Resolv is a newly launched cryptocurrency token that powers the Resolv Defi protocol – an ambitious project centered on Delta-neutral, load-bearing stability and stability called USR. With yesterday’s Token Generation Activity (TGE), many investors are evaluating Resolv’s short-term price potential.

Brief and brief

The Resolv protocol is designed to create a “real Delta-Neutral Stablecoin” called USR, which is fixed at 1:1 at 1, but is fully supported by Crypto Assets (not FIAT).

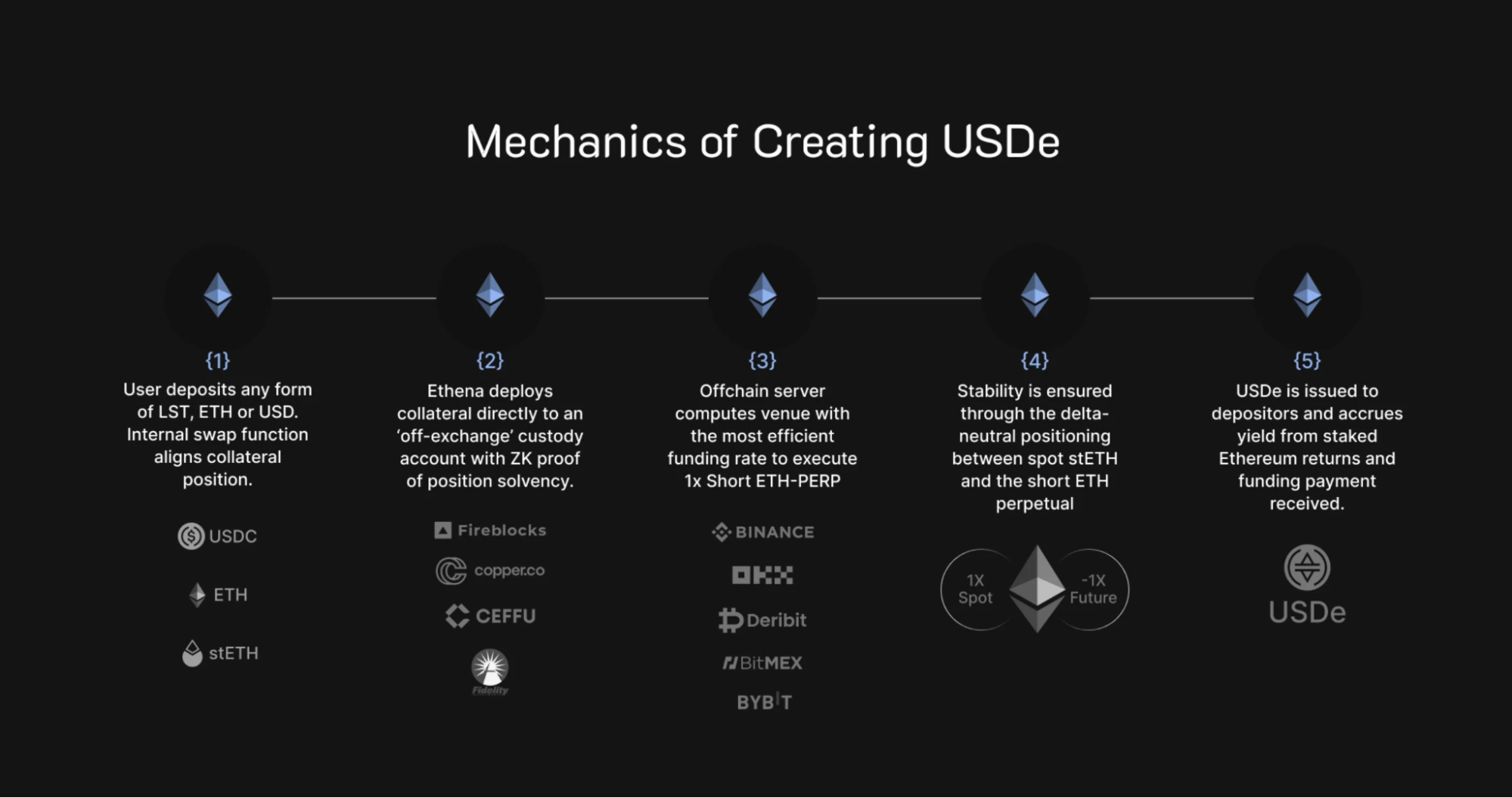

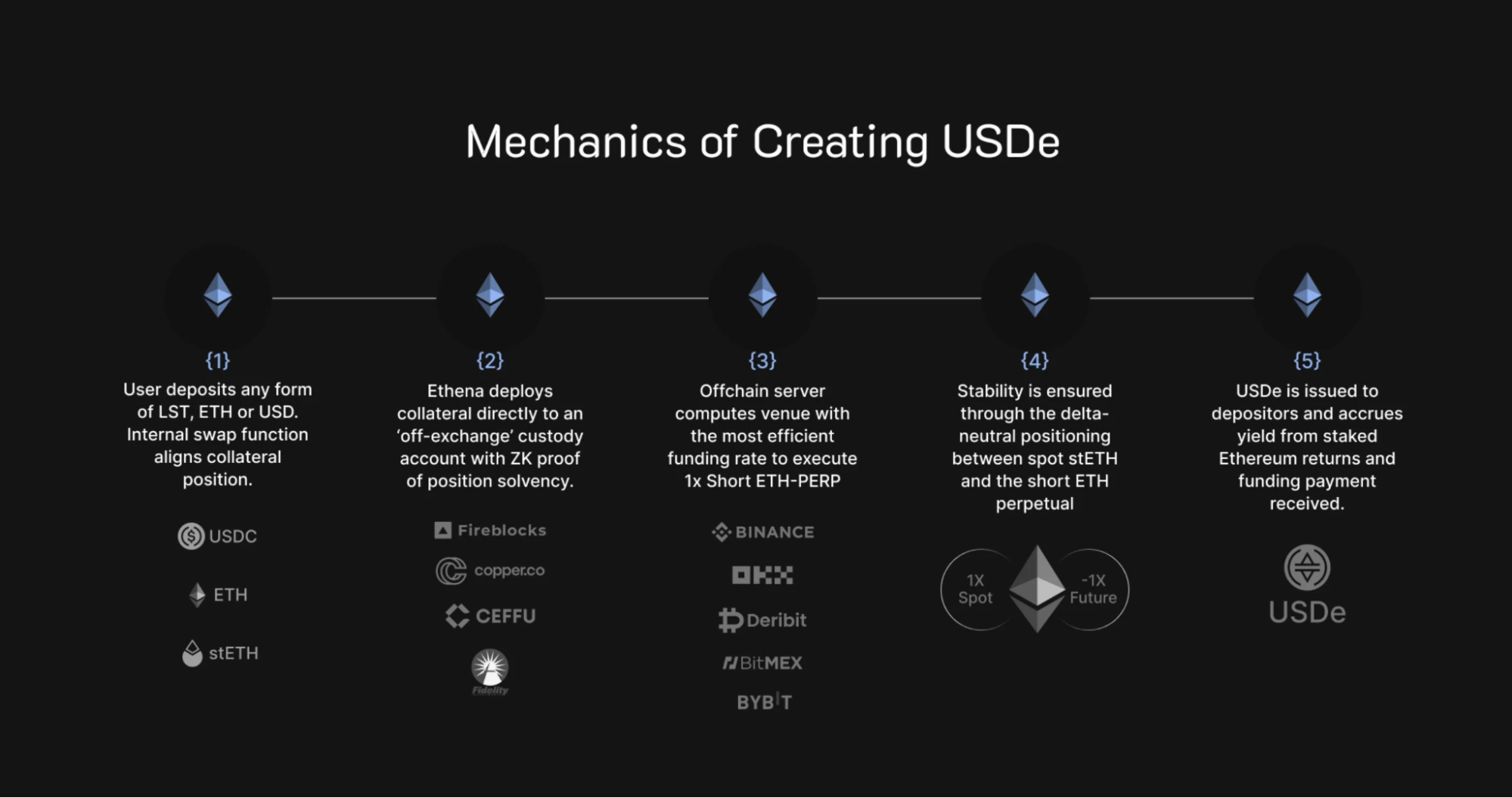

It achieves this by using Ethereum (ETH) and Bitcoin (BTC) as collateral while holding short-term positions in futures – a hedging strategy that neutralizes price volatility. This innovative mechanism keeps the stability of USR without relying on traditional reserves or excessive reserves, distinguishing Resolv from the early algorithm stablecoins, which proves fragile.

