There is nothing more exciting than the projects listed on binary. This is not only the stamp of product verification. This is a liquidity catalyst that often pushes the project to the next stage of growth. This article explores the potential binary list that currently causes five projects in the Web3 space: DeepBook, Hyperlane, Gomble, Megaeth, and Aster (Astherus).

Recently, Binance’s launch of the “Vote for Delist” program further indicated a strategic shift: clearing underperforming or dispersed tokens to make room for updated high-potential projects, many of which are binance-based entities such as Yzi Labs. The move not only simplifies liquidity across the platform, but also paves the way for the upcoming list to launch with a higher dilution valuation (FDV).

Each project will be evaluated based on four key pillars – ecosystem roles, product maturity, tokenology and links to binary – to fully look to its listing potential.

Fermentation

Megaeth is an emerging layer 2 solution optimized for ultra-fast trading speeds inspired by high-frequency trading (HFT) systems in traditional finance. With processing time below 10ms, very low latency, and the ability to process up to 100,000 transactions per second, Megaeth aims to be the preferred infrastructure layer for high-performance Defi applications.

As of early 2025, the project raised a total of $57 million, including the $20 million Series A led by Paradigm in June 2024 and the $10 million strategic round in December 2024.

First, Binance’s paradigm, one of the closest venture capital allies, supports Megaeth, a factor with considerable weight. Historically, projects such as DYDX, Blur, and Blast have been supported by paradigms and were included in Binance shortly after their tokens were released.

Additionally, Megaeth raised funds through the Echo, similar to the performance of the regular and Initia. It is worth noting that both the General and Initia received Binance listing shortly after completing the Echo-based fundraising round. This reinforces the case where Binance is currently monitoring community-driven projects, especially those supported through the ECHO launch framework.

Read more: Megaeth Airdrop Guide: Earn exclusive Airdrop releases

Megaeth grew up on the Echo – Source: Echo

Deep Book (Deep Book)

DeepBook is a book that is built directly into the SUI network infrastructure. Unlike traditional standalone DEXs, DeepBook is a shared liquidity layer for the entire Defi ecosystem on SUI.

Several times the major exchanges, including Gate.io, Bybit, Kucoin, Bithumb and Mexc, all went deeper into the list.

DeepBook is the core infrastructure component of SUI – just like the cosmos Raydium and Serum do for Solana or Dydx. Historically, Binance prioritized it as a marker for “core liquidity subordinates.” Since deep anchors are liquid in most DEFI schemes on SUI, it is a natural candidate for Binance radar.

Secondly, the usage indicators are highly positive. According to the SUI Foundation, SUI flows through Deep Books orders exceed 85%, especially through DEXs such as Cetus and Turbos. By integrating locally into the SUI consensus, DeepBook provides ultra-fast matching speeds without relying on standalone smart contracts like most other DEXs. This gives it a technical advantage in scalability and security – two key inventory factors of binary.

Deep is also suitable for Binance’s broader strategy to expand liquidity and list key SUI ecosystem tokens. Binance has listed SUI, followed by Cetus. According to ecosystem logic, the next candidate is most likely.

Furthermore, Deep’s token distribution is very strong, and most people allocate to users and builders through airdrops, incentives and liquidity mining – closely aligned with Binance’s preference for the decentralized distribution model.

