Hyperlipiel is a well-known derivative DEX recently facing multiple whale attacks due to the vulnerability of price manipulation involving jelly tokens in the past 24 hours. This incident not only led to a sharp decline in the total value locked in the hyperliquid liquidity vault (HLP), but also raised concerns among the Web3 community about the security and transparency of the exchange.

In super fluent price manipulation

Background of the case

Hyperliquid is a diversified exchange (DEX) specializing in permanent futures trading. It runs as its own layer 1 blockchain, HypEREVM, designed for fast and efficient transactions.

Hyperliquidity providers are hyperliquidity internal liquidity libraries that can act as market makers and handle liquidation. Users can deposit USDC into HLP to share their profits or losses. The HLP vault on the HLP is responsible for liquidity management and supports the system in case of forced liquidation.

Source: Medium

$Jelly is a cheap market cap token that initially ranges from $1-200,000, listed on Hyperliquid – New Rumors lists CEXs like Binance or OKX on CEX. Due to its small amount of capital, it is susceptible to price manipulation.

Whale jelly price manipulation

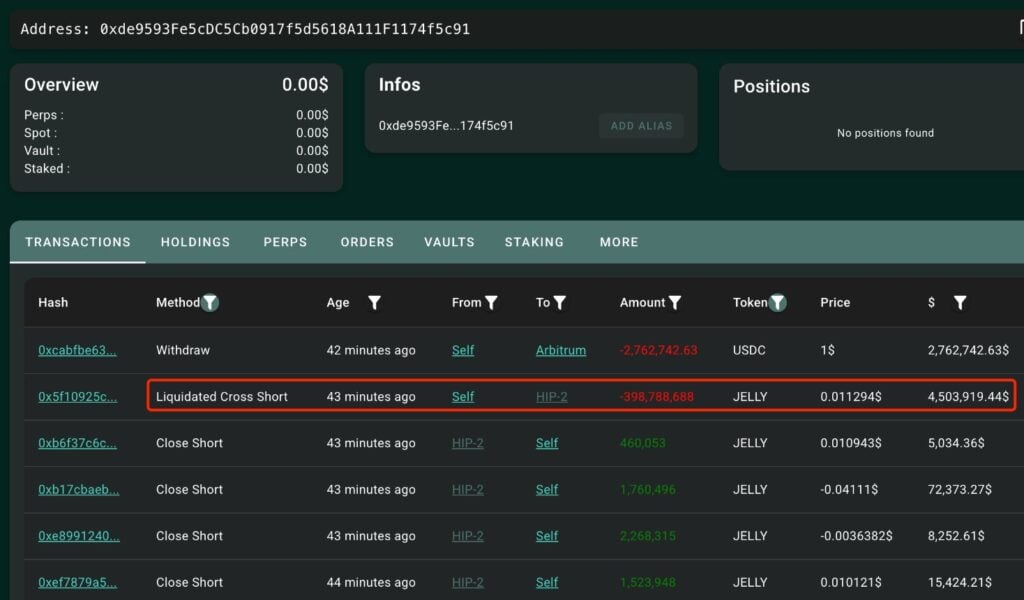

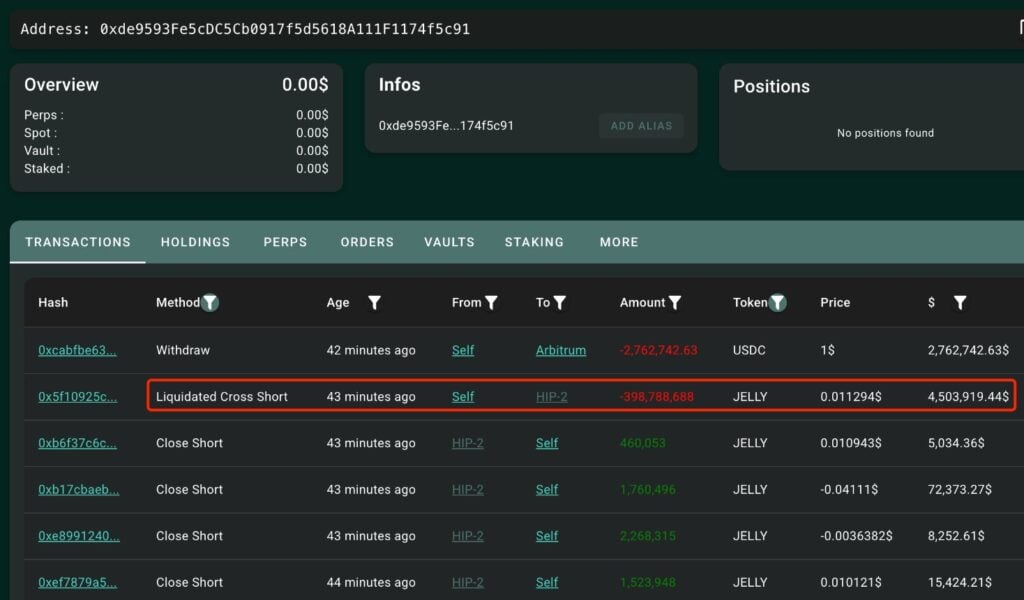

March 26th event starts with whales, using wallet 0xde95, Opened a huge short position Through Hyproliquid, the value of $Jelly is about $8 million. This position is equivalent to 126 million jelly, which is enough to manipulate the market price of jelly.

