In a market downturn, most technology-centric coins stagnate or drop sharply, Superfluid continues to consolidate its position It has significant elasticity. Let’s dive in and analyze the next potential trend of super fluent price forecasts.

What is mixed blood?

Super fluid Tout yourself as a next-generation platform designed to completely revolutionize the way you interact with your digital assets. Made from scratch to provide simple, seamless one-click trading, mixing cutting-edge technology with a focus on real-time liquidity and accuracy.

Super liquidity: DEX revolution challenges top CEXS

Super Flow quickly becomes one of the leading Defi platforms, surpassing traditional decentralized communication (DEX) through fully integrated optimization optimization Level 1 A blockchain ecosystem for transactions and smart contract deployment.

With over 60% market share in the diversified derivatives sector, Hyperliquid not only competes with other DEXs, but also directly challenges centralized exchanges (CEXs), such as Binance, OKX and BYBIT. Able to handle 100,000 transactions per seconda book with a full chain order for complete transparency and leverage Overclocking The consensus mechanism reduces the delay to 0.2 seconds, and the platform provides high-speed trading experience while maintaining full decentralization.

In addition to earning a record $15 billion in daily transaction volume, Hyproliquid is the highest-revenue blockchain, surpassing Ethereum, Solana and BNB chains with $3 million in daily revenue. This proves its ability to maintain liquidity and growth without relying on second-hand currencies or other centralized lists. Additionally, $hype is still undervalued compared to actual potential due to the transparent token model with venture capital (VC) manipulation, making it an attractive investment opportunity. Hyproliquid is not just DEX, but also lays the foundation for the next generation of a decentralized financial ecosystem where users can have complete control over their assets, benefit from optimized transaction costs and access to groundbreaking financial opportunities.