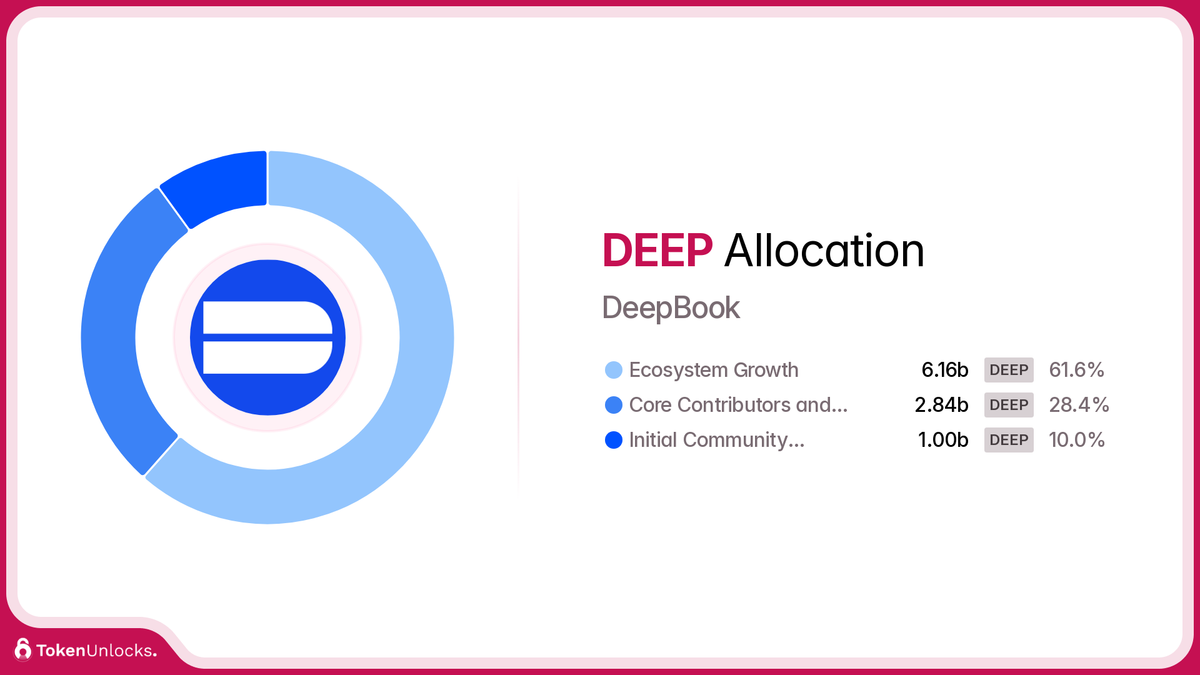

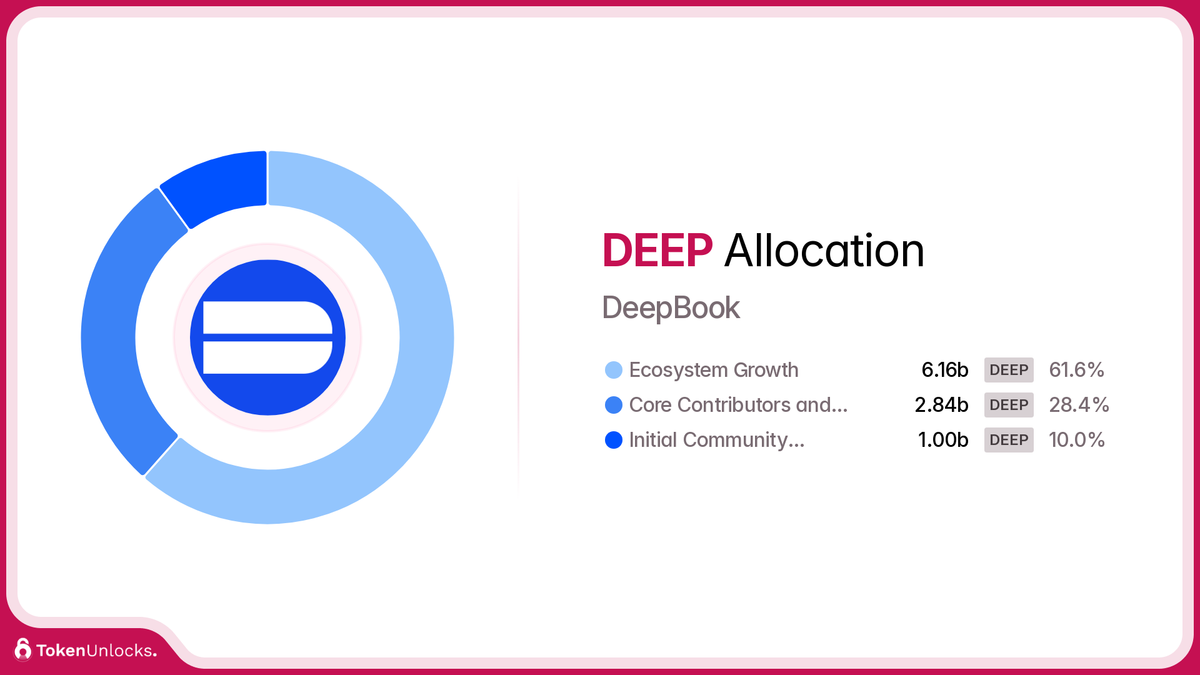

Token allocation failure:

- 61.57% of the community

- 10.93% of investors

- Mysten Labs 10%

- 7.5% to early contributors

- Initial airdrop 10%

Deep allocation – Source: Tokenunlocks

HyperlanE (Super)

Hyperlane (Hyper) is a cross-chain messaging protocol that allows blockchains to send and receive data safely and flexibly, similar to layerzero.

