Tether CEO Paolo Ardoino announced that the company announced its focus on overseas markets while driving U.S. Stablecoin laws, revealing plans for compliant Stablecoin and a comprehensive review of the four major companies to increase transparency.

Genius Act raises concerns among Stablecoin issuers

On May 25, 2025, Tether CEO Paolo Ardoino outlined the company’s strategic direction in an interview, highlighting the continued focus on overseas markets as the growing US Stablecoin legislation.

Ardoino highlighted Tether’s close monitoring of the Genius Act, a U.S. bill proposed in February 2025 to regulate Stablecoin issuers. The bill cleared the Senate Banking Committee and aimed at stricter oversight of large issuers such as the Federal Reserve and the Office of the Master Calculator.

Despite these regulatory pressures, Ardoino has expressed confidence in Tether’s global user base, especially the 3 billion unbanked people around the world who rely on USDT for financial communications.

To address transparency, Tether is conducting a full review of reserves with a major four accounting firm, an important step beyond the current quarterly report. This is the appointment of Simon McWilliams as CFO in March 2025 to guide the company towards greater financial accountability.

Ardoino also reveals a compliance-stable plan tailored for institutional investors, which has the potential to position Tether to compete with US-centric stable U.S.-centered like Circle’s USDC.

A comprehensive audit of tethers prioritize regulatory compliance

Tether’s strategic move is in a rapidly growing Stablecoin landscape where regulatory clarity and competition are reshaping the market. The Genius Act could force Levre to comply with transparent reserve requirements in order to operate in the United States, especially as competitors like USDC attract institutional investors.

Learn more: Bitcoin returns to $109K after Trump delays EU tariff deadline

However, Ardoino is still not shocked by the rise of bank-issued Stablecoins, which the company noted that major U.S. banks are exploring common Stablecoin issuances. Tether’s focus on the unaccounted historical mission, as the 2024 chain analysis report shows that USDT dominates in emerging markets, accounting for Stablecoin transactions in emerging markets, including Africa and Southeast Asia.

Tether USDT is advancing dollar hegemony in all emerging markets, especially in developing countries, with a quarterly increase of 30m+. pic.twitter.com/nxwuqnoai7

-Showha array🤖 (@palandoreo) April 18, 2025

The push for a comprehensive audit could address long-term criticism of the non-transparency of Tether’s reserves, potentially improving its credibility among regulatory agencies and institutional players. Tether’s reserves are backed by Treasury bonds through a partnership with Cantor Fitzgerald on Treasury securities, which is a dispute, especially those associated with Trump’s Commerce Secretary Howard Lutnick.

