As of May 28, 2025, this article provides technical segmentation and updated price forecasts for BTC, ETH, SOL, XRP, LINK, DOGE and SUI.

BTC price forecast

BTC Monthly candle setting causes caution. While there are new highs (ATHs) at your fingertips, the bearish difference appears on the RSI, which is higher in price, while the RSI shows lower highs – a common setting before a bearish reversal.

Potential resistance levels for the monthly time range include $123,000-$128,850 and $143,200. These are key areas where sharp rejection can occur. Although the long-term trend remains bullish, capital preservation is key due to the increased risk of allocation.

BTC Advantage (DOM) continues to rise and approaches a significant resistance level of 65.87%. A confirmed breakthrough above may make the DOM higher as high as 68%–71%.

This increase in this advantage usually indicates that capital spins back to Bitcoin, usually at the expense of altcoins. If this happens, the altcoin market may face great pressure in the near term.

Source: TradingView

ETH price forecast

eth There is no meaningful pullback for six consecutive weeks of gains. This uncorrected scalable run often lacks long-term sustainability, and traders should be prepared for potential profits.

The critical resistance zone is $2,825.36, $3,013. The closing price above $3,013 on the daily chart will confirm the continuation of the bullish trend, with the next target being close to $4,000 at previous all-time highs. Instead, a wick to $3,013 and then refuse, no level above this level every day, which may indicate a local top and will be reduced to $2,000.

SOL price forecast

sol Key resistance at $186 is currently being tested. The region will determine whether the current bullish momentum can be maintained. If the daily closing price of price management exceeds $186, it will confirm the continuation of the uptrend. In this case, traders can look for a backtest of $186 level to enter long-term positions with a potential upward area target of about $237.3 to $252.5.

However, if SOL fails to break this resistance, it may answer. Support levels monitor lies at prices of $165.93 and $153.9. The most important key level here is $143.6, which should be a price below this level, which may mark a shift in the direction of the trend and opens up deeper corrections toward previous cycle lows for deeper corrections.

