The emergence of fixed interest rates and bond-like instruments in diversified financing (DEFI) is not a novel invention. Instead, it is a complex redesign. It is taken from the established traditional financial engineering principles (TradFI). This adaptation is designed to make the inherent volatile crypto market predictable. It also seeks risk management capabilities. These have long been associated with conventional fixed income securities.

Origin of the concept: From traditional finance to blockchain

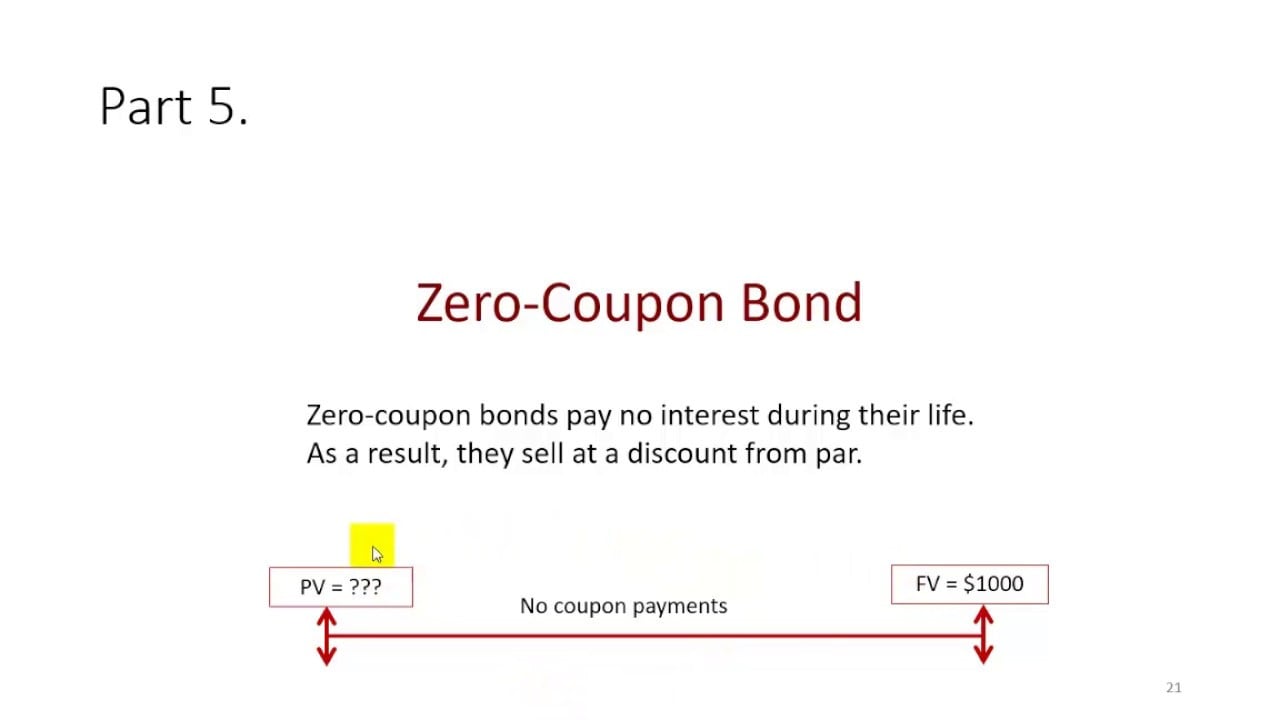

