Key Points

Bitcoin may undergo a period of correction or lateral movement in the coming year.

Defi faces a decline in 2025 due to regulatory and scalability challenges.

CryptoQuant CEO Ki Young Ju announced that Bitcoin’s bull cycle has ended and predicts that prices will fall or sideways over the next 6 to 12 months. Previously, he said that the market has not yet entered a bearish stage. So, what caused him to change his opinion?

Viewpoint

Previously, CryptoQuant’s CEO said “It’s too early to call it a bear market.” This view is reflected in the encrypted chart.

Bitcoin price moves in different periods

The chart shows that the price of Bitcoin (black line) has experienced several powerful volatility cycles:

- 2021: Bitcoin BTC In the first half of the year, its all-time high (about $69,000), then a major correction was made at the end.

- 2022: The market enters a downward trend, with BTC losing over 60% of its value to around $20,000.

- 2023 – 2024: Bitcoin is gradually recovering, reflecting the improvement of market sentiment and new capital inflows.

Source: TradingView

“Obvious Demand” – Market Demand Indicators

The chart highlights two main color areas, representing the trend of capital flows in the market:

- Green (obvious demand): Indicates that BTC is accumulating or holding, reflecting positive market sentiment.

- Red (obvious demand): represents BTC outflows, usually marking strong sales pressure.

Relationship between “obvious demand” and Bitcoin price

- Bitcoin tends to rise or consolidate when the chart turns green for a long time. This is a sign of accumulation and investors believe in a long-term uptrend. Notable examples include early 2021 and late 2023.

- When the chart turns red, the market usually goes through corrections or drops sharply. From the end of 2021 to mid-2022, it is obvious that the price of BTC has dropped significantly from $60,000 to around $20,000.

Recent trends and market signals

- In 2022, Bitcoin BTC One of the steepest price drops in history, which coincides with the crimson area on the chart, suggests that sales pressure is high.

- Since the beginning of 2023, “obvious demand” has shifted to the accumulation of green signal markets. This is one of the key factors supporting BTC recovery.

Data on the chain suggests that the “apparent demand” index continues to reflect existing market demand, with inflows of institutional and Bitcoin ETFs still present, while BTC’s price remains at a critical support level.

Source: X

Ki Young Ju cites 4 main reasons why he changed his prospects:

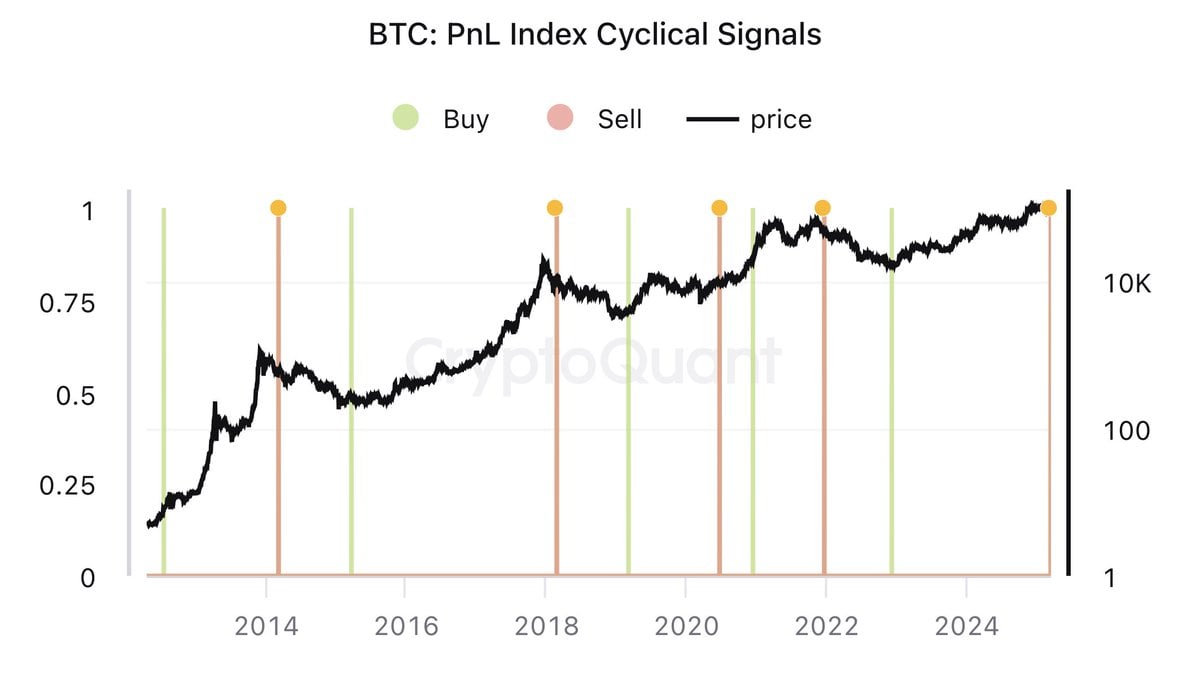

PNL index periodic signal

Chart structure

- Black Line: Represents the price of Bitcoin over time (logarithmic scale).

