Spotted Bitcoin ETFs and Ethereum ETFs are experiencing record inflows, reflecting institutional confidence in cryptocurrencies as Bitcoin exceeds $106,000 and Bitcoin exceeds $106,000 driven by global adoption and market dynamics, with the Ethereum gain momentum.

Spot Bitcoin ETF reaches US$1009 billion

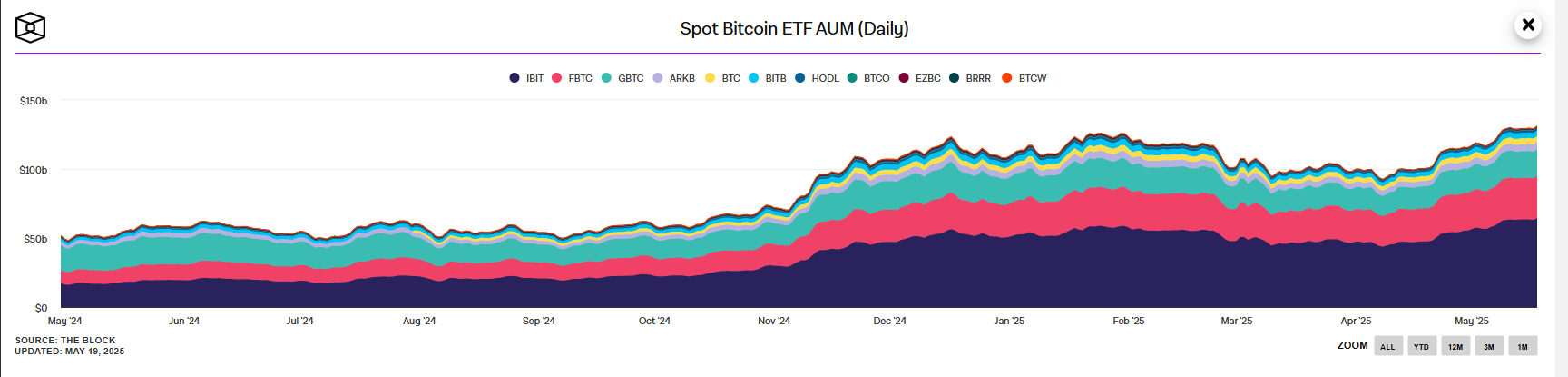

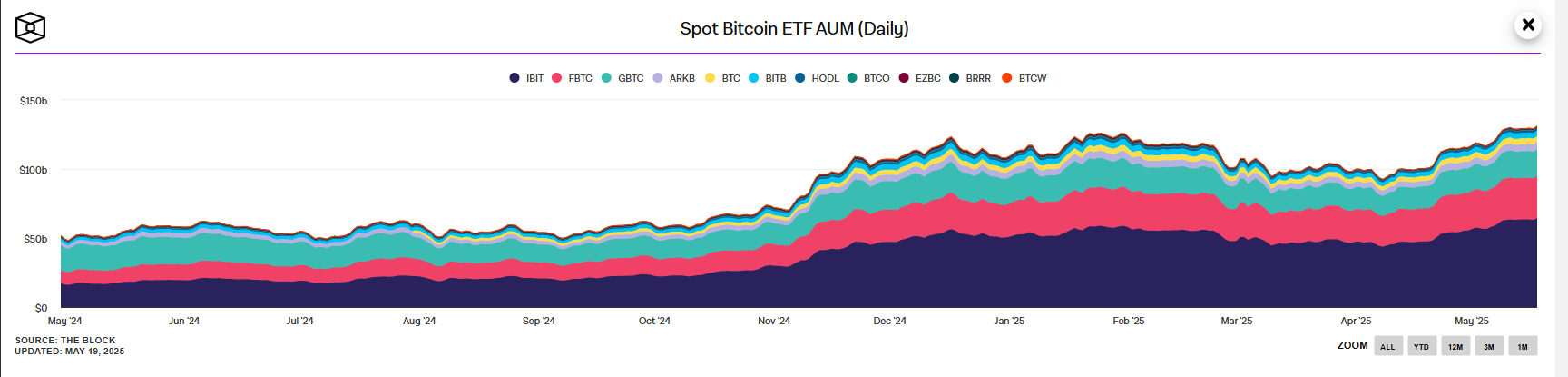

The cryptocurrency market is witnessing a historical surge in institutional investment, with U.S. spot Bitcoin exchange-traded funds (ETFs) reaching $100.9 billion in assets (AUM) as of late April 2025.