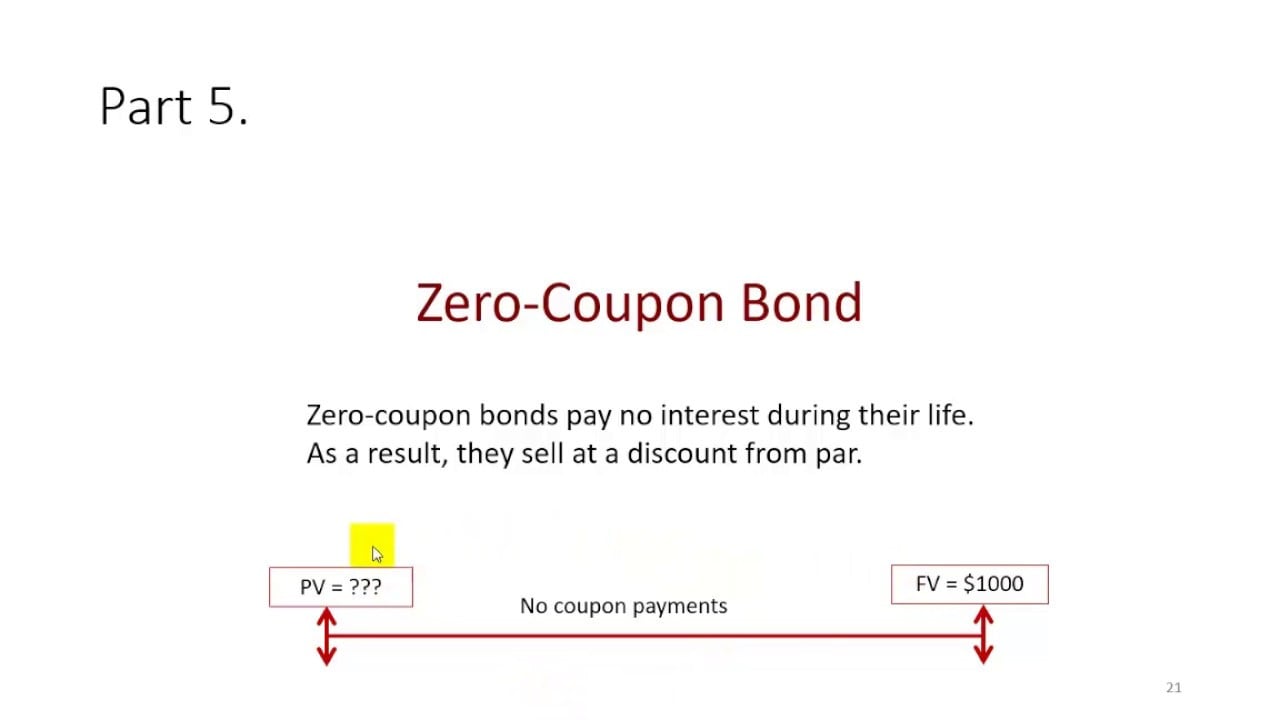

The basis in traditional fixed income: zero corporate bonds and output tokenization

In traditional finance, instruments such as zero enterprise bonds (ZCBs) play an important role. They provide predictable returns. ZCB repays its face value when it matures. They do not pay interest regularly. They became more and more popular in the 1980s. This is further enhanced by the financial practice of “split-up”. It separates the principal of the bond from the interest payment. This creates a new zero-interest bond.

