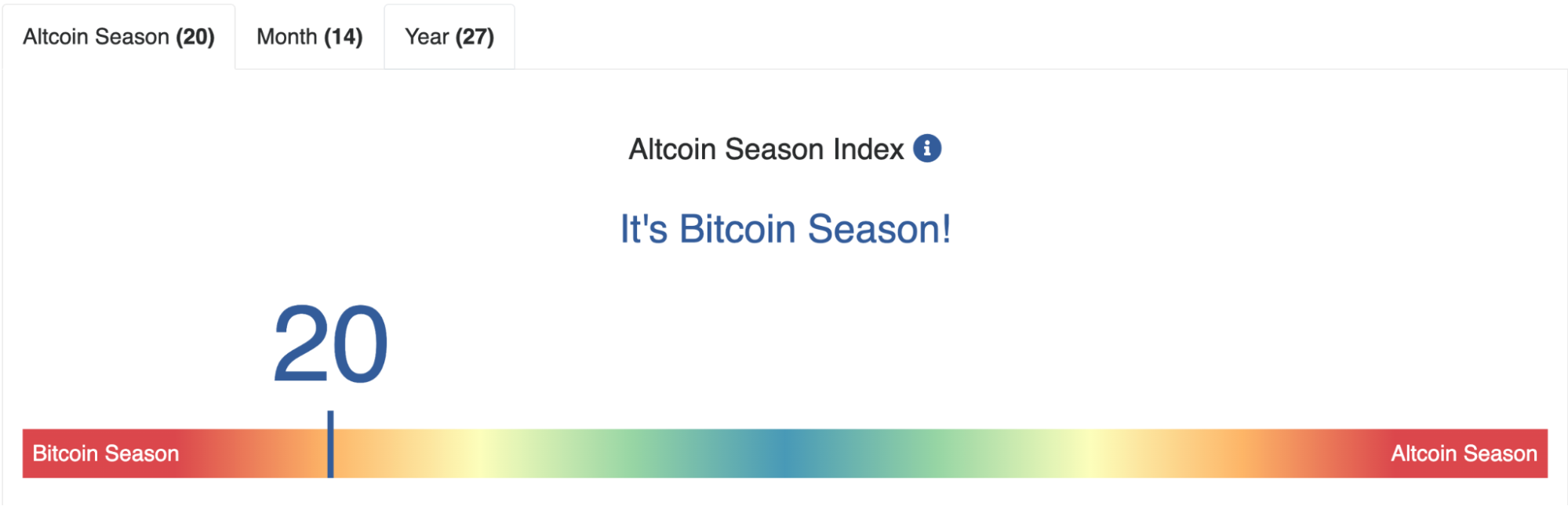

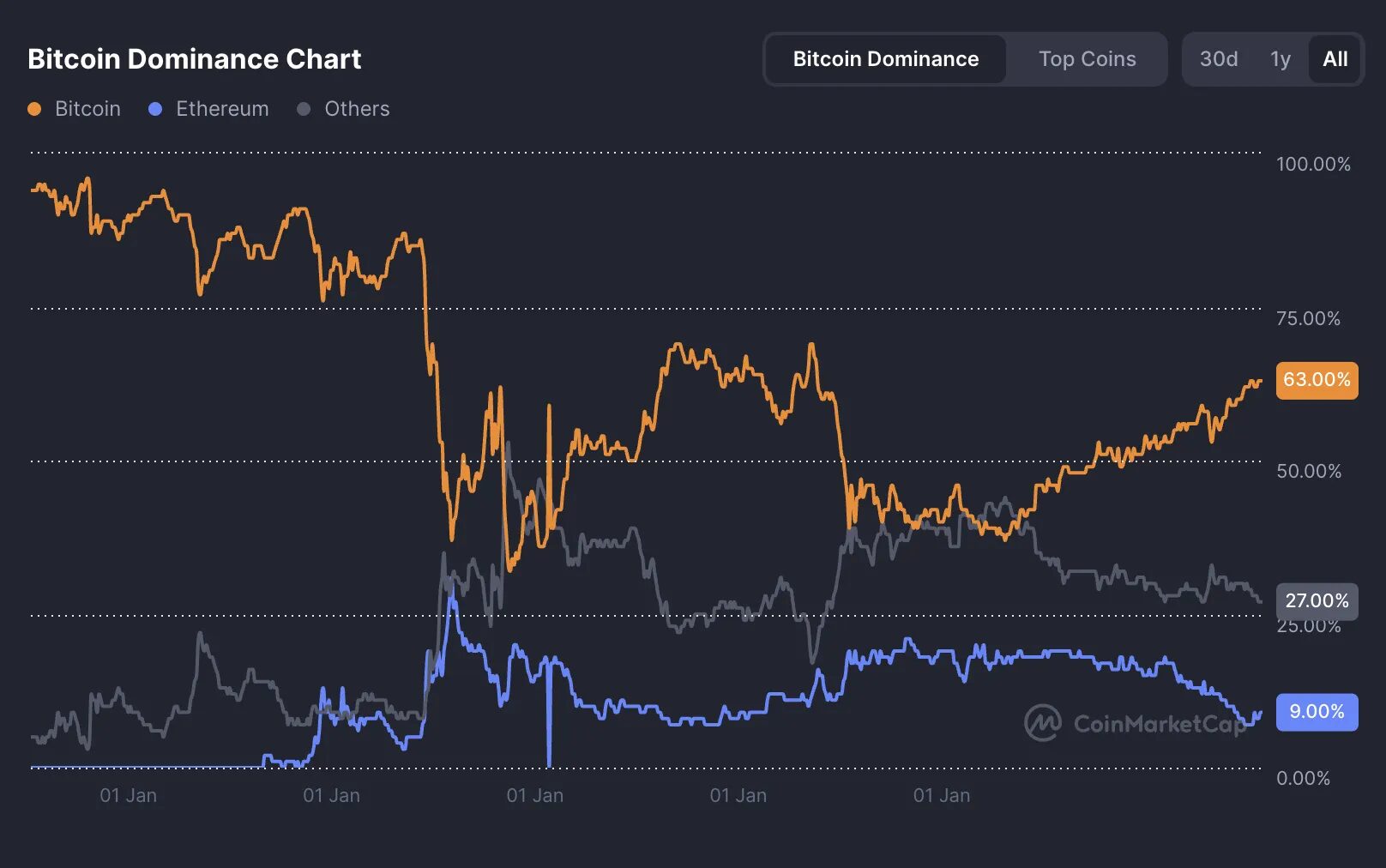

Bitcoin’s share in the cryptocurrency market has soared to a level not seen in four years, close to the 75% threshold of psychological significance.

Although Bitcoin itself trades slightly below its $111,970 on May 22, its advantage (BTC.D) continues to climb, suggesting that the unbalanced recovery rate greatly supports BTC, rather than other digital assets.

What is BTC Advantage (BTC.D)?

The Bitcoin advantage abbreviated as BTC.D measures Bitcoin’s share of the total capital of cryptocurrencies’ market capital. It reflects the proportion of capital allocated to Bitcoin relative to all other digital assets. The rise in BTC.D usually indicates that capital is at the expense of altcoins, often indicating risk sentiment or institutional preference for BTC’s liquidity and regulatory clarity.

Instead, the decline in BTC.D shows that there is an increasing interest in altcoins and may cause wider market speculation.

Bitcoin’s market share approaches four-year high

In early May, Bitcoin’s advantage exceeded 64%, reaching its highest point since January 2021. The latest data from the Trade View show that BTC.D oscillates between 64% and 65%, marking a persistent over-effect for Altcoins.

Source: TradingView

It is worth noting that this rise happened even as Bitcoin prices hovered below new record highs, indicating that capital is spinning towards BTC without fresh historical peaks.

Coingecko reports that Bitcoin’s market cap is now $2.18 trillion, accounting for 61% of the $3.54 trillion crypto market. When BTC and ETH (3 in total) are not included, the Altcoin industry is still fighting for $11.17 trillion in April’s resistance – currently losing.

