Trump announced that the global comprehensive tariffs would be imposed for more than 24 hours, and the financial markets have endured strong volatility for 24 hours. While the stock market is still immersed in the red, the cryptocurrency market shows some signs of recovery.

Stocks strongly dumped after Trump’s tariff order

The turmoil in the global stock market began to reach April 2025, with major indexes falling sharply. At the morning meeting alone, capitalization of the U.S. stock market evaporated more than $2.85 trillion, highlighting the severity of the recession.

Source: TradingView

Meanwhile, Japan’s Nikkei index fell 2.77%, reaching its lowest level since August 2024. This sharp decline reflects an increasing focus on the region’s economic stability, while geopolitical tensions and changes investor sentiment.

Source: TradingView

In the United States, the S&P 500 index fell by 4.5%, and the Nasdaq fell by 5.5% from its opening clock on April 3, 2025 (American Times). These declines have left both indexes on their worst trading days since the March 2020 crash. The technology-heavy Nasdaq is the first to bear the brunt, as stocks of major U.S. tech giants such as Apple, Microsoft and Amazon eroded 7.5% to 10% in just a few hours.

The S&P 500 has just raised $2.5 trillion worth of value pic.twitter.com/d81ysmcfo1

— Evan (@stockmktnewz) April 3, 2025

Analysts attribute this blood to a combination of macroeconomic fears, including rising inflation expectations and uncertainty surrounding U.S. monetary policy.

Read more: Crypto Volatiles Follow Trump’s Tariff Announcement.

Encryption recovery and elasticity

Despite the shake-up of traditional markets, the cryptocurrency industry has shown significant recovery, which defies the wider financial dilemma. Several factors and specific segments within the cryptocurrency space contribute to this resilience, in stark contrast to the stock market’s dilemma.

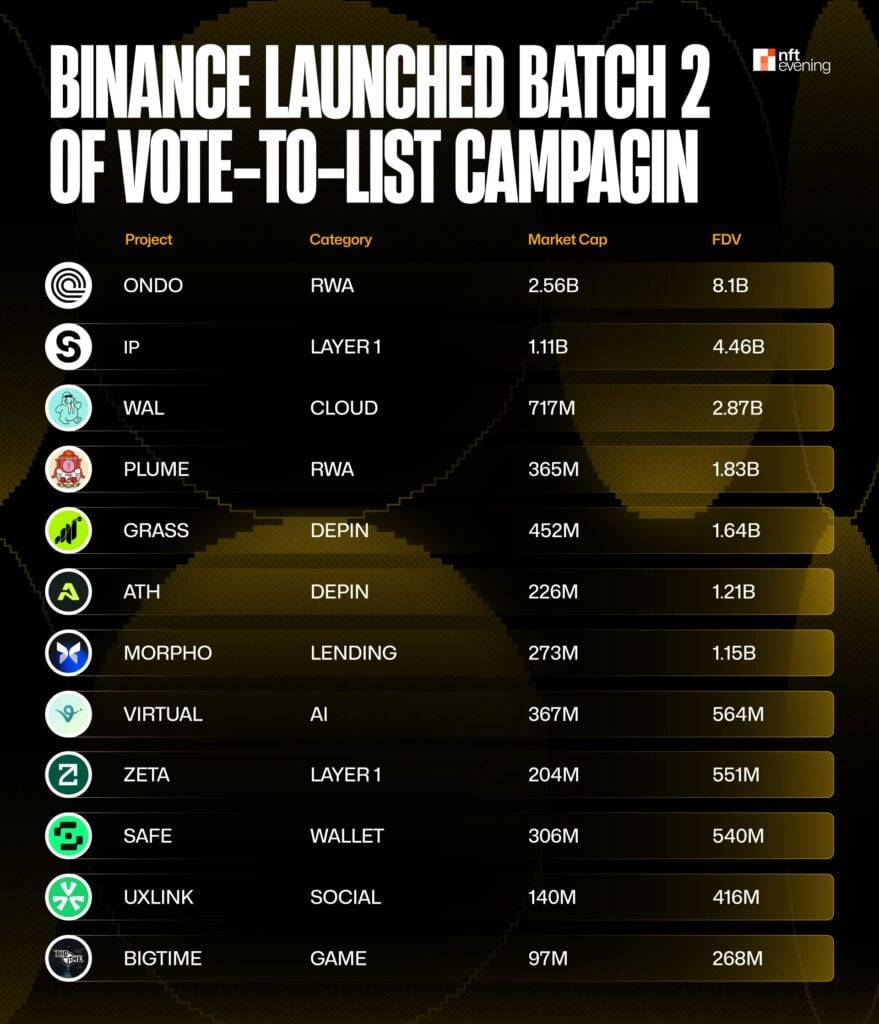

Binance “Voting List” group trend

In this recovery, the outstanding performer was recently a set of utilities in Binance’s second “Vote List” event. The program includes technology-driven coins such as $virtual, $bigtime, $uxlink, $morpho, $grass, $ath, $wal, $wal, $safe, $zeta, $ip, $ip, $ondo and $plume. These tokens representing departments such as AI, Depin and Real World Assets (RWA) have seen major rally.

