As Sophon prepares for Token Generation Activity (TGE), investors focus on how the project’s consumer first-tier strategy and $73 million in funding translate into its market debut, especially compared to Starknet, Scroll, Scroll and recently Binance Hodlane Hodlance Hodlane Airdrop Tokens.

Sophie’s Overview

Sophon is an emerging layer project built on the ZK stack – a modular blockchain development toolkit provided by Zkrollup Technology provided by ZKSync. Unlike Tier 2, which focuses on scrolling or Starknet, Sophon positions itself as a “consumption chain” dedicated to serving mainstream Web3 applications including gaming, AI proxy, social networking and forecasting markets.

On the finance side, Sophon successfully raised $10 million in seed investment in March 2025 and was backed by well-known investors such as Maven11, Paper Ventures, Okx Ventures, HTX Ventures and Dao5.

In addition to traditional risk fundraising, the project launched community-driven node sales and received an additional $63 million in sales. This put Sophon’s total capital raised by more than $73 million, an impressive figure, especially in bearish markets, highlighting the project’s strong appeal to institutional investors and the wider community of builders.

Source: Crypto Fundraising

Sophon tokenomics

Token allocation

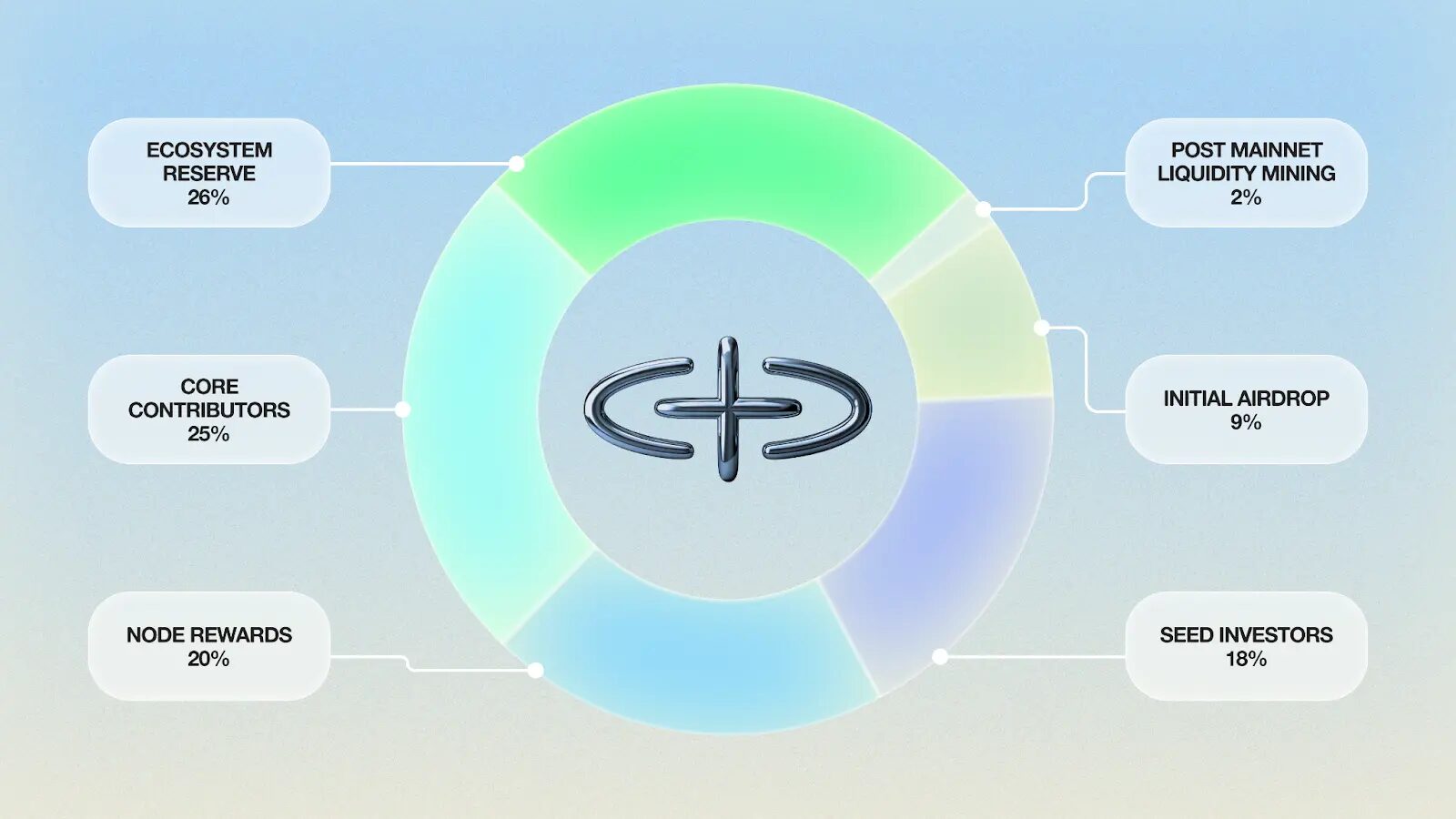

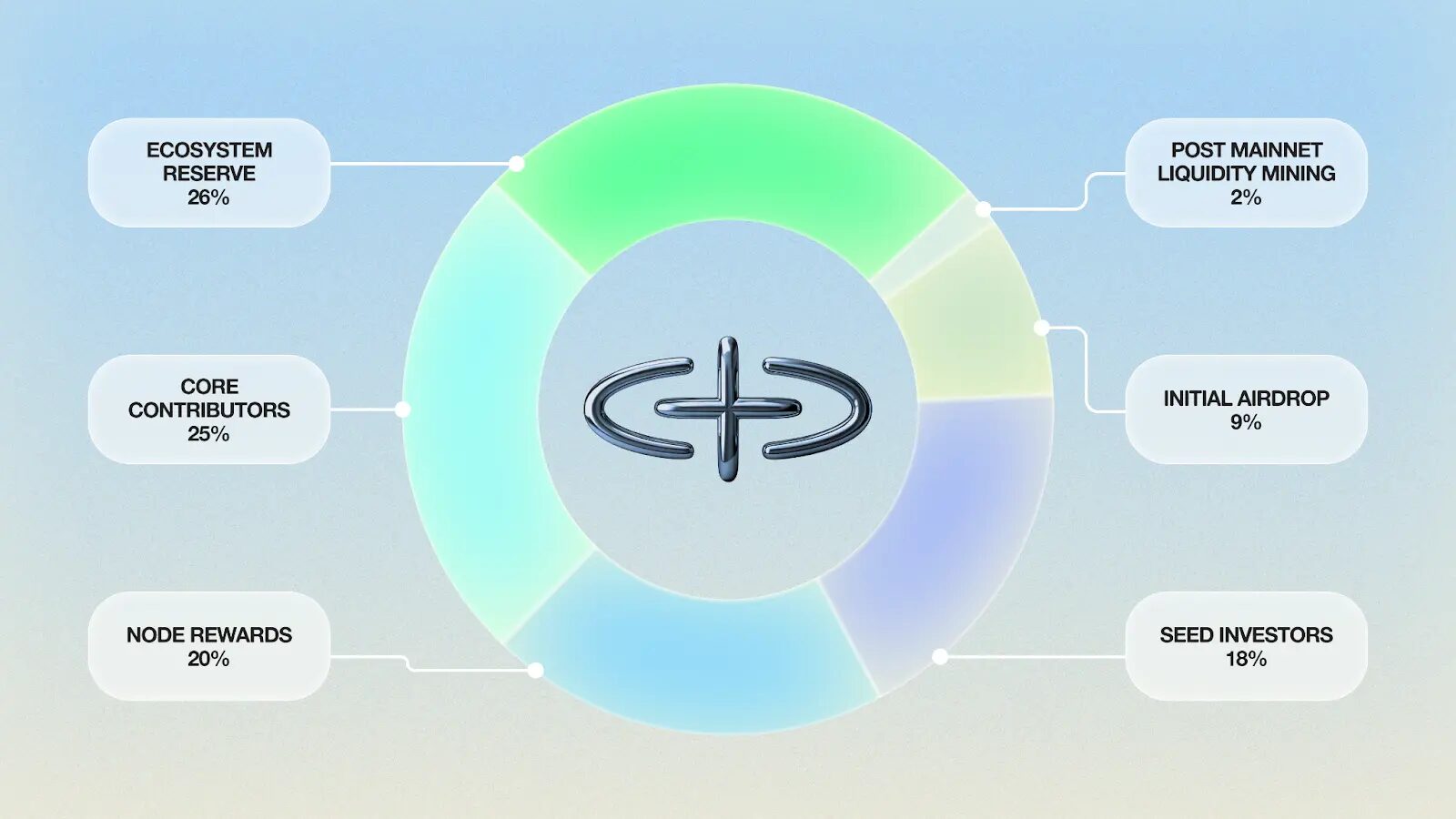

The fixed total supply of Soph tokens is 10 billion. Its distribution structure is as follows:

- Ecosystem reserve: 26%

- Core Contributors: 25%

- Node Reward: 20%

- Seed Investors: 18%

- Initial air conditioning: 9%

- Postal liquidity mining: 2%

Source: Sophie

One notable drawback of Soph’s token distribution is the disproportionate allocation to internal stakeholders – 25% allocated to core contributors and 18% allocated to seed investors, totaling 43% of the total supply. This raises concerns about the potential concentration of control and market influence, especially in the early stages.