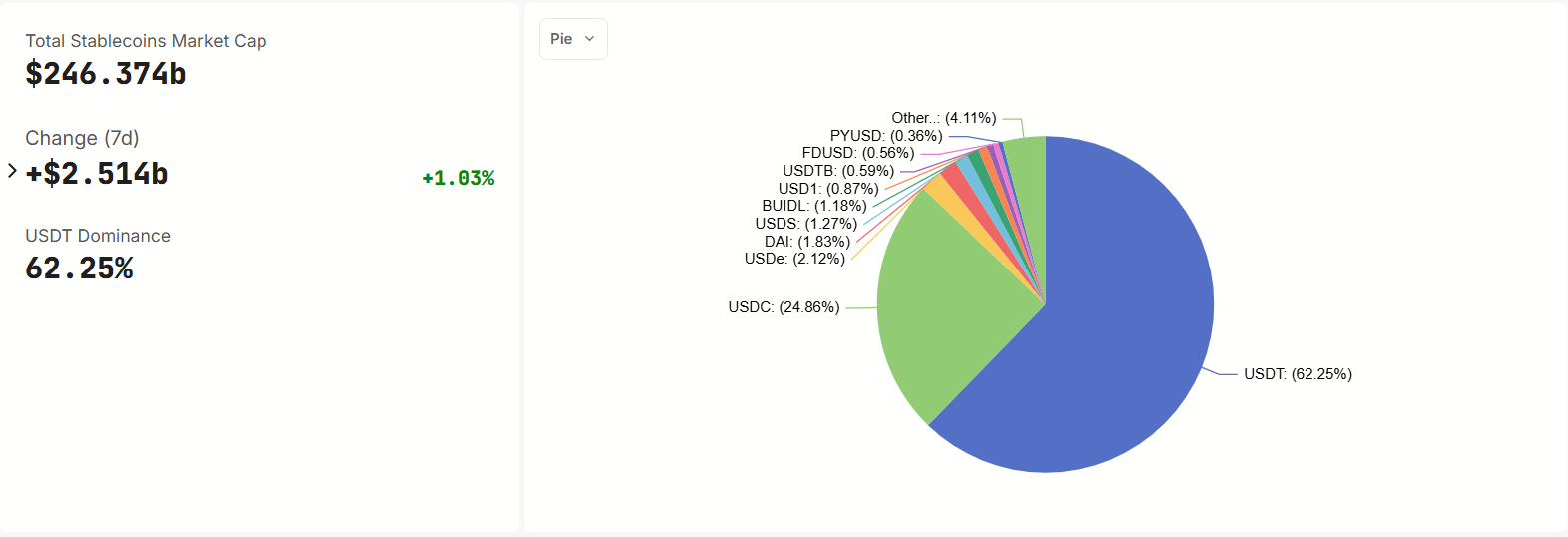

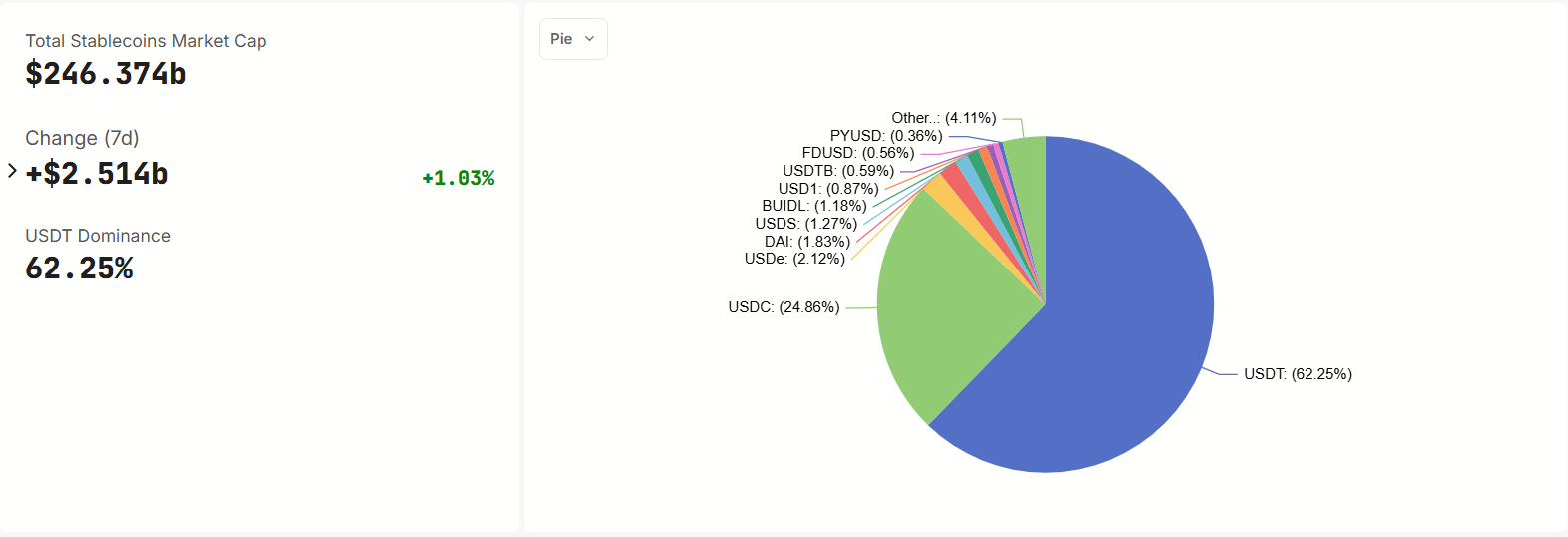

As the tether faces these challenges, its ability to balance global expansion with regulatory compliance is crucial to maintaining dominance in the $246 billion Stablecoin market.

Source: Defillama