SEC requests amendment to revisions regarding SOLANA ETF recommendations

The U.S. Securities and Exchange Commission (SEC) is reviewing a proposal for Solana (SOL)-based spot exchange-based funds (ETFs), marking a green light for possible approval later this year. Several issuers, including Grayscale, Vaneck, 21shares, Canary, Bitwise, Franklin and Fidelity, have received requests from the SEC to update their S-1 registration files in the coming week.

The Securities and Exchange Commission (SEC) request reportedly focused on revisions to the redemption mechanism within the proposed ETF, including the exchange structure between ETF stocks and SOL tokens. Another area of regulatory concern is that allowing the use of stand-alive sol tokens in fund structures, a theme that remains legally ambiguity, but is increasingly important given the nature of many Tier 1 assets.

These developments represent a clear shift in regulatory posture toward Solana. Bloomberg analysts have now increased the likelihood of Solana Spot ETF approval to 90%, while earlier estimates were 70%. The earliest potential approval date is currently expected on October 10, 2025, although industry observers believe that the earliest SEC decision could be made as early as July if progress is made at the current pace.

“The SEC’s request for updated S-1S is a very positive signal,” said Eric Balchunas, senior ETF analyst at Bloomberg Intelligence. “This means they are participating in the documents, rather than rejecting or delaying them indefinitely.”

Accelerate timelines and market impact

According to reports from Beincrypto and Blockworks, the SEC is expected to comment on the updated S-1 filing within 30 days. If the issuer responds quickly, the approval may arrive immediately in late July, far ahead of the official deadline in October. This has sparked new optimism in the market, with the forecast platform bull market showing a sharp increase in the chances of approval in July.