For example, $Bigtime, associated with Web3 multiplayer RPG, soared 60% in the hours after the announcement, reconciling with 30% gains. Similarly, $uxlink rose 18%, $Zeta 9%, and $Plume 8%, influenced by community excitement and Binance.

This momentum emphasizes the appeal of utility-centric projects in markets seeking innovation.

Read more: Binance launches second ‘voting’ batch

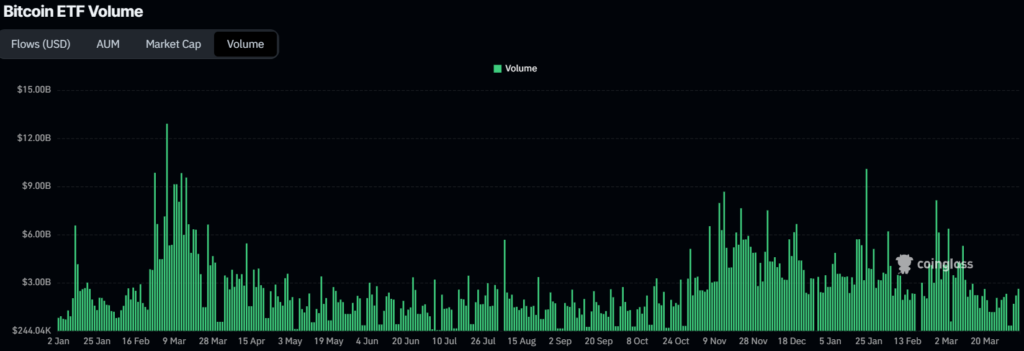

Bitcoin remains stable

In the chaos, the top coin Bitcoin shows significant stability. Despite the decline in the inventory index, Bitcoin has kept its ground above key support levels, avoiding a catastrophic decline. Bitcoin has just dropped 1% in 24 hours, keeping its price level at $82,755.

This resilience strengthens its reputation for potential hedging of traditional market volatility, thus attracting new interest from investors seeking safe havens outside of stocks. Although it has not released dramatic gains, its ability to “hold lines” has strengthened confidence in the wider crypto ecosystem.

The holder’s sentiment further emphasizes this stability. GlassNode’s data show that the net position change of Bitcoin’s long-term holders (LTH) remains positive, with LTHS accumulating 42,000 BTC over the past week, expressing strong belief despite the pressure.

Source: Xiaodian

Bitcoin’s long-term ratio is slightly bearish from 0.94 in last week’s coinglass data, shifting to 1 (50.5%) than Bitcoin’s length ratio (50.5% position). This neutralization suggests that BTC holders have a firm attitude and are waiting for clearer signals rather than panic. These factors collectively emphasize the robustness of Bitcoin in the face of macroeconomic turbulence.

Memecoins gained appeal

The Memecoin industry has also joined the rally, with speculative tokens carrying a wave of retail enthusiasm. These coins are often driven by hype rather than rationale, which exploits risk appetite shifts, publishing double-digit growth in some cases. Their performance reflects the unique ability of the cryptocurrency market to thrive emotionally, even when traditional assets are shaken.

Source: Cryptorank

And Memecoins Moon, Solana and Ethereum Flatline

However, not all segments of the crypto market are thriving. Solana and its ecosystem, as well as Ethereum, remain relatively stagnant.