- Green vertical line: Buy signal – indicates a period when Bitcoin is considered to have strong growth potential.

- Red Vertical Line: Sell Signal – Warns Bitcoin to reach peak and potential price correction.

- Yellow dots: Based on the peak of the PNL index, it usually indicates the extreme growth cycle of Bitcoin.

Historical Trends of Bitcoin According to PNL Index

The chart shows that Bitcoin follows a clear growth and correction cycle, as shown in the following signal:

- 2013-2014 Cycle: Bitcoin soared sharply before a sell signal around 2014, and the market then declined.

- 2017-2018 Cycle: Bitcoin reached a peak of nearly $20,000, and thereafter a sell signal appeared, causing the price to fall.

- 2021-2022 Cycle: Bitcoin reached new heights at a new historical height above $60,000, and then saw a significant decline after sending a sell signal at the end of 2021.

- 2024-2025 period: The graph shows another selling signal, indicating Bitcoin BTC It may have reached its peak or approached the top of this cycle.

Recent trends and forecasts

- The latest data shows that the selling signal appears in 2024-2025, similar to previous cycles.

- This suggests that the indicator has just released a sell signal, consistent with previous peaks in 2013, 2017 and 2021. Historically, in each of these signals, BTC has undergone a correction phase that lasts 6-12 months.

- While this does not necessarily confirm that Bitcoin enters a bear market, it suggests that BTC may face corrections or lateral movement in the near future

Source: X

On-chain indicator signal bear market:

Indicators such as MVRV, SOPR and NUPL all show a downward trend, reflecting negative market sentiment and potential entry into a bear market.

Source: X

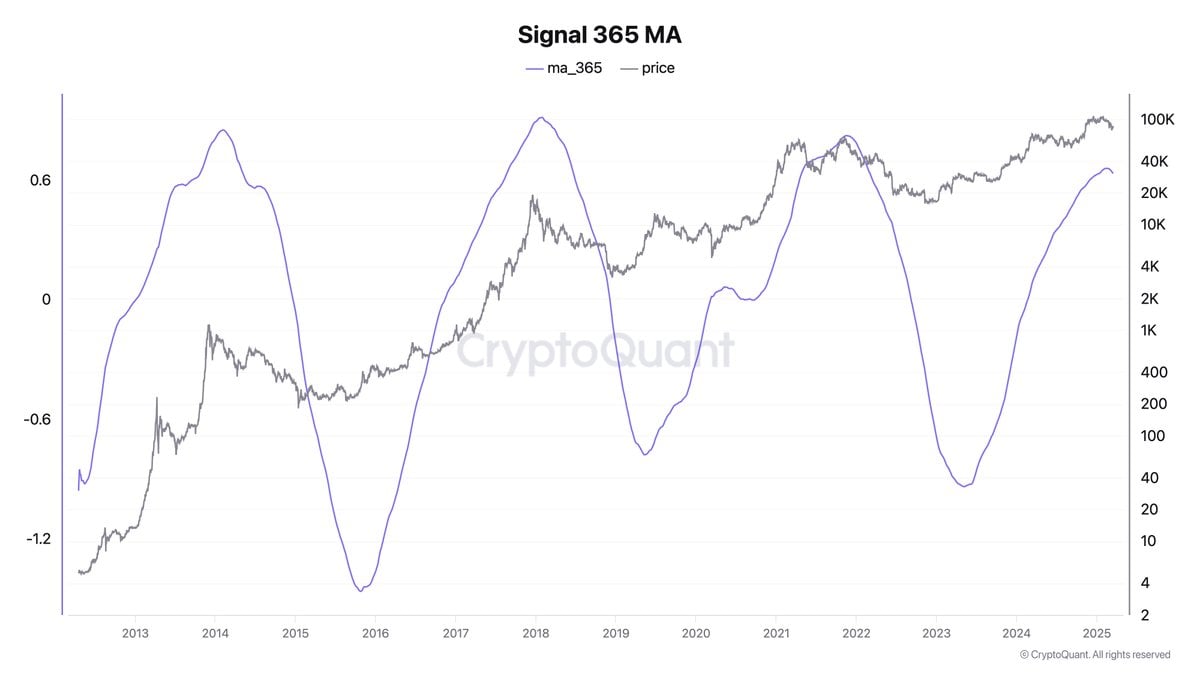

Chart structure

- Black Line: Represents the price of Bitcoin over time (logarithmic scale).

- Blue line (MA_365): The 365-day moving average calculated based on on-chain data, reflects the long-term momentum of the market.