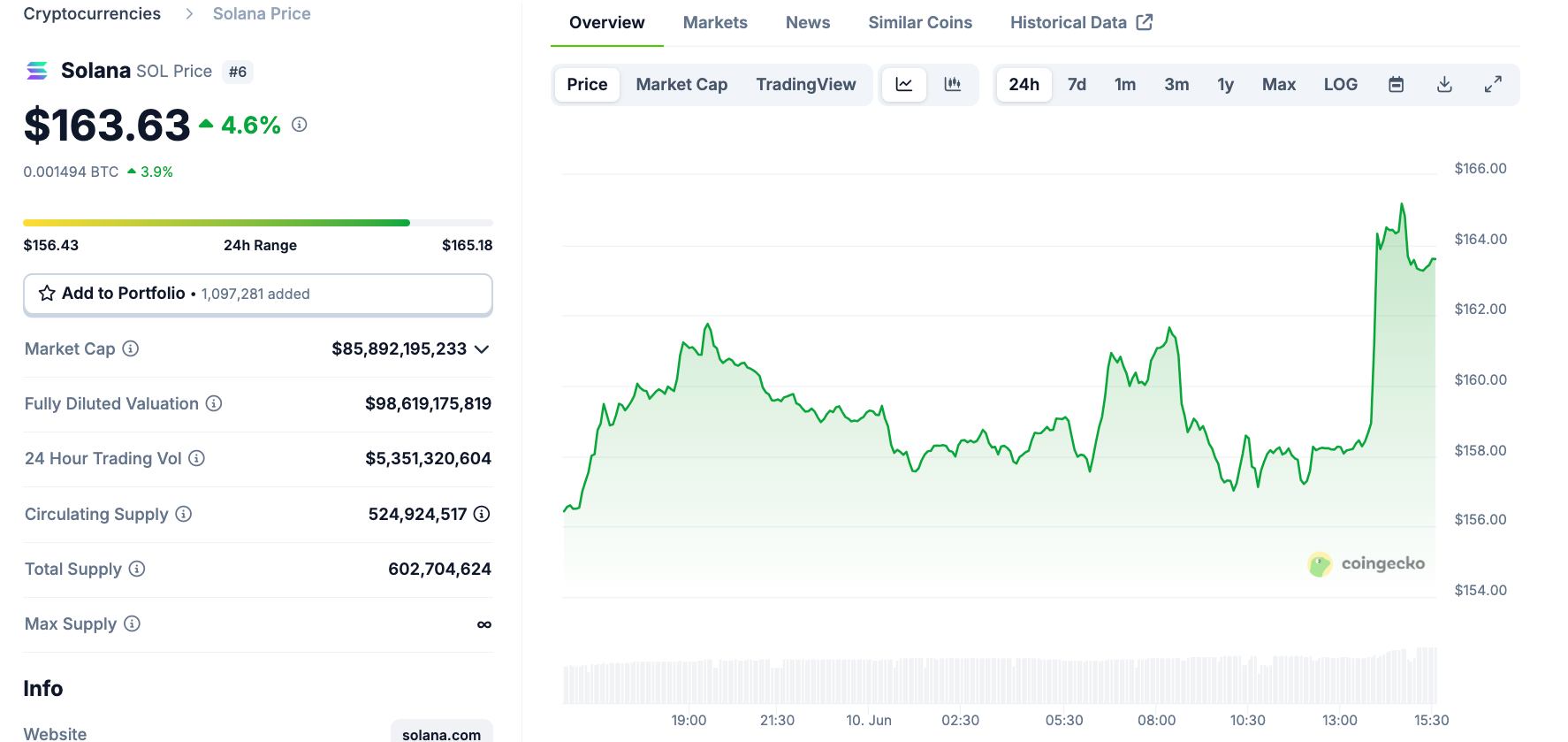

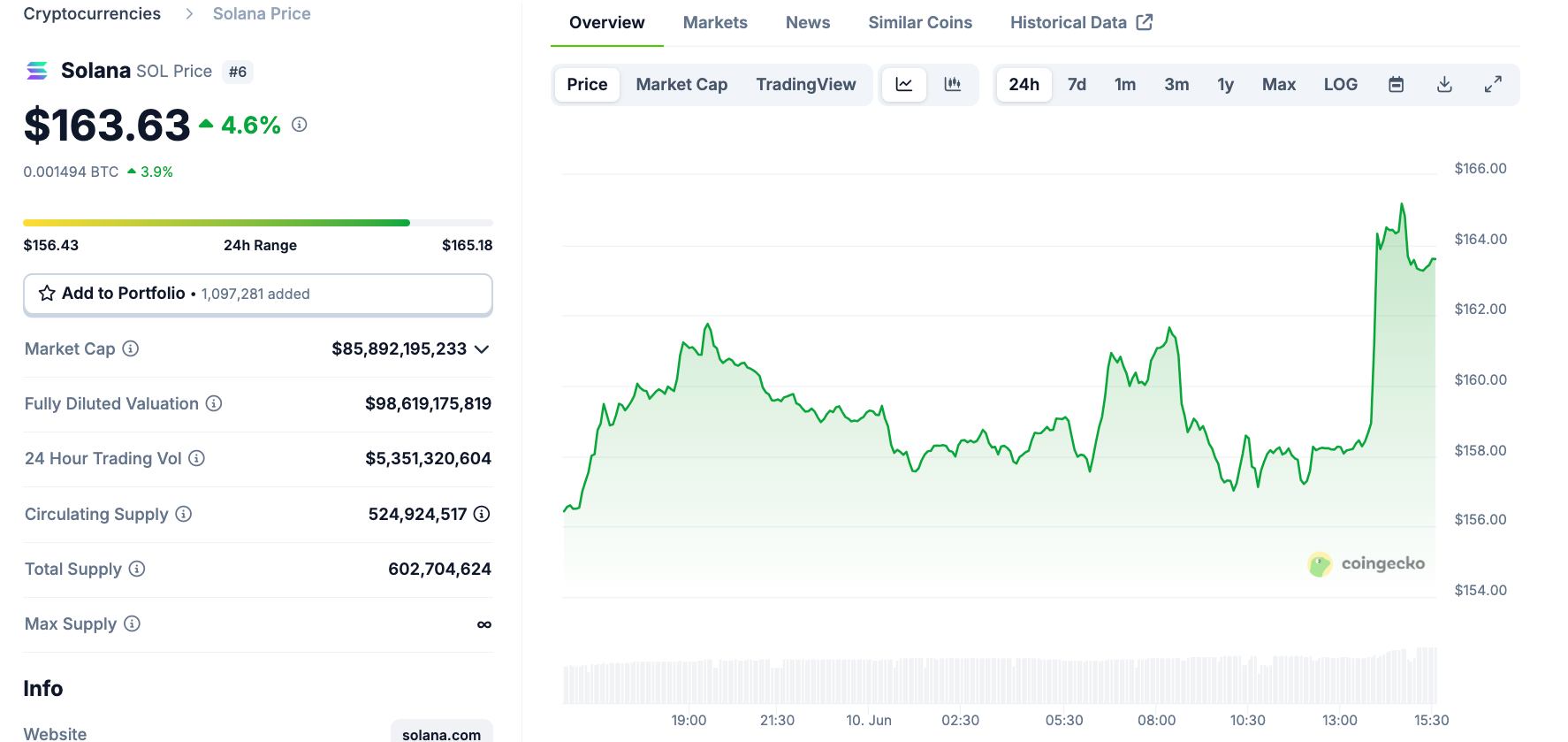

Amid this speculation, SOLs poured into more than 4.5% of the dish. Technical analysts noted that SOL lost more than its 50-day moving average and is now testing a downswing channel, with potential targets approaching $183 if Bullish Momentum continues.

Source: Coingecko

Optimism surrounding Solana ETFs is rising, a trend that is accepted by a wider institutional investment product based on crypto investment products. After successfully launching the spot Bitcoin ETF earlier this year, attention turned to other high-value assets such as Ethereum and now Solana, which is a logical next step.

Solana’s network has attracted developers and retail users, especially due to its high throughput and low transaction costs. Although the SEC has not officially declared SOL as a commodity, analysts believe that the same regulatory treatment as BTC and ETH is “possible”.

Read more: Is Solana a good investment in 2025? Comprehensive analysis