The project plays a strategic role in emerging modular blockchain waves, as well as projects such as Celestia, Sports Labs, Eclipse and Berachain. Binance is showing increasing interest in this trend, especially after listing modular tokens such as Zro. If ZRO helps to cross the EVM chain bridge, then Hyper can be used as a messaging main chain for modularization and application specific chains – through the modularization of BNB smart chains, direction binance can also be pursued.

Like Deep, Hyper has a decentralized token distribution, 57% is allocated to the community through incentives, grants, points, and liquidity mining. Private distribution is subject to long-term lockdown, consistent with Binance’s preference for decentralization.

Another notable advantage is Hyper’s investor profile, which includes funds closely linked to the Binance list. Companies like CoinFund, Variant and Galaxy Digital previously supported projects that were launched later. With a round of over $18 million, Hyper stands out as a strong listing candidate.

According to ICO Drops, CoinFund supports 93 projects, with about 28.57% of which make it Binance, which is a relatively high success rate.

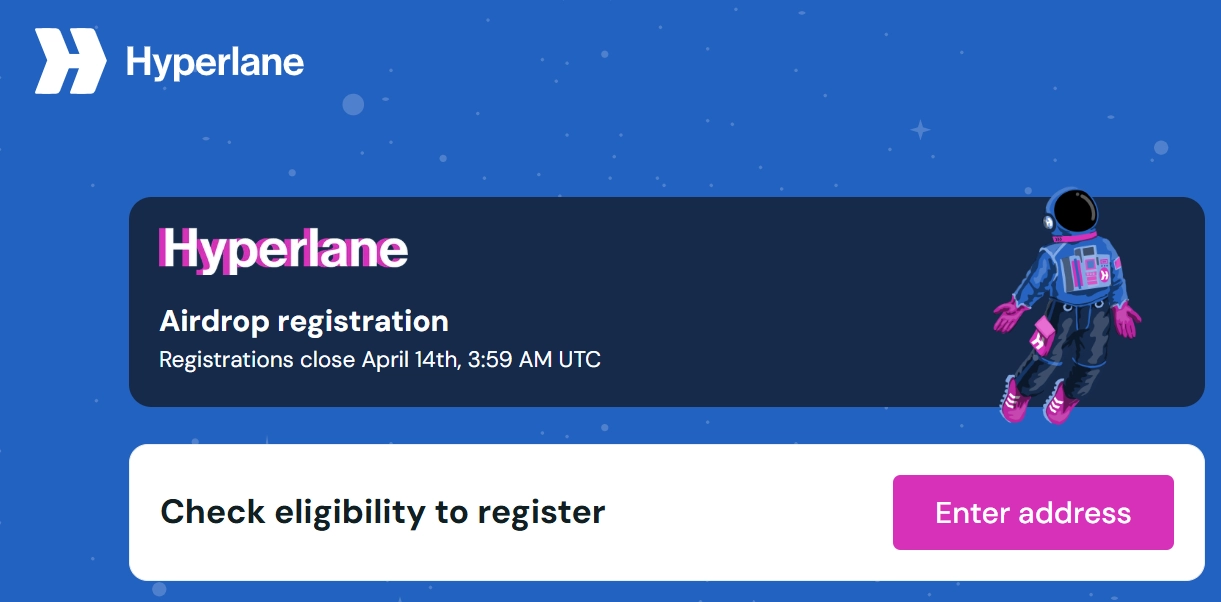

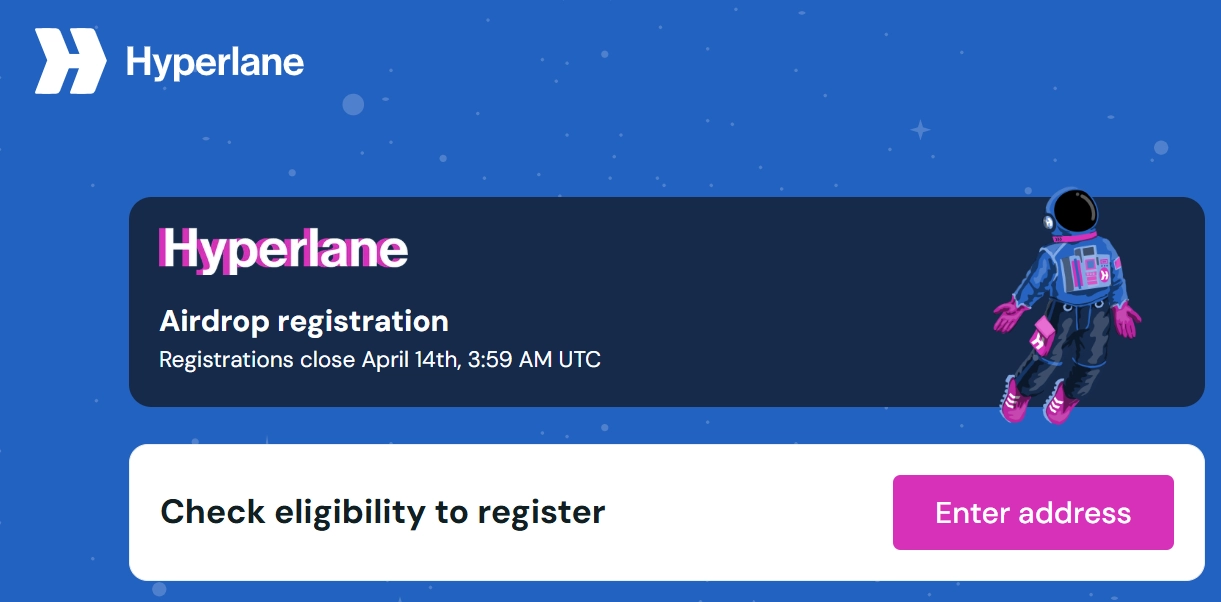

Read more: Check your overtake model air conditioner: Overtake claimant has turned on

Gomble (GM)

Gomble (GM) is one of the few Web3 game studios that prioritizes “entertainment” gameplay rather than focusing solely on the “Play-to-to-earn” model. With its flagship title Rumbystars, and a wider interconnected ecosystem built around social graphs, the project has attracted more than 3.5 million users, including 2.8 million monthly active players, a rare milestone in the web3 gaming space today.

Gomble has received direct investment from Binance Labs, which recently featured the project, which often suggests potential launch pool convergence or on-site listing.

In addition, Gomble has conducted early and meaningful integration with the Binance Wallet ecosystem, including official mentions of the community movement, Stabegring Trial and Binance social channels. This is consistent with the familiar patterns observed in the second-hand lists in the past: Media collaboration → User engagement campaign → Exchange lists. Notable examples include Renzo and Fusionist.

Finally, Gomble’s token distribution structure closely matches Binance’s emphasis on scattered token groups, a key criterion for many of its recent lists.

