Raydium, a leading diversified exchange (DEX) and automated market makers (AMM) Solana Blockchain, LaunchLab officially launched On April 16, 2025, it has had a positive impact on the price of $Ray and the Solana ecosystem, driving the increase in activity and innovation. Explore Raydium’s LaunchLab now and get involved in cutting-edge projects and opportunities.

What is a startup sign?

LaunchLab is a token launchpad platform designed to compete with the popular Solana-based Memecoin launch platform pump.Fun. It aims to simplify token creation and distribution of developers, creators and the wider Solana ecosystem.

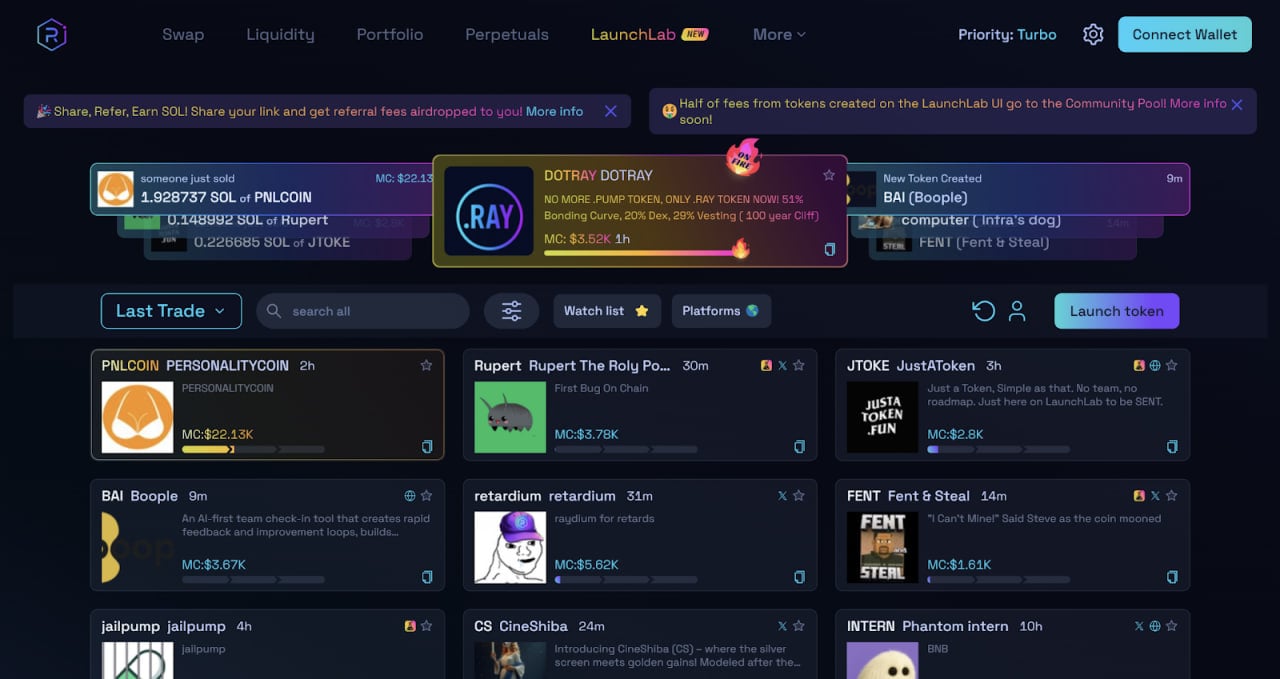

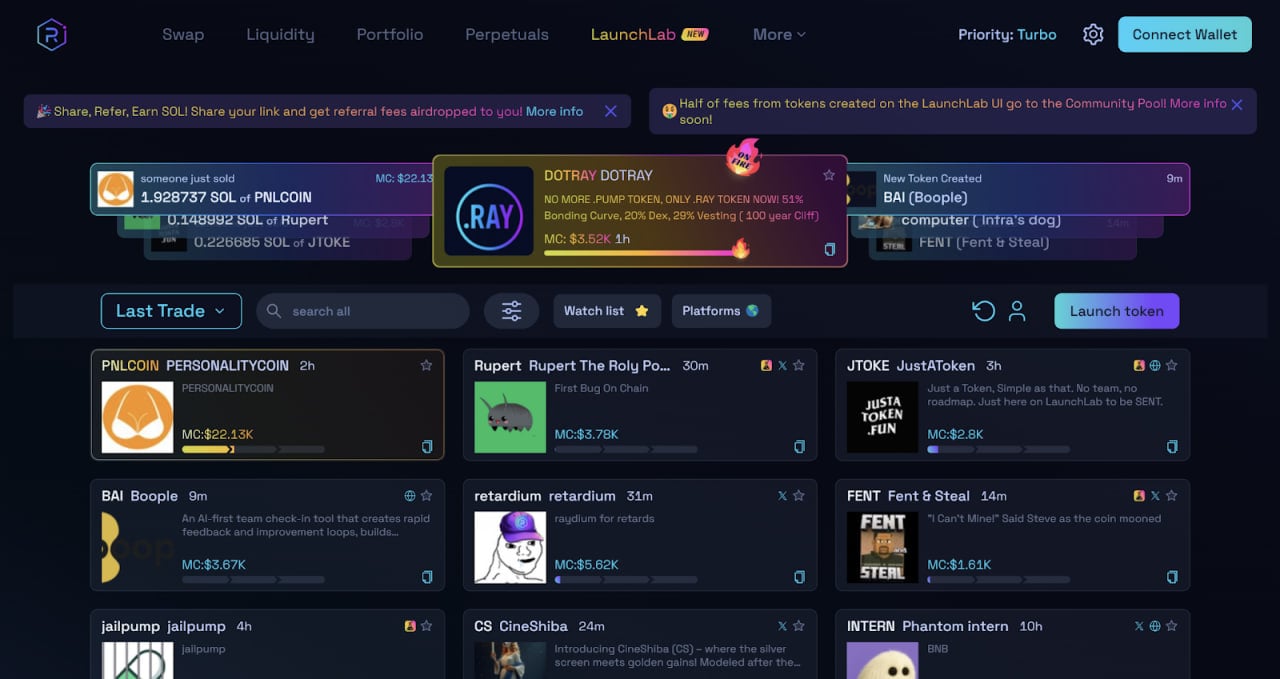

Source: LaunchLab

Raydium’s LaunchLab has launched an innovative set of features designed to simplify and secure tokens released on Solana. Creators can use customizable bonding curves to set the token sales amount, enabling dynamic pricing that can adapt to market demand. The platform’s codeless interface provides flexibility in two modes: “JustSendit”, quick boot and “Start LAB” for default settings, for tailored options such as token supply, attribution and distribution.

Free token launch makes the platform accessible, allowing anyone to create a token and liquidity automatically migrates to Raydium’s AMM pool when targets like 85 $SOL in JustSendit mode.

To ensure trust, liquidity locks in or burns immigration, minimizes the risk of carpet pulling. LaunchLab’s fee structure includes a 1% transaction fee, divided into community pools of 50%, $25% $ray repurchase and 25% infrastructure and operations. Additionally, token creators benefited from their post-immigration expense share, capturing 10% of AMM Pool Trade’s LP fees, incentivizing long-term project participation.

Competitive Dynamics: LaunchLab’s reaction to pump.fun

LaunchLab is a strategic response to competitive pressure, especially from Pump.Fun, a key revenue driver for Raydium. Pump.Fun announced its own AMM (Pumpswap) in March 2025, reducing its dependence on Raydium’s liquidity pool. Previously, the Pump’s fun token reached $69,000 in market capitalization would be moved to Redim for transactions, accounting for about 41% of Raydium’s exchange fee revenue.