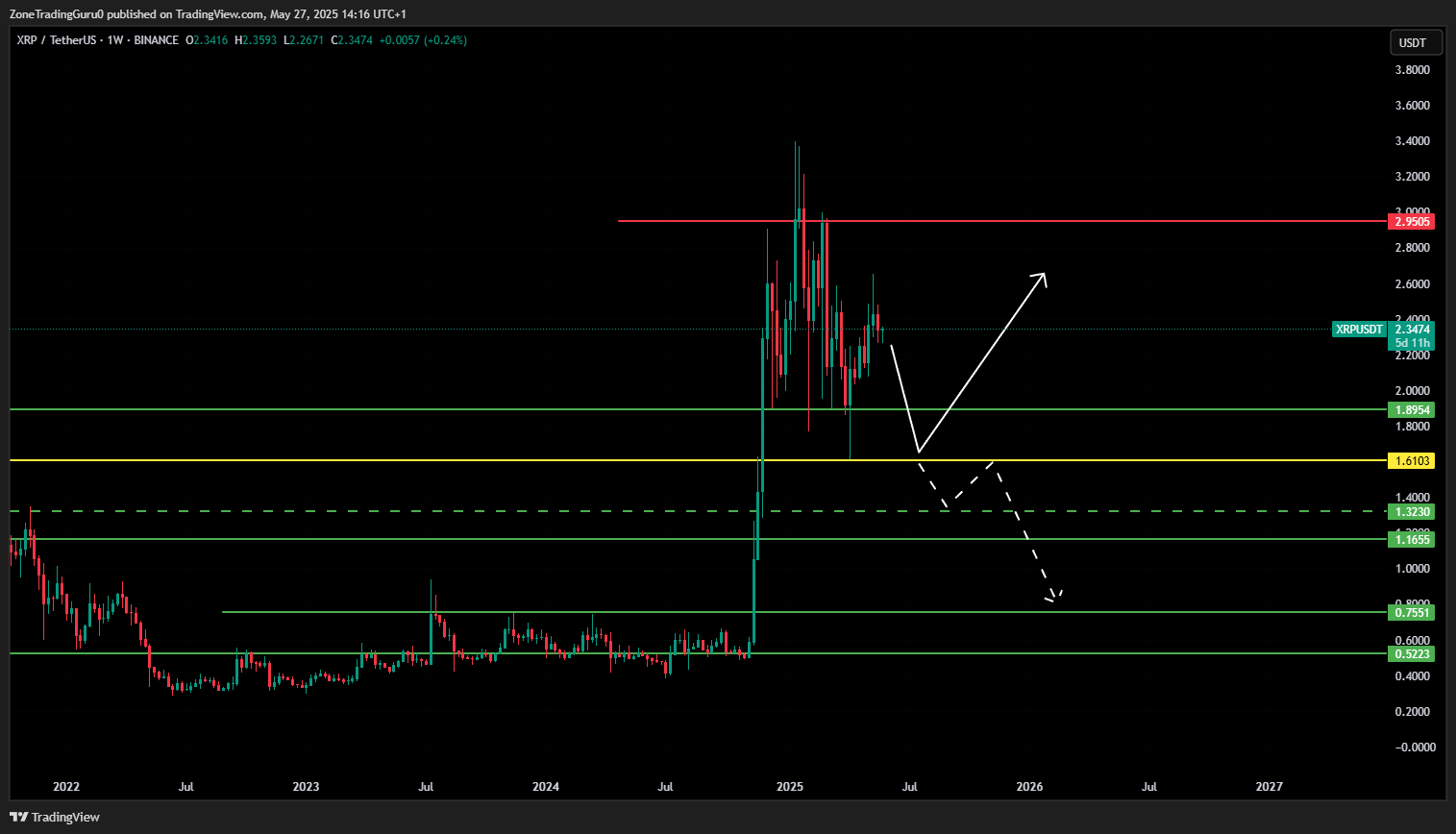

XRP Price Forecast

XRP Recently, the explosive rally has produced an impressive 550% return from $0.52 to $3.40. However, this upward movement lacks a corrective wave, which has attracted attention to the sustainability of trends. Before reaching a new high, the answer seems more likely.

Currently, XRP has resistance of $2.95. Momentum indicators, such as the momentum indicators for the daily (D1), weekly (W) and biweekly (2W) charts, show weak bullish forces. The direct support zone is approximately $1.8954 to $1.61.

If the price closes $1.61 on the daily chart, it may trigger a drop toward a deeper level of support to $1.323 and $1.1655. Rests below $1.1655 may result in a drop to $0.755. Strategic short-term positions can be initiated in the regression test for the $1.61 area.

Link price forecast

Related Defends above the $17.4 level and shows a significant price response in the area. Assets have been damaged from previous downtrends, but establishing a corrected bottom-level callback is necessary for healthy continuation.

The potential support levels for this correction are $13.81, $12.67, $10.78 and $10.17. These are areas to consider for long entries or spot accumulation. If the $10.15 of the 3D candle is linked to $10.15, the bullish structure will be invalid and may be further lower.

On the plus side, a successful breakout and a closing price of over $19.35 will be a strong confirmation that extends to $24.91 or even previous highs.

Doge price forecast

Doge Currently being consolidated between $0.21 and $0.26 in the horizontal range. This side price action shows market hesitation and makes the immediate position a risk. A more cautious approach is to wait for a clear breakthrough to confirm directional momentum.

If Doge bursts out at the $0.26 price and successfully retests, the move could be extended to $0.31 with potential temporary resistance of $0.2719 and $0.285. Conversely, failures below $0.21 subsequently occurring inverse testing may trigger bearish action.

In this case, the price may drop toward support levels at $0.195, $0.185, $0.17 and $0.142. A daily closing of $0.142 per day will significantly increase the likelihood of getting deeper back to previous lows.