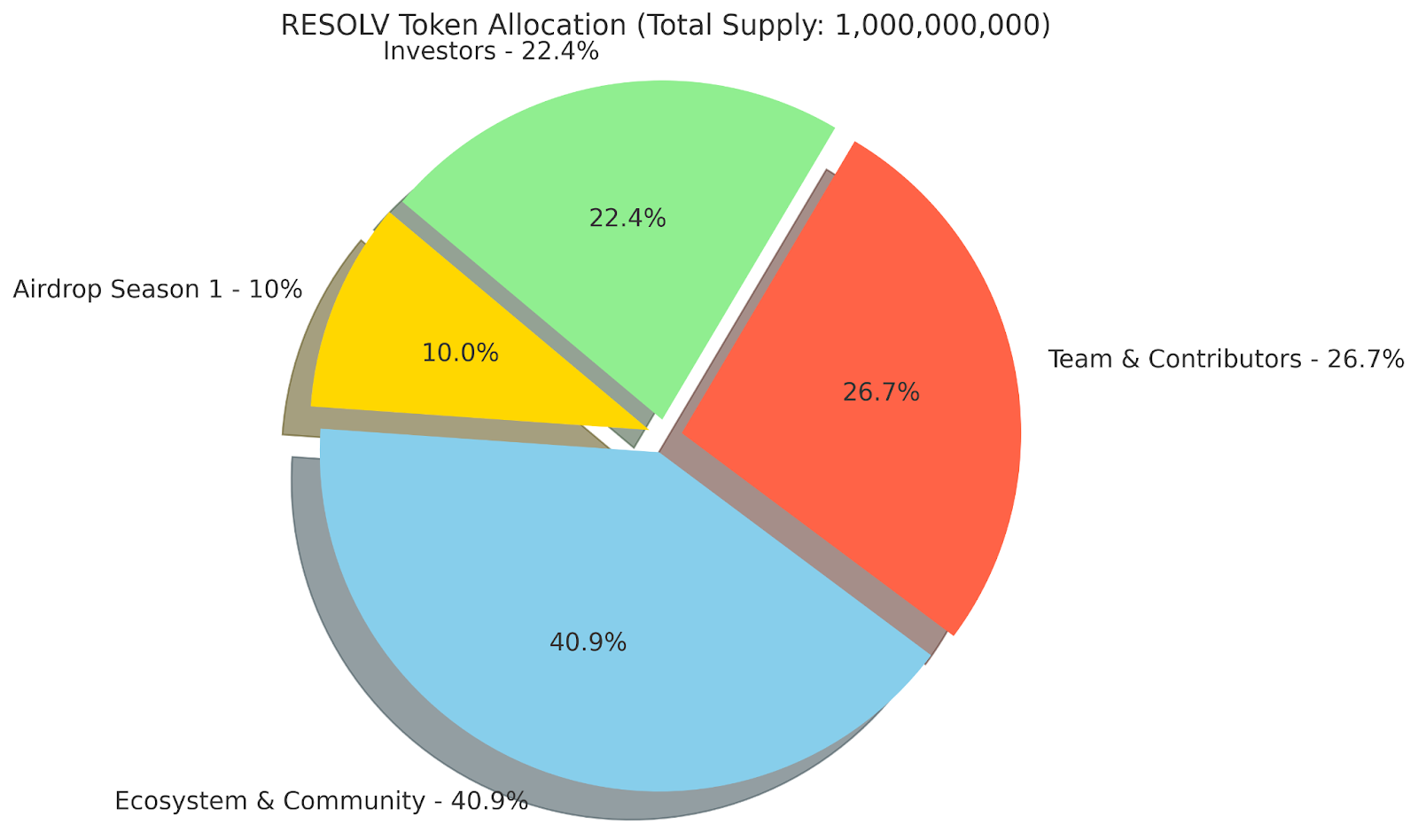

The fixed total supply of Resolv is 1 billion Resolv tokens, thus implementing a non-directional model. At the time of release, approximately 15.6% (155.75 million) were in circulation.