Source: TradingView

Hype Token Learning

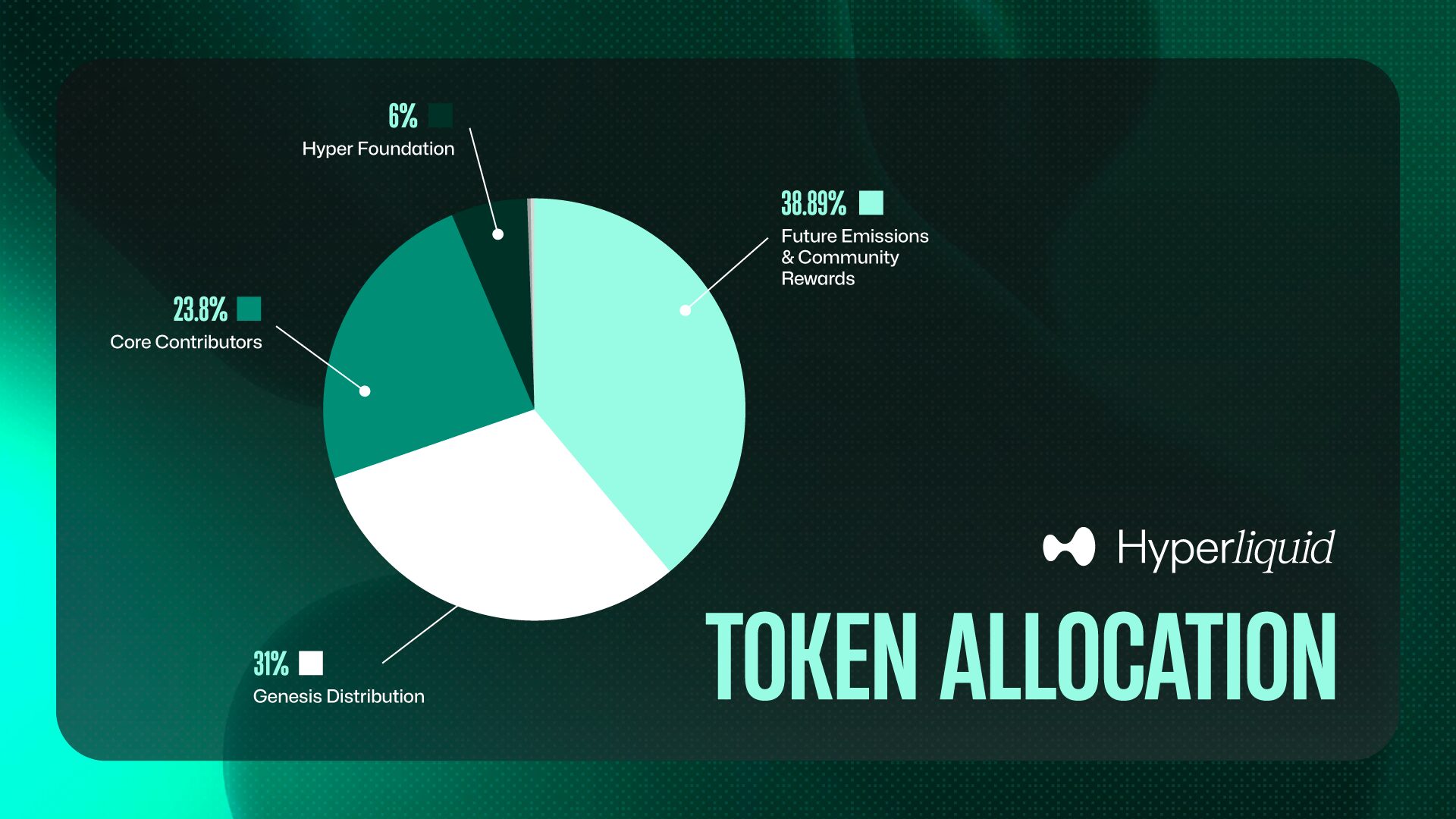

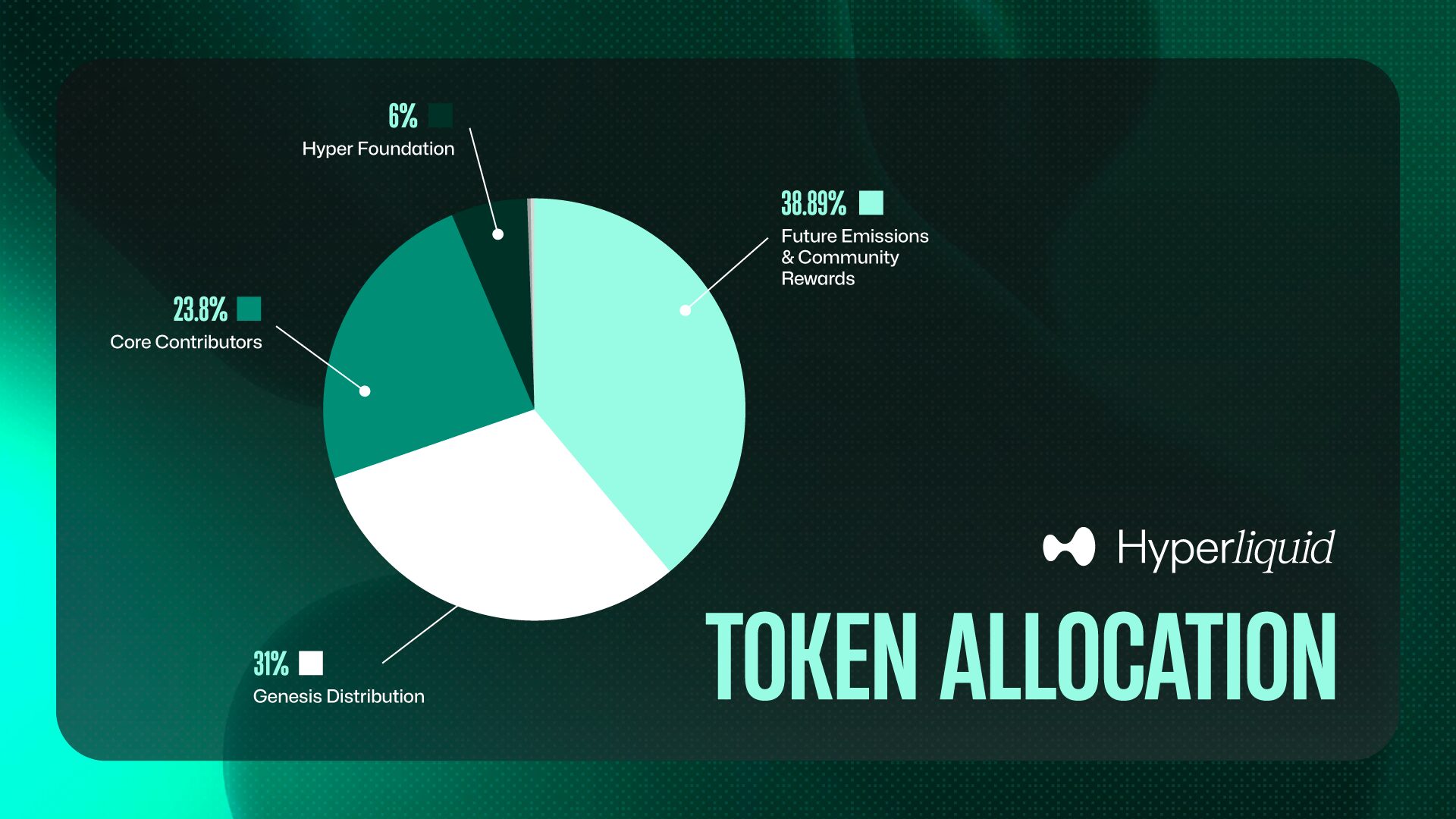

Distribute tokens

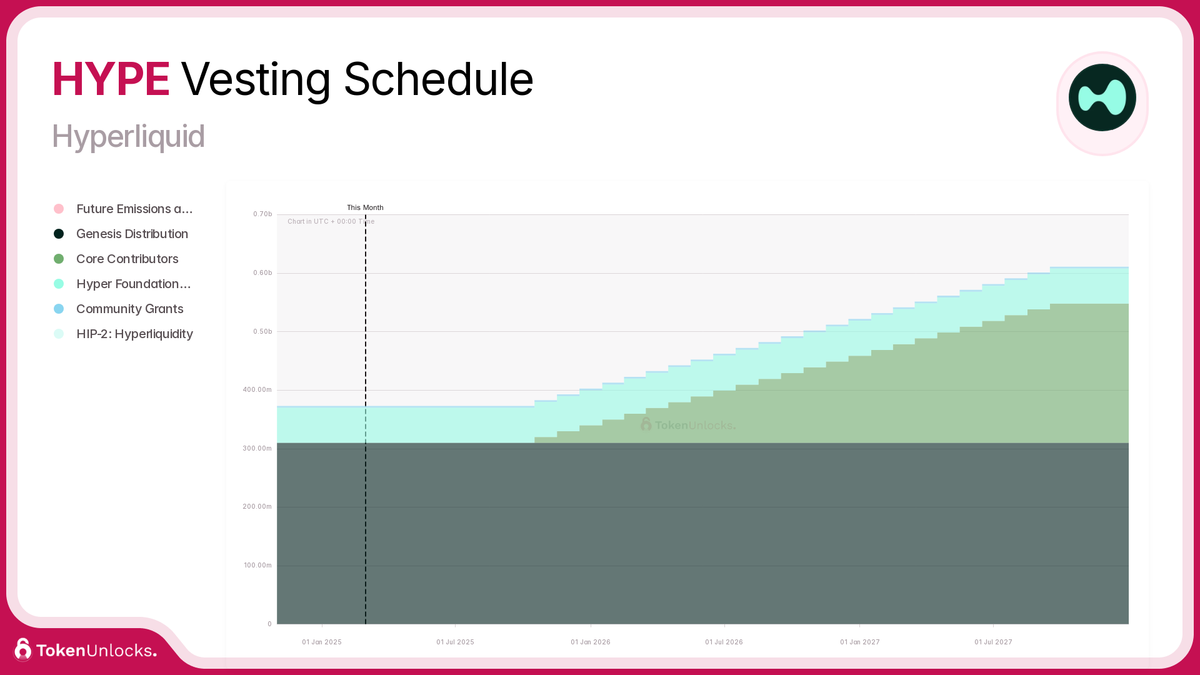

Total supply: 1 billion hype tokens

- Genesis Distribution: 31%

- Future emissions and community rewards: 38.888%

- Core Contributors: 23.8%

- Super basic: 6%

- Community Grants: 0.3%

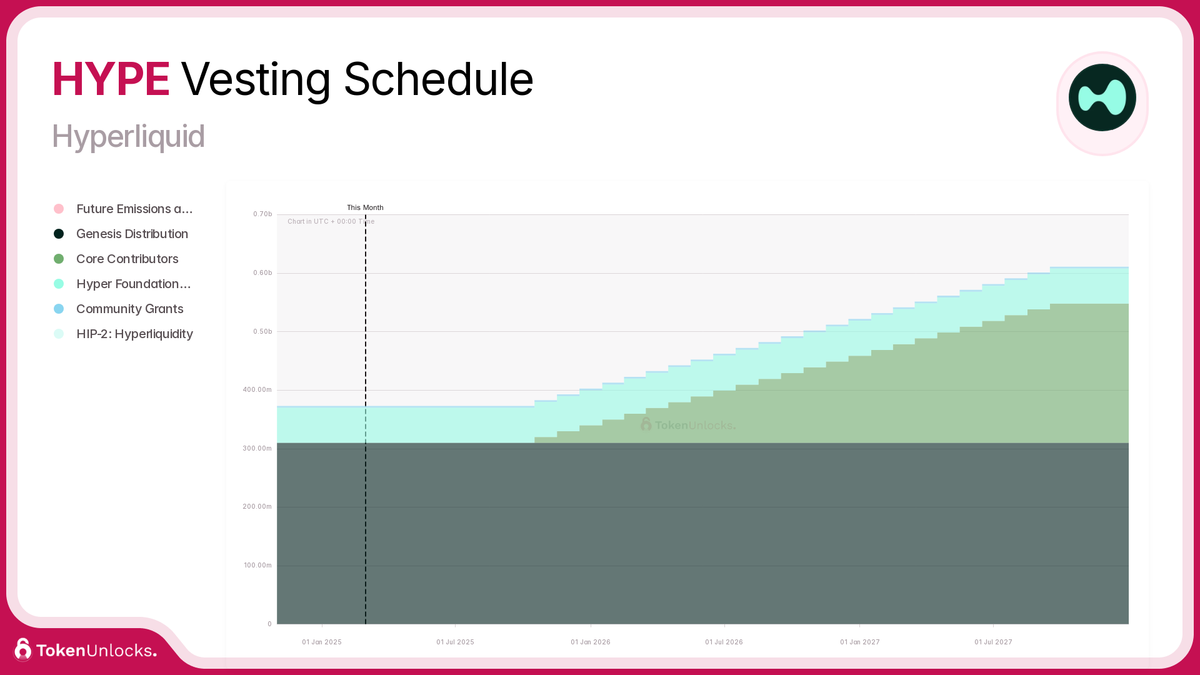

Attribution timeline

- Community Allocation: More than 30% of the total supply is distributed when released through the air conditioner.

- Team Token: Lock it for one year, then gradually unlock it for two years every month, and all of them will be released from 2027 to 2028.

Source: Symbolists

Super fluent price forecast

An overview of the hype chart

Hype is a relatively new trading pair with limited historical data. This makes it challenging to identify past levels of support and resistance. However, by leveraging Fibonacci backtracking, analyzing price structures and evaluating recent market behavior, we can make a wise assessment of its potential future trends.

According to Coingecko, the current price Hypereflecting a 24-hour change of -4.9%, and a 7-day decrease of -20.3%. However, prices have risen 42% over the past 30 days, indicating a significant recovery trend.

Historical data show that ATH was $34.96 on December 22, 2024, while the all-time low (ATL) was $3.81 on November 29, 2024, highlighting the significant price fluctuations of the token. The current market capitalization is $4,533,147,158 and trading volume is $134,598,198, indicating a relatively high level of trading activity.

Recent price trend analysis

According to Coingecko, hype has experienced significant price volatility over the past month. Specifically:

- 30 days ago, the price was about $9.51 (from a 42% increase to $13.51 now).

- 14 days ago, the price was around $10.04 (based on a 34.5% increase in 14 days).

- Seven days ago, the price was around $16.95 (reflecting a 20.3% decline in the past 7 days to the current level of $13.51).

Basic Analysis: Technical Advantages of Hyperliquidity and a Community-Centered Approach

