sui(Sui) is one of the most prominent next-generation layer 1 blockchains, which quickly attracted the attention of crypto investors and institutional participants. SUI builds on the legacy of the META DIEM program and originates from the legacy of the Meta Diem initiative to overcome the transaction speed and scalability limitations of early blockchain architectures.

Based on the latest technology and basic analysis, this article provides SUI with a comprehensive short-term price forecast. It also includes the Comparison Section (APT) about Aptos (APT), a mobile-based layer 1 to position SUI in the market.

Current market environment and latest developments

Sui launched its mainnet in early 2023 and has since shown significant growth and market momentum. Sui has soared about 46% over the past six months, and in the past month alone, it has grown 52%. Despite a 4% pullback last week, the trend remains firmly bullish.

From early 2024 to early 2025, Sui’s price on its peak rose by more than 300%. As of mid-May 2025, Sui’s trade was around $3.90-4.00, returning strength after a brief correction triggered by the large mark Unlock.

From a broader market perspective, institutional interests are accelerating. According to Coinshares, in May 2025, SUI-linked investment products attracted $11.7 million inflows, the highest of all Altcoins. Solana and other competitors saw a net outflow, capital surged.

Investment company 21Shares, Grayscale also applied for SUI ETFs in the United States and launched the European SUI ETP in 2024. These moves underscore the appetite exposed to the SUI ecosystem.

Growth of ecosystems and real-world use

As of Q2 2025, SUI’s Defi ecosystem has nearly $2 billion in total value lockdown (TVL), surpassing most other previous Erim 1 tiers. Leading loan agreements such as Suilend and Navi manage over $450 million in TVL. In addition, Bluefin, a permanent futures exchange, rose with a daily trading volume of $250 million.

Learn more: How high can BTC be in this cycle?

SUI is also integrated with real-world assets (RWA) protocols such as Ondo Finance to expand Stablecoin infrastructure. The network is increasingly seen as a destination for scalable, on-chain financial applications. Its design allows for a local fee market, low latency and cost efficiency – a key advantage of institutional transactions.