The allocation is designed to reward early community members while preventing immediate oversupply: for example, 10% of the ecosystem and community retain 40.9% of people (mostly 24 months of vesting), team/investor tokens have a year-long lock and years of vesting.

This phased unlock means limited initial cycle supply, which reduces immediate sales pressure and allows prices to be driven by real demand for token utilities.

However, this also means that liquidity is relatively low at the beginning – if large transactions occur, the factors that can expand volatility.

Resolv trades at about $0.34, giving it a market capitalization of about $53 million and a revolving supply of about $155 million. The fully diluted valuation is approximately $342 million.

Source: Coingecko

Use cases and unique features of Resolv

The cornerstone of the Resolv use case is USR Stablecoin, positioned as a next-generation stable asset for DEFI. Unlike USDT or USDC (holding cash or bonds), USR is backed by cryptocurrency (ETH, BTC) and derivatives positions, allowing it to earn real gains from the cryptocurrency market.

Through a delta neutral strategy (holding BTC/ETH long-term and short-circuit futures), Resolv captures interest rate revenues and deposit yields, which is partly shared with USR holders and Resolv Stakers.

This means simply holding or putting it in the Resolv ecosystem can generate passive revenues – a compelling utility when lower independent outputs elsewhere. In fact, since its launch, Resolv has allocated more than $10 million in yields to users, demonstrating the feasibility of its model.

In addition to Stablecoin, Resolv also introduced a significant security feature: on-chain asset recovery system. If the user’s ERC-20 tokens are stolen, Resolv allows them to convert these tokens into special “vaud” forms, and if theft occurs, a scattered expert jury can be called to review the claim.

Although time will test the effectiveness of the system, it adds a decentralized safety/insurance narrative to Resolv’s use cases – few competitors offer it. It can attract security-conscious users, further boost USR adoption and expand interest in Resolv tokens.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Team background and partnerships

Resolv was founded in 2023 by experienced Defi builders – Ivan Kozlov, Tim Shekikhachev and Fedor Chmilevfa.

The seed wheel is led by the well-known crypto VCS Cyberfund and Maven 11 and participated in the participation of Coinbase Ventures, Arrington Capital, Animoca Ventures and others. This is a strong lineup of supporters.

High-profile support is often associated with greater market visibility and credibility, which can support token value as more investors realize the fundamentals of Resolv.

At this stage, Resolv has not announced a partnership in areas such as e-commerce or identity. However, its collaboration with major exchanges and integration into the functionality of hypermobile networks helps to improve its profile.

If the agreement grows, we can expect more partnerships to form – for example, integrating with wallets, lending platforms, or stable, focused applications that can use USR as collateral or custodial assets.

Current market trends and emotions

Any short-term price forecast must take into account broader cryptocurrency market conditions. Fortunately for Resolv, it entered a market that showed signs of a strong bull cycle in mid-2025. Bitcoin recently flirted at an all-time high, breaking over $110,000 in early June.