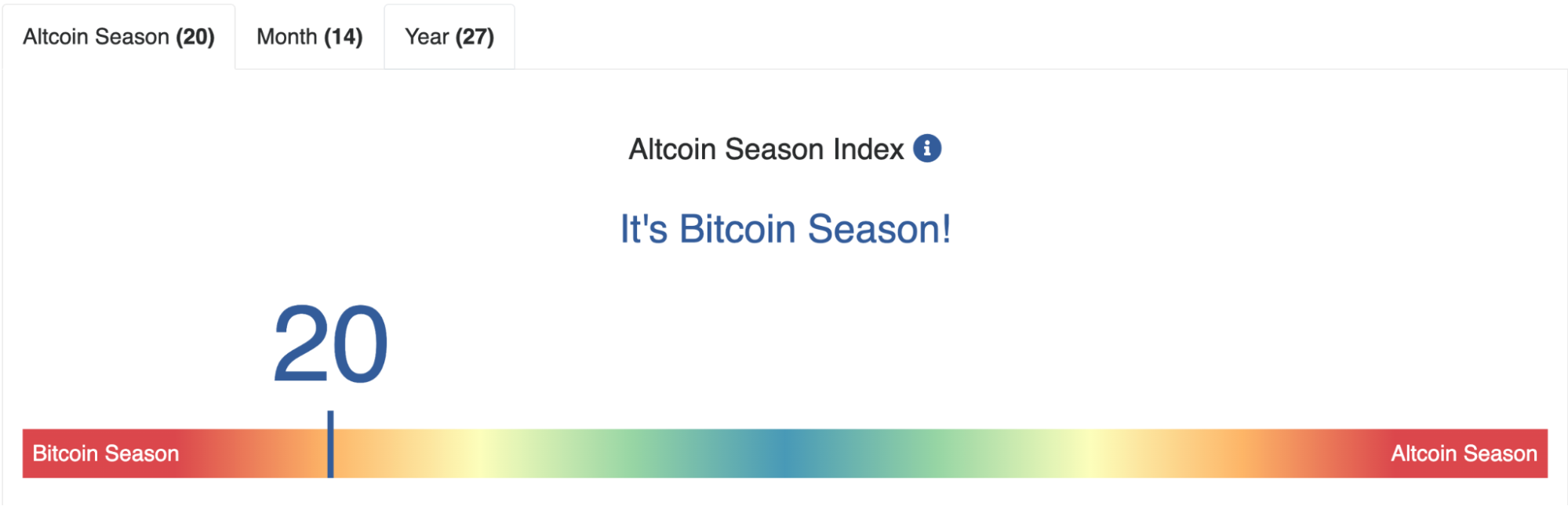

When the BloxchainCenter Altcoin season index surpasses 75% of BTC in 90 days to outperform BTC, the index marks Altcoin’s strength, currently in the depths of the “bitcoin season.” Now, the ongoing Altcoin bear phase has been extended by 1,200 days, the longest in the industry’s history.

Source: Blockchain

Leading Altcoins still outperform their all-time highs. Ether is still 64% below its November 2021 peak, while Solana is still down 36%. Meanwhile, the total 3 continues to reject at critical resistance levels, raising doubts about the recent rotation.

Capital continues to flow into Bitcoin

Since the SEC approved the on-site Bitcoin ETF in early 2024, institutional capital has poured into these products on a scale that was previously invisible in the crypto market. More than $1 billion in net inflows entered BTC-centric ETFs, reflecting new professional investor participation. According to Coindesk’s 13F filing, registered investment advisors and wealth managers now dominate the ETF shareholder registration form.

By comparison, Ethereum ETF recorded a net outflow of $228 million in 2025 in Q1. Analysts interpret the differences as clear signals that institutions prefer Bitcoin as a “first exposure” asset due to their longer trail, perceived regulatory security and higher liquidity.

Source: Coindesk

Bitcoin continues to benefit from its de facto regulatory clarity. With American agencies like the CFTC classifying it as a commodity, this is unlike many altcoins that are still entangled in legal gray areas or law enforcement actions. London Financial News reported that since the approval, hedge funds such as Millennium Management and Brevin Howard have greatly expanded their positions in Bitcoin ETFs.

Meanwhile, the lack of regulatory approvals for cryptocurrency basket ETFs, including altcoins, and their limited institutional diversification enhances Bitcoin’s primary position in regulated portfolios.

Bitcoin’s deep liquidity remains one of its most compelling attributes, especially in an uncertain macroeconomic environment.

Macro risks, such as new tariff conflicts, Fed policy ambiguity and geopolitical outbreaks, prompted portfolio managers to seek shelter to take refuge. Mitrade’s cross-exchange data confirmed that in the case of a sharp drop, BTC.D actually increased, suggesting that traders uninstalled Altcoins in the first place.

This pattern has become self-reinforced: the more liquid flows Bitcoin is dominant, the more cautious it attracts, further marginalizing altcoins during peak volatility.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Can the Altcoin season be broken freely?