Historical trends and forecasts

- 2013-2014: The MA_365 index peaked, causing Bitcoin to reach its all-time high of about $1,100, and then dropped sharply in 2015.

- 2017-2018: The MA_365 index peaked again, with Bitcoin reaching an all-time high of $20,000 before experiencing a significant decline in 2018.

- 2020-2021: The MA_365 index reached its highest ever level, matching Bitcoin’s all-time high ($69,000), followed by in-depth corrections in 2022.

- 2024: The MA_365 index is currently rising strongly, indicating that the market is in the expansion phase but has not yet reached its peak level in previous cycles.

Investors’ market signals

- The MVRV ratio (market value vs. realized value) is close to the key areas, similar to the previous market peak. This suggests that Bitcoin may be approaching the overheating phase.

- SOPR (used output margin) shows that many investors are selling Bitcoin at a loss, which indicates a shift from profit-taking.

- NUPL (Unrealized Profit/Loss) shows unrealized profit declines, a pattern that has historically preceded market corrections.

These indicators have appeared in past bear markets, suggesting that Bitcoin may be entering a stage of increased risk or potential market adjustment.

New fluid drying:

Institutional capital inflows and declines in Bitcoin ETFs have led to a lack of liquidity supporting BTC prices. Blackrock’s Bitcoin ETF, for example, has recorded outflows for three consecutive weeks.

Whales sell BTC for lower prices:

Large Bitcoin holders (whales) unload their BTC at lower price levels, increasing market pressure.

Is Bitcoin really entering a bear market?

Based on these factors, Bitcoin BTC It is facing strong downward pressure and may enter a bear market. However, the cryptocurrency market is inherently volatile and difficult to predict. Investors should be cautious, closely monitor key market indicators, and be aware of smart investment decisions at all times.

Defi underperformed in 2025

Decentralized Finance (DEFI) is expected to be the main driver of the crypto bull cycle, providing decentralized financial services such as lending, borrowing, points and yield farming. However, as of early 2025, DEFI has performed poorly and has not met its initial expectations. The following is a detailed analysis based on the latest data and research as of March 19, 2025.

Background and initial expectations

DEFI is a decentralized financial ecosystem based on blockchain technology that allows users to conduct financial transactions without intermediaries such as banks or traditional financial institutions. During the upward trend, DEFI is expected to attract more capital through production farming, accumulation and innovative financial products.

According to the explosive theme, Defi’s Total Value Lockdown (TVL) increased 14 times in 2020, and by 2021, TVL reached a peak of $112.07 billion, indicating its growth potential during the bull market. Expect DEFI will continue to drive the next uptrend, while TVL soars as new capital inflows from retail and institutional investors.

Reality: Defi’s performance is not good

However, recent data suggest that DEFI faces multiple challenges, resulting in performance below expectations. Key factors include:

Locked Total Value Decline (TVL)

TVL is a key indicator of DEFI’s health and activity, measuring the total value of assets locked in the DEFI program. According to Defilama, TVL hit $140 billion in December 2024, but by March 2025, it had dropped to $90 billion. This sharp drop signal reduces liquidity and investor confidence. Possible reasons include:

- Investors withdraw funds due to security concerns, especially after major hacking attacks.

- The wider crypto market is accepting corrections that affect the value of locked assets.

Regulatory Challenges

An unclear regulatory framework, especially in major markets such as the United States, has become a major obstacle. AML (Anti-Money Laundering) and KYC (Know Your Customers) regulations impose compliance barriers that prevent large financial institutions from interacting with Defi. This restricts institutional capital inflows and is expected to drive protest growth during the bull market.

In addition, regulatory uncertainty in the United States has forced many Defi projects to suspend or adjust their strategies, slowing down their overall development.

Scalability and transaction costs

Major blockchains like Ethereum (the main Defi platform) are still fighting scalability, processing only about 15 transactions (TPS) per second, much slower than blockchains like Solana.

However, the Layer 2 ecosystem, including arbitration and optimism, has significantly improved scalability, with total TPS increasing to around 592 as of January 2025. While this helps speed up transactions in Defi applications, the limitations of Ethereum have not been fully parsed.

According to L2BEAT, TVL for Tier 2 solutions grew 232% over the year to more than $37 billion, but these solutions have not yet completely replaced the demand for mainstream Ethereum transactions.

in conclusion

Bitcoin shows signs of entering the correction phase, with its on-chain metrics such as PNL indicators, 365 Ma Signal, MVRV, SOPR and NUPL reflecting increased sales pressure and decreased liquidity. Although no bear market was confirmed, historical data show that the market merger may decline by 6-12 months.

Meanwhile, DEFI has performed poorly in 2025, facing declines in TVL, regulatory hurdles, security issues and scalability challenges. Despite the adoption of a layer 2 solution, DEFI still fails to meet the expectations of a key growth driver.

Will the market view of the crypto CEO this time be correct? Will there be any bullish waves in 2025?