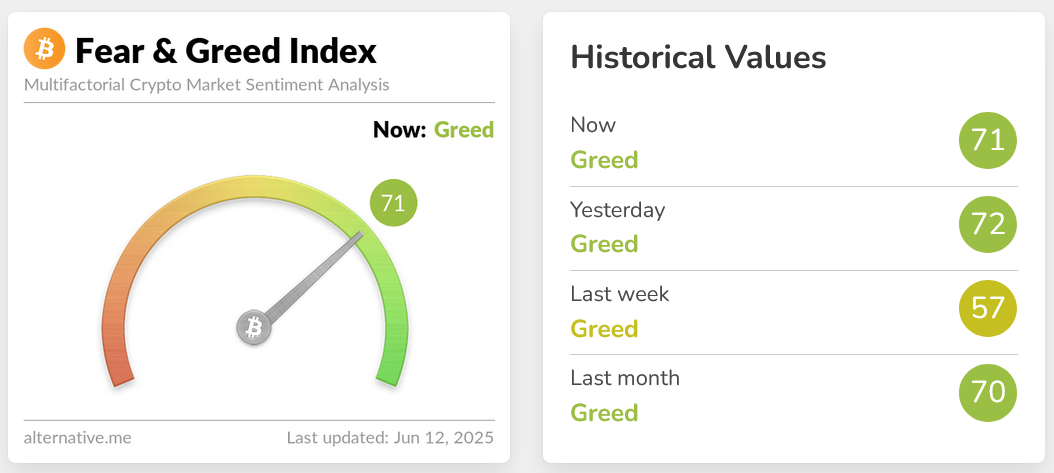

Market sentiment is very optimistic – Cointelegraph reports more than 2.1 positive BTC comments, each negative comment on social media, which is the most bullish bias in 7 months. The overall crypto fear and greed index is located in the “greed” field (~71/100).

In a bull market, investors are actively looking for the “next big thing”. With the rise of Bitcoin’s potential customers and retail interest, capital often spins into high-potential ALT projects. Resolv is a low-type coin (about $50 million) with a compelling story that fits Altcoin’s profile that traders might guess.

If you don’t pay attention to regulations, you can’t discuss stable proteins. In 2025, global regulators are developing Stablecoin rules. For example, the U.S. Congress has been enacting a stability bill, and the SEC has developed interest in stablecoins that assume surrender.

Resolv’s approach (both cryptocurrency-backed and algorithmic) may evade some rules for Fiat-backed coins, but its commitment to using derivatives and output may cause scrutiny. This represents the overhang of all items in this niche. In the short term, regulatory actions (even rumors) can wield emotions.

Still, the “regulatory fog” is a risk factor, and if any negative news breaks out, it may reduce the price.

Comparing Resolv to Competitive Projects

By examining peers, we can measure how the market valuates resolv if it executes well.

Ethena vs Resolv

The closest thing to Resolv is Ethena, which provides a crypto-backed Stablecoin of Delta-Senutal called USDE and governance token ENA. Ethena was officially launched in 2023 and quickly gained traction as a decentralized “synthetic dollar” solution. It uses a very similar hedging strategy.

