Author: Julie Rennett, Vice President and Industry Advisor, Circana U.S. Toys

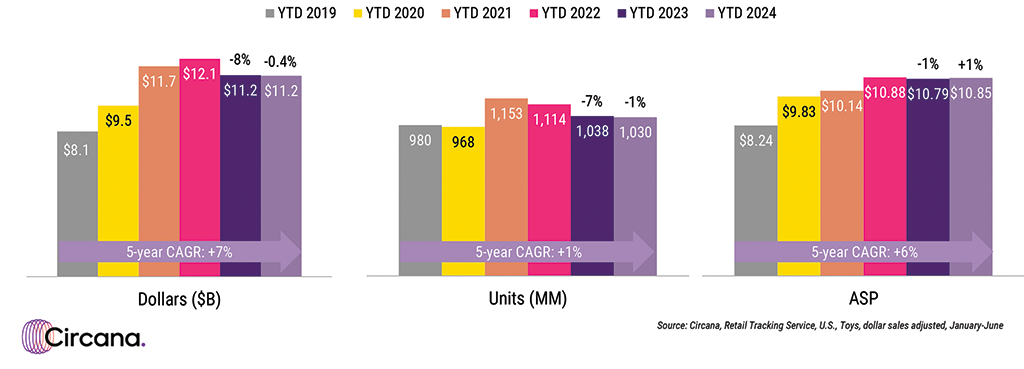

The U.S. toy market will remain relatively stable in the first half of 2024. %, while the average selling price (ASP) rose 1% to $10.85.

The industry continues to demonstrate resilience, and although U.S. dollar sales are down 0.4% in 2024, the overall picture remains positive. Over the past five years, the toy market has experienced a compound annual growth rate (CAGR) in dollar sales of 7%, driven by average selling price growth of 6% and unit sales growth of 1% annually. The industry grew by $3.1 billion, or 38%, compared to 2019, highlighting the toy market’s ability to thrive amid evolving challenges. While this year’s stabilization performance is an improvement over the larger decline experienced in 2023, it’s important to remain cautiously optimistic given that the current stabilization was preceded by severe recessions.

The challenges affecting the toy industry remain largely the same. While inflation is starting to cool, unemployment has increased slightly. Student loan repayments, swings in consumer confidence, and the upcoming election are important factors to monitor. The industry must remain alert to the changing environment in order to respond effectively to this dynamic era. However, the toy industry remains stable despite declining employment opportunities and rising household debt. Recent price cuts announced by retailers on certain items have been a significant driver, increasing store traffic and toy purchases.

Highlights for the first half of 2024

Consumer preferences have shifted across supercategories so far in 2024, with three of the 11 supercategories tracked by Circana showing growth. Building packages led the way, with dollar, unit and average selling price growth. This super category contributed 72% of total year-to-date revenue, driven primarily by LEGO icons. Discovery Toys and other toy super categories, driven by NBA Trading Cards, and the vehicle super category, driven by Monster Jam, also contributed to growth.

Conversely, the biggest declines were in action figures and accessories, dolls, games and puzzles, and baby, toddler and preschool toys, which together accounted for 81% of the decline. This year’s standout toy products include Pokémon, Squishmallows, Star Wars, Marvel, Barbie, LEGO Icons, Hot Wheels, NFL, Fisher-Price and NBA, highlighting key consumer preferences and trends for 2024.

Looking to the future

Looking to the future, it is clear that the toy industry is facing a complex situation of both opportunities and challenges. Consumer sentiment remains mixed, fluctuating between optimism and concern. While economic growth is showing a promising pickup, rising household debt and the potential impact of student loan repayments have created some uncertainty.

The increasing spending power of parents with annual household incomes of $100,000 and above is an important trend to consider. However, declining overall birth rates and demographic changes among younger cohorts pose ongoing challenges to the industry.