The whale then deliberately removed the edge, eliminating the necessary collars to maintain position. This triggers automatic liquidation, forcing the hyperflowing HLP library to take over the huge short position (forced liquidation).

Source: hyburrscan

Wallet 0xde95 actively draws out the price of jelly and buys a large amount of jelly in the spot market to artificially expand its value. In less than an hour, the market value of Jelly soared from $10 million to over $50 million, resulting in a brief squeeze and losing a brief position. As a result, HLP caused up to $12 million in unrealized losses. According to analyst Abhi, if Jelly’s market cap would reach $150 million, Hyproliquid could face complete bankruptcy.

Amid the chaos, a new wallet (0x20E8) opened up a huge long position on the hyper-mobile, and unrealized profits quickly amassed about $8.2 million as the price of $jelly soared.

The crazy squeeze caused Super Mobile Provider (HLP) to lose about $12 million in the last 24 hours!

0xde95 short circuit $Jelly exist @hyhyperliquidx And the margin was removed, resulting in the passive liquidation of $4.5 million in short positions in HLP.

A newly created wallet “0x20E8” opens in a long position on… pic.twitter.com/fagfo1upjp

– lookonchain (@ lookonchain) March 26, 2025

Seeing extreme volatility, centralized exchanges (CEXs) such as Binance and OKX quickly listed $Jelly’s permanent futures (PERPS), further exacerbating trading activity and price volatility.

Rumors suggest that wallets 0x20e8 and 0x67f are binary funded. Zachxbt’s Investigation. While unverified, the super fluent face comes from the ruthless attacks of whales and major CEXs.

Read more: Is centralized communication intended to destroy hypermobility?

Super flow in chaos

Recognizing the risks, hyperliquids took decisive actions to deal with attacks and mitigate potential financial losses. The Verifier Group held an emergency meeting and voted for Delist Jelly Perps, adjusting Jelly’s Oracle price to $0.0095 per token and closing all public positions related to $Jelly.

Super fluent proficiency #jellyjelly / $Jelly After Binance and OKX futures list

It’s really a move pic.twitter.com/g4ppft5al6

– Langerius (@langeriuseth) March 26, 2025

As a result, HLP not only avoided significant losses, but also made a net profit of $700,000. Hyper Foundation promises to compensate affected users, excluding manipulated wallets. However, not everyone is satisfied with this resolution!

DEX’s HLP Vault and Price Manipulation?

After the incident, many praised super liquidity for the quick and decisive action of protecting users. However, the exchange’s moves – both overturned jellyjelly and adjusted Oracle to avoid losses – raised serious questions about the real decentralization of this DEX in the cryptocurrency community.

Hyperliquid later announced on X that after discovering suspicious trading activity, the validator decided to intervene and vote for Delist Jellyjelly. The exchange defends the validator’s responsibility to intervene in system integrity, but acknowledges the need for greater transparency during the voting process.

After evidence of suspicious market activity, the validator set up to convene and vote for Delist Jelly Perps.

All users will be complete from the super base except the tagged address. This will be done automatically in the next few days based on OnChain data. No…

– Hyperliquidx (@hyperliquidx) March 26, 2025

However, this explanation does not satisfy everyone in the community.

Furthermore, the hyperliquid hybrid vault mechanism may be a major vulnerability that makes it susceptible to meticulous planning, intentionally operated by whales. HLP high liquidity HLP vaults are responsible for liquidity management and handling mandatory liquidation. This is the mechanism a week ago by shorting BTC and eager to get millions of dollars anonymous whales.

Bitget CEO Gracy Chen compared Hyplliquid to “FTX 2.0” to criticize its non-professional handling of the situation and high-risk financial product design. She believes that the mixed vault structure puts users at a disadvantage, which exacerbates serious regulatory issues due to the lack of KYC/AML compliance.

#Hyperliquid Probably expected to be #FTX 2.0.

How it handles $Jelly The incident was immature, immoral and unprofessional, causing losses to users and creating serious doubts about its integrity. Even though…

– Gracy Chen @bitget (@gracybitget) March 26, 2025

The total value of the HLP fund fell from $283 million before the attack to $190 million at the time of writing. Meanwhile, super liquid hype token Hype It fell 6% as the short circuit of the jelly caused huge losses on the project.

Source: Super Mobile

The community is increasingly skeptical about the decentralization of DEX after super fluent Jelly stands out from its platform to avoid losses. This has seriously damaged user trust and presents a significant challenge to the builders of the project – balancing real decentralization while preventing manipulation events like those that have recently occurred. This is a rigorous course of super liquidity, highlighting the risk of listing a liquid token that can control its supply through decentralized communication.