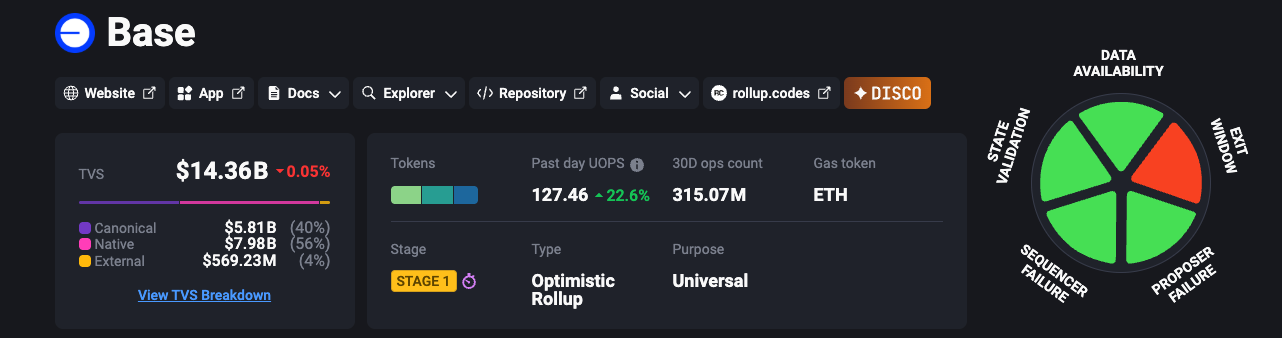

Coinbase’s OP-stack crolup Base has quietly become the largest real-world (RWA) playground in cryptocurrencies since Ethereum itself.