Learn more: Binance alpha new launch of darkness and gomble

bomble on Binance alpha – Source: binance

universe

Aster, formerly known as Astherus, is a decentralized permanent exchange (permanent DEX) that aims to compete with leading platforms such as DyDX, GMX and Hyproliquid. The project aims to deliver high performance through a CEX-like user experience, while also establishing a local rewards points system and proprietary Stablecoin to support long-term growth.

As of April 2025, Aster has exceeded $258 billion in cumulative transaction volume, making it one of the most active DEXs to have not yet launched tokens.

Aster participated in Binance Labs’ seed funding round, joining projects like Arkham (Arkm) and Ethena (Ena), which was later secured with the list through Binance Launchpool or Direct Spot Markets. Recently, nearly 50% of Binance Labs’ seed-stage portfolio has made it Binance, a model that emphasizes the strength of internal support and ecosystem alignment.

You can join Aster Airdrop and Ave 10% off on this link

In addition to funding links, Aster also has technical integration with Binance infrastructure. Specifically, the project carried out a Straking motivational campaign through Binance’s keyless wallet, demonstrating the true traction in the Binance ecosystem.

There are many different versions of BNB rewards. Asbnb, Slisbnb, Clisbnb…to combine them together? https://t.co/j5mlt44prt

– cz🔶bnb (@cz_binance) April 18, 2025

The PERP trading narrative is clearly reappearing after the surge in next-generation permanent dex tokens such as Hyplipiel and Aevo. As Binance hopes to diversify liquidity through CEX alternatives and promote healthy competition, Aster stands out among potential launch pool convergence or direct listing candidates, such as the previous Ethena (Ena).

in conclusion

Few projects really stand out in the fierce Binance list competition, but these five bring unique advantages that give them a clear advantage.

Each project is closely aligned with Binance’s known inventory patterns: strong narrative fit, a positive user base, consistency of strategic investors and (and perhaps most importantly) related to Binance’s own infrastructure or venture capital weapons. While cryptocurrencies are not guaranteed in cryptocurrencies, second-hand businesses may soon turn their attention to these five promising projects.

Read more: Top 5 Best Air Conditioning Agricultural Projects in Solana (Part 1)