Source: Defillama

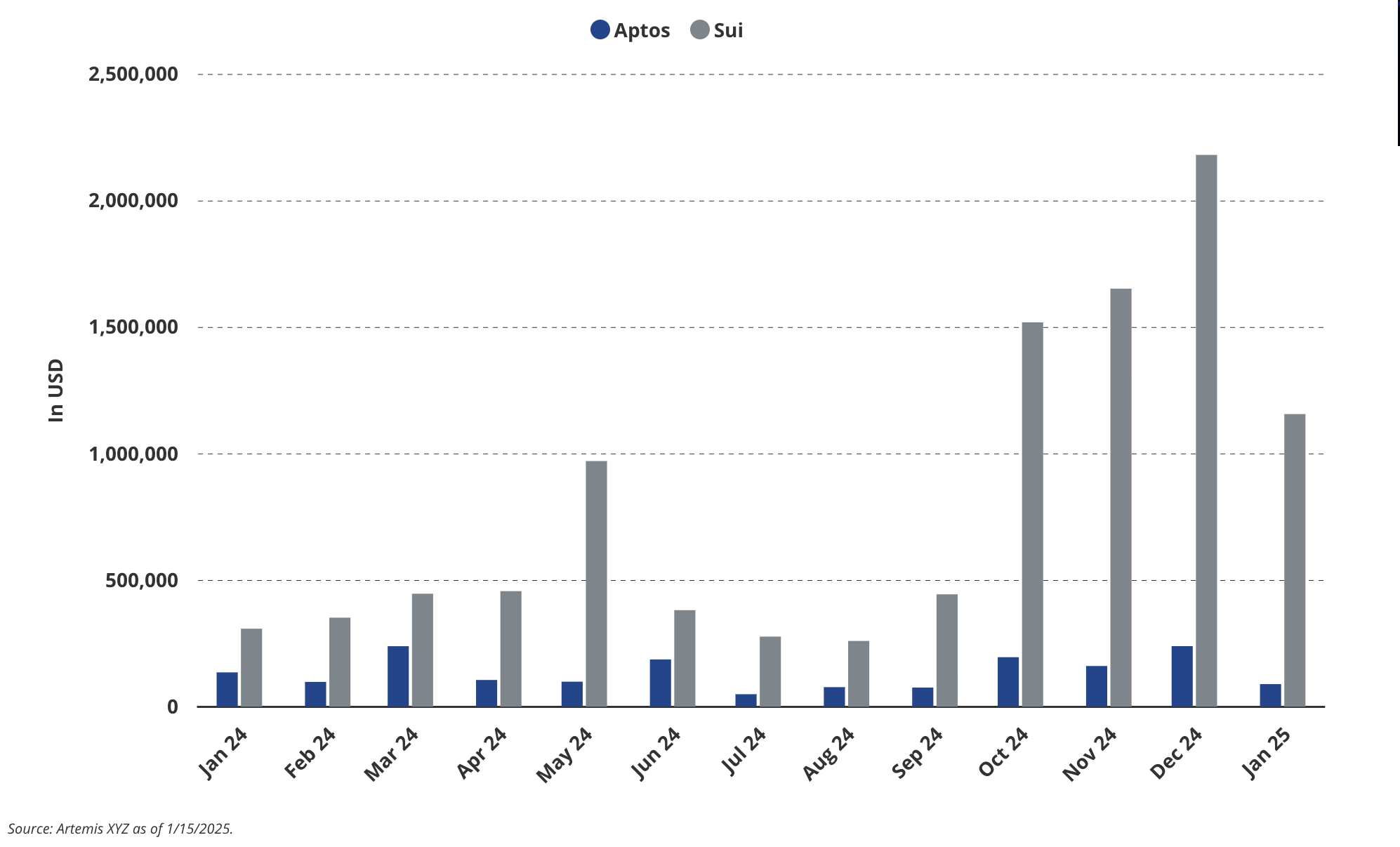

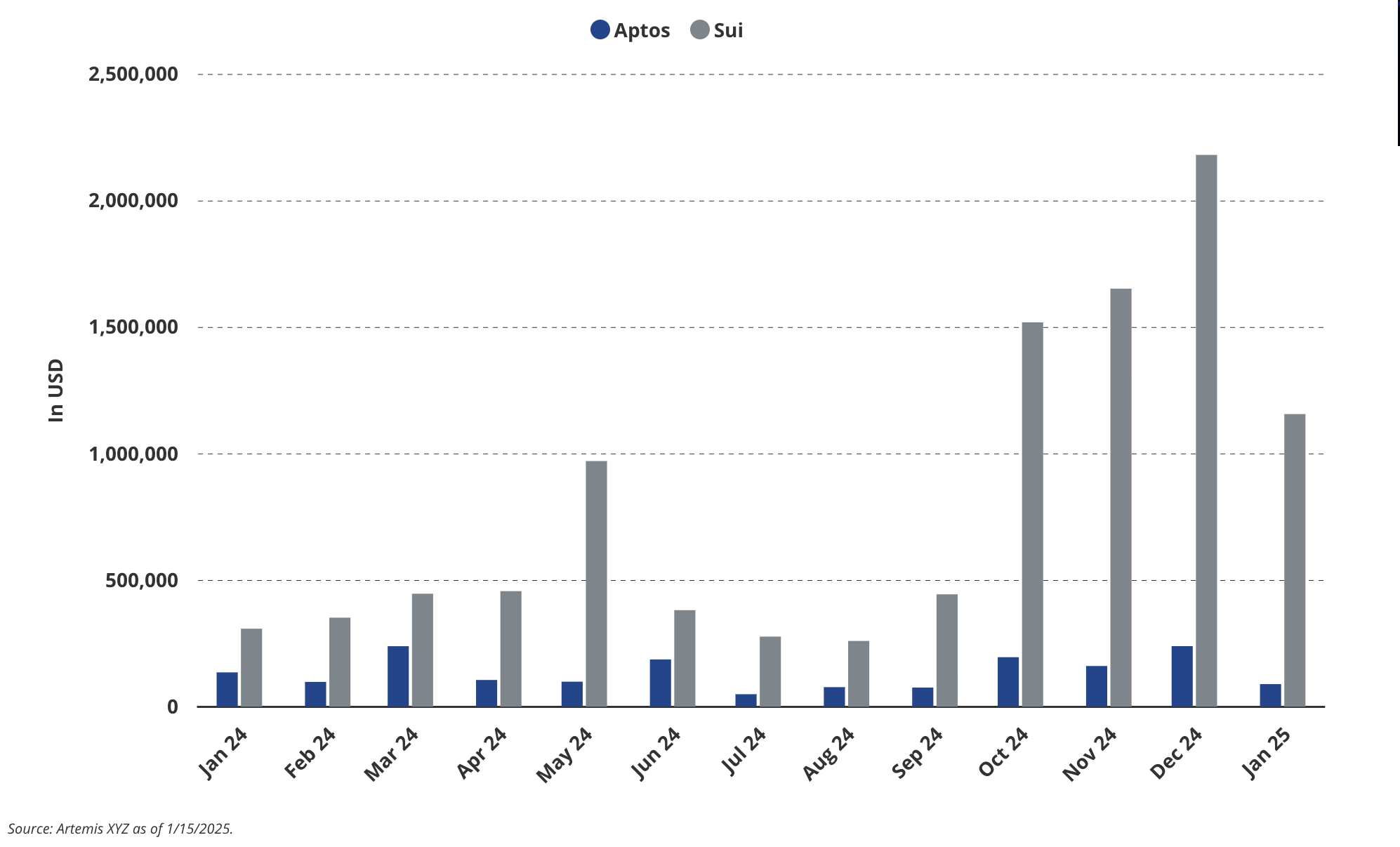

A key metric: SUI’s on-chain fee revenue exceeded Aptos’ full fee revenue in November 2024, up 24% from revenue revenue in the previous year, which illustrates its higher network activity and validator profitability.