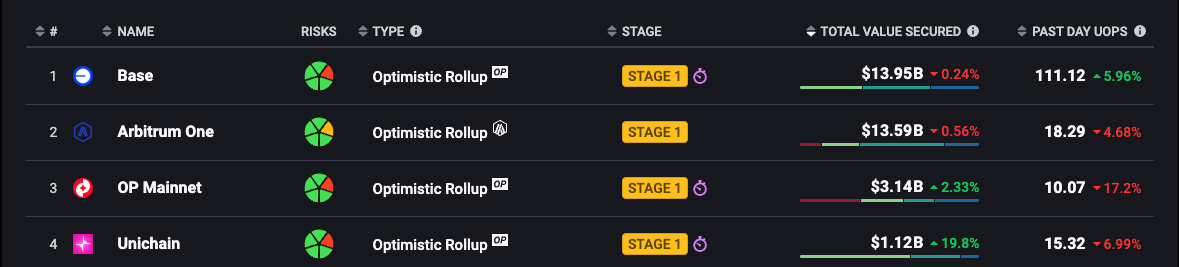

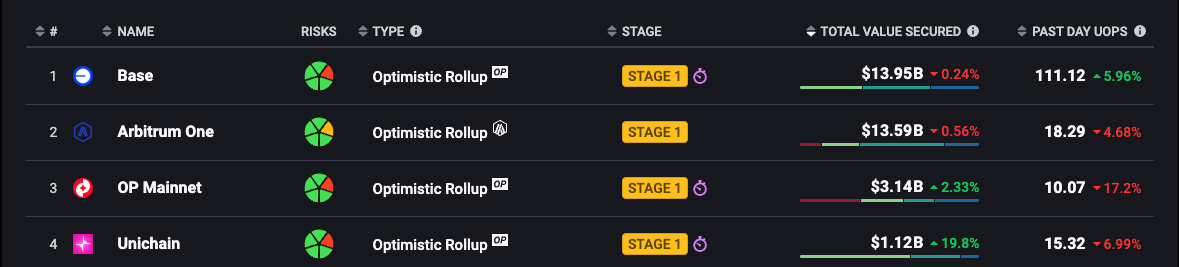

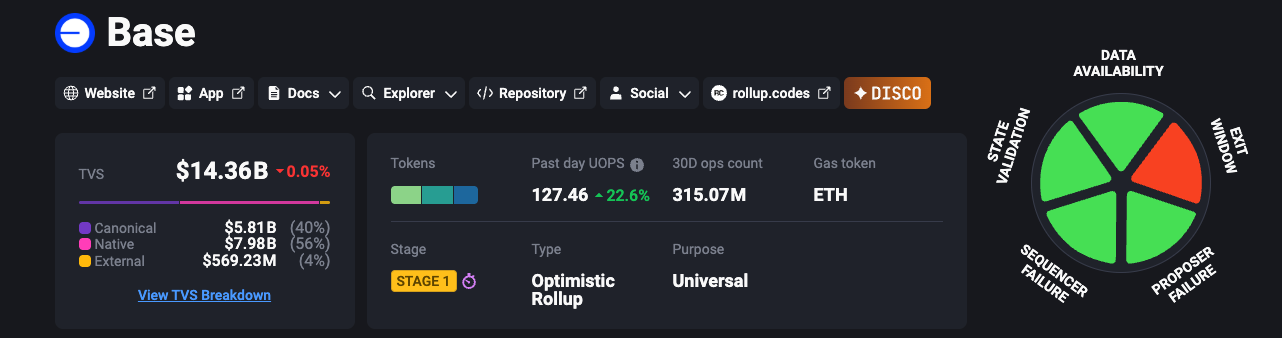

The value obtained on the network is now over $14.3 billion – 173% of graduation to date – in L2, Total Value (TVS) increased by 173% in the voting base (TVS) in L2, and Total Value Lock (TVL) in Bridges and Local Assets is about $13.7 billion.