Zero-interest bonds

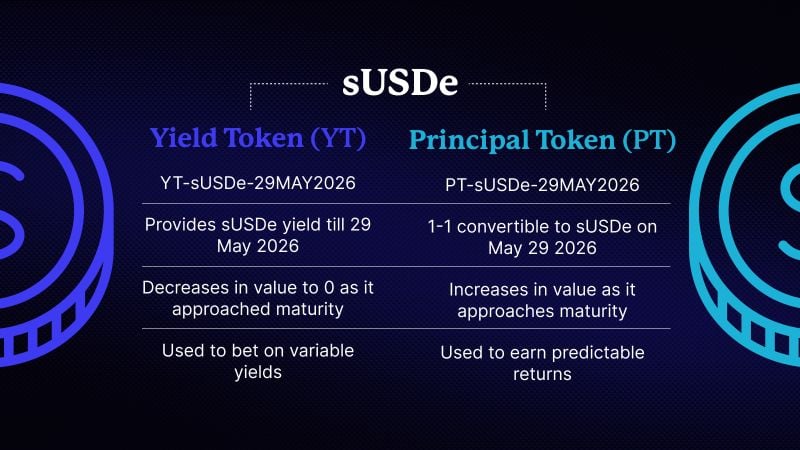

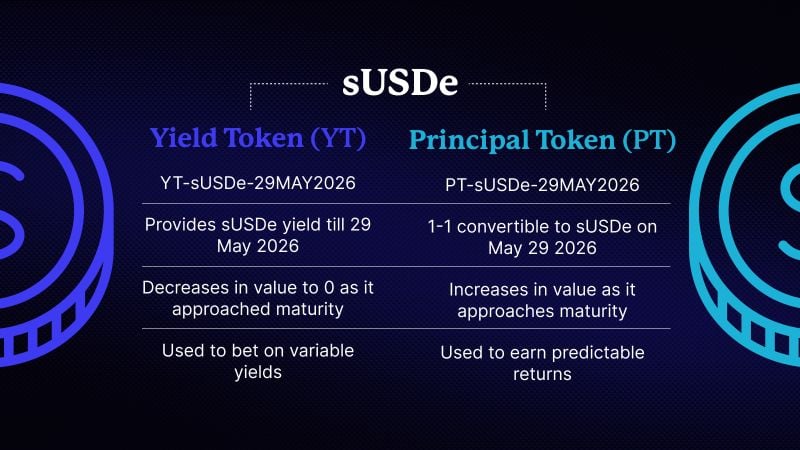

This concept has direct similarities in Pendle’s production token. Here, the load-bearing assets are broken down into main tokens (PT) and yield tokens (YT). Basic borrowing from traditional finance is very important. It shows that the evolution of Defi fixed income may reflect the Tradfi fixed income market. This means that over the decades of maturity and market segmentation are getting bigger. Ultimately, DEFI can provide more complex structured products and derivatives. This will attract a wider range of investors accustomed to this tool.

More about: Fixed and Fixed Income Breeding Rewards

Susde with YT and PT

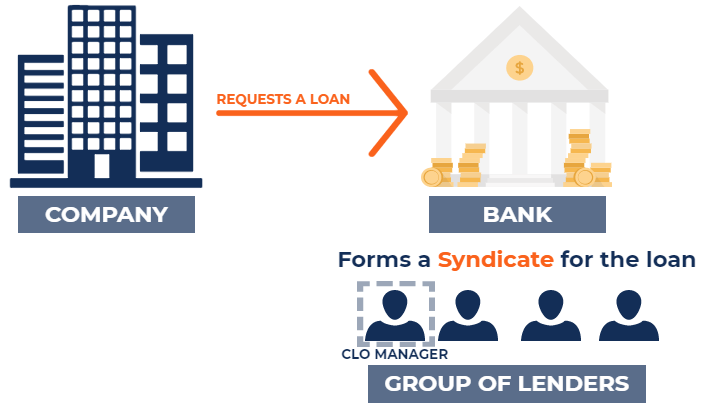

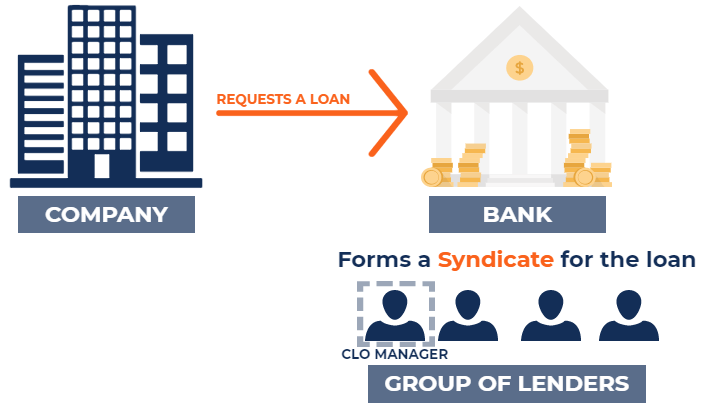

Senior debt structure and hedging

In addition to simple bonds, Tradfi has developed complex debt securities. These include mortgage obligations (CMOs). These instruments mortgage loans. They divide them into divisions. Each has a different risk recovery profile. Primary batch absorbs losses first. Advanced classes are designed for safer. They usually get lower but more stable rates.

