Since its inception, Pendle Finance has demonstrated a significant trajectory of rapid development and strategic growth, characterized by a series of important milestones in the evolution of its protocols and increasing market adoption.

Pendle Finance was officially launched in June 2021. Pendle’s fundamental ideas stem from the effective choice of earnings assets observed within existing Defi landscapes and pricing tokens.

Pendle Finance’s key milestones

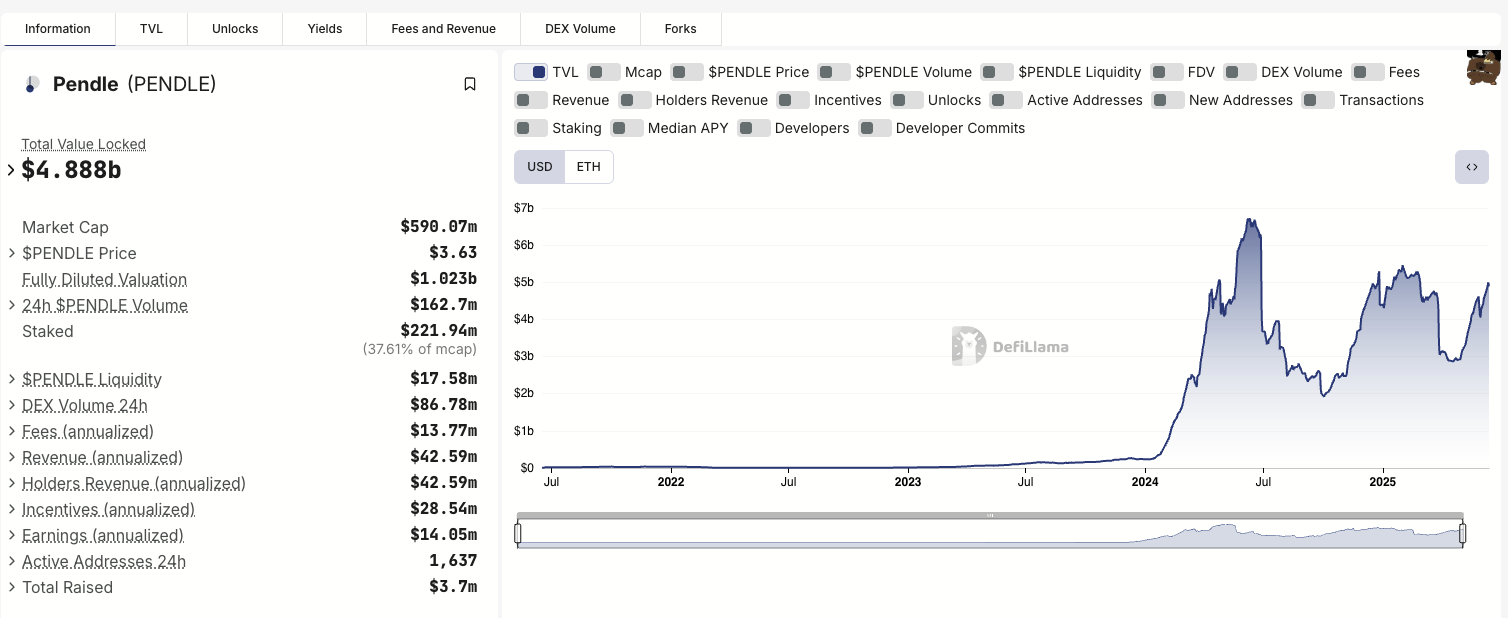

Pendle’s TVL statistics

The protocol’s TVL has experienced huge growth since its launch. By June 2024, Pendle’s TVL soared to $6.72 billion in ATH, and later stabilized by about $2 billion. Current data suggests TVL is about $4.88 billion, with other sources reporting more than $4 billion. The majority of the TVL is concentrated on Ethereum, accounting for nearly $4.5 billion.

Source: Defillama

However, Pendle’s multi-chain strategy is obvious. Its TVL is distributed in other chain stores. These include Basic ($18034 million), Sonic ($1117.8 million), Arbitration ($49.9 million), Berachain ($32.4 million), Mantle ($12.31 million), BSC ($4.25 million), Avalanche ($57,474) and OP Mainnet (37,438).

This distribution emphasizes Pendle’s success in cross-chain expansion. It expands its user base. It also reduces dependence on individual blockchains, thereby enhancing resilience and accessibility.