Source: Artemis

Additionally, Binance Alpha has recently played a key role in accelerating visibility and adoption of the SUI ecosystem. In Binance Alpha’s research pipeline, several SUI-based projects are listed on Binance, which clearly shows confidence in the potential of the network, such as:

- Scallops (SCA)

- Vessel (NAVX)

- Bluefin Tuna (blue)

- Hippo (Hippo)

To further support, Binance Alpha formally integrated the SUI blockchain into its infrastructure in early May 2025, thus providing more in-depth analytical tools and exposure for SUI-based projects. This level of back-up with exchanges is rare and enhances Sui’s position as a Rising 1st-tier competitor.

Developers and community momentum

SUI is backed by Mysten Labs, which raised $300 million in 2022 from top investors such as A16Z and FTX Ventures. In 2024, the team repurchased FTX’s equity and token rights for $96 million and strengthened its long-term commitment to decentralization.

Source: Electrical Capital

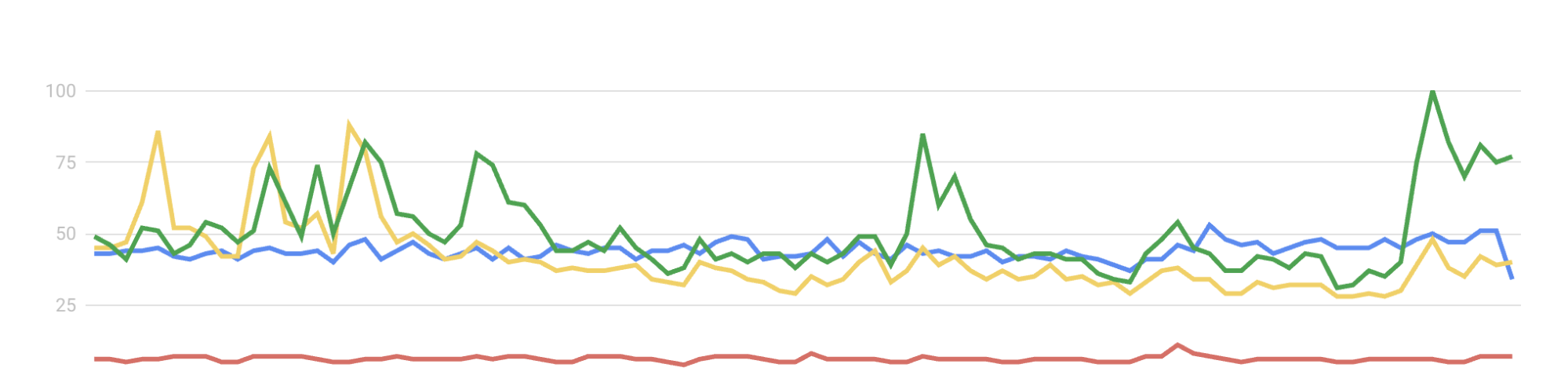

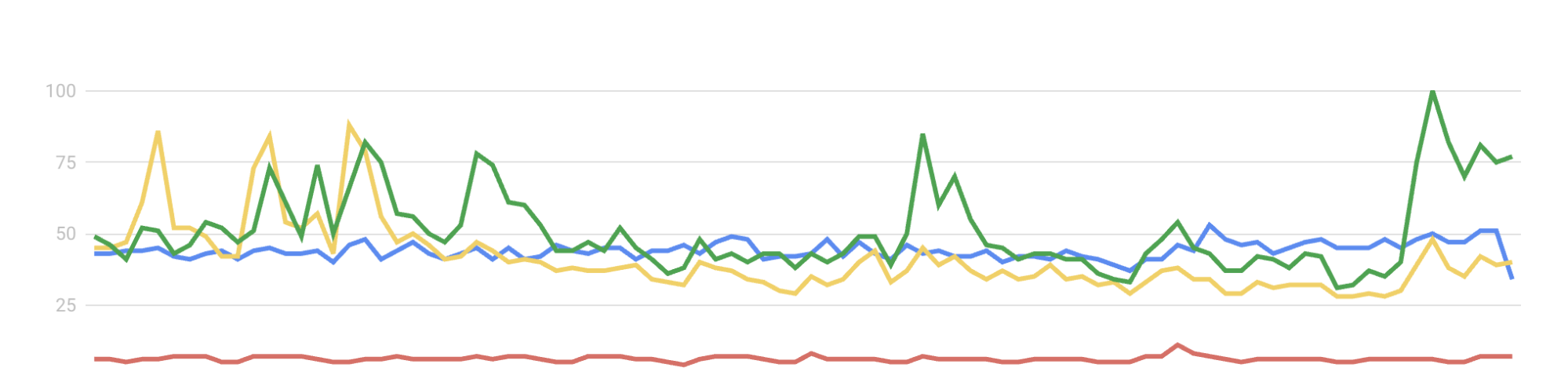

The SUI developer community remains active, with an average of more than 280 contributors per week in early 2024, slightly more than APTO. Social indicators indicate that SUI dominates the public’s attention. As of the end of 2024, Google Trends data showed that interest in “SUI” was 9 times higher than “Aptos” and sometimes even surpassed Ethereum and Solana.

SUI (blue), Aptos (red), Solana (yellow) and Ethereum (green) – Source: Google Trends

The platform’s public-oriented momentum is further reflected in its outstanding social media and interactions with X and Discord.

Tokenology and Capital Flow Mechanics

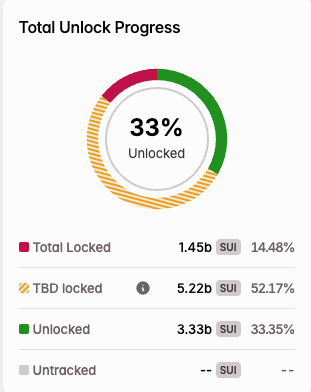

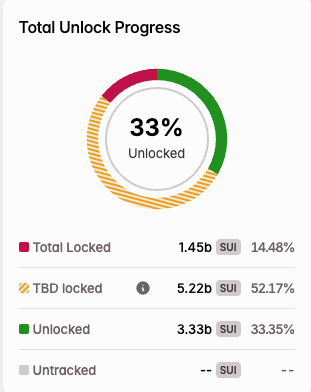

The total supply of SUI is 10 billion tokens. As of early 2025, about 30.9% of the supply is in circulation. A series of large token unlocks, including the $322 million division in February 2025 – created temporary price pressure earlier this year. However, recent unlocks have been better absorbed, indicating stronger market maturity.

Unlike APTO, APTO burns transaction fees, SUI allocates all fees directly to the validator. As network activity grows, the model provides higher economic incentives for node operators and stakers. In addition, SUI has an innovative storage fee system: users deposit SUI when storing data on the chain, and can recycle up to 99% after deletion. The remaining 1% enter the public storage fund for long-term sustainability.

