Oversaturation of tokens: Scattered volumes of cryptocurrency markets

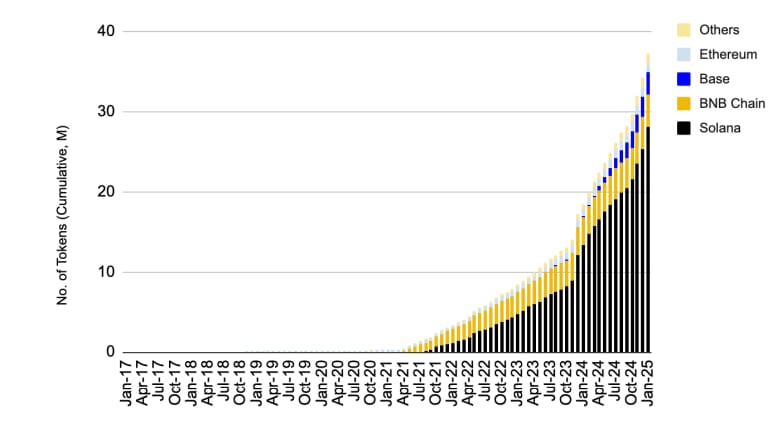

The number of new tokens in the crypto market is soaring, totaling more than 37 million. A large number of markets that introduce new coins into the ecosystem every day break down. As investors’ interest and liquidity are spread across the expanding asset library, this custody causes transaction volume to become diluted.

Spreading trade volumes in several tokens reduces liquidity in a single coin. Low liquidity makes it difficult for traders to trade in large quantities without affecting the price, which often leads to price increases. Institutions and average investors may find that due to this split, currencies with firm fundamental principles distinguish between the number of new plans.

Source: Binance Research

The steep price drop that occurs after TGE is a worrying trend in the cryptocurrency space. After their token launch, famous projects such as Azuki, Story Stastion and Berachain have a harsh dump.

After that, the highly anticipated projects Belling The sharp drop in prices caused huge losses to early investors. Story AgreementFocusing on content generation infrastructure, prices fell similarly after TGE and failed to maintain its initial enthusiasm. AzukiThis is known for collecting NFTs and also faces challenges. Shortly after the launch, the value of the token plummeted.

These patterns indicate that the gap between pre-start enthusiasm and post-send results is widening. After TGE, many tokens lost value, which begs the question of how useful they are and how trust investors trust these types of businesses.

Investor sentiment changes in market saturation

Investors are becoming increasingly cautious due to the increase in token count and the frequency of post-TGE dumps. Projects with sustainable models and proven use cases are becoming increasingly popular. Since promising opportunities are difficult to spot due to oversaturation, this change indicates mass rather than quantity.

In addition, investors are cautious about speculative debuts. Projects that don’t stand out or make progress after TGE may lose favor. Therefore, it is now necessary for fresh tokens to show unique value propositions and strong foundations in order to gain ongoing interest.

According to statistics from recent market reports, the rapid growth of tokens has led to a fragmented trading environment. As more tokens are introduced, the average transaction volume of a single token is decreasing. In addition to having an impact on liquidity, this also reduces the possibility of stable prices.

For projects that cannot get strong community support and sustained development after TGE, tough dumps are taking place, with prices falling by double-digit percentage. For example, Azuki’s tokens fell by more than 50% in the weeks since its inception, indicating a lack of trust in the project’s plans. Once these serious dumps stop potential investors, it will be even more difficult to recover momentum.

Due to the market conditions, as in the case of hyperliquidity, new projects must be innovative and credible. Token releases must produce quantifiable results and exceed the enthusiasm of a crowded market. To stand out, more and more projects require community participation, open communication and obvious utility.