As May ends, the cryptocurrency market continues to show mixed signals, with several top tokens – BNB, WLD, Shib, Trump, Trump, Tao, near and TRX – hovering around key technical levels. While some people have tried to break through after weeks of merger attempts, others are approaching key resistance or support areas that can define their short-term trajectory.

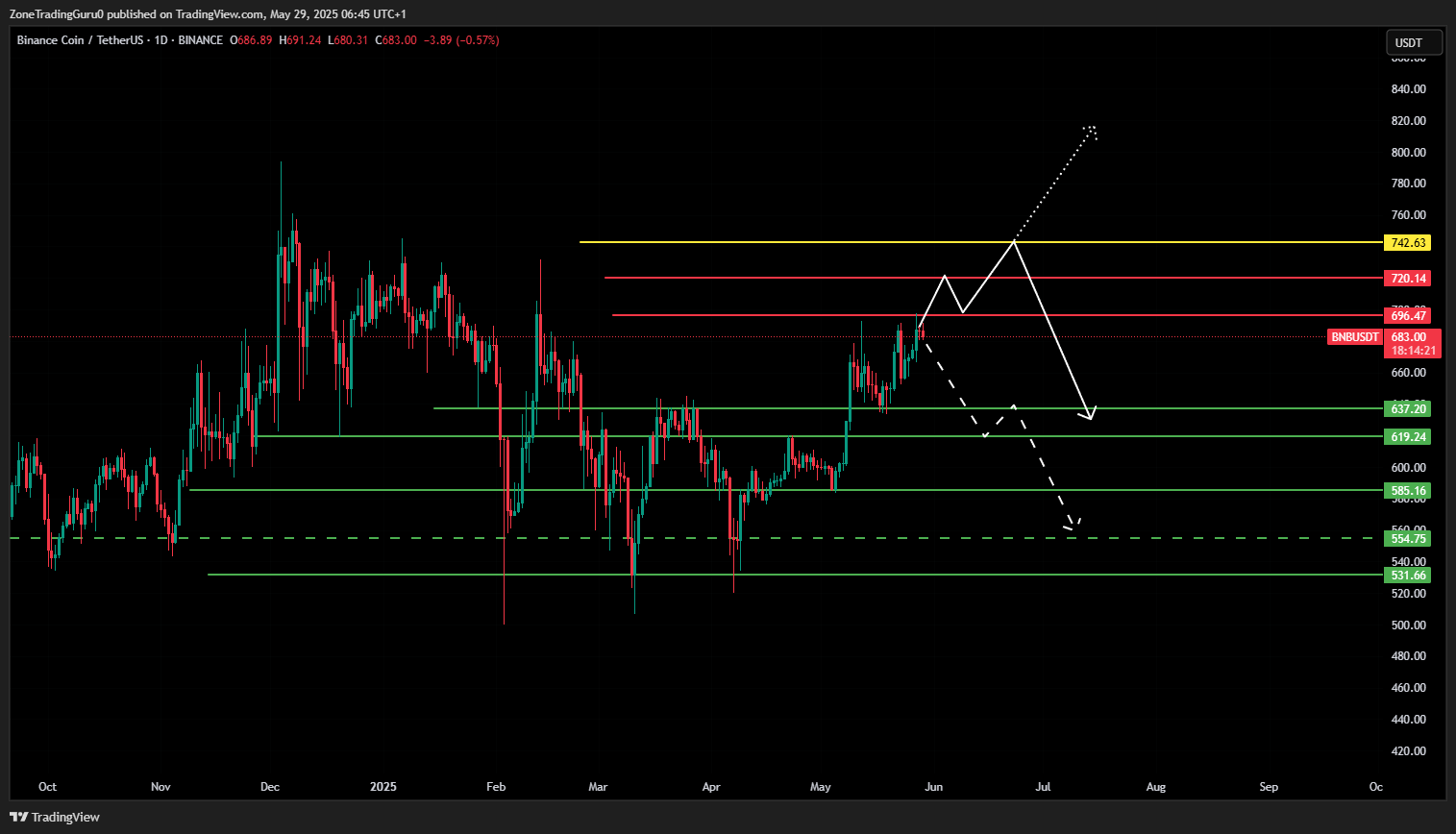

BNB price forecast

BNB is currently facing strong resistance at $696.47. It is necessary to approach this level every day to maintain the upward trend. Further resistance is $720.14 and $742.63.