Source: L2Beat

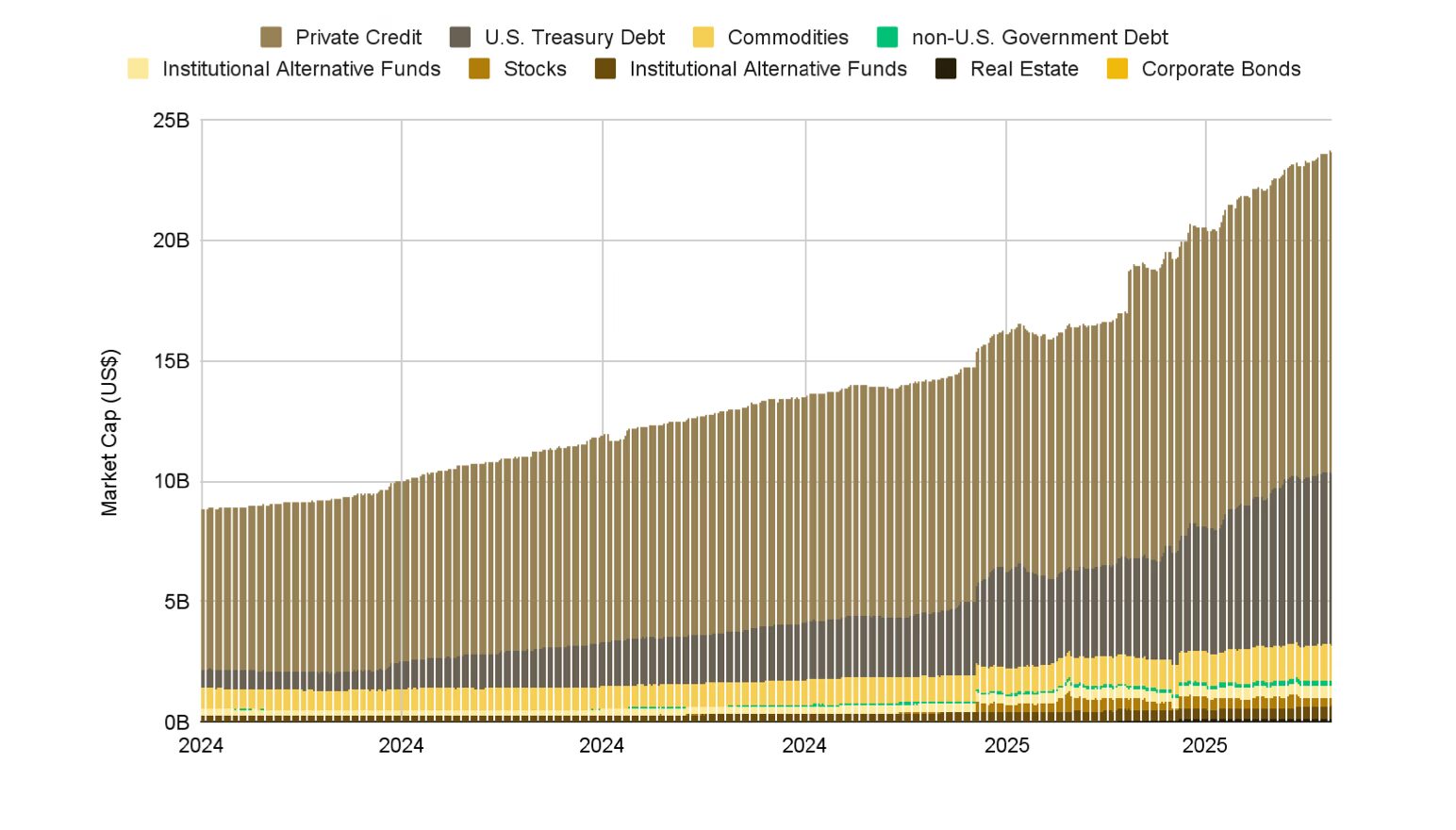

Against this backdrop, RWA experts flock to the base:

- Keeta (KTA) has provided a staggering throughput and 6x price gains over the past month.

- Physical (TNGBL) brings paid real estate NFTs to L2 Rails.

- Openeden’s token, the U.S. fiscal suite now covers three chains, with its flagship USDO and TBILL vaults driving a set of $450 million chain libraries.

Together, these projects show why RWA is the fastest growing crypto vertical – sector capitalization has surged 260% to $23 billion in 2025 alone.

KTA: A quiet giant with a huge number

Keeta’s marketing itself is: 10 million TP, second-endurance and former Google CEO Eric Schmidt in the consulting lineup. After debuting on the base in early May, the token climbed from $0.22 to $1.18 (+435%) and briefly surpassed the $600 million cycle market cap.

News reports have expanded the move. 99bitcoins’ deep dive highlights Keeta’s “8× rally in two weeks”, which attributes the surge to Bitmart’s listing and investors’ demand for compliant L1.

Coindesk’s March Daybook first marked Keeta’s public testnet as a basic key RWA catalyst.

Source: TradingView

Although daily activity listing metrics remain opaque, the 24-hour address count tracked the chain dashboard in Moralis’ top five “trend assets” earlier this week.

Other pipelines: tangible and open

The tangible has shifted its real estate market from polygons to bases to cutting settlement costs and leveraging local liquidity. TNGBL today changed hands for $0.27, up about 40% over the past two weeks after the agreement introduced a USDC-based rental allocation.

Currently tangible controls about $43 million in tokens, wine and gold, mainly polygons, but are specifically used for migration to the basic vault later this year.

