On May 21, 2025, a federal jury issued a guilty verdict on Safemoon CEO Braden Karony, marking an important moment in combating cryptocurrency fraud. Karony was convicted of plotting a plan to defraud more than $300 million of investors. The case has caused Safemoon’s market value to soar to $8 billion before it collapses, highlighting the vulnerability in the crypto market and the urgent need for stronger oversight.

The rise and fall of Safemoon

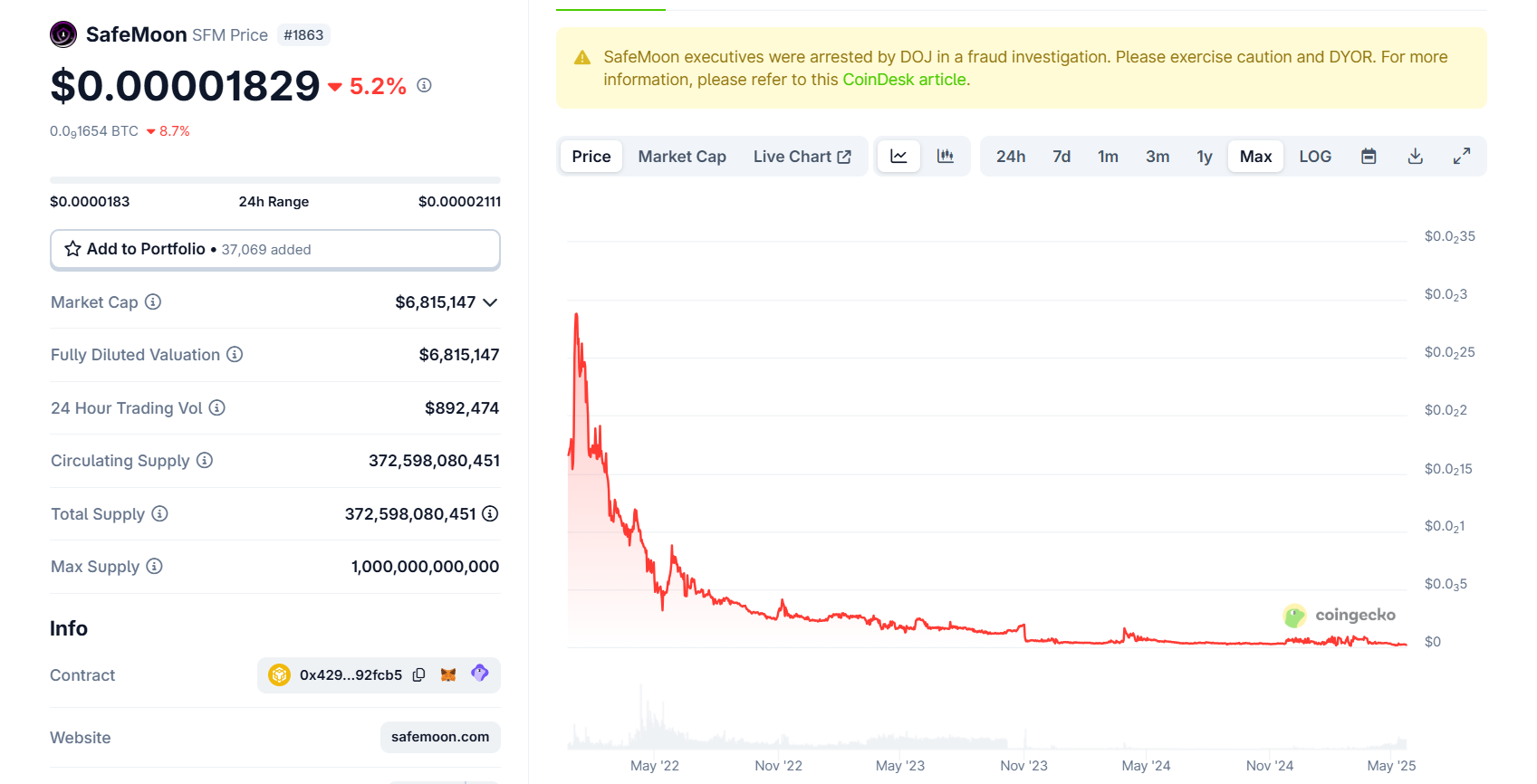

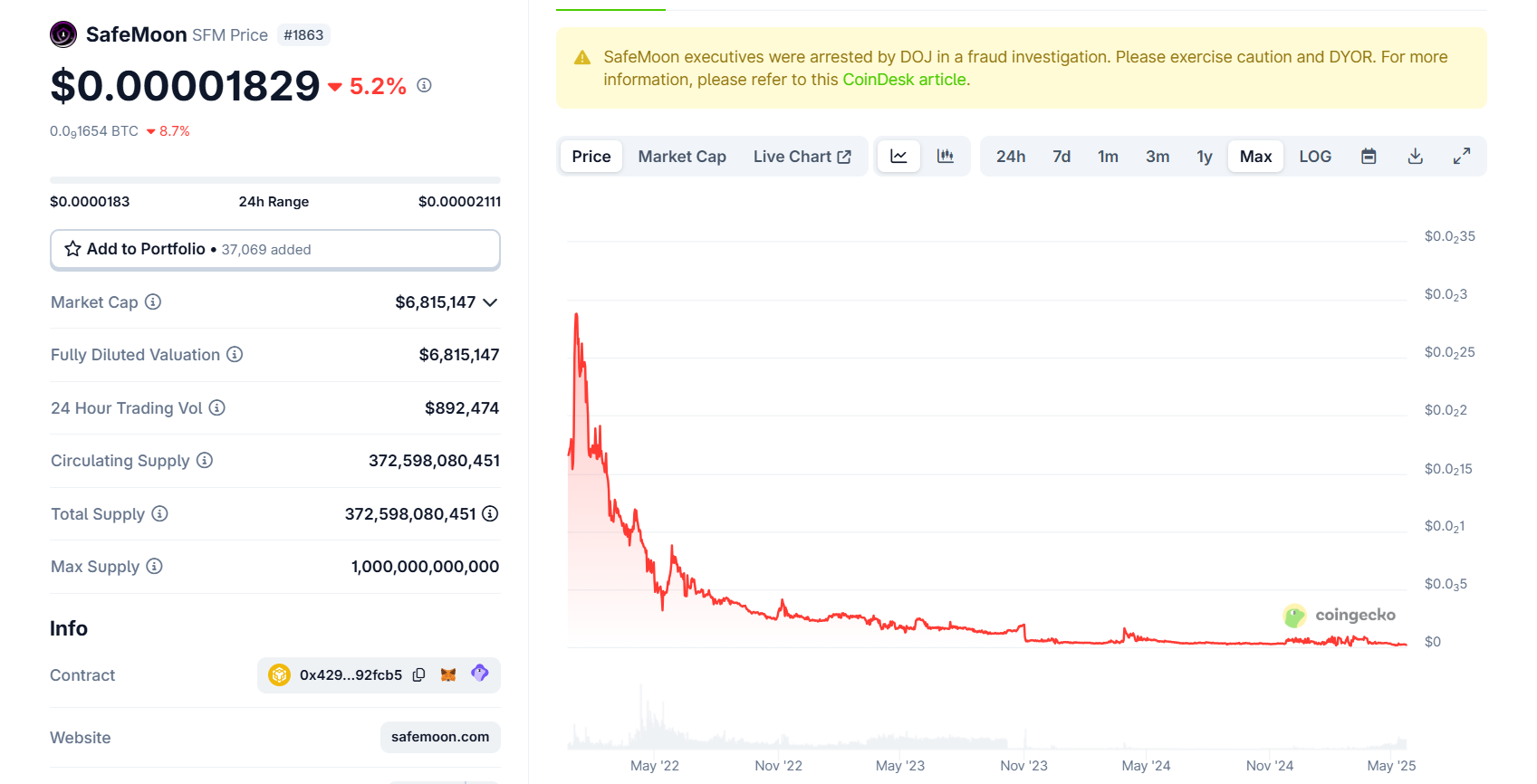

Launched in 2021, Safemoon is riding the wave of NFT and Defi Boom, with the promise of astronomical rewards through its Sokenomics model. this SEC’s 2023 Complaint The price of the token soared 55,000% between March and April 2021 and reached a market cap of $5.7 billion.

Source: Second

However, this displacement is driven by deception. Karony, along with founder Kyle Nagy and CTO Thomas Smith, claimed that the liquidity pool was locked in, ensuring safe investors. In fact, they provide funds for personal gain, buying luxury cars and real estate.

The plan was unravelled when the public learned that the liquidity pool was visited, causing the price to collapse by 50% in April 2021. Kari continued to manipulate the market by stealing funds to support the price of the token, but the losses caused. By 2025, Safemoon is a cautionary tale where investors leave behind worthless SFM tokens.

Source: Coingecko

Encryption’s unstoppable misconduct: an ongoing battle

The Safemoon CEO crash is not an isolated incident, but part of a fraud trend in the crypto industry. Safemoon’s case reflects other compelling failures, such as 2022 FTX Collapse, where executives abuse customer funds.

Read more: SEC Twitter Account Hacker and Fake Bitcoin ETF Posts 14 Months Incarceration

According to the SEC’s 2023 complaint against Safemoon, David Hirsch of the SEC strengthened law enforcement, crypto assets and networking division highlighted the responsibility for unregistered products.

The broader market environment shows that investor confidence has declined, and the 2024 Coingecko report shows that 60% of crypto investors are on alert for new token launches due to fraud issues. Karony faces up to 45 years in prison, a clear reminder of the legal consequences of waiting for bad actors in this field.