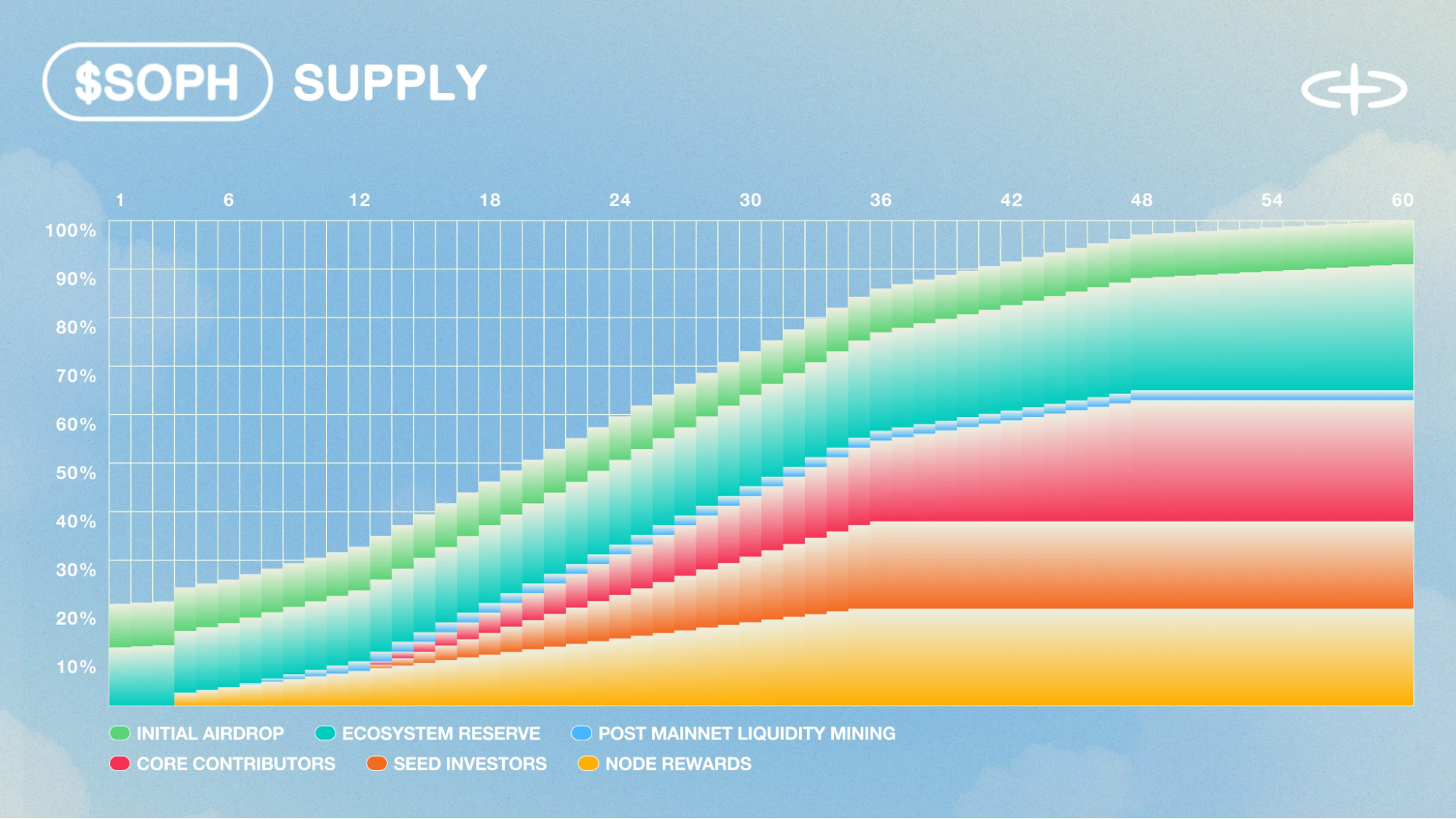

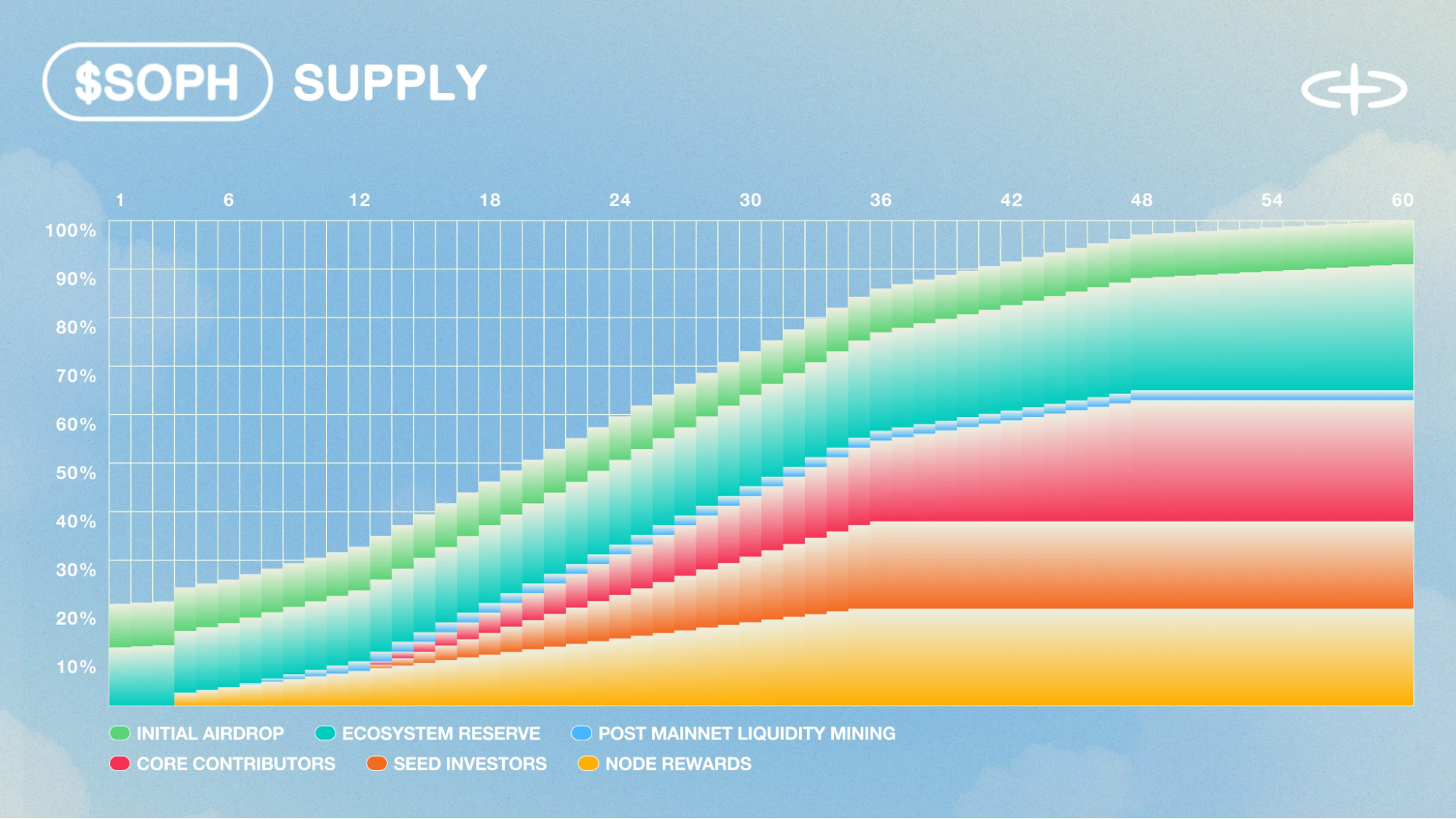

Soph’s markup is designed with a long-term design with positive factors such as controlled release schedules, strong incentives for node operators, and a large reserve of ecosystem growth.

However, the large allocation to seed investors and core contributors presents significant risks worthy of close monitoring, especially with accelerated attribution schedules or any changes to the terms of the release without transparent communication.

Source: Sophie

Market comparison

Comparing Soph with Starknet and Scroll is appropriate, as all three projects belong to the tier 2 ecosystem of zero-knowledge (ZK) technology.

Soph vs Strk

Starknet utilizes ZK-Stark and its proprietary Cairo programming language to provide high speed and security at the expense of EVM incompatibility. Its parent company Starkware has raised more than $270 million in funding, including a $100 million D round with a valuation of $8 billion.