Technological innovation

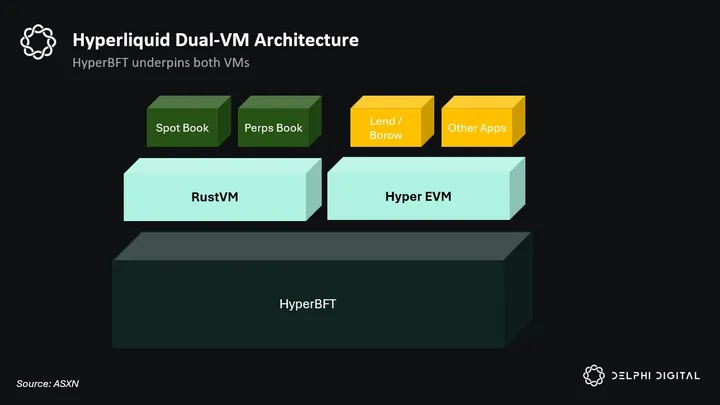

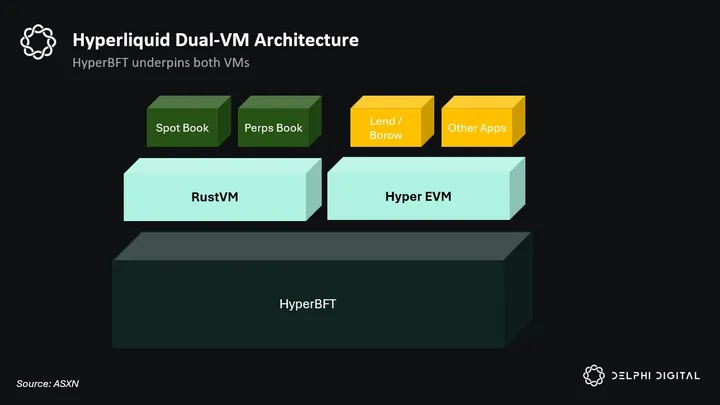

Hyperliquid’s blockchain adopts the HyperBFT consensus mechanism, a variant of Byzantine fault tolerance (BFT), thus achieving fast transaction speeds for block terminals under 1 second. This efficiency supports high-frequency trading and complex decentralized financing (DEFI) applications. HypereVM integration ensures compatibility with Ethereum’s virtual machines (EVMs), facilitating developers familiar with the Ethereum ecosystem to facilitate seamless deployment of smart contracts and decentralized applications (DAPPS).

Source: Delphi Digital

Unlike many DEXs that use automatic market makers (AMM) models, the super-liquid model adopts an order system that provides traders with deeper liquidity and more favorable prices. This approach reflects traditional CEXS and provides users with familiar and efficient trading experience. In addition, hyperliquidity eliminates gasoline fees for transactions, which can greatly reduce user costs and enhance platform accessibility. That’s why large leverage positions are now open on this platform, rather than more lifetime positions.

Team and community engagement

The core team behind Hyproliquid includes alumni from prestigious institutions such as Harvard University, Caltech and MIT, with professional backgrounds at leading technology and finance companies such as Google, Hudson River Trading and Nuro. This diverse expertise is for the innovation and strategic direction of the platform.

Emphasizing the philosophy of community priority, Hyproliquid avoids venture capital funds and distributes a large portion of its native tokens directly to the community. This approach promotes a decentralized governance model and aligns the platform’s success with its user base, thus facilitating active engagement and long-term commitment.

Income model and financial sustainability

Hyperliquid’s revenue comes mainly from transaction fees, which are redistributed to the community. It is worth noting that all expenses are targeted at the UltraFiber Liquidity Provider (HLP) and aid funds to ensure that the community benefits directly from the growth of the platform. This model is in contrast to other protocols that benefit teams or insiders primarily.

The platform’s markup is designed to support long-term sustainability and community engagement. During the stacking process, a portion of the token may be burned to reduce loops, thus integrating the release model to increase the value of the token.

Distinguishing from other layer 1 platforms

Hyperliquidity is distinguished from other tier 1 platforms such as Ethereum and Ethereum Solana Through several key aspects:

- Dedicated blockchain: Operating on its own layer 1 blockchain, hyperliquidity ensures custom optimization for trading activities, thereby improving performance and user experience.

- Community-centric token learning: By allocating most of the national tokens to the community and avoiding venture capital funds, super liquidity promotes real decentralization and aligns incentives with their user base.

- Order book model: The use of using order systems provides traders with deeper liquidity and more precise pricing to meet the needs of retail and institutional participants compared to the general AMM model.

Identify key levels in technical analysis

Key support levels

- The highest point before the hype plays a crucial role in confirming the level of support.

- After breaking through this key support level, the price retested it, confirming the Fibonacci backtracking level.

- A smaller rebound may occur when the price reaches the deep support zone.

Accumulation and breakthrough zone

- The graph shows the price consolidation in a narrow range, which is a sign of accumulation.

- When the price breaks through the accumulation zone, it must be confirmed whether it is a real breakthrough or a trap.

- If the price rises after the price breaks through, it may mark a confirmed bullish trend.

- Conversely, if the price cannot exceed the breakout level, it may indicate a bull trap.

Source: TradingView

Hype trading strategy

At present, there are no clear signs of a trend reversal. Therefore, Nfteing will still prioritize bearish situations in the near future, especially when the price bursts out of the storage zone, which now shows a recovery action to confirm this breakthrough.

- If the price continues to remain below the newly formed resistance zone, the downward trend may continue.

- On the other hand, if a strong reversal signal appears in the market, the strategy should be adjusted accordingly.

If prices continue to drop, key support levels

If the downtrend continues, the price may reach a critical level in Fibonacci, which is the potential support zone:

- 12-12.5 USDT: This range is close to previous lows, and buying pressure may appear and may trigger a slight rebound.

- 10-10.5 USDT: This is expected to be the strongest support area. If bearish momentum persists, nftevening expects prices to fall to this range.

in conclusion

The hype is currently on a strong downward trend with no obvious signs of reversal. Trading at this stage requires careful and confirmation through technical signals. To optimize trading strategies, investors should monitor price responses at critical support levels and wait for a reversal pattern before making any purchase decisions.