Source: Block

This milestone highlights the acceleration adopted by institutions around the world, Bitcoin ETFs reach all-time highs, with inflows of more than $41 billion Since its launch in early 2024.

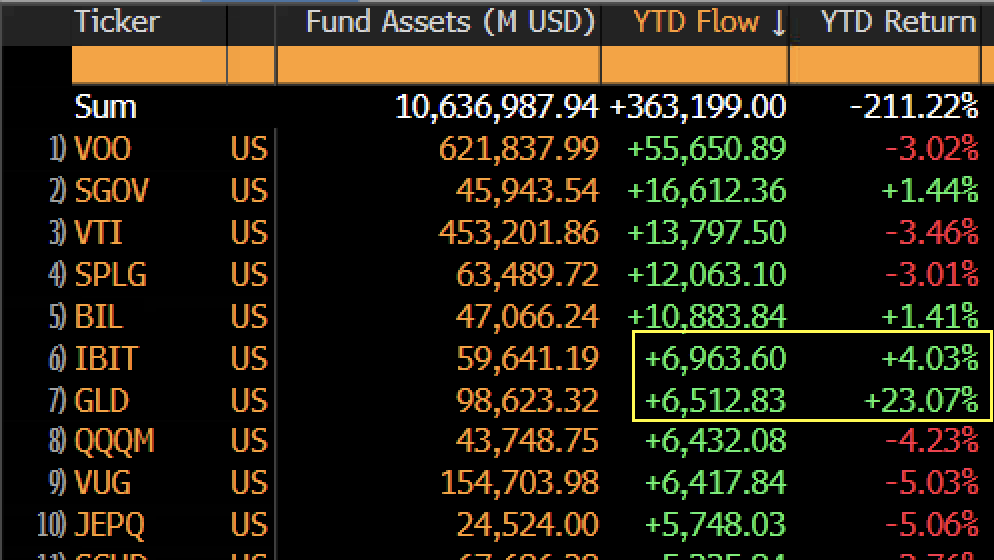

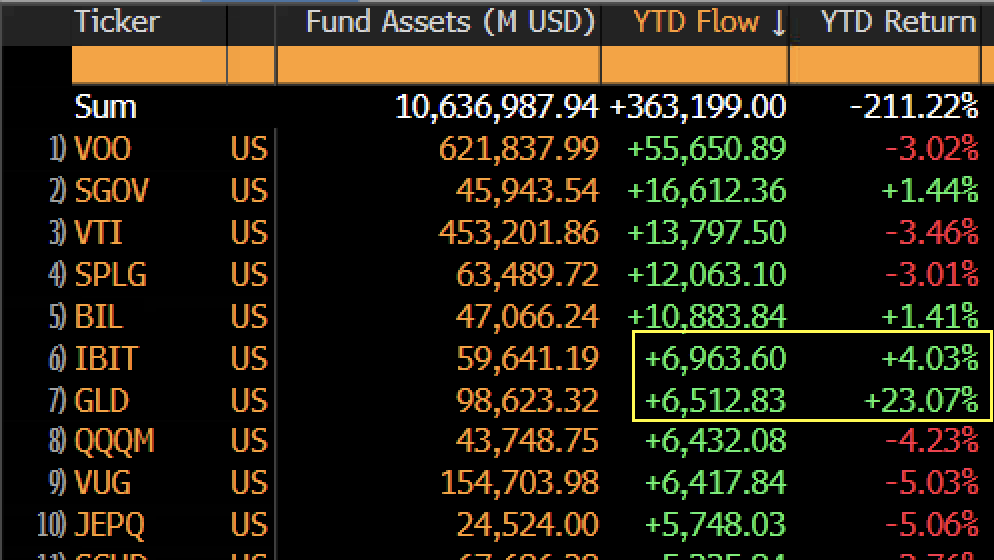

On May 8, 2025, investors put new capital into these funds, pushing the total to this record number. Blackrock’s iShares Bitcoin Trust (IBIT) is the largest spot Bitcoin ETF, attracting $6.96 billion every year alone, surpassing the world’s largest gold ETF, SPDR Gold Trust (GLD), which scored $6.5 billion.

Source: X

This performance is better than institutional investors’ confidence in Bitcoin is growing BTC As a long-term store of value, although the price is slightly 3.8%, Gold’s 29% gain is 3.8% this year.

Long-term buying pressure from Bitcoin whales points to the potential continuation of the bullish trend.

