Since early May 2025, Ethereum (Ethereum (eth) staged a significant recovery, rising from about $2,200 in mid-April to $2,600 above $2,600.

Despite the high rebound in prices, on-chain signals and market sentiment suggest that ETH may not have entered its true breakthrough phase during this cycle. Instead, the current price rallies seem to be driven primarily by institutional accumulation, and the common indicators of the “playoffs” have not yet appeared clearly. Has Ethereum reached its peak, or is it just the beginning of a new growth phase?

Ethereum Gas: Reflects the Real Estate of Ecosystems

One of the key indicators that the Ethereum ecosystem has not yet been fully heated is the current gasoline fee level. According to ultrasonic currency, the average gasoline price remains low, usually below 25 GWEI for several consecutive weeks.

This is moderate compared to previous bull markets, as gasoline prices typically exceed 100 GWEI due to the surge in demand for DAPP, NFTS and DEFI activity.

Source: Ultrasonic

It shows that the main trends in the Ethereum ecosystem such as NFTS, DEFI, Socialfi or Memecoins have not yet created enough pressure to push the network to congestion. Despite the rising price of ETH, actual on-chain activity remains cautious – a sign that the current rally lacks retail-driven FOMO, which is usually seen at cycle peaks.

Institutions are accumulating, but that doesn’t mean ETH is ready to soar

According to GlassNode, institutional capital continues to enter ETH through investment tools such as Grayscale Ethereum Trust (ETHE) and CME Futures. The growing accumulation of whale wallets and institutional participants suggests an increase in long-term confidence in ETH.