If the daily candle wicks above and RSI form lower highs while the price forms higher highs, this will indicate bearish divergence and potential trend reversal. If the price fails to exceed $696.47, the country may fall at $637.2.

Daily close-up below this support may lead to a further drop in the previous bottom, at a price of $531.66, at the middle level of $619.24, $585.16 and $554.75.

Source: TradingView

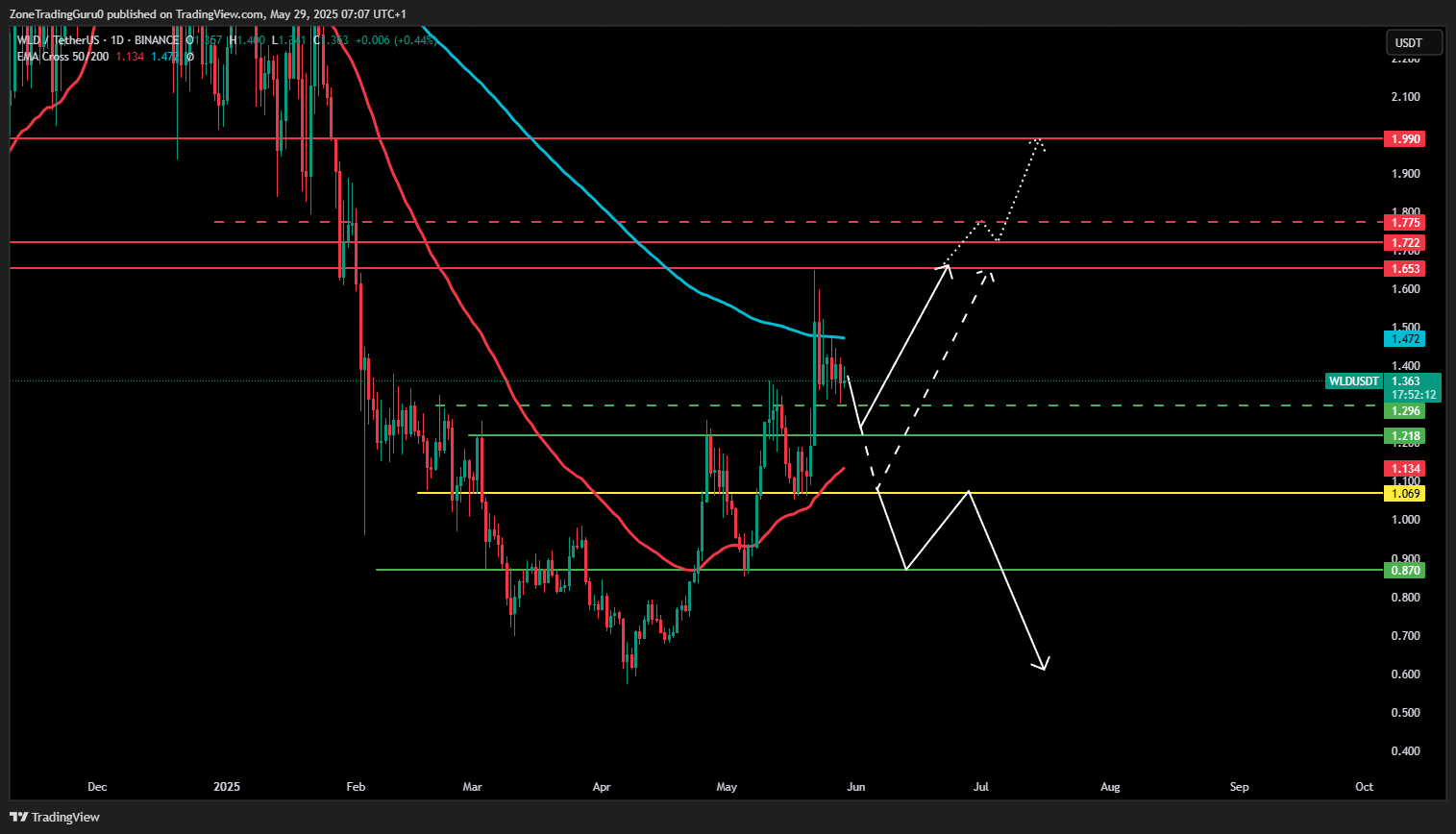

WLD price expectations

WLD responded strongly to the $1.653 resistance, triggering the corrective wave and testing secondary support for $1.296. If the price continues to fall, the next support is $1.218, $1.069.

The key level is $1.069, and if it is violated on daily closing, the uptrend may be invalid and the assets may revisit previous lows.

Instead, a breakout above $1.653 will result in the next resistance of $1.99. Notable to watch the intermediate resistors are $1.722 and $1.775. The $1.653 backtest could offer a long chance.

What price expectations

SHIB is currently consolidating between $0.00001478 and $0.00001384, and is also bound by the downward trend line formed by the two previous highs. Failures below this range may send the price to strong support of $0.00001267, which may trigger a rebound resistance towards $0.00001708 $0.00001708.

Closed daily by $0.00001267 will open the road to the previous low for $0.00001054. On the other hand, a breakout beyond the top of the range could reduce SHIB to $0.00001585, followed by backtesting and potential continuation to $0.00001708.

If Shib closes $0.00001708, it may rise towards the next major resistance at a price of $0.00002222–$0.00002228.

