Hyperliquid is a decentralized exchange built on its own layer 1 blockchain, which cements its position as a major player in the crypto derivatives market, ranking among the top venues for permanent Bitcoin swaps.

Through its innovative approach to trade and high-performance infrastructure, Hyproliquid challenges the dominance of centralized exchanges such as Binance, marking a major shift in the Defi landscape.

The rise of hyperliquidity of crypto derivatives

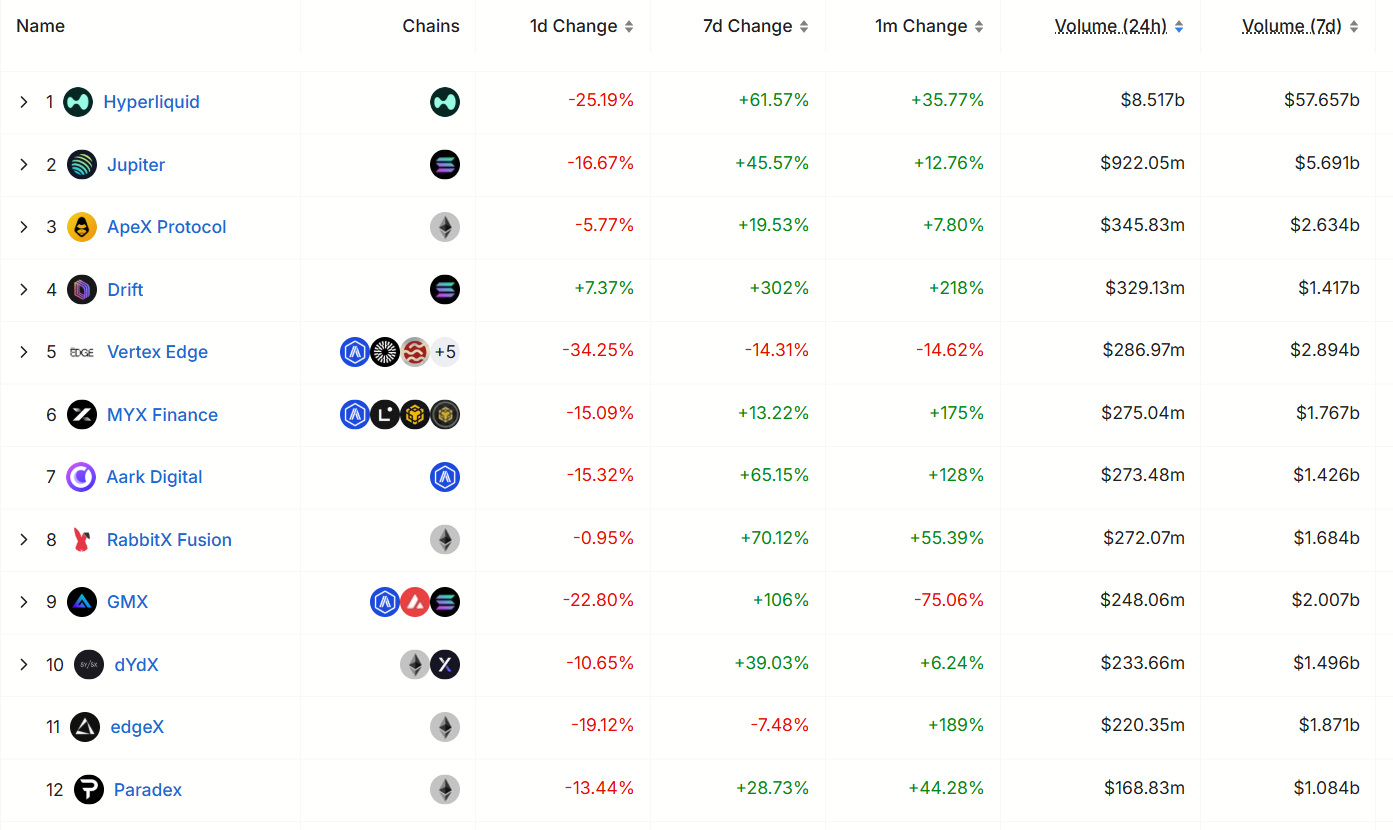

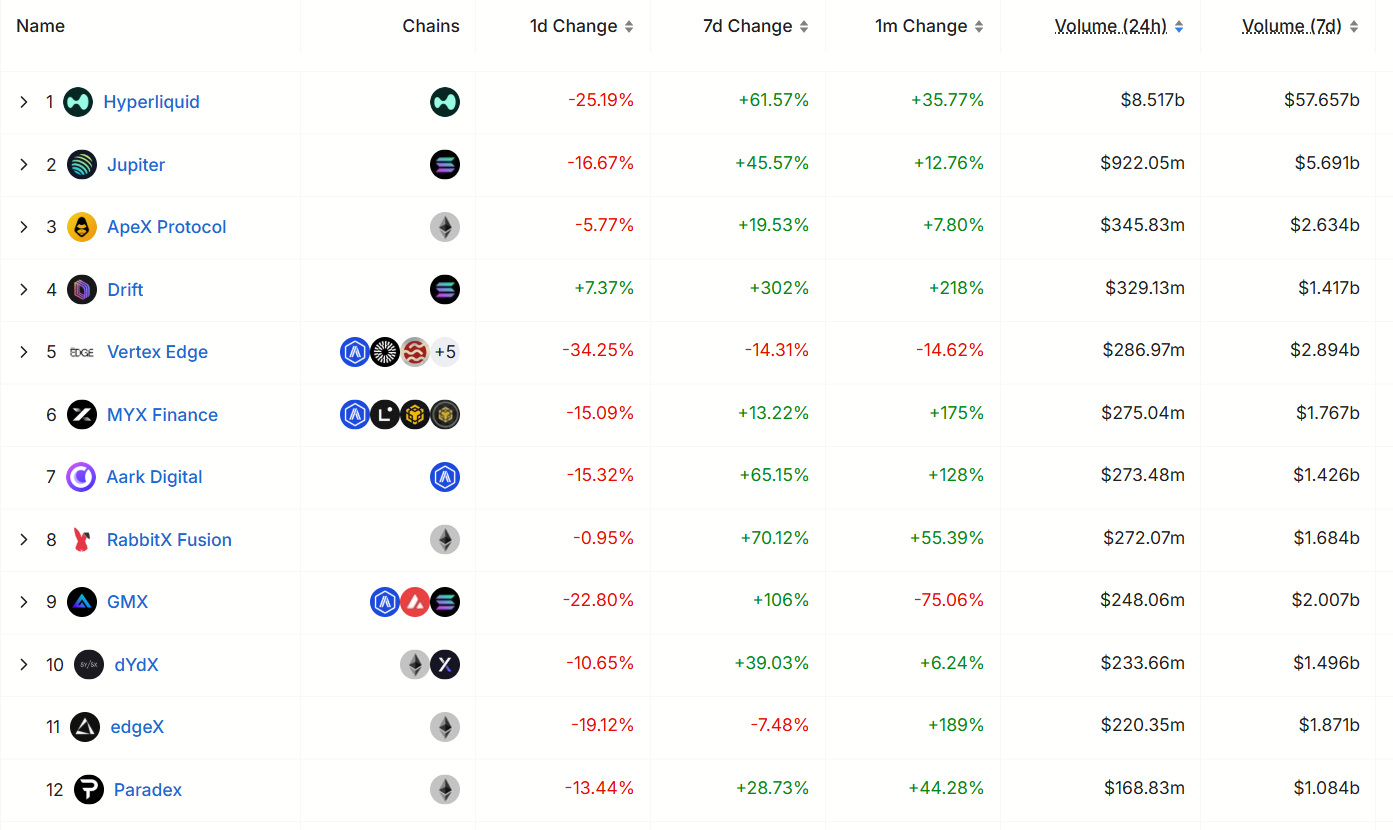

High liquidity has risen rapidly, becoming the leading platform for crypto derivatives, especially in permanent Bitcoin swaps, also known as “PERPS”. According to a May 13, 2025 Bloomberg report, the decentralized exchange (DEX) is now one of the largest venues for these financial instruments, an extraordinary feat in historically dominated markets such as Benance.

A communication is realizing the prejudiced dream of breaking into markets dominated by second-hand businesses and other centralized exchanges, @MuyaoShen Written in @crypto Newsletter https://t.co/z7sofngv7c

– Bloomberg (@business) May 13, 2025

Hyperliquid’s success is rooted in it, as a peer-to-peer trading platform, with the least intermediary in the intermediary, consistent with the core spirit of decentralized finance (DEFI). This model allows superflow types to gain a large share in the derivatives market, which has long been a stronghold of concentrated communication.

The growth of the platform is a critical moment for Defi as decentralized communication efforts break into markets traditionally controlled by centralized players. Hyperliquid is able to provide the ability to trade permanent futures, a popular derivative that allows traders to speculate on the price of Bitcoin without an expiration date, a key driving force behind its popularity.

Source: Defillama

By leveraging its own 1-layer blockchain, hyperliquidity ensures fast transaction speed and low fees, addressing common pain points in Fefi trading. The platform’s infrastructure, including a new consensus mechanism called Hyper BFT, can handle up to 200,000 transactions per second, allowing it to support a book of fully chained orders, a feature usually found in centralized exchanges.

Read more: Super fluent daily fee Ethereum destruction

Hype 60% per month, showing significant price recovery

Super fluid Hype Strengthen its leadership in crypto derivatives through innovative economic models, eliminating gas charges for permanent futures, providing manufacturer discounts and keeping receiver fees low. This cost-effective approach attracts retail investors and a large number of traders seeking competitive advantage.

The platform recently launched its local token Hype, which costs $25.33, also strengthened its ecosystem as of May 14, 2025. The token is expected to increase liquidity, governance and incentives, further exacerbating the growth of hyperliquidity.

Source: TradingView

The impact of hyperliquidity rise is not just its platform, which contributes to the wider adoption of decentralized financial services. By providing high-performance, transparent alternatives that can be used for centralized communication, Hyproliquid helps bridge the gap between traditional finance and Defi.

Read more: Hypermobility Ecosystem: From perp dex to emerging crypto ecosystems