U.S. spot Ethereum ETF entered a strong inflow record – an increase of about $837.5 million for 15 consecutive days since mid-May, bringing cumulative 2025 inflows to more than $3.3 billion. With Blackrock’s Etha lead (about $600 million), a successful U.S. listing can reposition institutional funds and stay away from BTC.

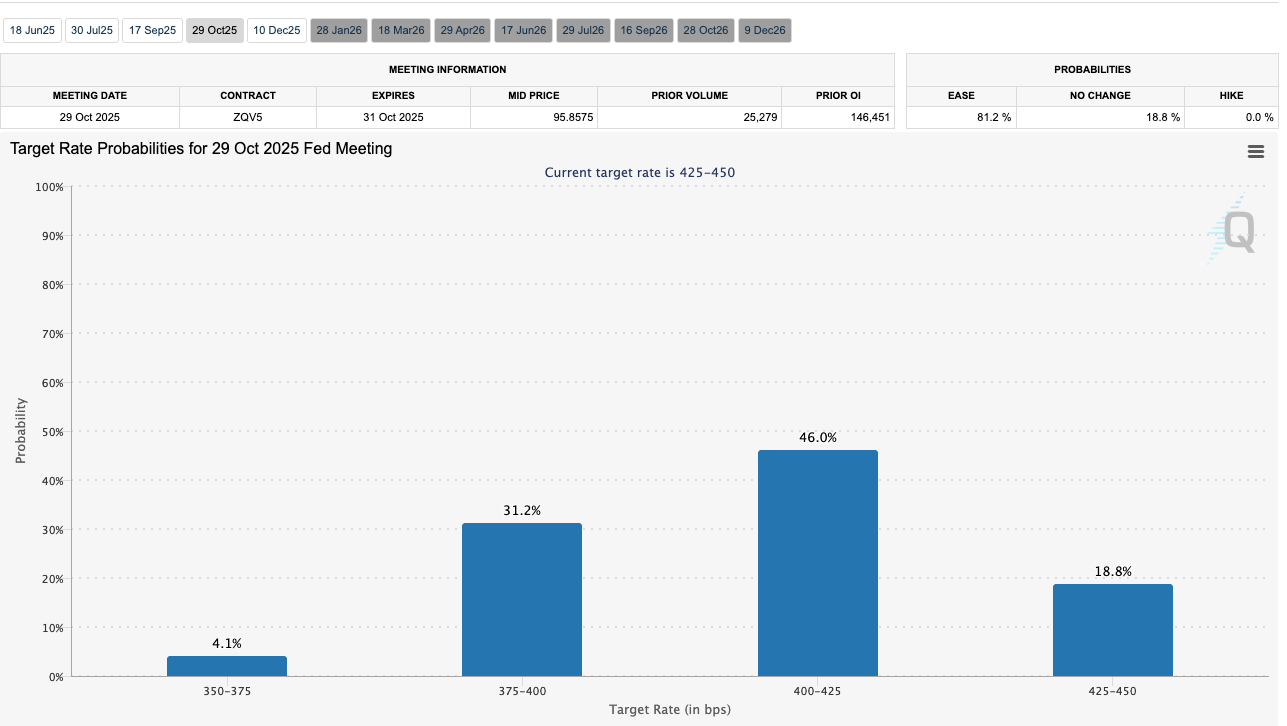

Ainvest’s chain risk model shows that the probability of easing federal policies could trigger Altcoin rally is 90%. The CME FedWatch tool is still allocating an opportunity for a reduction rate of about 4.6% in early June, but if it is implemented after the cut, the historical model suggests that smaller cover PAP cryptocurrencies may be connected.

Source: CME Group

Additionally, new thematic bets, such as AI-linked tokens, real-world dramas or industry-specific protocols, may briefly stand out from the trends in the BTC zone. However, these departments currently lack ETF channels or strong institutional exposure, which makes any breakthrough vulnerable in the absence of wider adoption drivers.

Note, however, that even bullish technical signals such as Golden Cross on the Total 3 chart require new capital inflows to make sense, and capital is still concentrated in Bitcoin.

At present, structural advantages supervision, liquidity and institutions are conducive to BTC. Unless one of these levers changes, the catalysts disrupt the dominant trend, alternative token investors may continue to face tough headwinds as Bitcoin consolidates its role as the liquidity king of cryptocurrencies.

Read more: When will the Altcoin season begin?