SUI has steadily gained traction in Defi and gaming fields with its unique object-centric model and high throughput capabilities.

In 2025, the narrative surrounding Airdrop agriculture shifted to early chains, Sui offers one of the most lucrative landscapes for active users and contributors.

Why use farm gas water on the Sui?

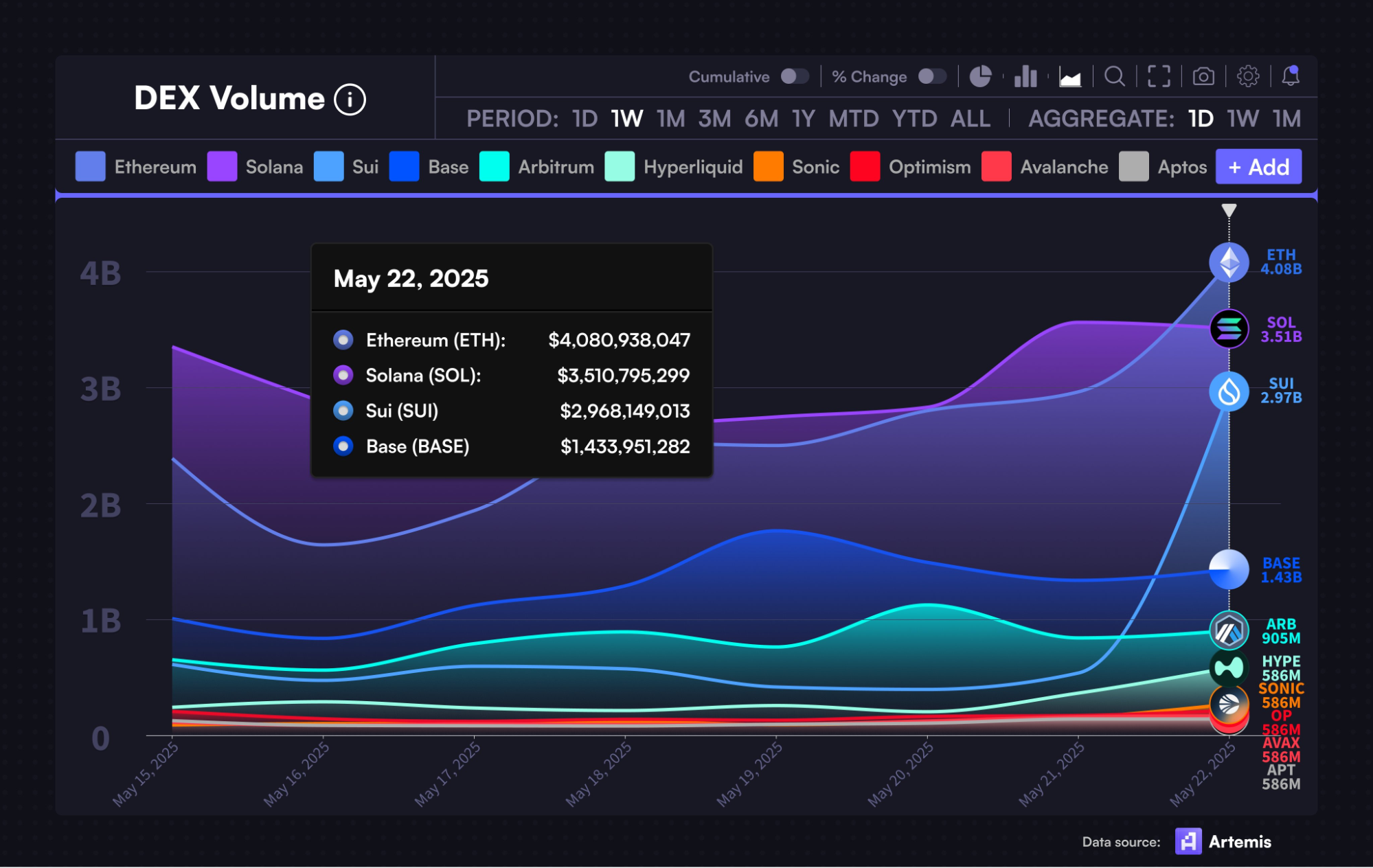

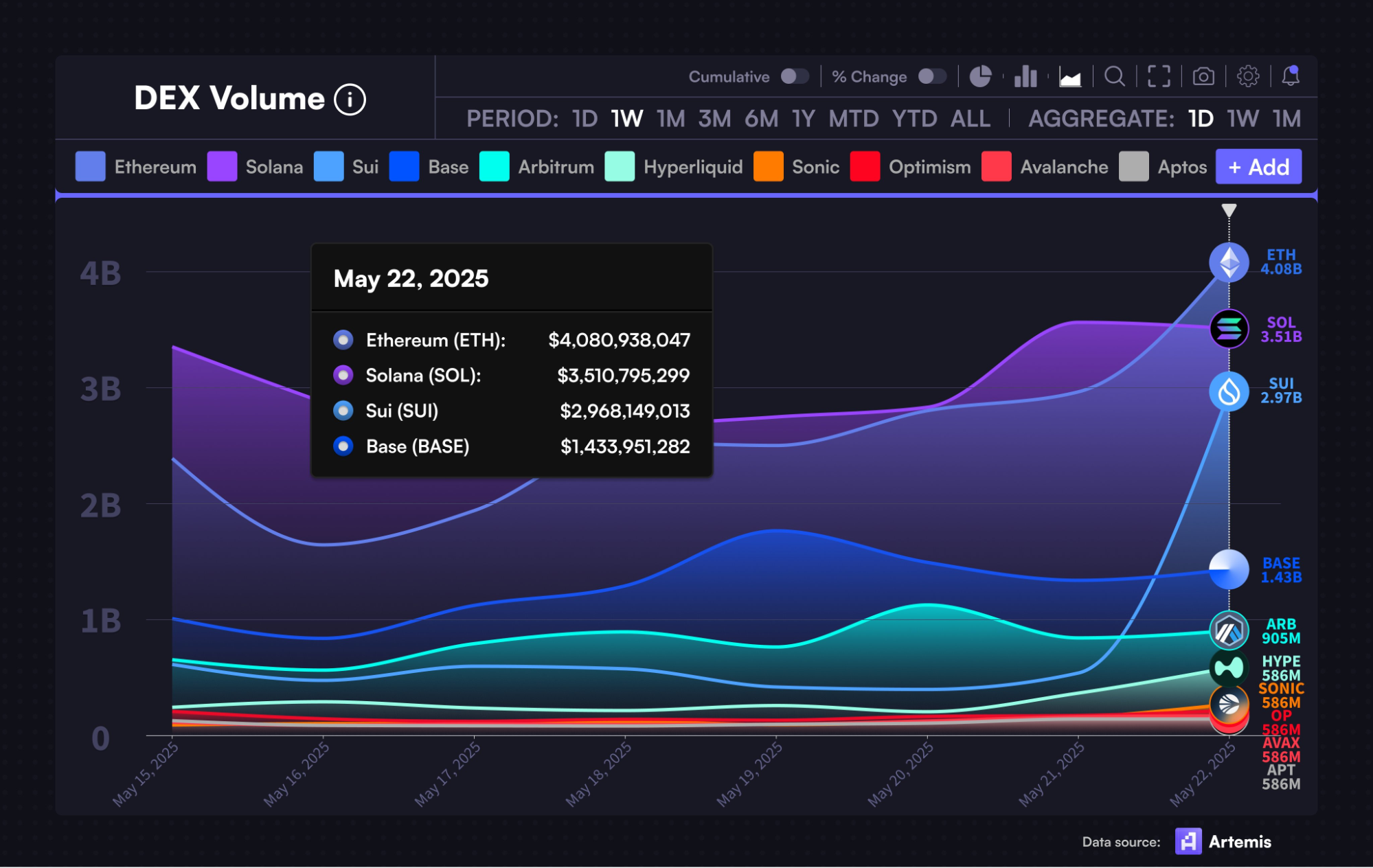

SUI has recently flipped the foundation in daily DEX transaction volumes, indicating strong user engagement despite the security incidents briefly rocking the network. Even affected by protocol-level utilization, the ecosystem has shown great resilience – users have not given up on SUI, and chain activity is still consistent.

This shows community trust and long-term confidence.

With the recent decline in SUI token prices, many people think it is an opportunity to accumulate – not only for local tokens, but also for undervalued ecosystem playback. As activity continues to grow and intensify air conditioning incentives, early positioning can provide capital upside and token rewards.

Source: Artemis

SUI combines a strong developer ecosystem with a rapidly expanding user base. SUI projects usually reward early users through airflow through air conditioners, incentivize on-chain activities and guide community participation.

Several past examples, such as Deepbook and Cetus, have shown that early involvement in testnet and mainnet interactions can lead to a large number of token allocations.

If you plan to earn Airdrops on SUI, here are the top five items you should watch (and use):