This stratified risk structure has been adopted through the DEFI protocol. Examples include waterfall defi and centrifuge. They offer “teenage” and “advanced” divisions. This allows you to customize the investor risk-reward profile. Advanced classes often offer fixed returns. In addition, the concept of interest rate swaps is important. These are agreements between the two political parties. They exchange future interest payments. This provides a mechanism for hedging interest rate fluctuations. The Defi ecosystem has actively sought to reinvent these products. This is intended to provide certainty in a blockchain environment.

Mortgage Mortgage Obligation (CMO)

Defi’s maturity and institutional appeal

Power towards fixed-rate products means a real crucial step. Indeed, it marks the continued maturity of Defi. This transition frees Defi from purely speculative “production farming” and ultimately directs it to a more predictable and therefore an institutionally friendly financial instrument.

Furthermore, this shift is absolutely essential as it can attract a wider, inherently risky investor base. It is worth noting that this includes traditional financial institutions, whose balance sheet and portfolio management fundamentally require certainty. Therefore, this growing demand for stability is a direct response to the inherent interest rate fluctuations so prevalent in the early Defi market and is effectively resolved.

Early crypto bonds and recent digital bond issuances

The early conceptualization of crypto bonds significantly laid the foundation for today’s digital assets. For example, the basic idea explores innovative approaches to digital currencies and store of value, especially Bitcoin. The pioneering projects such as Digicash (1989) and E-Gold (1996) for anonymous digital payments (focusing on the digital value supported by gold) are investigated, exemplifying these keen efforts.

Recently, the landscape has made great progress. For example, Luxdeco, in partnership with Nivaura, issued the world’s first cryptocurrency-led bond to a blockchain. This major event demonstrates the obvious potential of faster resolution and automatic smart contract payments.

In addition, in March 2025, the Inter-American Development Bank (IDB) issued its first 15-month, £5 million, fixed-rate bond managed by HSBC (HSBC) and NATWEST, a platform based on a chain-chain. In addition to this momentum, the World Bank’s “Bond 1” in 2018 has provided compelling evidence for public bonds.

Early fixed income agreements in defi

After the key “Defi Summer” in 2020 (which spans June to August), there is indeed a unique wave of agreements. These new entrants have a clear goal: to lend and borrow fixed interest rates into emerging decentralized ecosystems.

Therefore, these early innovators worked on various mechanisms. Ultimately, their main purpose is to provide much-needed production certainty in a volatile market. In doing so, they jointly laid the key conceptual and technical foundations for subsequent more advanced solutions such as Pendle.

Key early-stage fixed income agreements

Several protocols were initiated during this period:

- Nominal Financing: Founded in 2019 and early 2020. It pioneered fixed interest rates, fixed-term borrowing and loans to Ethereum. It uses the “FCASH” instrument of its novel.