Source: Pendle

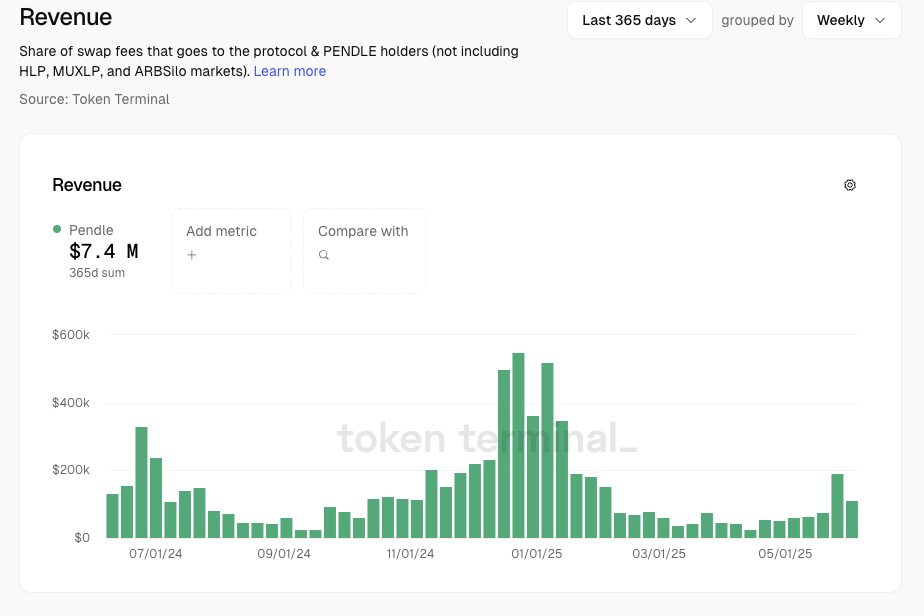

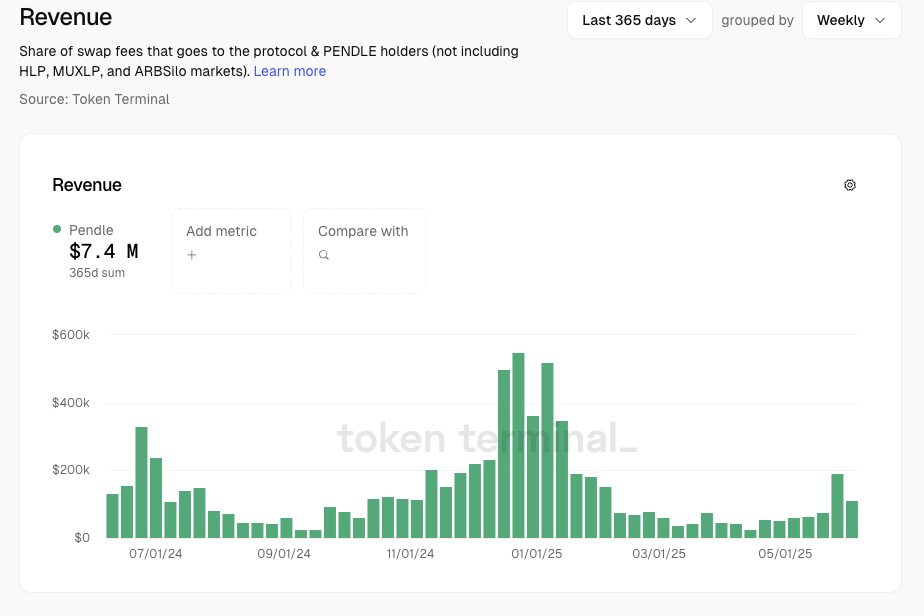

Pendle’s income

Since June 2024, Pendle has also shown consistent and stable revenues, with an average of more than $4 million per month. The annual revenue figures are reported at $22.32 million and $42.88 million, mainly from the 5% yield and transaction fees generated by assets on its platform.

An important milestone is the full unlocking of team and investor tokens in September 2024. This event shows that Pendle maintains “stable income” and “increasing utility-driven sustainable demand”, which suggests a strong underlying economic model and organic demand rather than relying on artificial tokens.

For institutional investors and long-term stakeholders, this post-lockdown stability is a strong signal of maturity and viability. It greatly reduces the investment profile of Pendle tokens to address concerns about the “carpet pull” or “capital flight” that plague many Defi projects. This resilience positions Pendle as a more reliable and sustainable player in a fixed income space.