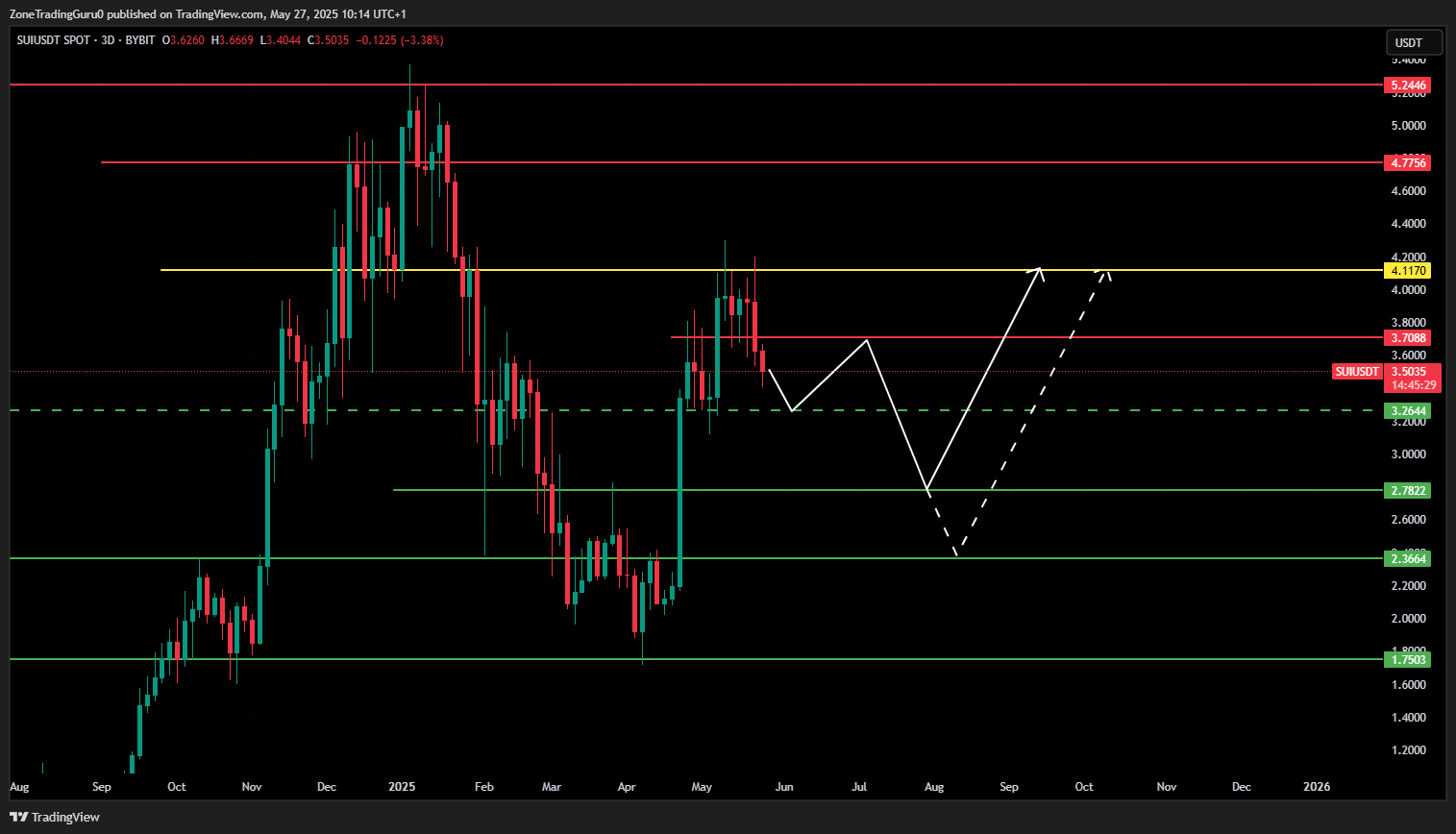

SUI price forecast

Sui The main resistor is being tested at $4.117. Confirmed daily close-range confirmation of this level is crucial to confirm the continuation of the upward trend and has the potential to set new all-time highs. Failure to break this level indicates that correction is about to proceed.

The secondary support level of $3.2644 has been tested several times and may no longer be held. More reliable support zones are $2.7822 and $2.3664, which also corresponds to the fair value gap (FVG) in the 3D chart, indicating strong prior purchase interest. These areas provide favorable risk rewards for long entries or on-site accumulation.

in conclusion

Key resistance and support levels for XRP, Link, Doge, Sui, ETH, SOL and BTC are being tested, and BTC’s advantages indicate possible away from altcoins. Traders should exercise caution and prioritize capital protection, especially with monthly approaches ending and potential divergences emerged between multiple indicators.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Post price forecast 5/28: BTC, XRP, Link, Doge, Sui, Eth and Sol first appeared on NFT night.