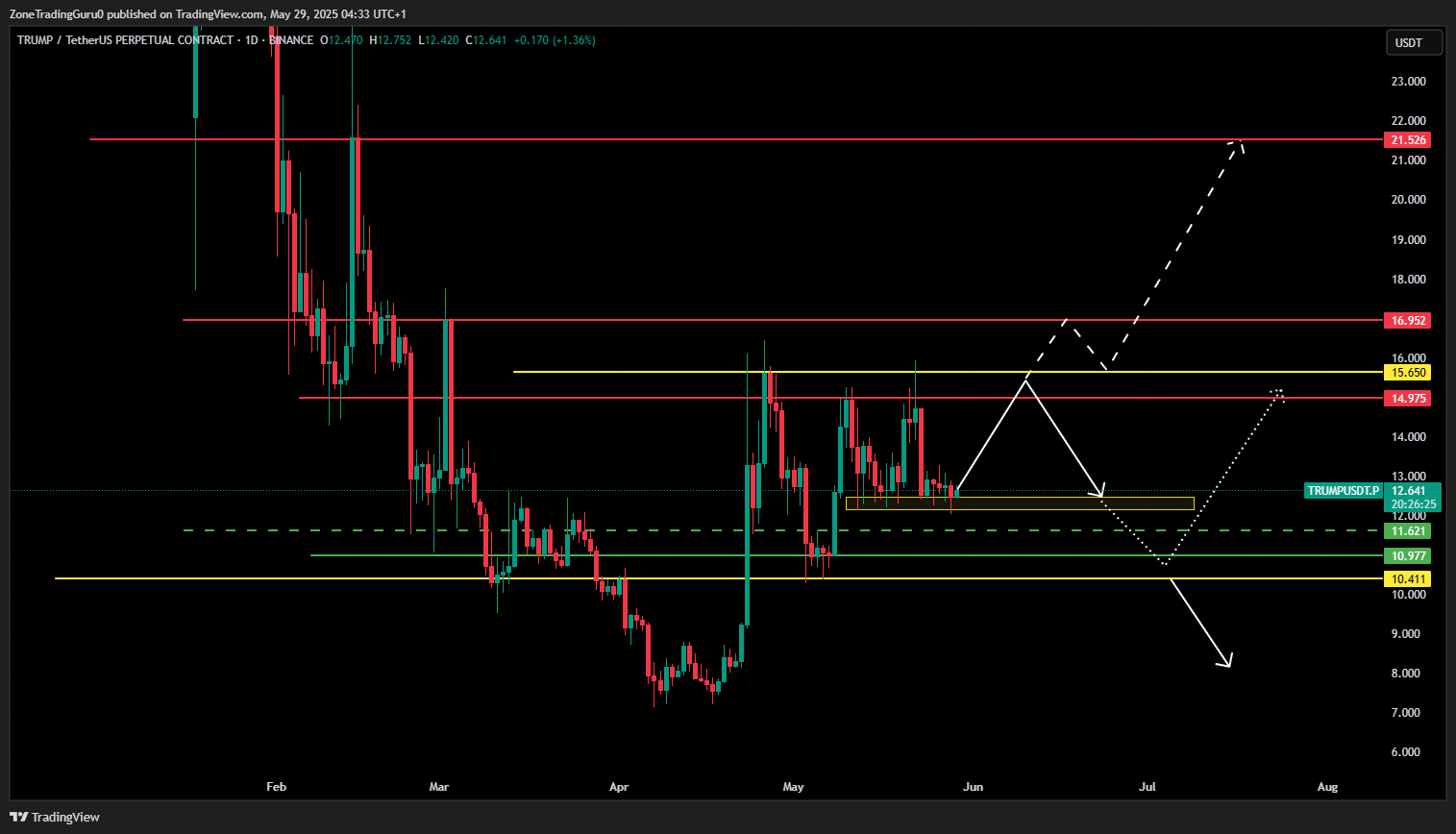

Trump price forecast

Trump is in a strong upward phase, but a breakthrough in potential 2x gains requires confirmation of action, exceeding the $14.975-$15.650 resistance zone. The key level is $15.65, and the daily candle that closes this threshold daily will confirm the long-term bullish trend with targets of $16.952, $21.526, $24.537 and $26.023.

Currently, Trump has merged $12.469-$12.151 near the smaller support zone, which could be a temporary entry point. DCA zones are $11.621, $10.977 and $10.411.

The primary support of $10.411 must be held; daily closures below this level will invalidate the bullish setting and may cause previous lows to be retested.

Road price forecast

Tao’s current side trading range is $490 to $389.3, with mid-support of $435. If the price drops above $490 and the next resistor is $565, the asset may be between $490 and $565 until the daily closing price above $565 is $713.

Conversely, if the price drops below $389.3, you might test $356.4. The confirmed failure could lead to deeper targets, $317.1, $272.3 and $230.2. The $230.2–$272.3 area is considered a strong support, making it a favorable area for spot contestants.

Close to price expectations

Nearby is trying to break through the long-term downward trend. However, to establish a new higher low, a shift towards a corrective action of $2.285 is needed. Support now is $2.652.

The daily candle of $3.355 closed daily will confirm a bullish reversal and open upside potential to $3.568, $3.67, which may be $4.033. The $3.355 backtest may provide a long-term setup.

TRX Price Forecast

TRX has risen sharply to $0.45, and in the short term, the possibility of further steep upward movement is reduced. After a range of $0.2103 to $0.2611 in 140 days, the TRX is damaged above the upper boundary and sets resistance at $0.2971.

Potential wicks above 0.3188 $0.3188 may trigger sharp corrections. If the price closes below $0.2103, it could invalidate the breakout and trigger the next support to drop to $0.1667 and $0.1431.

A brief swing position can be considered on confirmed faults.

in conclusion

Most of the assets analyzed are in the merger or early decomposition phase, indicating hesitation before a potential larger movement. Traders should be alert to confirm critical levels, especially daily candles close above or below the main support and resistance areas.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Price Forecast 5/30: Trump, Tao, Nearly, TRX, BNB, WLD and SHIB first appeared on NFT night.