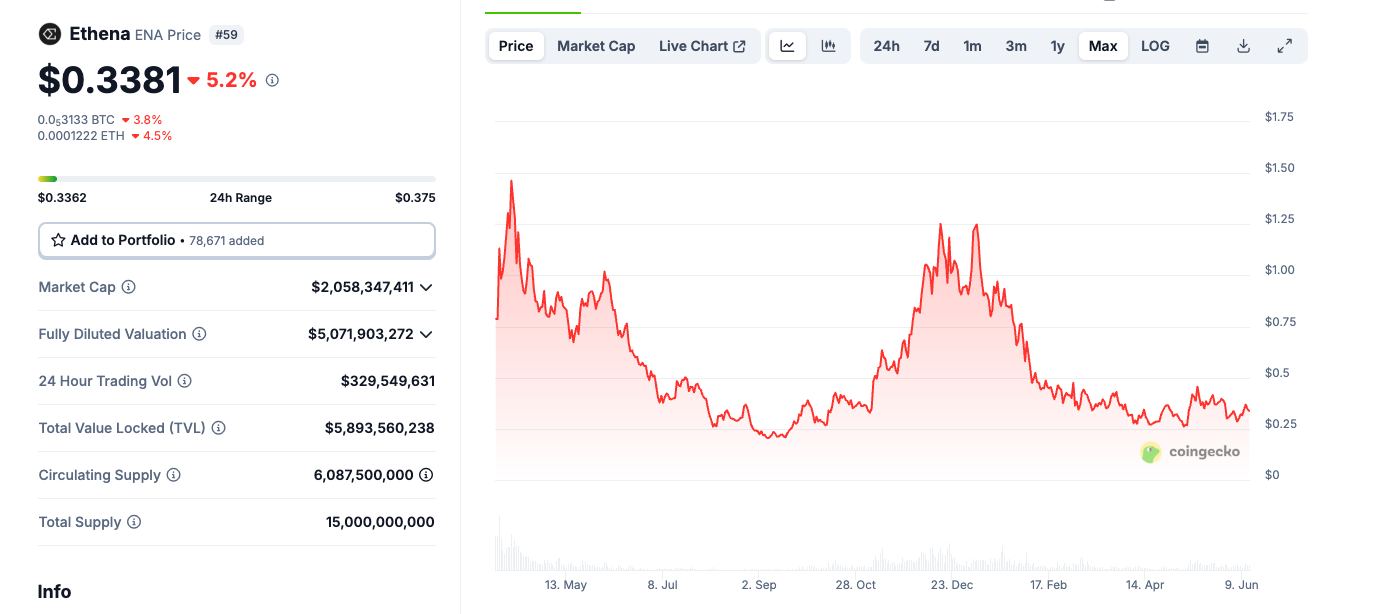

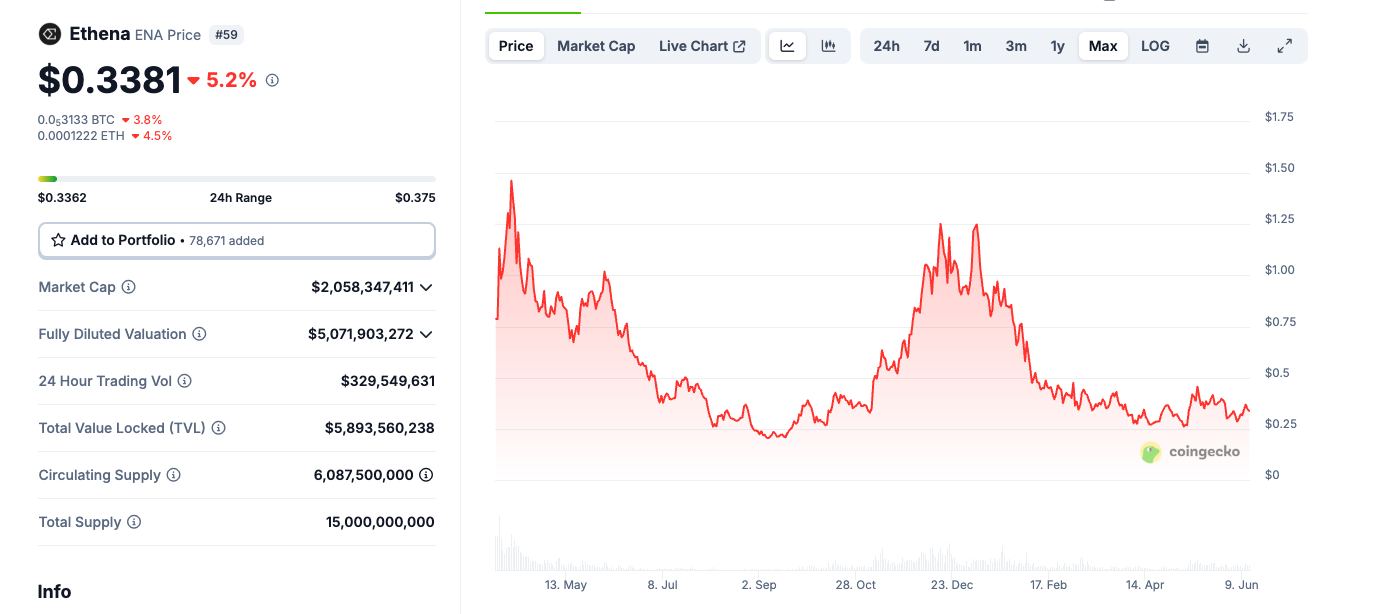

result? Ethena’s USDE Stablecoin has grown to about $5 billion in circular value by mid-2025 – this extraordinary adoption demonstrates strong market demand for crypto-native Stablecoins. Ethena’s governance token, ENA, also has a multi-billion-dollar valuation; its market cap is about $6.1 billion, and its market cap is about $2.1b (price is about $0.34).

These figures involve a market cap of about $50 million in resolution and highlight the huge valuation gap between established leaders and newcomers. If Resolv could even follow the trajectory of Ethena, it even showed that the upward potential was great.

For example, 99bitcoins analysts pointed out Resolv at $54 on $54 in stock and tagged Resolv as one of the “best low-cap bets of the season” for $5B, given the difference.