This storage-based mechanism acts as a natural vent sink, complementing a validator-centric revenue stream. Combined with high-chain activity, these features create strong basic support for the value of tokens.

Source: Token Unlock

SUI Price Forecast: Target Range $5-6

In the short term, Sui’s price trajectory continues to look bullish, with its next upward target expected to be in the $5-6 range, assuming wider market sentiment remains constructive.

The token has shown a strong technical recovery since the $1.90 bottom bottom in early April, with trading more than doubled in one month in mid-May 2025.

The analysis leads to a deliberate comparison between SUI and APTO, not only because both projects are rooted in Meta’s Diem Legacy and Move programming languages, but also because their market performance is different as investors’ capital becomes increasingly selective.

In the case of macro uncertainty and liquidity changes, evaluating relative strength becomes crucial as capital rotation tightens across layer 1.

Source: TradingView

On the other hand, Sui benefits from multiple tailwinds. ETF-powered Bitcoin inflows restored risky appetite for altcoins, especially for those with strong ecosystem growth. Binance strengthens institutional confidence by focusing on SUI through frequent project lists related to its ecosystem.

Read more: Trading with free encrypted signals in the Evening Trader Channel

On-chain metrics back up this: SUI has recently surpassed network activity, daily active users and DEFI TVL’s APTOS. Its object-centric parallel execution model has also gained attention among developers who build high-frequency financial applications and games.

That is, the broader market conditions remain fragile. The liquidity absorption in the United States, the uncertainty in the United States, and the faded hype cycle are easily capped. To bring SUI to the $5-6 range, it will require continued momentum from ecosystem expansion and ongoing demand for institutional and retail demand. SUI may also face sharp corrections if Bitcoin backtracks or macro headwinds recover.

in conclusion

Overall, SUI currently has the upper hand in growth momentum and market attention. In the short term, Sui’s target range is $5-6 as long as broader market sentiment remains optimistic, while SUI continues to expand its ecosystem, and SUI maintains the unit trajectory.

However, Aptos is not behind and still has the potential to catch up – as long as it can take advantage of its technological advantages and effectively recalibrate its strategy.