After a turbulent quarter in the crypto market, Solana (Sol) is once again the focus of attention as investors increasingly ask: Does SOL form a bottom and prepare for a rebound, or is the downward trend not over yet?

As of today, SOL is trading at $130-134, significantly below its March peak of $205. However, technical indicators and capital flows show some encouraging signals that could lay the foundation for a short-term recovery.

Technical indicators suggest Solana’s short-term bottom

The $120 level is currently Solana’s most critical technical support sol In April. As long as the price is higher than the area, it remains a realistic possibility to return to the $144-$145 range in the next few weeks.

On the daily chart, this area represents the recent resistance, which previous price rallies have repeatedly rejected. Retraction of this level will be a confirmation signal of a significant short-term trend reversal.

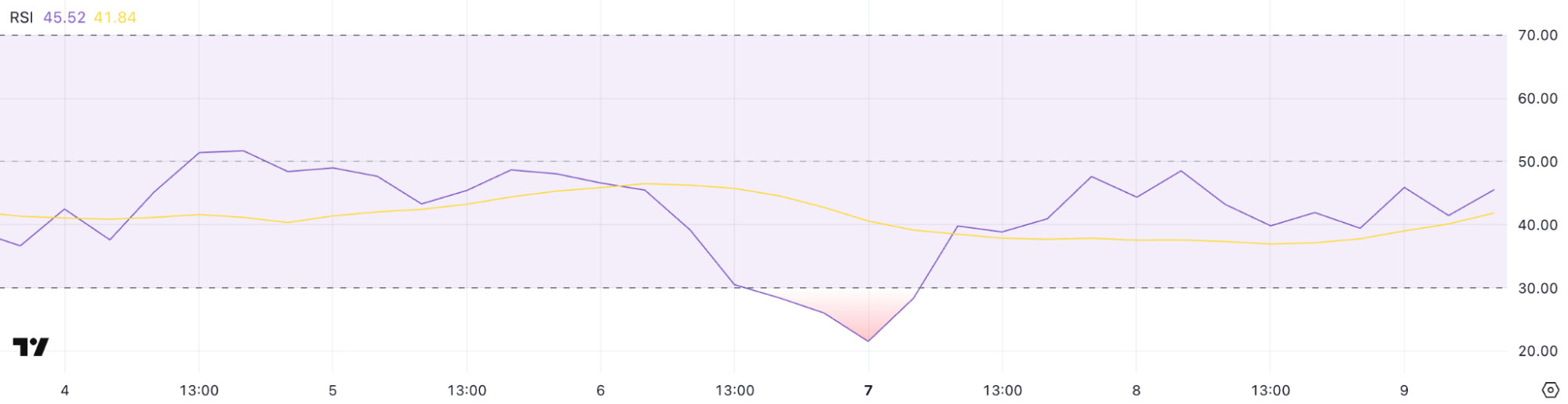

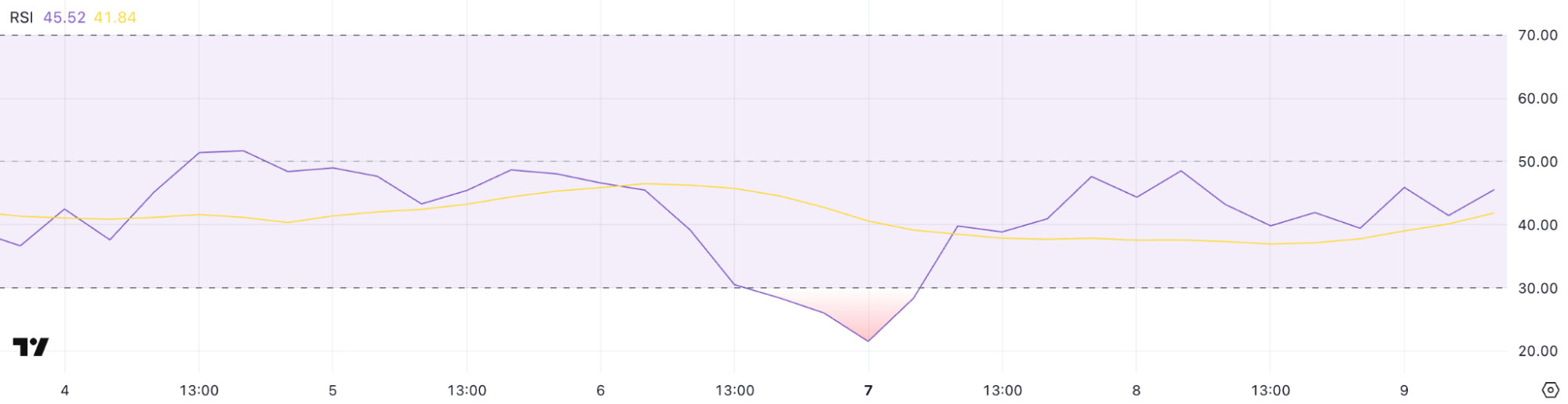

Additionally, late last week, the Relative Strength Index (RSI) was a momentum indicator used to measure negligence or oversold conditions. Technical analysts often interpret this level as an indication of an overselling market, which suggests that sales pressure may be exhausted and a rebound may be imminent.

