What do we know about Alliance Entertainment’s acquisition of Diamond Comcis in a bankruptcy auction and what it means to comic publishers?

Spoiler: Not much, because it was early, the court must approve the sale. But something has happened.

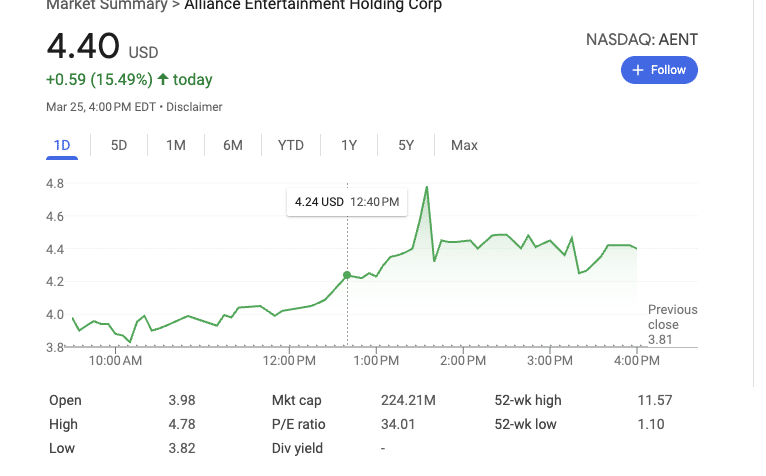

Investors like to switch from Alliance to buying toys, games and oh yes, the main distributor of comics. Their stock rose 15%, with its market capitalization rising from $200 million to $225 million from the time of the announcement of purchase. Actions based on promotional tweets

• Increased over $200 million in expected revenue and $10 million + EBITDA in fiscal 2026

• Deepen the existence of comics, games and collectibles and have over 5,000 retail accounts

• Cross-channel synergy with fan best IPS unlock (@Miracle,,,,, @pokemonD&D)

• Funding through revised line of credit – Capital Light Expansion Strategy

Alliance already has a $120 million credit line, which they have expanded to $160 million to fund purchases. Given that Universal only bids for Diamond UK for $36 million, you’ll see how big the purchase price is.

We contacted our unusual suspicious comic insiders and retailers about Alliance Entertainment, but the company is almost unknown to the average comic shop. As distributors, they specialize in audio and family entertainment, and recently branched out into more popular culture-centric products as you will see if you continue reading. The general feeling is cautious positive opinions.

Here are some things collected from the afternoon search of Yahoo Finance. (Note that Alliance Entertainment is publicly traded, so there is a lot of information to be spread over.)

Alliance run by CEO Jeff Walker and the Executive Chairman Bruce Ogilvieboth of them are from the music industry. The company’s website lists it as “employee-owned” through its 2023 incentive stock program, which is when the company goes public, a photo of employees standing in front of a warehouse will make some feel familiar. Walker’s Story is through our Story Page alliance, he started with the CD Listening Bar and has been operating the alliance for 34 years.

Founded the Abbey Road distributor in 1980 and sold Abbey Road in 1994. He became CEO of Warehouse Music in 1996 and helped Warehouse get out of bankruptcy. Joined Super D in 2001 as CEO, purchased Alliance Entertainment in 2013 and merged Super D with Alliance Entertainment and became chairman. Purchased Anconnect from Anderson in 2016. Acquisition of Mecca Electronics in 2018. Acquisition of distribution solutions from Sony Pictures 2018. Mill Creek acquired in 2019. Game Fly acquired in 2019. Merger with Cokem International in 2020. Merger with Adara in 2023 and listed on Nasdaq and listed on Nasdaq

In recent years, the company has adopted a “Growth Through Acquisition” program, which includes Mecca Electronics, Cokem International, Mill Creek, connectivity and distribution solutions.

Alliance was handcrafted by Funko-style company Robots just a few months ago and most interestingly, his acquisition will “start us into a licensed collectible business, leveraging our strong relationship with entertainment licensors to create a variety of iconic characters.”

According to the PR of this move:

With the handmade robots now part of their portfolio, Alliance Entertainment plans to focus on producing a selection of top-level licensed products, including the most famous and popular characters in movies, TV, music artists, video games and anime. By leveraging the alliance’s extensive distribution network and partnerships with major retailers of Costco, Costco, Walmart, Target and Hot Topic and Hot Topic, as well as e-commerce retailers like Amazon, Ebay, Shein, and more, the company is expected to significantly expand the coverage and visibility of the craftsmanship of robots’ unique collectibles. The alliance will also be sold globally to customers in 72 countries.

Given this direction, it makes sense to buy diamonds and choose toys, and it can enter the direct market of 2000-3000 comic stores.

There are many numbers in this stock analysis page, which report:

Strategic rationale is based on three value drivers: product portfolio expansion, customer base diversity and operational synergy. Scale can be increased immediately by adding more than 15,000 SKUs and relationships with more than 5,000 retail stores. More importantly, the cross-selling potential between mass retailers and professional channels creates a compelling narrative of revenue growth.

The collectibles and tabletop gaming markets are often higher in profit margins than traditional media distributions, which has the potential to improve Aent’s profitability. Adding a favorite Scoring Authority has introduced a high-value service component that can further enhance profit margins.

But that’s not all the sunshine and roses. According to the 2Q earnings document, revenue has declined

-

income: $393.7 million, down 7.5% from the same quarter in the previous fiscal year.

-

net income: $7.1 million in fiscal 24, $0.14 per diluted share, below $8.9 million, $0.18 per share.

-

gross profit: $47.7 million, an increase of 128%, attributed to profitable sales strategies.

The acquisition of diamonds will undoubtedly increase these numbers.

However, you will notice that there is not a single word in all these analysis and archives: comics. Just from the outside, the deal seems to be about toys, games and storefronts, not about the very low margin independent comic publisher business. For the last sentence, I turned to Milton Griepphe has the best 10,000-foot view, to put it simply:

Alliance is the kind of well-funded, well-managed company that has the resources to revamp and modernize the comic and game distribution business it is acquiring (see “According to the World of Griepp”).

Indeed, all our sleuths this afternoon revealed a company with good communication, clear strategies and many resources. I think Diamond’s toys and gaming business is good and I will even see more resources invested in it.

And comics? As the comics industry has been completely disappearing for diamonds, large ships have discovered a port in the storm. But what about all the pants and dingies? OK, there are more.