Spell regardlessThe local tokens for the Mantra Dao ecosystem recently experienced a historic crash in April 2025, falling more than 90% in just a few hours. The activity not only brought OM prices down from a multi-dollar high to below $1, but also seriously shocked investors’ confidence in the project.

This article will conduct a comprehensive analysis of the impact of the crash, evaluate OM’s price trends on the short- to medium-term timeline, examine key influencing factors (overall market conditions, macroeconomic news, marking and development teams), and provide insights on the risks and investment opportunities of OM around OM at this critical juncture.

OM’s April 2025 collapse and damage to investor confidence

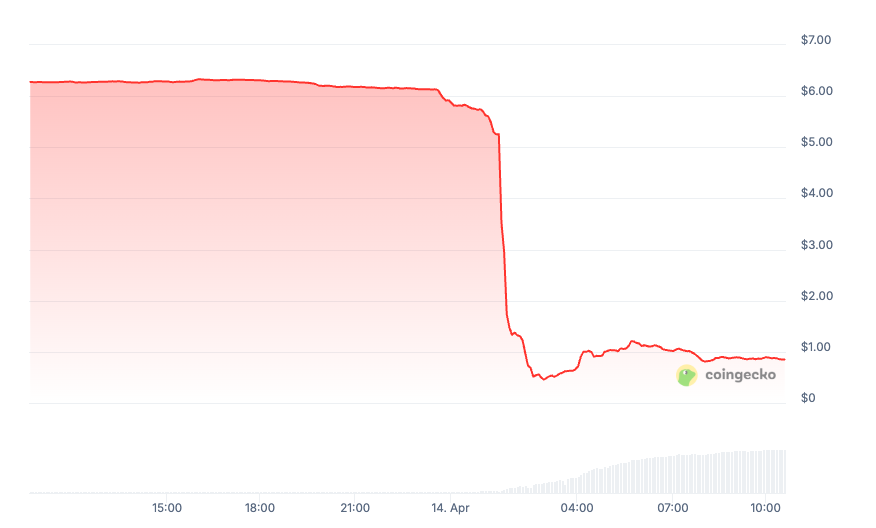

Around April 13-14, the price of OM dropped from $6.30 to below $0.50, consuming more than 90% of its market value overnight. OM’s market value fell from about $6 billion to $700 million.

The crash made an immediate comparison with the 2022 Luna/Ust crash, sparking widespread fear and speculative rumors. Rumors have been said that the team has sold 90% of the total token supply, causing some merchants to doubt insider manipulation or carpet pull.

OM crashes within 2 hours – Source: Coingecko

In response to the backlash, the Spell DAO team took quick action to assure the community. John Patrick Mullin, co-founder of the Spell, denied any carpet pull, noting that the drop was triggered by a “forced liquidation” on the centralized exchange (CEX).

He explained that during a period of low market liquidity, a communication – unnamed, but was proven not to be a binance, accidental freeze and liquidation of OM positions.

To restore confidence, the team announced a series of corrective measures. Mullin reveals a plan to buy back and burn large amounts of OM to reduce the circulating supply.

He also launched a $108 million ecosystem fund to support technology development, partnerships and marketing.

These actions are considered an effort to use the project’s remaining resources to “atone” and restore investor trust. Additionally, a community call was held to provide transparency around the event and an overview of the recovery roadmap.

Read more: Spell catastrophic collapse: $5.5 billion disappears in the crash

Nevertheless, 90% of the psychological damage to collapse remains deep. A clear signal: Even after a positive announcement, OM prices will only rebound weakly and continue to trade at $1.

Technical and basic analysis by time frame

Short term (1-3 months)

The technical outlook for OM remains bearish. During the major sell-off period, the OM briefly rebounded to the range of $0.80-1.00 but was soon sold again. As of mid-April, tokens were trading between $0.60 and $0.80.

The $0.68–$0.70 area is becoming a short-term psychological support level, acting as a temporary “floor” after the crash.

However, $1.00 has now entered a strong resistance zone – a key support level before, with OM failing to regain it with certainty, highlighting the weak buying momentum.

Looking ahead to the next 1-4 weeks, the downside risk remains higher. If overall market sentiment does not improve, OM may retest its nearest bottom near $0.35-0.40, with many technical indicators now marked as potential crash zones.

OM – Inflow and outflow of SOURCE: Nansen

OM may further drop to around $0.32-0.36 before discovering strong purchase interest.

Instead, OM may show signs of lower sales pressure. At this stage, the token may trade within a narrow range and gradually decline until the situation stabilizes.

Medium term (3-6 months)

In the mid-term, OM is entering a critical “trust testing” phase. A few months will be enough for the market to evaluate whether the project actually delivers on its recovery commitments.

The overall trend remains flat to neutral until a significant reversal signal appears. On the weekly chart, the trend indicator turns negative: the supertrend has shown a buy signal for months and has now flipped after the crash for sale. Furthermore, a death cross between long-term EMA has been formed, with EMA12 crossing EMA26 in a weekly timeframe.

Source: TradingView

These signals indicate that the medium-term trend of OM is still weak. The OM can slide further toward the $0.32 support area.

However, given the rate at which OM has declined, the lateral accumulation phase may unfold in the coming weeks or months as sales pressure gradually fades. In this case, the OM can be traded in a narrower range (possibly between $0.50 and $1.00) as the market tries to establish new prices.

On a more optimistic scenario, if strong demand reappears, OM could go back to around $2.18, where it will encounter obvious resistance.

In the basic aspect, the focus of this timetable will be on execution. The community will closely monitor the Spell Team to follow its token burn commitment and the utilization of the $108 million ecosystem fund. If OM buybacks and burns start seriously within the next 3-6 months, it can help stabilize prices and gradually restore investor confidence.

Like Luna or ftt, OM may bounce after a pressure fades out in the new accumulation phase. With the right catalyst or team action, OM can see 30-40% Rebound from the current level.

High-risk phase, but if there is a calm market or surprise catalyst, it can rebound in the short term.

in conclusion

The recent collapse of the Mantra (OM) is a painful event, but it does not necessarily mark the end of the project. If the trust returns, OM can earn a huge profit from the current fear-driven price level.

On the other hand, this is still a highly speculative investment, and the losses may deepen if existing risks are achieved. Therefore, investors should practise caution and monitor the team’s next steps closely over the next few months.

Read more: How Market Makers Become Executors: Course of Spell Crashing.

Spell (OM) Price Forecast: Last Chance for Profiters? First appeared on NFT night.