However, Essena also illustrates some challenges:

- Ethena benefits from the first step advantage in this particular Delta-Delta neutral stablecoin narrative, now known quantity.

- Ethena saw its volatility. Resolv may face similar tests. A mistake can affect perceptions of all “algorithmic returns are stable”.

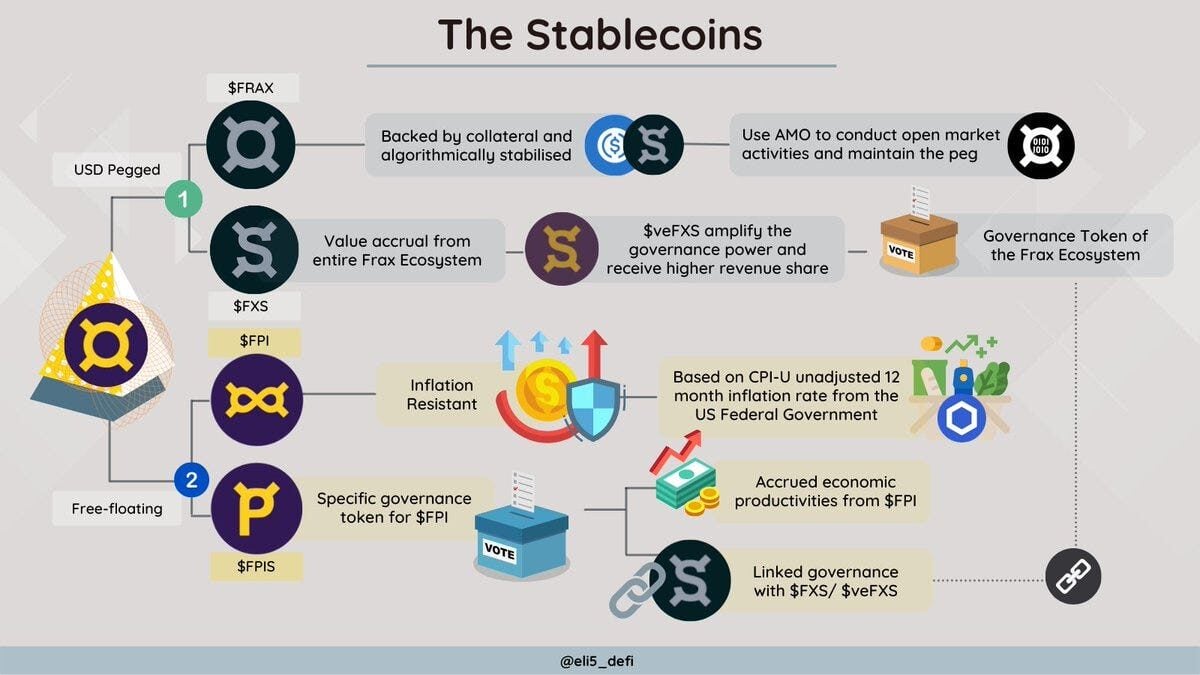

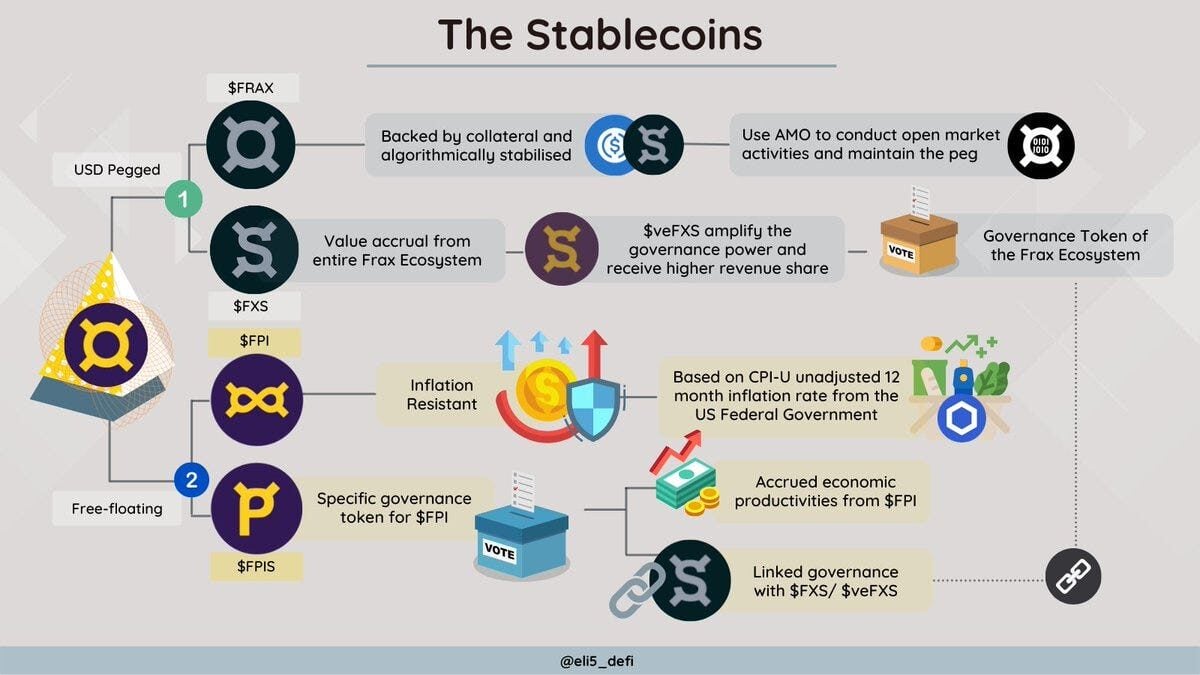

Frax vs Resolv

Frax introduced the idea of the algorithm stablecoin, partially supported by collateral, and used the governance token FXS. Although Frax’s mechanisms are different, its goal is the same: a decentralized stable USD.

Frax’s FXS token currently has a market cap among millions of people, and in the industry, many view FRAX as one of the post-stable models after success. Resolv contributes to the ongoing wave of innovation in Stablecoins.

Frax is also heading towards real yields (investing collateral on desires, curves, etc., and even considering real-world ROE), which is similar to Resolv’s “crypto-local yield”.

Frax has a years of beginning and an ecosystem (Fraxlend, Fraxeth, etc.), and Resolv has just launched its first product. In the short term, investors may favor Resolv’s novelty and higher growth potential, but the existence of Frax shows that it takes time to occupy a large market share in Stablecoins and has a good and stable track record.

All in all, Resolv’s basics are integrated into the league with the most exciting new Defi projects of 2024-2025. Its closest peer, Ethena, showed a case study growing rapidly – and provided a yardage number that showed that if it captured a small portion of the stablecoin market, it indicated that Resolv traded at a discounted price.