When Starknet launched its original token, Struk, on February 20, 2024, it marked several notable financial milestones within the 2-layer space. The total supply limit for Srk is 10 billion tokens, with approximately 728 million StRK (7.28% of the supply) released into the cycle through the gas disk and initial distribution in TGE.

The Srk’s debut was about $1.90, which means the FDV was $19 billion – an unusually high number relative to other Tier 2 projects at the time. On this basis, Starknet’s circular market capitalization at the time of release was approximately US$2.55 billion. Backed by hype and strong brand, Srk jumped to $5 with the FDV priced at $50B and CAP $3.6B.

Source: Coingecko

However, after the initial hype, the decline of Srk has dropped sharply, with each token falling below $0.20. FDV is now at around $1.6B, down more than 97%, indicating that the market corrects weak demand.

Sophon, by contrast, takes a more measurable and pragmatic approach. The project raised $10 million in seed funding and $63 million from node sales, avoiding early valuations.

The team plans to release about 20% of the total supply at launch to minimize potential liquidity shocks.

More importantly, Sophon relies not only on speculative narratives of new programming languages or deep technical ZK innovations. Instead, it focuses on low-cost, user-friendly tools and simple Web2 integration for wider adoption.

Based on these fundamentals, Sophon’s FDV may range from $1.5B to $3B in TGE. This will put Soph’s issuance price between $0.15 and $0.30.

Soph vs scr

Scroll raised $50 million in Series B competition in March 2023, reaching a valuation of $1.8 billion. When the rolling (SCR) token was launched in October 2024, the project announced a total supply of 1 billion SCR, with approximately 190 million tokens (19% of the supply) being issued on TGE.