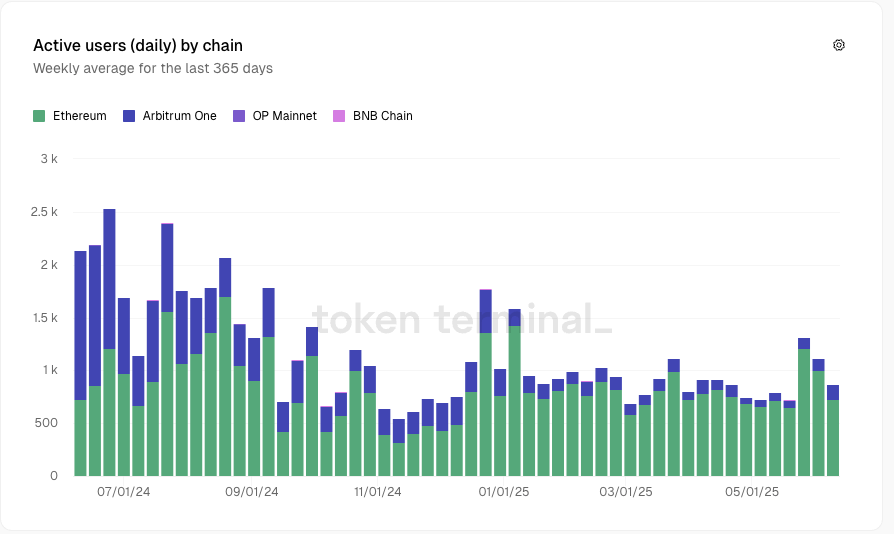

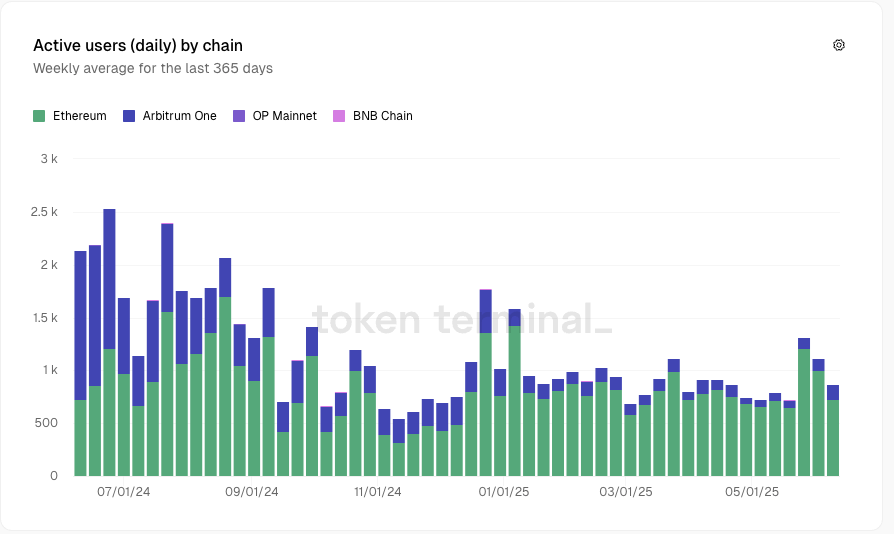

Daily Active Users of Pendle (DAU)

In terms of user participation, Pendle has approximately 280,000 active users. Daily activity address is reported at 1,000. It is important to pay attention to these active address counts. They usually only include users who interact directly with the protocol. They exclude people who may use DEX aggregators or other intermediary contracts. They are also limited to specific chains.

