines, rather than its intrinsic value.

Shortly after these policy-driven price volatility, a new challenge emerged: a major token unlocking activity.

On April 18, 2025, about 40 million Trump tokens (20% of the supply) were unlocked, causing sell-off issues. Investors contribute to the potential segmentation of inflationary pressures and market stability.

Prices remained firm after two Trump-linked companies retained most of the unlocked tokens. The move helped stabilize market sentiment after a turbulent political quarter.

Nevertheless, this concentrated token holding has attracted attention. If these entities decide on unexpected sales, they can trigger large-scale volatility and even market crashes. Sudden large sales crashed tokens and triggered panic sales in past crypto cycles.

Chain Analysis

First, the top 10 wallets dominate more than 82% of the total supply. If the big wallet is sold in a weak mood, the concentration of high holders will drop sharply.

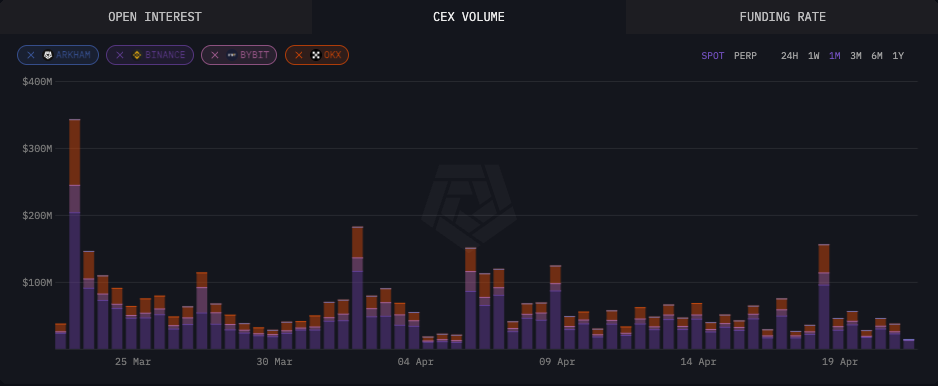

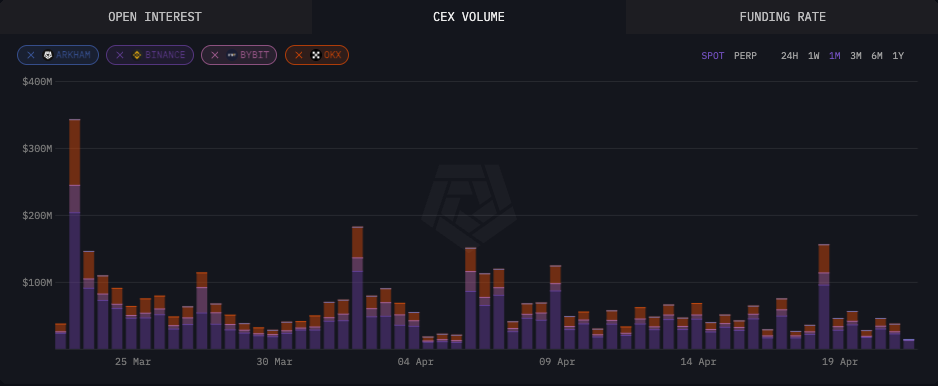

When Trump appears publicly, the transaction volume usually exceeds $100 million. By comparison, during quiet times with little news traffic, the daily volume may be less than $15 million. This reflects the dependence of the token on hype cycles and crowd behavior rather than a stable capital inflow or fundamental utility.

For example, after the truth social remarks made by Donald Trump on March 23, 2025 “I love Trump – It’s so cool!!!!!!!!!!!!!!!!!!!!!!!!!!!the price of Trump tokens soared 10%, with daily trading volumes exceeding $1 billion, more than triple from the average in previous days.

Source: Arkham

However, such price gatherings are often unsustainable. 60% of transactions in March came from FOMO-driven new wallets, not long-term beliefs. Once the media’s attention fades, these wallets tend to exit their position, triggering sharp and rapid price corrections.

From a price forecasting perspective:

- In the short term (3-6 months): Media-driven volume spikes may trigger rapid rally, but steep corrections may be made without new capital.

- In the medium term (6-12 months): Trump’s tokens may stay within range or fall further unless media hype gives way to real utilities or steady inflows.

With all factors in mind, Trump remains a speculative asset—more politically opinionated than utility-driven tokens. Its price remains very sensitive to media volatility and large wallet behavior.

Read more: Survey: One in 7 Americans buy Trump Memecoin

Trump price forecast

Short-term price forecast (the next 3-6 months)

In the short term, Trump tokens may remain volatile, trading between $7 and $15. Major debates such as political events, Trump’s speeches and surprise policy actions may exacerbate this volatility.

Trump’s threat to school funding stirs the debate and may continue to push the price transfer of Trump’s tokens.

Source: IG

Strong trade rhetoric, especially the rejoining tensions in China, could impact short-term sentiment and drive speculative trading.

Additionally, news about new partnerships or real-world use, especially in politics or finance, may increase the short-term token.

Interim price forecast (6 – 12 months)

In the medium term, Trump tokens can rebound and stabilize between $15 and $35.

This prospect comes from Trump’s realistic use and support for U.S. policy.

Additionally, services such as using Trump tokens for event tickets or campaign donations can support long-term price growth.

The forecast emphasizes the removal of legal risks and politics to protect the token’s long-term reputation. If these issues are not resolved, Trump’s tokens may remain high for a long time.

in conclusion

Trump tokens remain one of the most politically sensitive and speculatively driven assets in the cryptocurrency space. In the short term, news and Trump’s political moves may drive token price action. In the medium term, its potential depends on whether it can develop real-world use cases and gain regulatory clarity.

For investors, Trump represents both high risk and potentially high-level opportunities. The key challenge is navigating its extreme volatility and distinguishing between short-lived hype cycles and lasting utility. The political shift in 2025 will affect the behavior of the token, making it unique but unpredictable.

Read more: Is the beginning of a new growth cycle of Bitcoin?