Source: Encryption

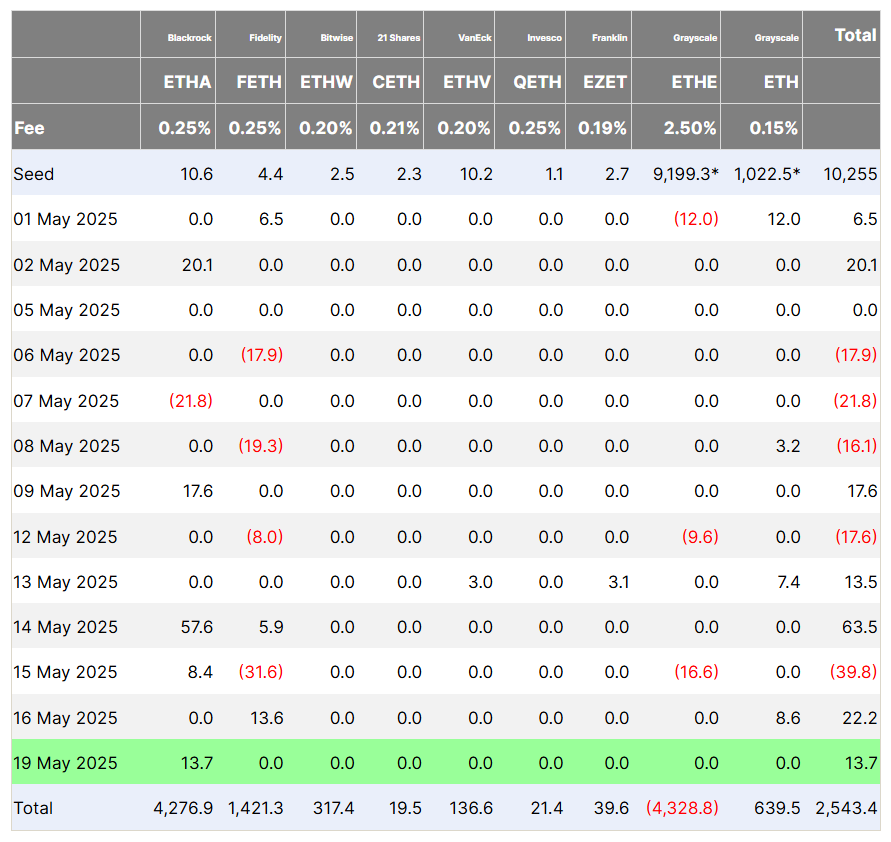

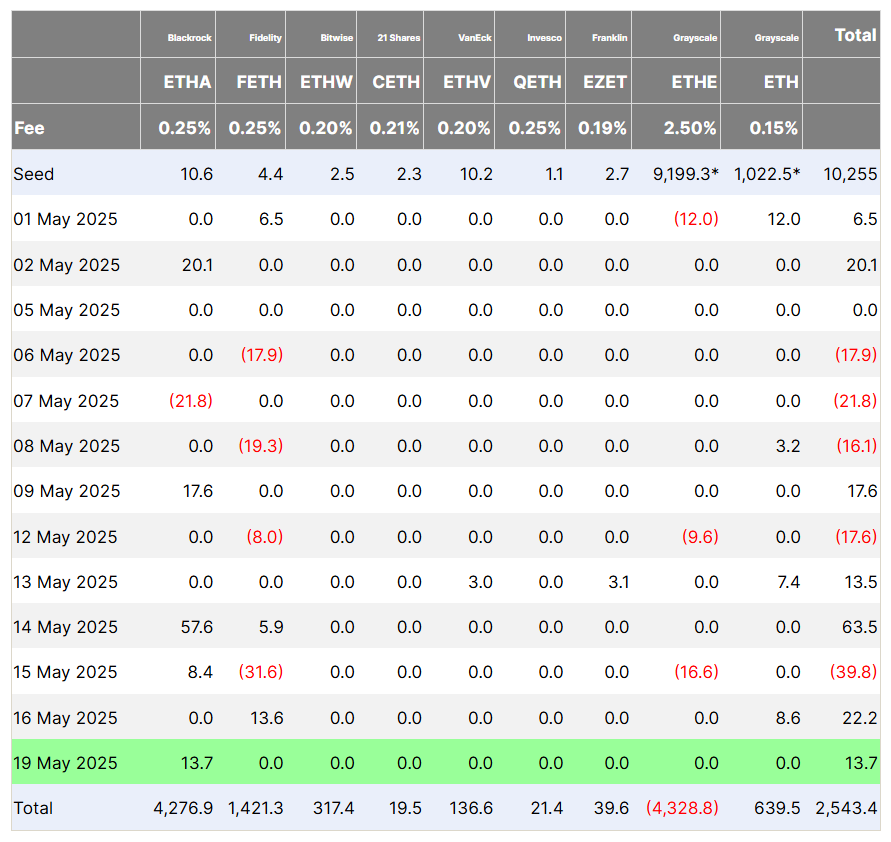

Ethereum ETF gains momentum

While Bitcoin ETFs continue to dominate the headlines, the live Ethereum ETF is steadily engraving its success.

In early May 2025, the Ethereum ETF recorded a large number of net inflows, ending eight weeks of outflows, driven by the wider cryptocurrency market rally. This marks their first positive weekly inflow since February 2025, reflecting investor confidence.

Source: Farside Investors

BlackRock’s Ethereum ETF (ETHA) has been an outstanding figure, attracting a lot of capital and growing AUM for the fund, now reaching billions of dollars.

Despite earlier challenges, including the famous outflow in March, recent stimulus has tweaked the appeal of Ethereum as an institutional investment, driven by its strong ecosystem and Pectra upgrades.

Analysts point out that although Ethereum ETFs are still lagging behind Bitcoin in scale, their recent performance has shown a shift, with institutions increasingly recognizing the potential of Ethereum as a cornerstone of the crypto market.

Increasing capacity of institutional trust ETF inflow

Although Bitcoin benefits from digital gold from its established narrative, Ethereum ETF remains the “partner” of its Bitcoin counterpart, with significantly lower inflow rates.

Recording inflows into Bitcoin and Ethereum ETFs demonstrates a structural shift in the financial sector, with institutions increasingly viewing cryptocurrencies as viable portfolio assets. Analysts attribute the trend to macroeconomic factors, including ongoing inflation, a weak dollar and expectations for the Fed to update quantitative easing.

Rachael Lucas from the BTC market noted that these inflows reflect the “mature role” of Bitcoin and Ethereum eth In a diversified portfolio. In addition, global adoption rates are attracting attention, with countries such as the UAE, Singapore and Hong Kong launching spot Bitcoin and Ethereum ETFs to further legalize cryptocurrencies as asset classes. Despite short-term volatility (such as Bitcoin’s price drop of 12% in Q1 2025), the ongoing inflows show unwavering institutional optimism.