Resolv price forecast: Postal

With all of the above in mind, Resolv’s short-term outlook seems cautiously optimistic. Resolv checks out many boxes: an experienced team, strong support from well-known investors, a new product that meets real needs (a gain on stable assets + Defi Security), and tangible early traction.

Unlike the typical “AirDrop + TGE dump” scenario, early receivers were eager to deliver on, Resolv showed signs of buyer support than expected, suggesting a possible cumulative phase or coordinated purchase effort.

More measured predictions, continue toward $0.50-$0.60 If the catalyst appears, you can imagine that the range can be done, but if early buyers cash out, it will be a drop below the listing price (perhaps $0.20).

If such a tailwind occurs and the current momentum continues, Resolv can actually reach this price range in the next 2-4 weeks. However, any delay in roadmap execution or macro-risk events may delay this timetable.

It is important to emphasize that short-term forecasts are inherently uncertain, especially for brand new tokens in the volatile sector. Resolv (Resolv) will not only trade with its advantages, but will also trade in the cryptocurrency market. Now, broader sentiment remains positive, with Bitcoin’s strength and investor enthusiasm providing headwinds.

Resolv may have a lot of room for upward compared to his peers – the Essena gap suggests that the narrative of “underrated advanceers” may drive speculative inflows. However, it is important to note the risks we outline. Early volatility and complexity of the Resolv mechanism mean that the token’s journey will not go directly upward.

Read more: Ethereum price forecast for June 2025