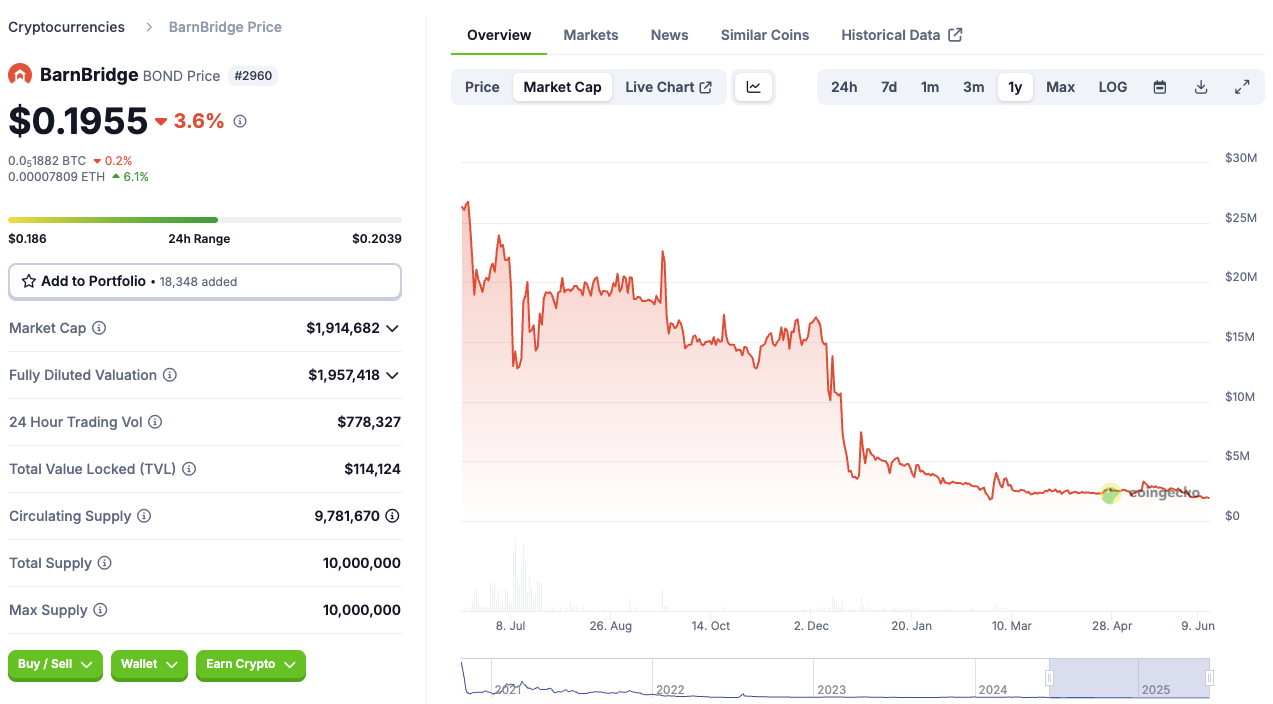

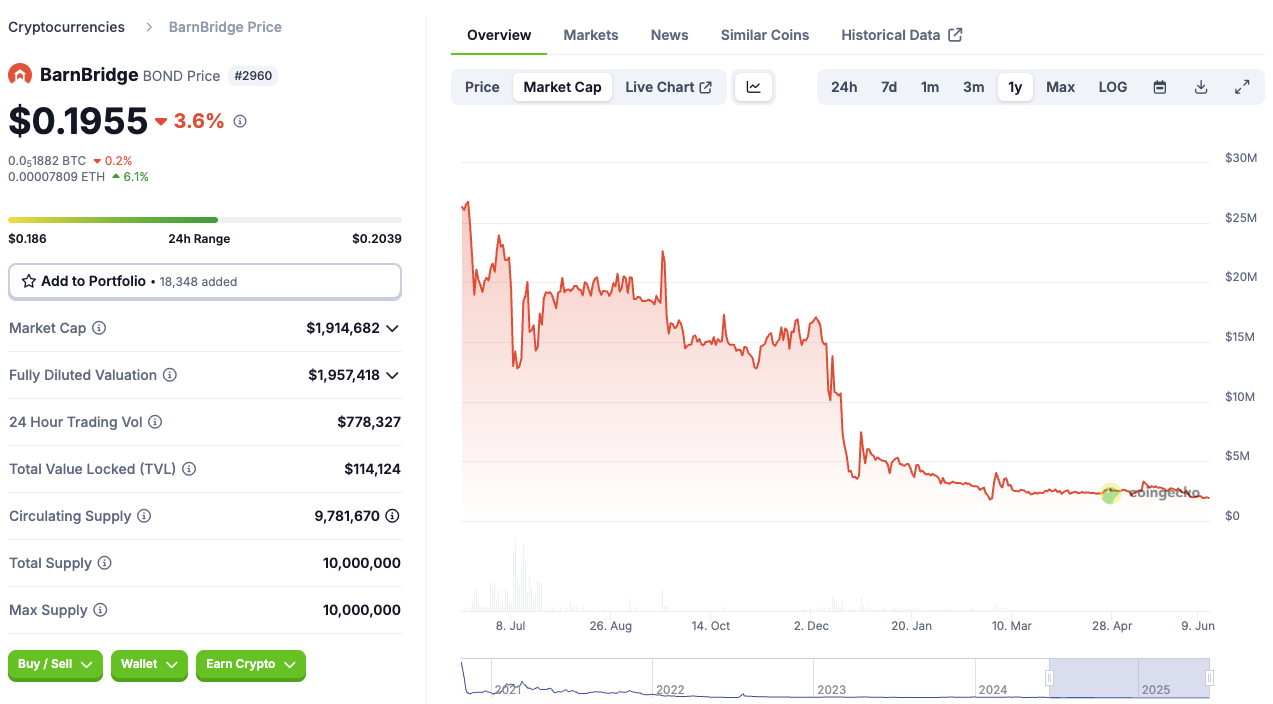

- Barnbridge: Founded in 2019 and launched in September/October 2020. Its smart income product arrived in March 2021. It provides users with fixed or leveraged variable yields. The agreement is designed to introduce risks into branches. This provides investors with different risk profiles.

- 88 mph: Its initial version (V0) was launched in April 2020. The current iteration was released in late November 2020. It enables users to lend cryptocurrency assets at fixed interest rates. Or, they can buy floating rate bonds.

- Saffron Finance: Price historical data shows that activities will begin in 2021. Its focus is chain chains. It also provides custom risk/return profiles through its A, AA and S packets.

- Earnings Agreement: Launched in 2021, introducing fixed interest rates, fixed term borrowing and loans. It uses “fytokens” (fixed yield token). These tokens have similar functions as zero-interest keys. They can be redeemed at a fixed value at maturity.

- Element Financing: It raised seed funds in March 2021. A “upcoming” official release is planned. It is designed to provide a fixed rate of yield. It allows users to purchase assets at discounted prices. This is without locking fixed terms.

The Challenges and Limitations of the “First Wave”

Early fixed-rate agreements broadly fall into two distinct categories. First, some take advantage of the synthetic nature of Defi, thus bringing fixed interest rates to existing earning opportunities; notable examples include Barnbridge, 88mph and Saffron Finance. By contrast, others aim to build their own lending markets, such as fixed interest rates, such as nominal and earnings agreements.