Pendle dau chain decomposition. Source: Token Terminal

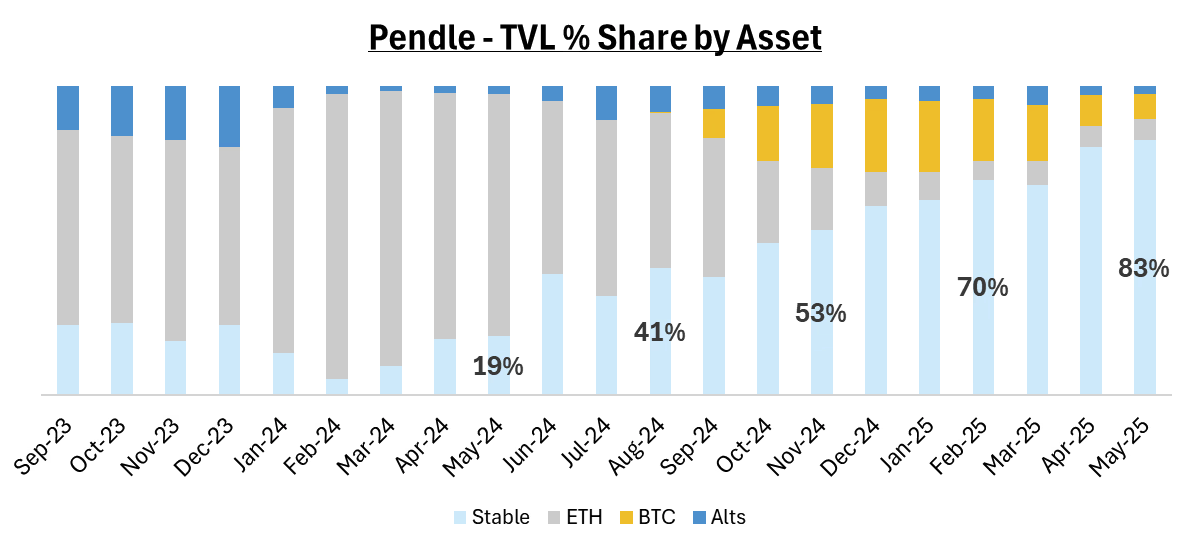

Pendle production carries Stablecoin market share

Pendle also occupies an important position in a stable market with stable load-bearing. It captures 30% of the stable amount of all load-bearing stability. The value of a stable market with a stable load-bearing market is US$11.3 billion. This accounts for 4.5% of the total stable market. Pendle’s share is expected to remain around 25%. This focus on the growing and relatively stable Defi market, which contributes to its powerful TVL.

Source: Pendle

Pendle cross-chain expansion and adoption trends

Multi-chain strategy and future expansion

Pendle adopts an active multi-chain strategy and builds key partnerships to expand its reach and utility in a decentralized ecosystem. This expansion is critical to improving accessibility, reducing transaction costs and leveraging various liquidity pools.

In addition to its initial deployment on Ethereum, Pendle also expanded its operations to multiple Layer 2 solutions and alternative blockchains. Its current existence includes EVM chains such as Ethereum, arbitration, foundation and voice.

The agreement has a specific plan for further expansion, and is expected to provide Solana support in Q3 2025, with additional integrations planned for Hyperliquid and Ton. This multi-chain approach aims to increase accessibility and reduce transaction costs for users, thereby attracting a wider user base.

Key Integrations: AAVE V3 and Pendle Finance

PENDLE’s support for PT-USDE as collateral in the AAVE V3 protocol. This integration allows holders of Pendle’s fixed income PT-USDE tokens to use it as collateral for AAVE, whether for capital efficiency or replacing and leveraging yields.

Aave V3 and Pendle. Source: AAVE DAO Governance Forum

Due to this integration going online, approximately $1 billion of PT-USDE has been deposited into AAVE in addition to the existing $500 million Morpho. This move is crucial as it integrates Pendle into Ethereum’s largest lending package, greatly expanding its capital access and ecosystem participation.

Ethena & Pendle Finance Partnership

Pendle also has key partnerships with Ethena and its new Converge blockchain. Ethena’s EVM chain will incorporate a local knowledge of your customer (KYC) functionality. This gives institutions access to Pendle’s production and platform. This allows Pendle to participate in the growth of licensed Stablecoins, such as Ethena’s Iusde.

Source: 0xcheeezyyyyy

Ethena also took advantage of Pendle when it launched the USDE Stablecoin in February 2024. This is to guide initial use and liquidity. In just four months, Pendle helped Ethena improve from zero to more than $3 billion in offerings. It drives 50% of the growth and activity of Ethena. This is by facilitating fixed income lockdown on USDC deposits for users who do not want to interact directly with Ethena.

Unlicensed checklists and other integrations

Additionally, Pendle is moving towards the list of assets on its market. In March 2025, the agreement took the first step to put the first externally listed asset on its platform on its platform. Although official assets are under “Pendle Prime”, the program allows third parties to list assets without the team acting as bottlenecks. This is crucial to support all assets, especially long-tail stable.

Other notable integrations include the Falcon Finance generated by integrating $SUSDF with Pendle as enhanced chain yield. CoinShift’s CSUSDL Stablecoin also hit $100 million in TVL on Pendle, as the highest passive income asset. Cygnus Stablecoin Wcgusd is also recently launched on Pendle.