5 Airdrop projects on SUI

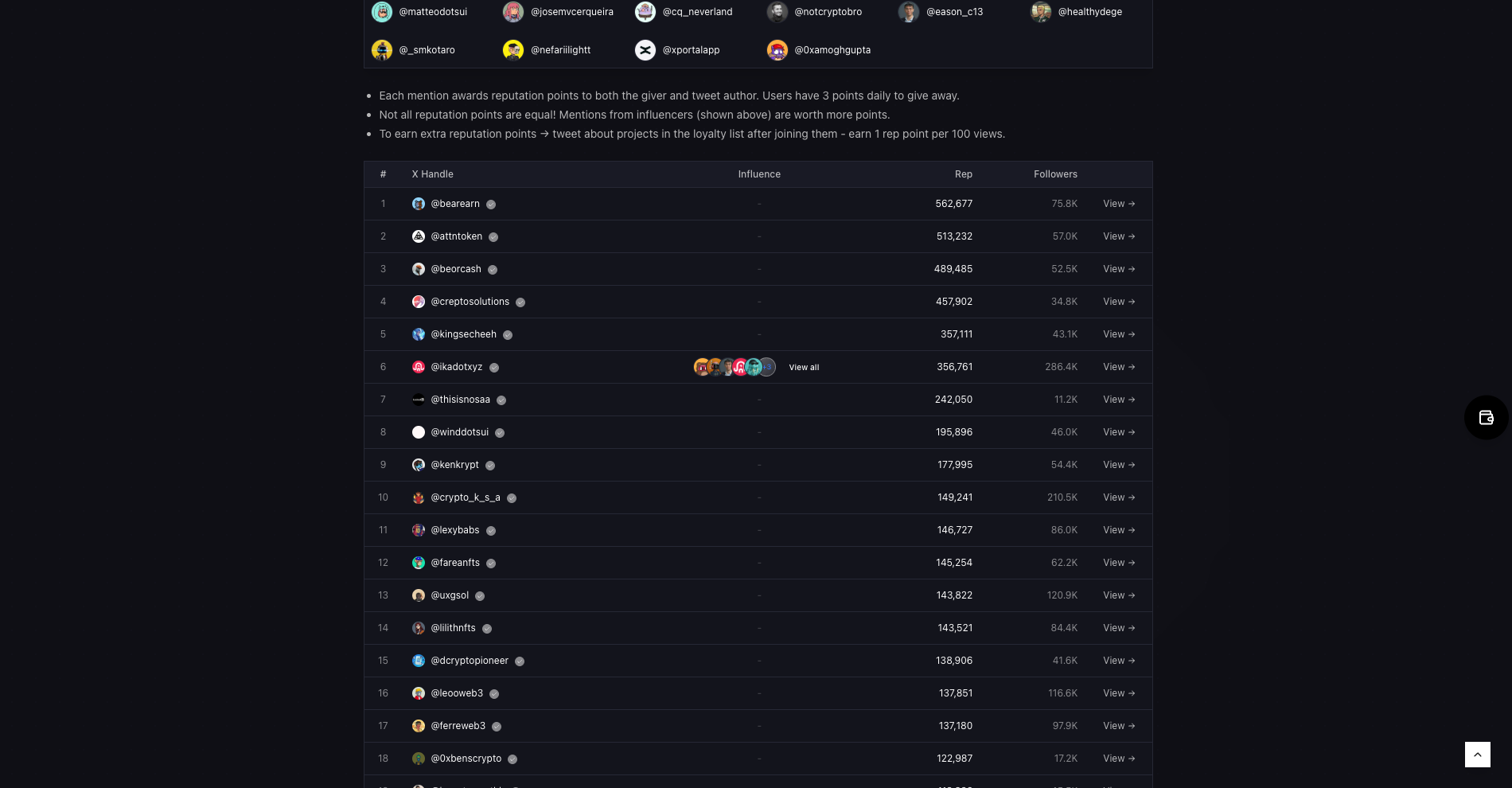

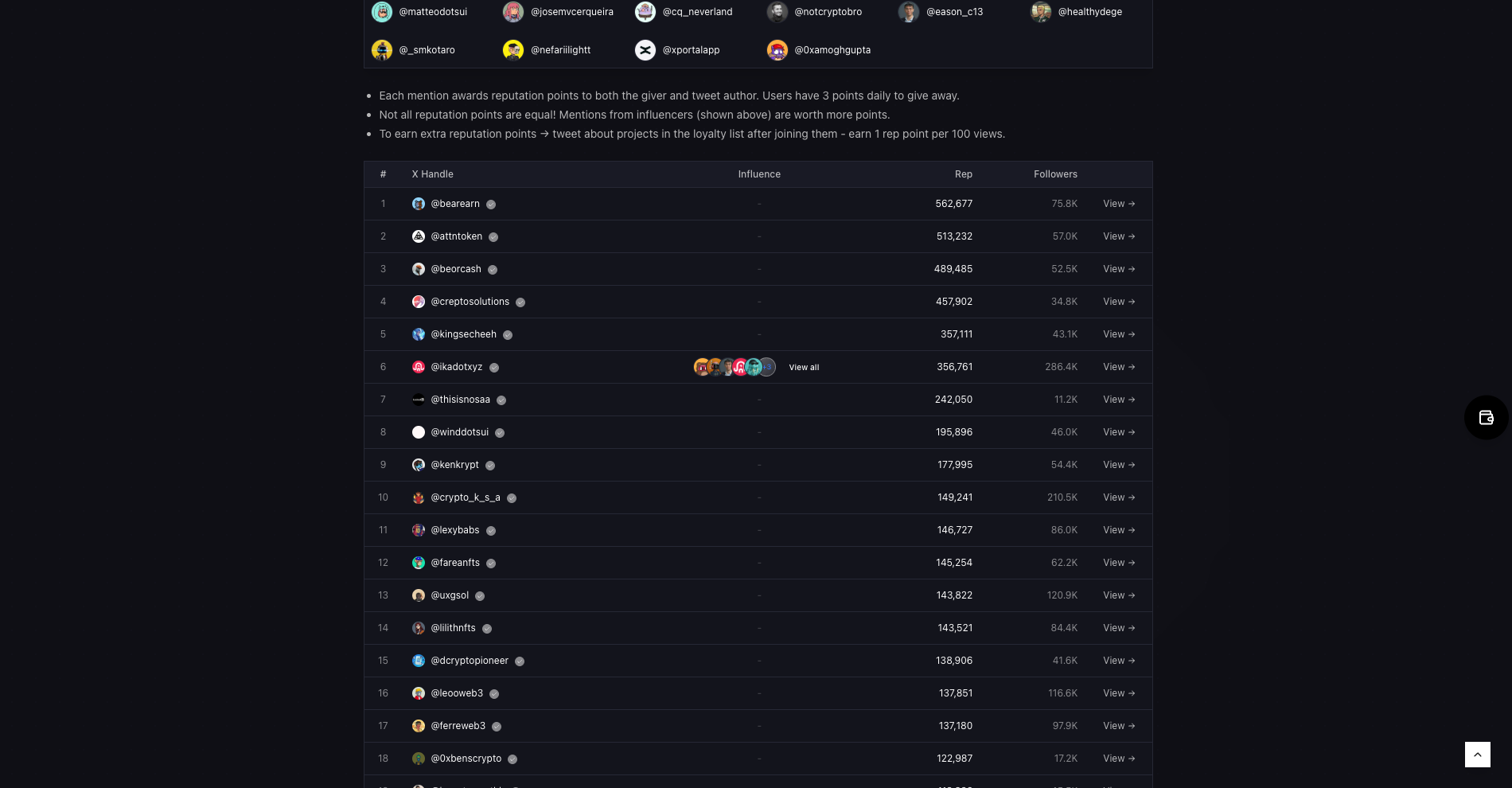

Giverep

Giverep positions itself as “Web3 LinkedIn” on the SUI. This protocol enables users to provide and gain recognition for on-chain behavior, engagement and expertise. In many ways, it merges the reputation system with token incentives.

Giverep hints at potential tokens Airdrop to $represented point holders, rewarding those who actively participate in the campaign, recognize others and provide