The token opens at about $1.10, bringing the initial market cap of the rolling to about $209 million, while the fully diluted valuation (FDV) is about $1.1 billion. This is seen as a cautious startup strategy that balances the token distribution with the market expectations of the newly launched ZKEVM Layer-2 network.

Source: Coingecko

Shortly after its release, the SCR dropped below $1 and eventually stabilized between $0.30 and $0.40. The current FDV is now less than $400 million. This trend illustrates two key gains: (1) Despite the large amount of fundraising and the mainnet launched, Scroll still chose a relatively moderate amount of FDV; (2) The market demand for ZK infrastructure tokens is still exploratory and tentative.

Soph, by contrast, represents a new direction for ZK-Rollups. Instead of participating in the infrastructure weapons competition, Sophon captures real user needs by focusing on consumer-facing verticals.

If Sop can offer engaging DAPPs such as AI proxy, mini-games and prediction markets, it can better maintain price stability than SCR.

The rolling case highlights the importance of valuing tokens with growth potential and current fundamentals. For Soph, TGE’s reasonable FDV range is between $1.5 billion and $3 billion, meaning the token price is $0.15 to $0.30.

This places Soph in a neutral assessment area: due to its consumer-centric narrative, it is higher than rolling, but much more conservative than Starknet, whose initial $35 billion FDV proves unsustainable in the face of scrutiny of the actual market.

Compare with recent Binance Hodlers Airdrop Projects

Here is a comparison of Soph with several recent tagged projects that have recently adopted BNB holders’ air energy mechanisms: Nexpace (NXPC), Symbol (Symbol), Hyperlane (Hyper) (Hyper), Stakestone (STO) (STO) (STO) and Haedal (Haedal). These projects have a large full token supply and are launched through Binance’s Hodler Airdrop program.

- Nexpace (NXPC): MapLestory (Avalanche) Tokens in the gaming ecosystem. The recurrent supply at the time of listing was approximately 169 million out of 1 billion (16.9%). The initial listing price is $3.03, equivalent to ~$3 billion of FDV; the ATH price reaches ~$3.70 (FDV ~$3.7 billion).

- hyperlane (super): Permitless cross-chain messaging protocol. Listed at $0.27, FDV is about $280 million; ATH price is $0.35 (FDV ~ $350 million).

- Stakestone (Sto): Total supply of 1 billion. The initial recirculation supply was approximately 225.3 million (22.5%). List about $0.12 (FDV ~ $190 million); ATH $0.215 (FDV ~ $110 million).

- Haedal Protocol (Haedal): Total supply of 1 billion. Listed at $0.17 (FDV ~ $170 million); ATH $0.213 (FDV ~ $110 million).

- Logo (mark): The total supply is 10 billion, and the initial recirculation supply is about 1.2 billion. List about $0.08 (FDV ~ $800 million); ATH price is $0.127 (FDV ~ $1.27 billion).

Overall, the tokens for these air conditioners usually have a FDV of less than $1 billion in TGE, and in some cases only a few hundred million dollars due to the large total supply and a low initial issuance rate. Their ATH price is usually 1-3 times the listing price, while FDV peaks below $3-4B, except for NXPC.

Soph’s projected multi-billion pound FDV is well suited to the expected range compared to these projects. Soph’s token price is $10 billion, which may be tens of cents. The team has an FDV of $2-3B, with the goal of Soph issuance between $0.20 and $0.30.

Secret price forecast: Pre-predictions

Drawing inspiration from these comparability, the conservative large price could be $0.10-0.20 (FDV $1-2 b), and if market conditions are very bullish, the optimistic upper limit is close to $0.30 (FDV $3 B). This range is consistent with the tier 2 peers and is below the extreme valuation of Starknet.

In all cases, the FDV is a key reference point at launch, and Soph’s strongest supplement (reel, Manta) recommends a mid-to-low-key percentage price under normal market conditions.

Read more: Trading with free encrypted signals in the Evening Trader Channel