However, despite these innovations, this “first wave” has largely worked to gain a lot of appeal and liquidity. This lack of adoption is often due to the relatively low yield offered to depositors. While the composable fixed-rate deal did have moderate success, Bond (Bond) reached its highest TVL at $79 million with a market cap of $125 million. However, the “first wave” of the fixed-rate agreement overall failed to ensure widespread appeal in the Defi market, and as a result, its various governance tokens were broadly underperformed.

This result clearly shows that providing a fixed rate alone is not enough. Potential problems may revolve around liquidity dispersion, price reductions in price discovery or a general lack of compelling value propositions. Therefore, these protocols simply cannot compete with the high yields provided by the more established DEFI protocol. Therefore, this challenging landscape effectively laid the foundation for the subsequent influential emergence of Pendle.

Barnbridge token. Source: Coingecko

Set up featured images

The fundamental tension and Pendle’s response

Early fixed-rate schemes in Defi face a core problem: they strive to attract enough liquidity. This is mainly because the rate of return of the depositors they provide is too low. During early (usually the phase of speculation), users always prioritize their return even if these yields are high. Therefore, fixed-rate products find themselves at competitive disadvantage if their yields are not attractive enough.

This situation underscores the fundamental and ongoing challenges of any fixed income agreement: how to provide stability without sacrificing competitiveness? Pendle’s unique approach directly addresses this tension. Pendle effectively creates a dynamic new market through its innovative “production token.” Here, users can flexibly use principal tokens (PTS) to lock predictable fixed returns, or instead, they can infer the volatility of the yield tokens (YTS). This dual approach caters to a wider range of risk appetites, thus potentially overcoming the limitations that plagued its predecessors.

More information: The stable load-bearing stable: Earn passive income