verifiable on-chain data. Users who often interact with social verification and contribute to the reputation of the ecosystem are likely to qualify.

Source: Defillama

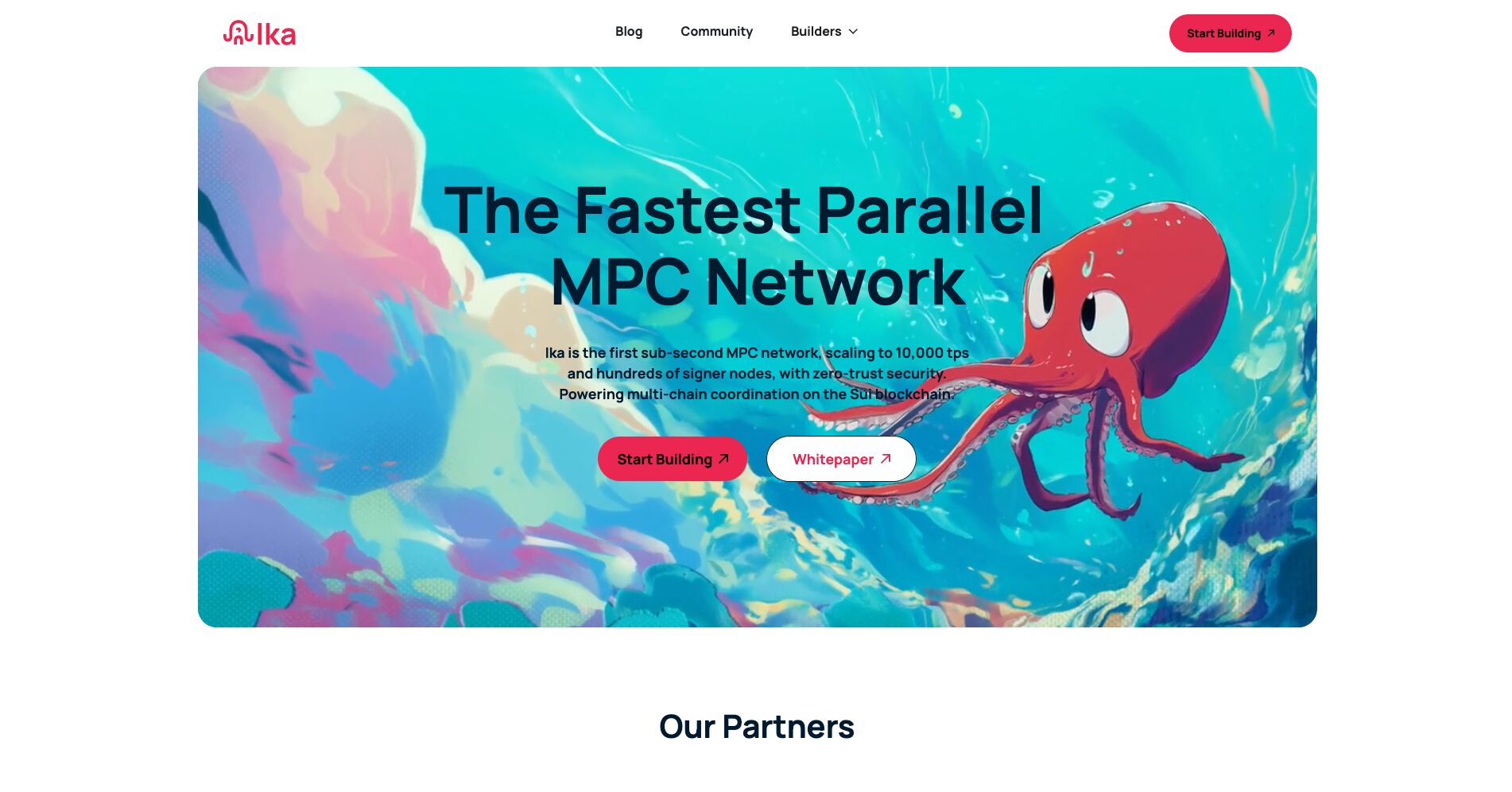

IKA Agreement

IKA is a Defi automation protocol built on SUI, enabling users to set up conditional orders, limit transactions and create smart libraries. It acts as a revenue optimizer and transaction manager, similar to the Defi option on Ethereum, but optimized for SUI’s parallel execution model.