According to Defilama, Pumpswap’s debut, with trading volumes of more than $31.7 billion in just 10 days, adding to fierce competition with Raydium.

Additionally, Raydium may lose its revenue as Pump.Fun turns to Pumpswap. LaunchLab aims to capture token release campaigns and maintain Raydium’s dominance as Solana’s top DEX.

Therefore, LaunchLab aims to regain the token launch activity and enhance Raydium’s dominance in Solana’s ecosystem. In addition to competition, it reflects Raydium’s vision of transitioning from a liquidity provider to a wider “ecosystem infrastructure builder”, which supports a wide variety of long-term projects with many key differences from Pump.Fun, including:

- flexibility: Compared to the aesthetically-only changes of pump.fun, LaunchLab offers premium customization (glue curve, attribution, charge).

- Integration: LaunchLab is connected directly to Raydium’s AMM, while Pump.Fun now uses pumping.

- Key points: LaunchLab supports all token types, not only Memecoins, but also criticism of Pump.Fun for the sustainability of long-term projects.

Direct effects of LaunchLab: $ray and $sol prices soar

Source: CoinMarketCap

The launch list announcement catalyzed a 13% peak rayonly more than one hour after the news, reaching US$2.43, with a market value of more than US$680 million. Trading volume soared 80% to $264.08 million in 24 hours. Releases and 25% fee allocations may support this bullish sentiment.

Learn more: Solana Price Forecast

for solthe direct impact is also direct, with prices rising 4.16% today to $131. This spike is due to the belief that launches the potential of rabs to drive ecosystem activity through new token releases and increased transactions, which can enhance the value of $SOL by enhancing Solana’s network usage.

While the initial market response was positive, LaunchLab showed great potential beyond the immediate transfer of prices. Its focus on a wider token type, long-term sustainability capabilities, and direct integration with Raydium’s ecosystem, positioning it as a platform for its long-term impact on Raydium and the wider Solana network.