Cryptopunks is the blockchain’s top NFT series that has recently faced investors’ trust losses after the tax evasion outbreak. Today, it happens after many scandals, from jaw-dropping price fluctuations to million-dollar mistakes. But apart from headlines, the NFT market in 2025 remains a battlefield for risks and returns.

Cryptozicode: Taxes and massive declines

Recent scandals have shaken the crypto stamp community. Pennsylvania investor Waylon Wilcox admitted selling 97 cryptocurrencies between 2021 and 2022, avoiding $3.3 million in taxes. This guilty plea marks the first criminal case in the United States, linking NFTs to tax evasion, showing that the review of digital collections shows that the review of digital collections shows. Wilcox now faces up to six years in prison, a strict warning to investors to get involved in the fuzzy waters of crypto wealth.

Guy made $13 million in flipped pixelated NFT-Tors (IRS) “Lol, never heard of encryption”

Waylon Wilcox, 45, of Pennsylvania, pleaded guilty to hiding more than $13 million in profits and unable to flip 97 cryptocurrency NFTs, and no information on the IRS was reported in 2021 and 2022.

But tax time is coming? … pic.twitter.com/rjacf8z6iu

– Navy (Meral) April 12, 2025

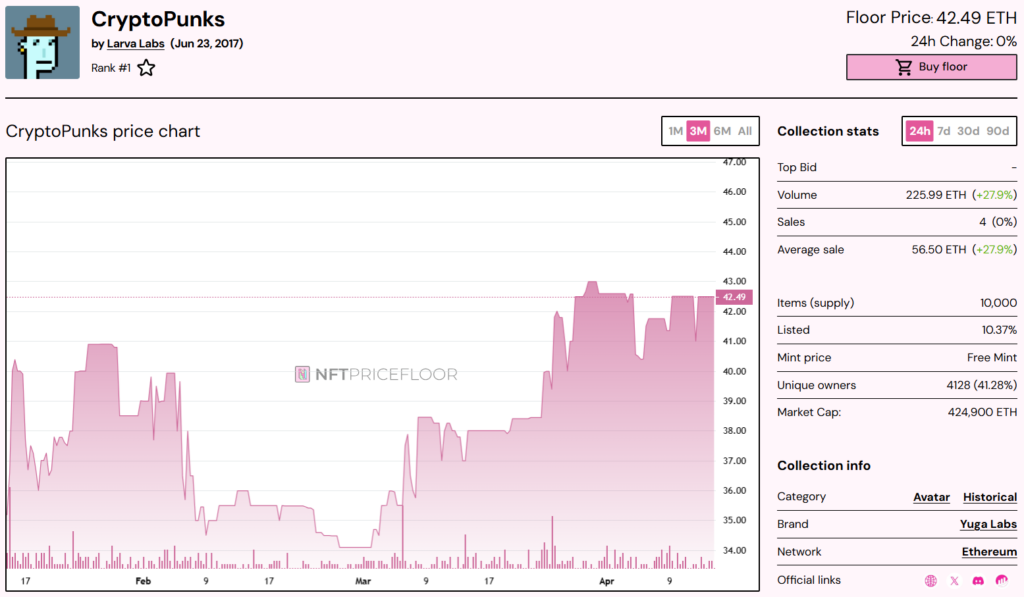

Meanwhile, Cryptopunks’ market performance tells an extreme story. The series surged 95% to $163 million and flooring prices rose by $100,000, cementing its position as a blue-chip NFT.

Source: NFT price ground

However, not every transaction is successful.

Cryptopunk #3100 is a rare alien punk that sold in April 2025 for 4,000 ETH ($6 million). The move lost money from a purchase of $16 million (4,500 ETH) a year ago. The decline reflects a 57% drop in ETH’s value, costing sellers 500 eth and millions of dollars. The deal, assisted by Fountain, may involve major investors because the buyer’s wallet received funds from the Coinbase Prime address. Despite Alien Punks’ dominance in high-value sales, Cryptopunks’ flooring price has dropped 44% to $65,373, indicating a decline from its 2021 peak. This fluctuation highlights the thin line between wealth and failure in the NFT space.

NFT Landscape in 2025: Risks and Rewards

In 2025, NFT integrates caution with opportunity around NFT. While scandals and losses have dominated the discussion, some investors are quietly taking advantage of market trends. The outstanding case for the first quarter of 2025 illustrates how strategic moves produce impressive returns.

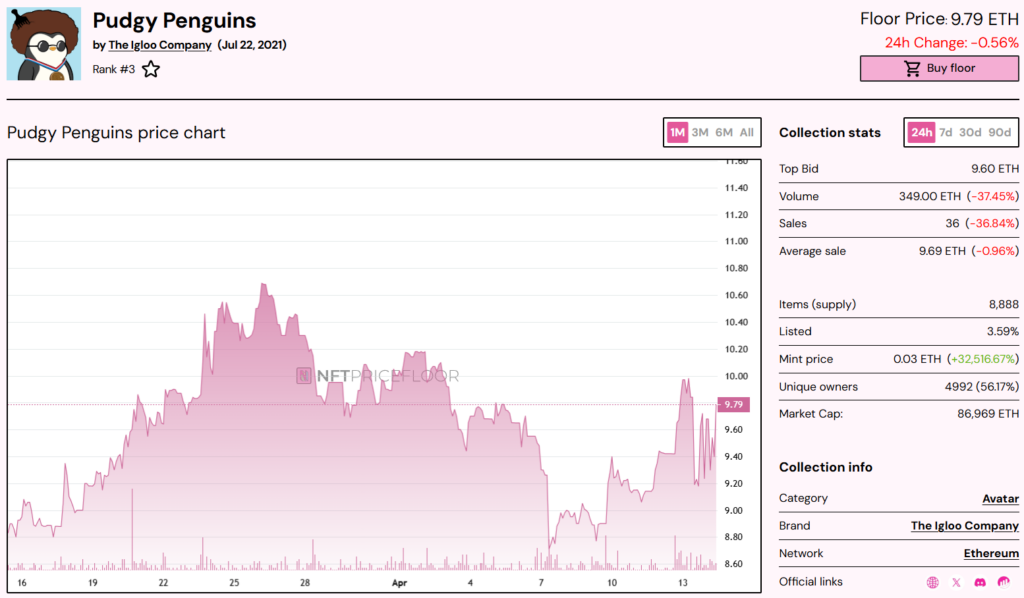

Consider the chunky penguin, the series gradually draws attention through clever branding and community buzz. In January 2025, an investor bought a rare short and plump penguin with 15 ETHs, which was equal to $24,000. By April, the same NFT was sold for 50 ETH, providing $80,000 in profits over three months. The surge has been strengthened by the savvy marketing of chunky penguins, which include exclusive merchandise and the virus’s Tiktok movement, strengthening its cultural dish.

Source: NFT price ground

Comparable cases of NFT collection performance in 2025 involve the collection of graffiti. It sees significant benefits driven by strategic partnerships and community engagement. In February 2025, an investor bought a rare graffiti NFT for 10 eth, which was about $18,000 at the time. By April, the same NFT was sold at 35 ETH and made a profit of $45,000 in two months. Doodles’ collaboration with major fashion brands’ limited edition clothing and viral augmented reality campaigns on social media has fueled the surge, thus enhancing its mainstream appeal.

Source: Kaihai

Unlike the turbulent rides of Cryptopunks, these cases show that community-driven collections can bring steady benefits to those early potentials. This success reflects a broader trend in the NFT market. Projects based on Solana are attracting attention, while Ethereum giants like Cryptopunks maintain their tempting charm.