Protocol highlights:

- Lock value currently exceeds $3.2 million

- More than 12,000 addresses have personalized smart vaults

IKA has conducted several testnet challenges and motivational campaigns and mentioned tokens on the roadmap. Users who participate in automation strategies, develop complex trading rules and provide liquidity to IKA-connected vaults are likely to be rewarded.

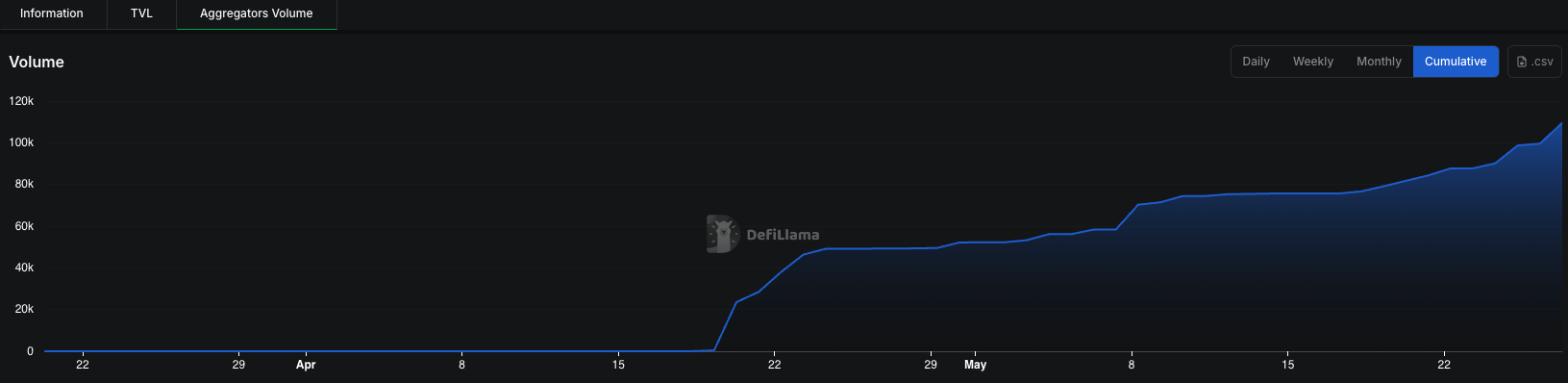

CRO Aggregator

CRO is the main DEX aggregator on SUI, similar to 1-inch or matcha on Ethereum. It comes from the best price source of all major SUI-based decentralized exchanges and allows for gas swaps and best routing.

Platform Overview:

- Currently integrated pricing from 8+ SUI-based DEX

- According to Defilama

- Historical sales estimated below $110,000

The CRO team hints at the upcoming CRO governance token and plans to air to active businessmen and liquidity providers. Using CRO for daily exchanges or referrals to new users may lead to future token drops.