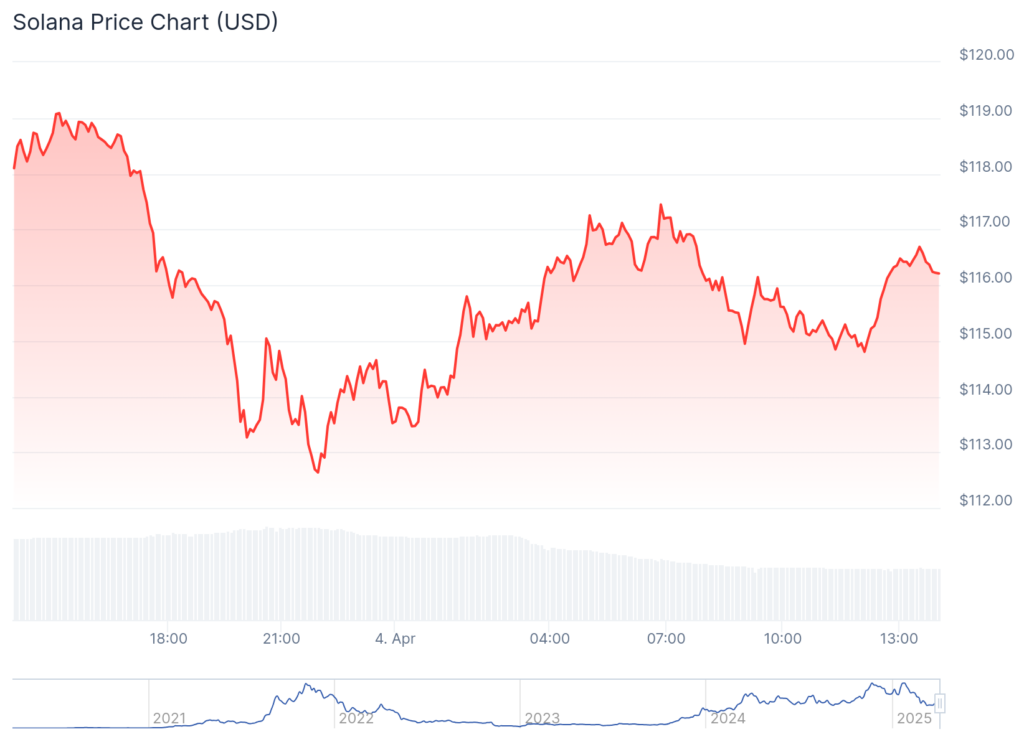

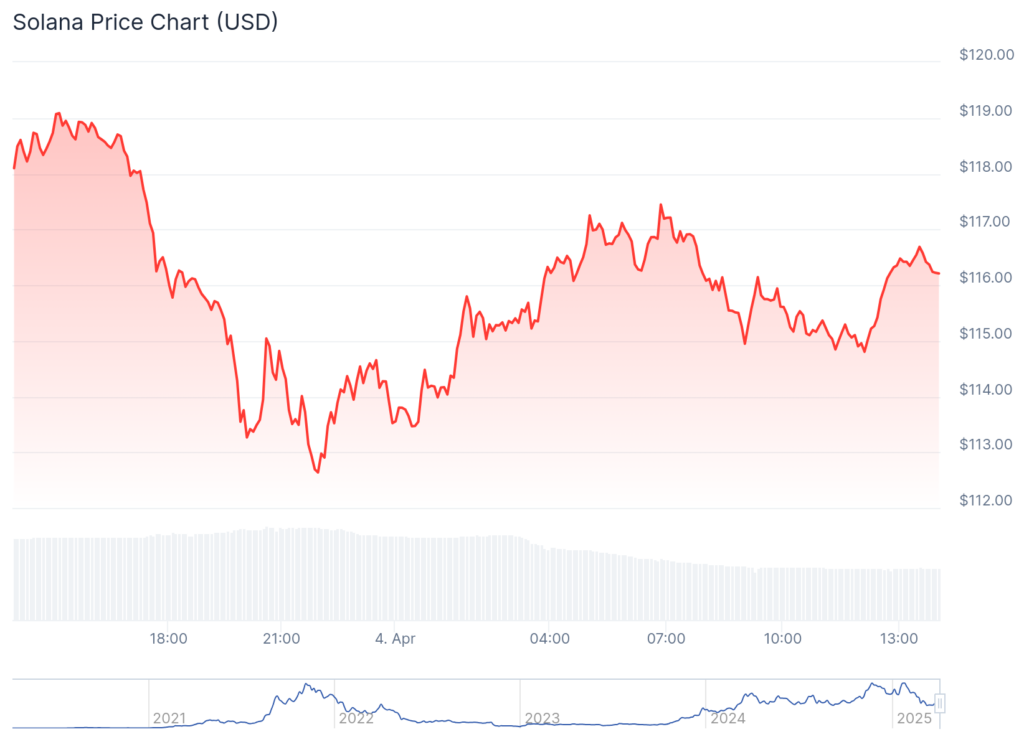

The price of Solana (Sol) has dropped to its lowest level in three weeks and is currently at $115, down nearly 12.75% in the past 24 hours. In the near future, 1.79 million sols will be unlocked and injected into the market, equivalent to US$200 million. This influx of large amounts of sols may increase sales pressure, especially as the price pattern continues.

Source: Coingecko

Despite their strong fundamentals, both networks are struggling to keep pace with the wider recovery. Issues of scalability and market saturation may put investors’ confidence in confidence, which makes them underperformed in the otherwise buoyant crypto landscape.

All in all, the cryptocurrency market has achieved an impressive rebound despite the huge losses in the stock market. From Binance’s “voting to listing” stars to Bitcoin’s stability, though Solana and Ethereum remind us that not every corner of the space is equally resilient.