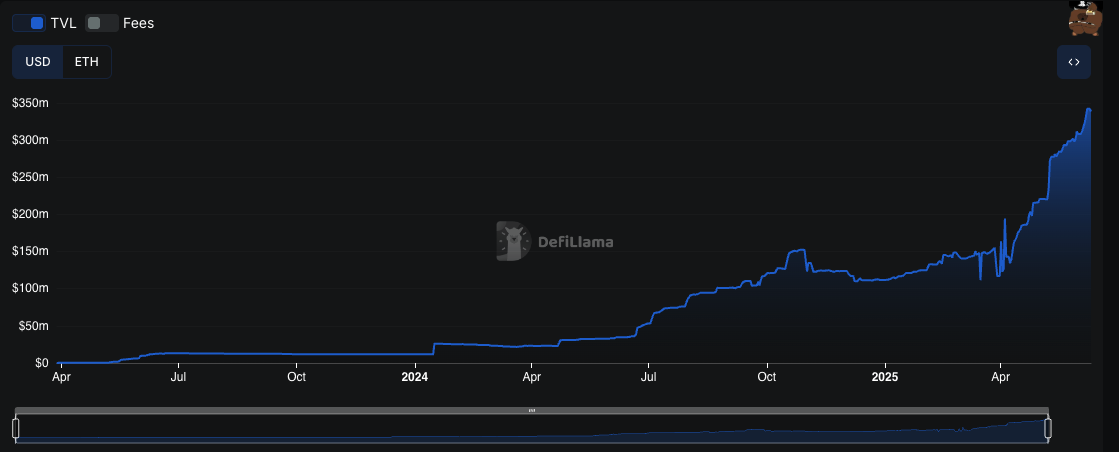

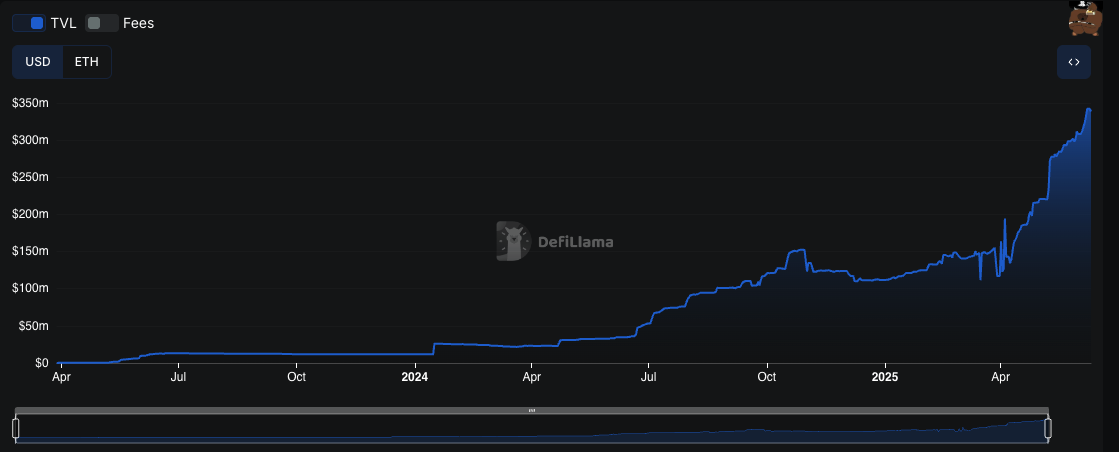

Source: Defillama

The dual-electric charge model, while burning balance, generated dividends of 66.7% of the market fees to the USDC dividend, an incentive that helped TNGBL outperform the broader RWA index on a flat market.

The production-hungry Dao flocked to Openeden’s tokenized T-Bill products. USDO Stablecoin Vault holds approximately $262 million, spreading collateral in Ethereum, arbitration and fresh white base lockers.

The separate TBILL SMART contract vault adds tokenized sovereign debt, bringing the group’s total regulated fiscal risk to more than $450 million. Form custody strategy exist according to Transfer Idle USDC arrive USDO, Automatic capture No risk speed.

New RWA Builders Target base obey heap and Liquidity, Exceed Big name.

- Tangle-free finance marks the plan to basically deploy invoice-backed credit pools after driving the CELO model. The agreement aims to integrate private credit markets into DEFI, making emerging market fintech a cheap route to funding.

- Realio Network is exploring an optimistic bridge to expand its digital equity platform that will enable private equity and securitize real estate supplies.

Both projects highlight the broader migration of primers on alternative assets to the basic compliance leading ecosystem.

RWA as a basic killer application

As Treasury earnings hovered at 4%, boosted link demand for goods denominated in USD.

Coinbase’s branding and compliance stack gives the base a unique advantage to issuers of regulated assets. according to make sure Exceed $14B and host More The country’s assets Compare Competitors L2S, and project emission Directly.

Delphi digital call according to one “Gateway drug for tradfi,” and KYC is ready design easy mechanism Tokenization.

With $14B of TVL and Coinbase support, the base will lead the compliant asset issuance. Three milestones to focus on the next 12 months:

- The stable bacteria behind rwa replaces non-wild tokens in the money market

- Automated KYC wallet provides the authority pool for institutions

- Cross Molkin RWA Collateral – Tokenized souvenir funding derivatives or real NFTs without leaving the base.

2025 may be the year for Tokenisation to become mainstream and start with an alkaline real-world asset.

Read more: Coinbase vs Binance 2025: Which swap is better?