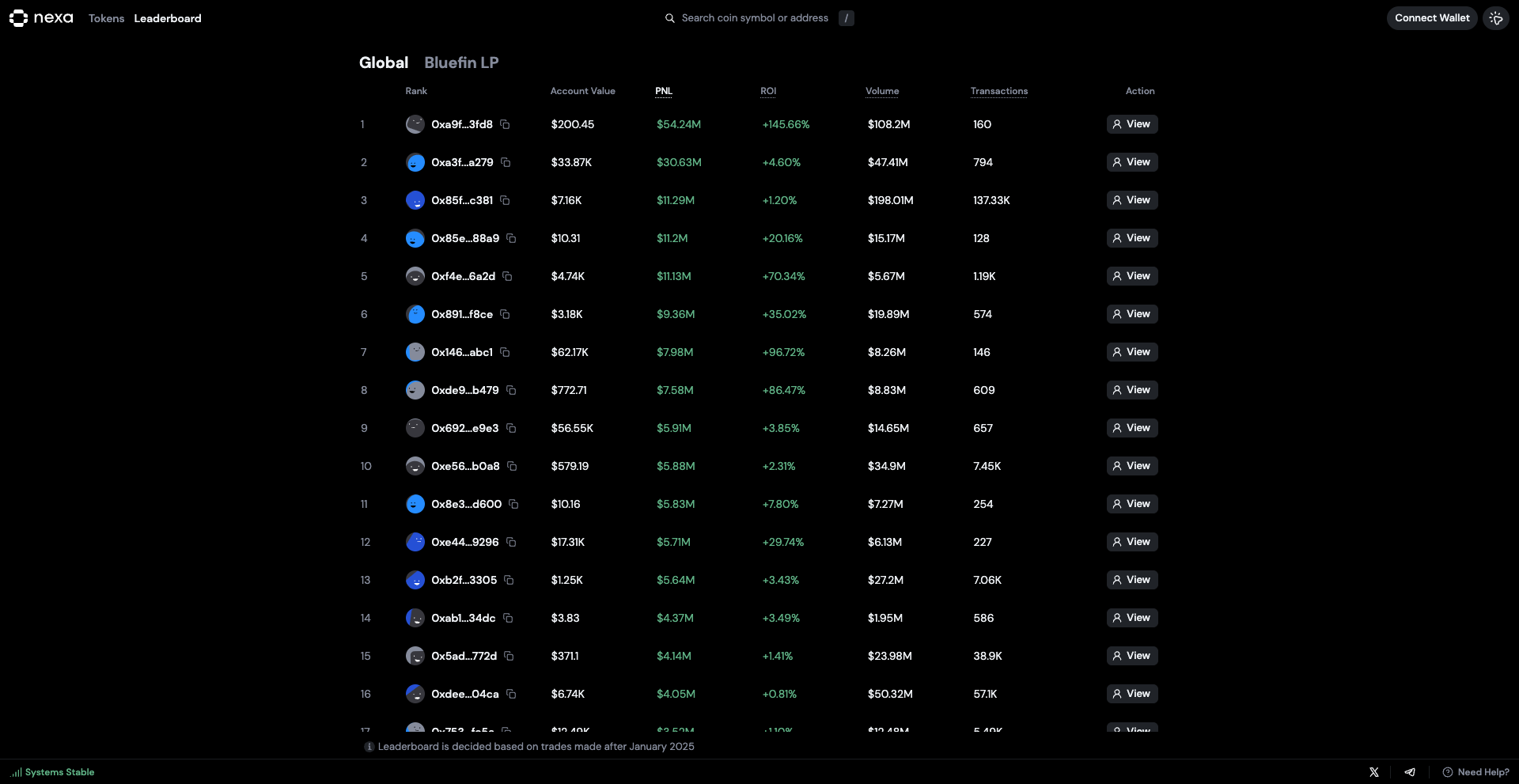

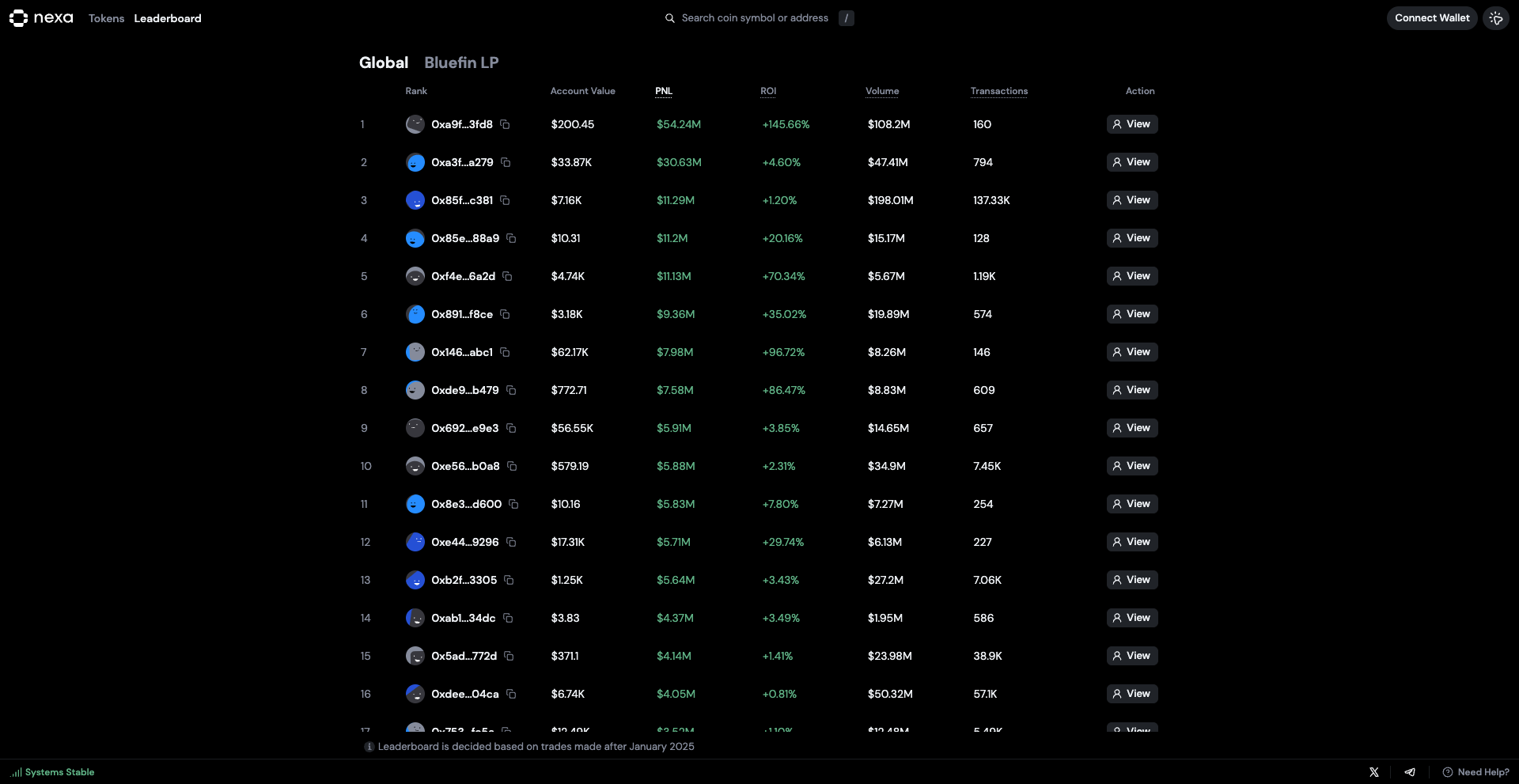

nexa

NEXA is an all-in-one trading terminal on SUI, which evolved from the original Insidex product. It combines multiple asset trading, real-time analytics and portfolio tools in a single UI built for professional and casual traders. Nexa has rapidly evolved its use and functionality with its sleek front-end and a performance-driven back-end.

Use snapshots:

- To date, more than 75,000 users have interacted with NEXA

- Actively track over 100 weekly traders using terminals

NEXA’s point-based reward system tracks transaction activity, recommendations, and terminal usage. These views are expected to play an important role in future airdrops. Early adopters, especially those migrating from Insidex, will benefit the most.