Several bullish candlestick reversal patterns have also begun to appear on the daily chart, further supporting the potential short-term rebound.

RSI dropped 35 times last week – Source: TradingView

In addition to technical indicators, Coingape’s on-chain data provides additional insights. In the recent price consolidation between $125 and $130, there was a significant increase in transaction activity from Whale Address (wallets holding more than 100,000 sols), suggesting accumulating within this range.

As long as the macroeconomic situation remains stable, the combination of technical analysis and chain behavior is a relatively optimistic short-term prospect that will lead SOL to the second half of April. That is, the daily closing price is still needed to exceed $145 to confirm a sustainable bullish breakthrough.

Macroeconomic factors remain key effects

Despite the encouraging technology signals, Sol’s prospects are still affected by the wider global market environment. A new U.S. tariff policy targeting Asian imported electronic products, including mining equipment and blockchain-related hardware, has attracted investors’ attention. This is a key reason why the Fear and Greed Index is firmly in the realm of “fear” at the age of 31.

In addition, interest rates in the United States continue to be very high, resulting in capital outflows from risky assets such as cryptocurrencies and weak recovery rates in the stock market. Every price gathering triggers strong profits and creates invisible pressure.

However, there are signs that the U.S. Federal Reserve may consider lowering interest rates if the economic conditions worsen, especially if new tariffs trigger recession. If needed, the Fed may take stimulus measures to support economic growth.

What makes SOL elastic?

