The cryptocurrency market is no stranger to volatility, and Sol has felt a significant price drop lately. As investors and enthusiasts scramble to understand the latest downturn, questions abound: What drives this tendency, and where is Solana next?

In this analysis, we will dig into the factors that influence Solana’s recent price movements, explore market trends, and provide insights into what this high-speed blockchain competitor may face. Whether you’re an experienced businessman or a curious observer, this is the next potential step you need to know about Solana.

About Solana

Solana is a high-performance layer blockchain platform designed for DAPPs and cryptocurrencies. It is known for its speed and scalability, and is able to process thousands of transactions with its unique architecture and handle them at low fees. On paper, it is designed to handle up to 65,000 TP at peak capacity.

Unlike some older blockchains, such as Bitcoin or Ethereum (pre-merger), Solana uses a consensus mechanism called Proof of Shares (POS), and combines a “Proof of History” ( POH) new system. POH is essentially a timestamp transaction to create a verifiable sequence of events, which helps the network stay efficient quickly and efficiently without sacrificing security.

Solana has in particular built its Memecoin ecosystem, which is considered a benchmark for its impact on other blockchains, as well as significant developments in areas such as Depin, AI and Gaming.

Learn more: Top 10 Solana Meme Coins Worth Investing in 2025

Solana Ecosystem This Issue

First, on Solana system, the information of Memecoin Launchpad, the largest Memecoin Launchpad on the market, was crypto on Pump.Fun, and began to build its own AMM liquidity pool. This could explain why the launchpad wants to charge independently from the LPS rather than relying on other Defi protocols including Raydium.

Source: Coingecko

This makes the $ray token drop by up to 30.5% today.

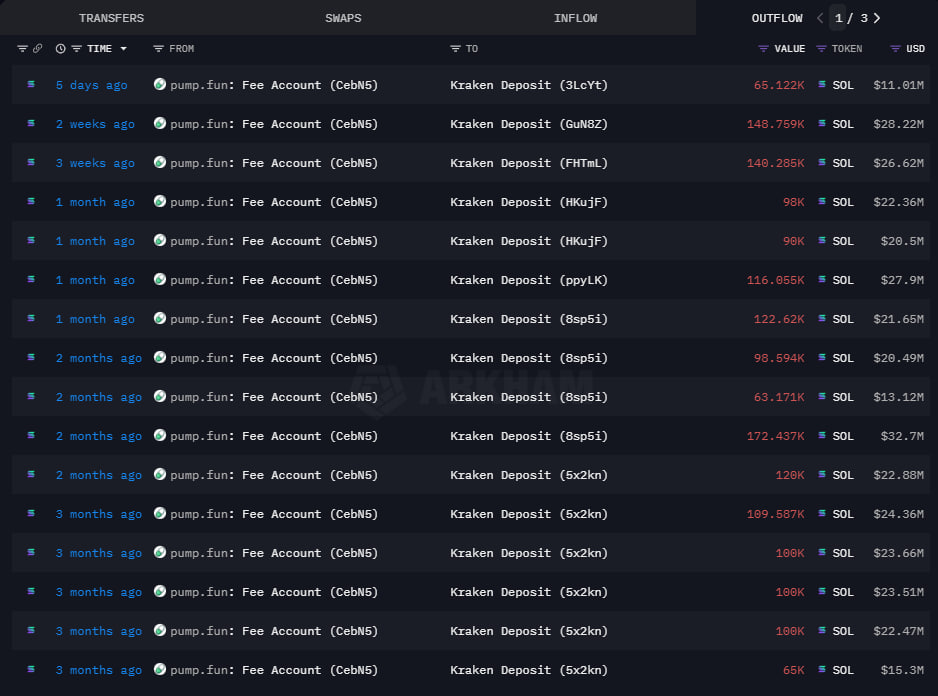

It is worth noting that, according to Arkham’s chain data, historical trends show that pumps often tend to clear sols (CEXS) obtained from memory transaction fees. The shift toward a self-managed AMM liquidity pool may increase the expense revenue generated by Memecoin creation, allowing the project to sell more SOLs.

Indeed, we witnessed a negative reaction to the $SOL price today (down 6.2%).

Source: Arkham Intelligence

From defill It also indicates that capital inflows have dropped significantly in recent days. Specifically, the total value lockdown (TVL) of leading platforms including Jupiter, Enella, Camino and Marinate has dropped significantly over the past month.

Source: Defillama

It should be noted that depreciation of SOL and its ecosystem also stems from signs of $SOL being sold by investment funds and municipal agency Wintermute, with the token value of over $17 million.

🚨New: Seller Wintermute has withdrawn a large number of them $ sol From the last 4 hours binance. pic.twitter.com/e3zjzgy2cl

– Cointelegraph (@Cointelegraph) February 24, 2025

Solana price forecast

Although the above are mainly negative factors affecting Solana, it is crucial to recognize that Solana remains an important source of liquidity in the wider market.

In addition, it is worth noting that the Trump token reached its all-time highest speed on January 19, which is related to the U.S. presidential figure. This token running in the Solana ecosystem inadvertently catalyzes the upward trend of the entire blockchain ecosystem. According to a survey nftevening14% of Americans have received Trump $. The data highlights the significant attraction of cryptocurrencies and shows that given the catalyst with sufficient impact, the wide-ranging Solana ecosystem, including SOL, retains the potential for strong growth.

Source: Coingecko

Looking to the future

The $11.2 million SOL from the FTX bankruptcy auction is scheduled to be unlocked on January 3 and is worth approximately $2.06 billion. The event is expected to introduce a lot of volatility in the $SOL market until the unlock date. Historically, previous tokens unlocked the FTX bankruptcy process, accompanied by the sales strategy of continuous accumulation of investment funds.

Regarding the short-term outlook, $SOL may build a support building in the range of $128-$134. However, as mentioned earlier, effective catalysts similar to the Trump case may cause very powerful recovery.

According to Bitwise Europe, $SOL’s valuation is likely to exceed $2,000.

The $SOL price forecast for the first half of 2025 shows a potential reintroduction of $250.

Disclaimer: This analysis is only used for the purpose of predicting the token price trajectory and should not be interpreted as investment advice.