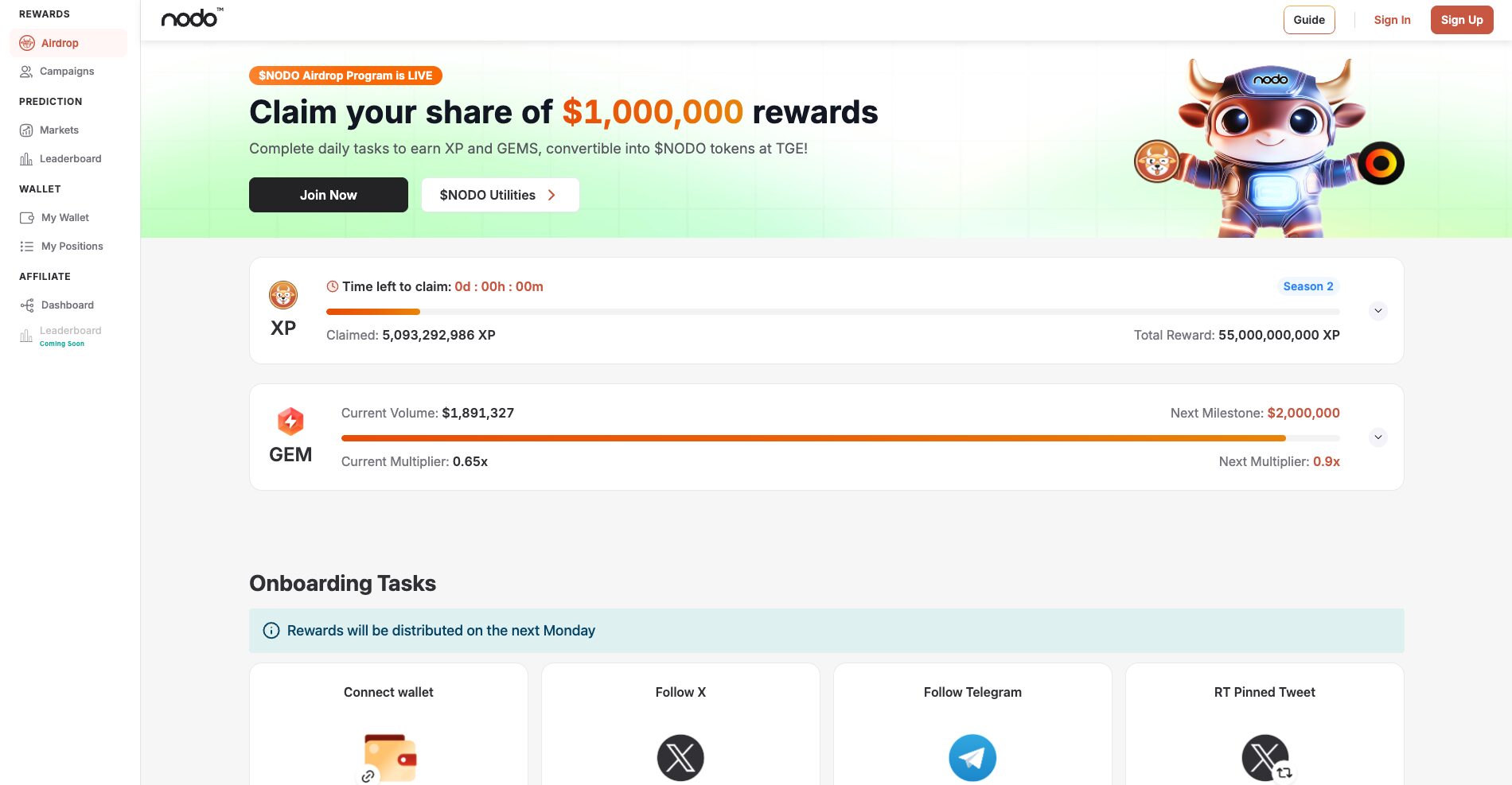

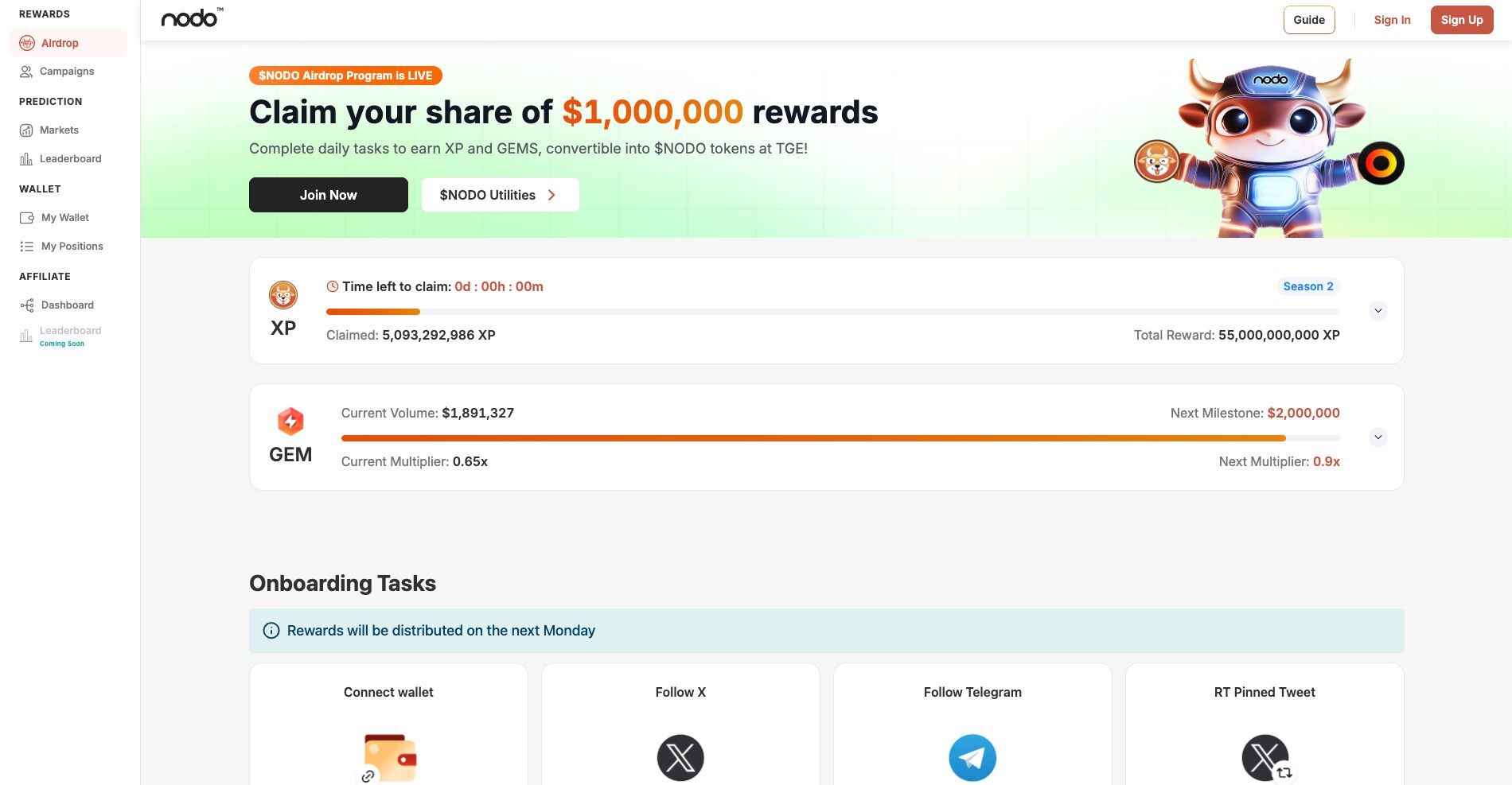

node

NODO is an AI-driven DEFI protocol on SUI, which utilizes automatic source proxy to optimize liquidity and output strategies across comprehensive protocols such as CETU. It enables users to deposit assets into an AI proxy vault, where intelligent strategies rebalance risks and automatically return.

Although TVL has not been publicly confirmed, Nodo’s documentation and community channels show an increasing appeal. Users who deposit assets like USDC will receive NDLP tokens and earn points, which are expected to be converted to Airdropped tokens in the future. Nodo positiones itself as the leading AI infrastructure layer in the SUI Defi ecosystem.

NODO introduces NDLP (NODO Liquidity Provider) tokens representing shares in these automatic vaults. Users depositing assets like USDC earn NDLP and accumulate expected to convert to tokens in future Airdrops. Nodo positioned itself as the preferred liquidity layer on SUI.

in conclusion

With the strong foundation of the network – fast termination, low fees and growing developer activities, rewards for early community members are stronger than ever. From social reputation to Defi automation, from trading terminals to AI-driven earnings strategies, SUI-based protocols cover the full Web3 spectrum.

By exploring these five projects – Giverep, IKA, CRO aggregator, NEXA and NODO, you not only get token rewards, but also get some of the most promising innovations on SUI as early as possible. It provides meaningful exposure to core innovations taking place on SUI, helping users understand and shape the evolution of this next-generation blockchain ecosystem.

Read more: Best Free Encryption Airdrop 2025: Optimizing Airdrop Potential