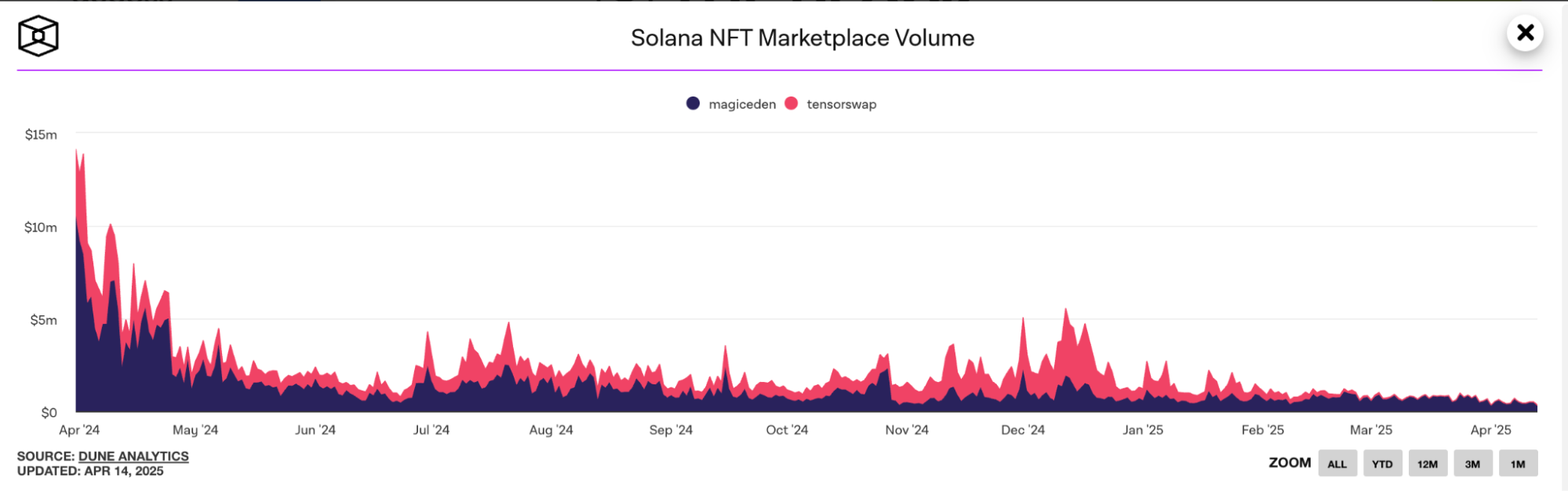

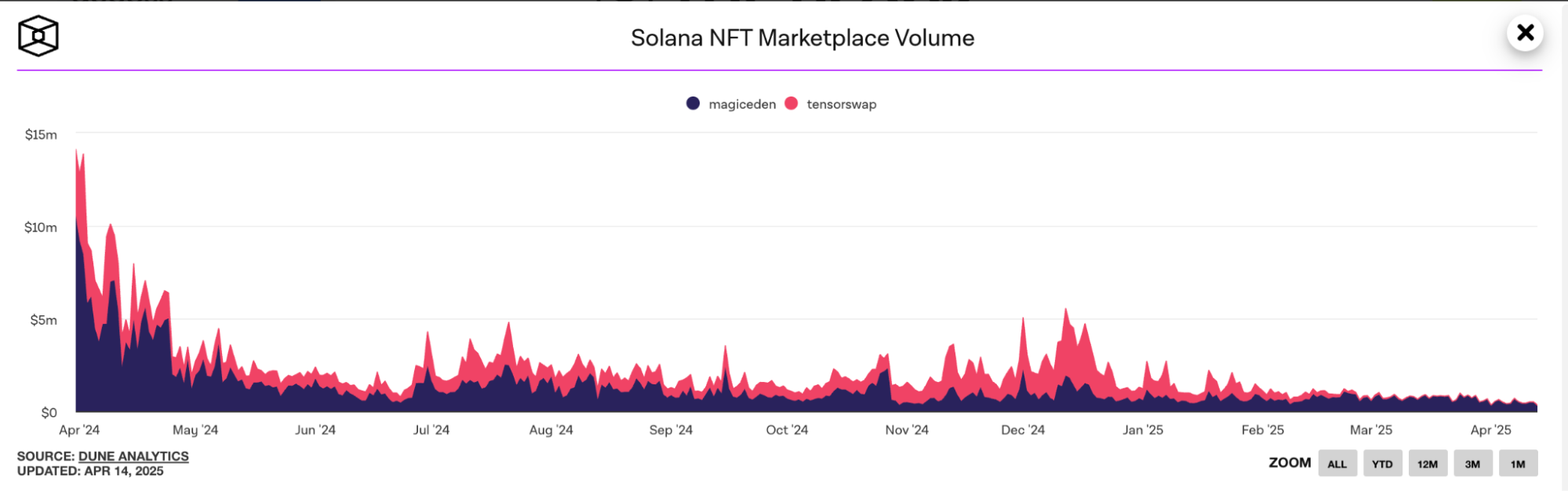

Amidst the ongoing volatility in the wider crypto market, the Solana ecosystem continues to show strong momentum – especially in the NFT and Memecoin sectors. Platforms such as Magic Eden and Tensor, as well as the growing popularity of Memecoins, play a crucial role in the activities that sustain the entire Solana network.

The vibrant NFT landscape has made a significant contribution to network use and provides a basic support layer for the value of SOL.

Magic Eden remains Solana’s leading NFT market and currently accounts for about 95% of all NFT transaction volumes in the network.

Solana NFT Volume – Source: Block

Meanwhile, Memecoins is seeing explosive activity. For example, over the past four days, Popcat has soared more than 105% to a price of $0.25. The whale’s accumulation of more than $80 million, as well as rumors about the listing of Binary and Robin have exacerbated this growth.

Similarly, butt It has grown by more than 300% in the past month and now has a market cap of $1 billion and is now $0.87.

A report from Gate.io shows that about 64.9% of all SOL tokens sit in contracts, indicating that there is a lot of long-term confidence in the network despite the recent correction of the price. Although Staking hasn’t surged significantly since then, the current levels clearly indicate that most sol holders do not intend to exit in the near term.

As Saul’s inflation rate will gradually decline over time and a more optimized stock reward schedule has been developed, the motivation for long-term token holdings continues to increase. This phenomenon partly explains why, even though SOL has dropped by more than 35% since early March, it still holds a $125-130 support zone.

Solana price forecast

To sum up, technical indicators point to the bottom, whales continue to accumulate $130, and these factors support the view that SOL may recover steadily if macroscopic conditions are stable.

In the short term, a breakthrough in resistance levels above $145 will clearly confirm the bullish reversal.

in conclusion

Despite the enormous pressure on the macro environment, including high interest rates, U.S. trade policy, and the widespread “risky-taking” sentiment among investors, the fundamentals of the Solana ecosystem continue to be a strong foundation for supporting the value of SOL.

As long as the support zone is about $125, the macro conditions suddenly do not deteriorate, SOL has a realistic opportunity to rebound toward the rebound $145 At the short-term level and may resume sustainable upward momentum in the medium term.

Read more: April ETH price forecast: short-term and medium-term analysis