Going forward, the industry must remain vigilant. While the toy industry continues to show resilience, the current stabilization should be viewed as a moderation rather than a radical shift. Through prudent strategies and an adaptive approach, industry leaders can effectively navigate trends and exploit emerging opportunities in this ever-changing environment.

Source: Circana, retail tracking service, January 2019 to June 2024. Data represents retailers participating in Circana’s retail tracking service. Circana currently estimates that retail tracking services account for approximately 76% of the U.S. toy retail market. *New = No sales from January to November 2023

U.S. Toy Industry: Results for the First Half of 2024

The decline through June has slowed compared with industry performance during the same period in 2023. The number of units decreased 1%, and the average selling price increased 1% to $10.85. U.S. dollar sales grew 38%, or $3.1 billion, compared to 2019 (CAGR +7%)

Drivers of change: first half of 2024

Of the 11 super categories, only construction sets, exploration and other toys, and vehicles achieved year-over-year growth. LEGO icons fueled the growth of construction sets; the NBA fueled exploratory and other toys; and Monster Jam fueled vehicles.

Other highlights:

- LEGO Icons, LEGO Creator 3-in-1 and LEGO Disney Classic drove 25% growth Building block set. The best-selling new* product in the building set is the LEGO Icons Rose Bouquet.

- NBA, MGA’s Miniverse, NFL, Donruss, LankyBox and Little Tikes drove 9% growth Exploration and other toys. The best-selling new* item is the Prizm NFL 2023 Football Trading Card Blaster Box of 24 Cards from Panini.

- vehicle It increased by 1%, with the most significant growth being “Monster Jam”, “Disney Pixar Cars” and “Godzilla x King Kong”, while “Hot Wheels” declined.

- Action Figures and Accessories It was down 12%, driven primarily by Funko Pop!, Marvel Universe, and Star Wars, while Godzilla x.com, King Kong, and Ninja Turtles all grew.

- youth electronics Sales fell 11%, driven by Little Live Pets, Kidi, Osmo and Tamagotchi, while Bitzee, Fingerlings and Robo Alive saw the largest increases. The best-selling new* item is WowWee’s Fingerlings Sweet Tweets.

- handicrafts A 10% decline was driven by Cra-Z-Art, LEGO Dots and Crayola. The ones that have grown most significantly are Play-Doh and Crazy Aarons.

- baby It dropped by 9%, with the biggest declines being in “League of Legends Surprise”, “Disney Phantom” and “Disney Princess”. Hello Kitty and Friends grew the most. The best-selling new* item is MGA Entertainment’s Rainbow High doll and pet set.

- Babies, Toddlers and Preschoolers Toys fell 6%, with Fisher-Price, CoComelon and Gabby’s Dollhouse suffering the most significant declines. Bluey and Stanley Jr. saw the biggest gains. The best-selling new* item is Spin Master’s Paw Patrol Jungle Pup Vehicle Combo.

- Games & Puzzles It was down 5%, driven primarily by Pokémon, Lord of the Rings and Yu-Gi-Oh! Both Lorcana and Magic have grown. The best-selling new* items are the Pokémon Scarlet and Violet Paldean Fates Collection Tin from Pokémon Company International.

- outdoor sports Toys declined 0.4%, driven primarily by declines in KidKraft, NERF, Razor and Step2. Cedar Summit and X-Shot were the top gainers in this category. The best-selling new product* is ZURU’s Bunch O Balloons Reusable Water 6-Pack.

- luxurious Shares fell 0.3%, driven by Squishmallows and Magic Mixies, while Hello Kitty, Snackles and Disney All Other gained. The best-selling new* item is Jazwares’ Hello Kitty and Friends Solid Color Plush 12-Inch Set.

A version of this feature was originally published in The Toy Book’s Fall 2024 Los Angeles Toy Preview issue. Click here to read the full article! Want to receive a printed copy of The Toy Book? Click here to view subscription options!

The post State of the Industry: The Story So Far… appeared first on The Toy Book.