Source: Xiaodian

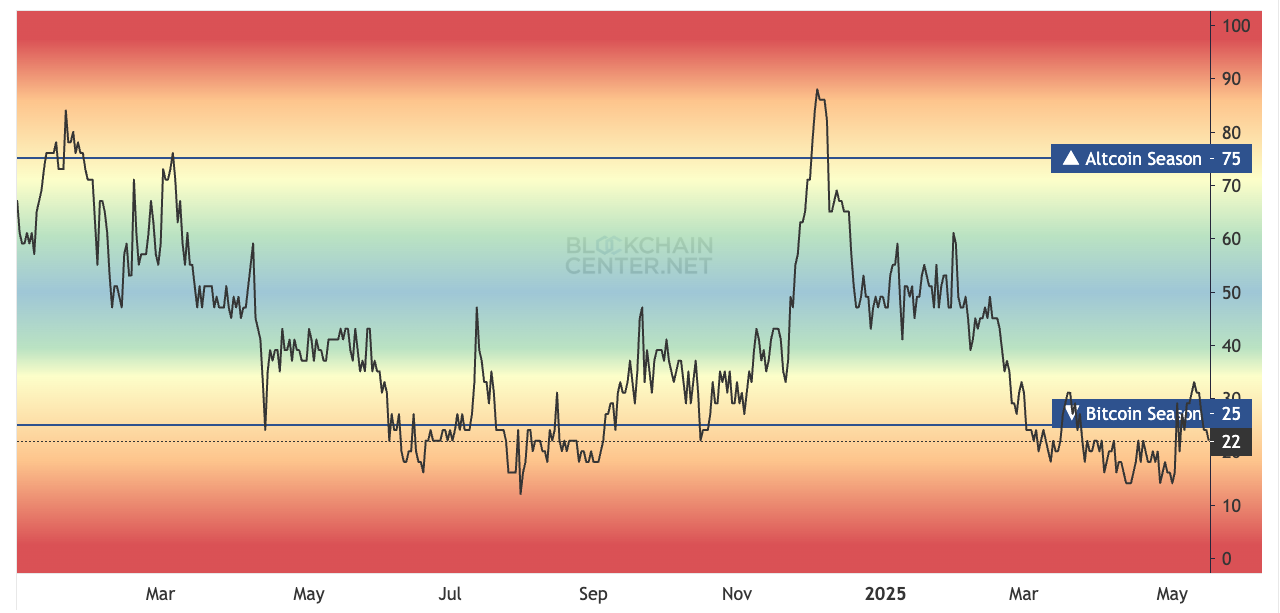

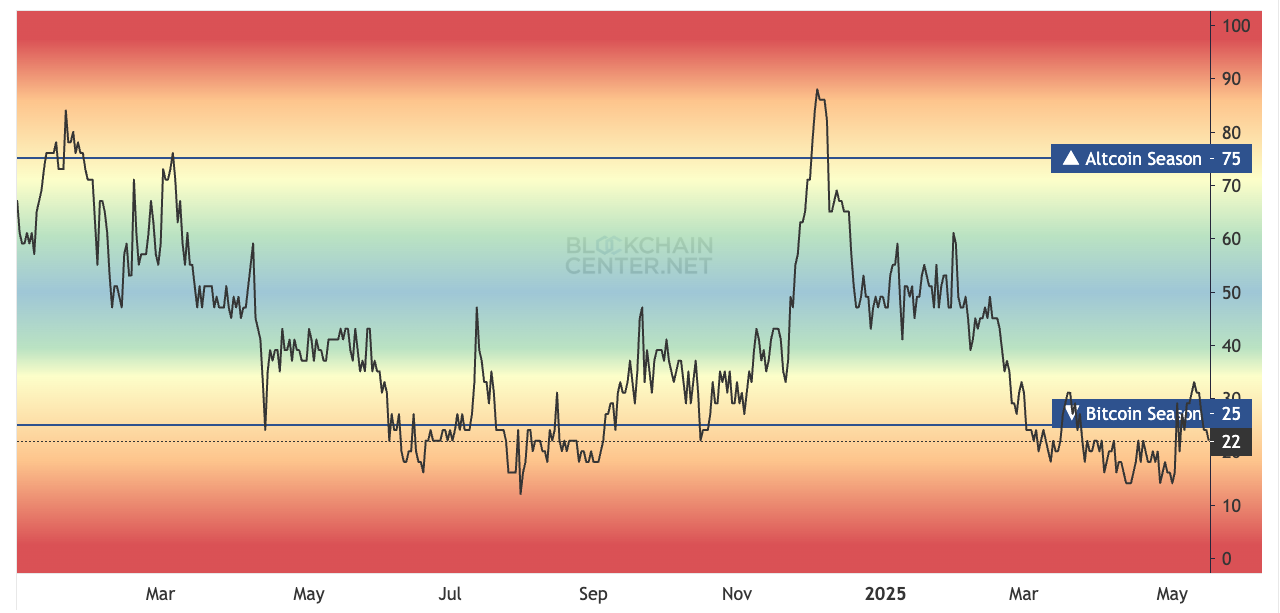

altseason has not yet: the index is still at low

Another important indicator is the Altsease Index, which measures the relative strength of alternative to Bitcoin. Currently, the index is still under 30 years old, indicating that the market has not yet entered the FOMO stage of tokens that are less than ETH. In previous cycles, the index usually had to exceed 75 to confirm that Altseason has indeed started.

Since Altseason is still absent, this shows that ETH as the leading representative – has not yet reached its final peak of joy in this cycle. This leaves room for ETH to continue to rise, but the market will need more time to rotate BTC’s capital to higher risk assets more clearly.

Source: Blockchain

It is particularly noteworthy that despite the recent strong rally of ETH, the Altseason index remains soft. Historically, such a powerful move in ETH will spark wider market enthusiasm and increase the index. The fact that this hasn’t happened yet shows that there is still huge unexplored potential in the altcoin market and that further upward momentum may occur as capital gradually rotates ETH.

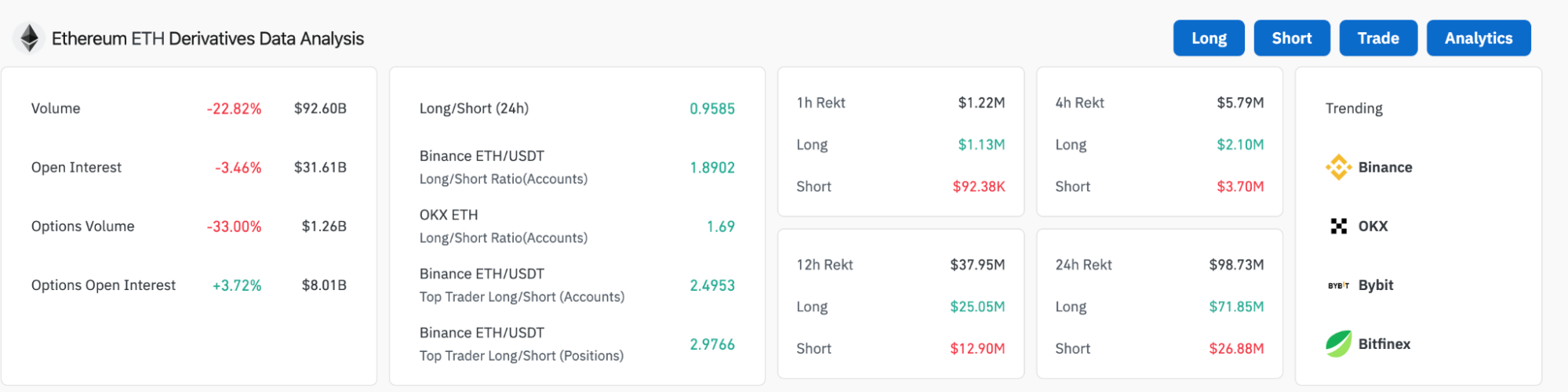

ETH shorts are no longer at record highs, has the market turned?

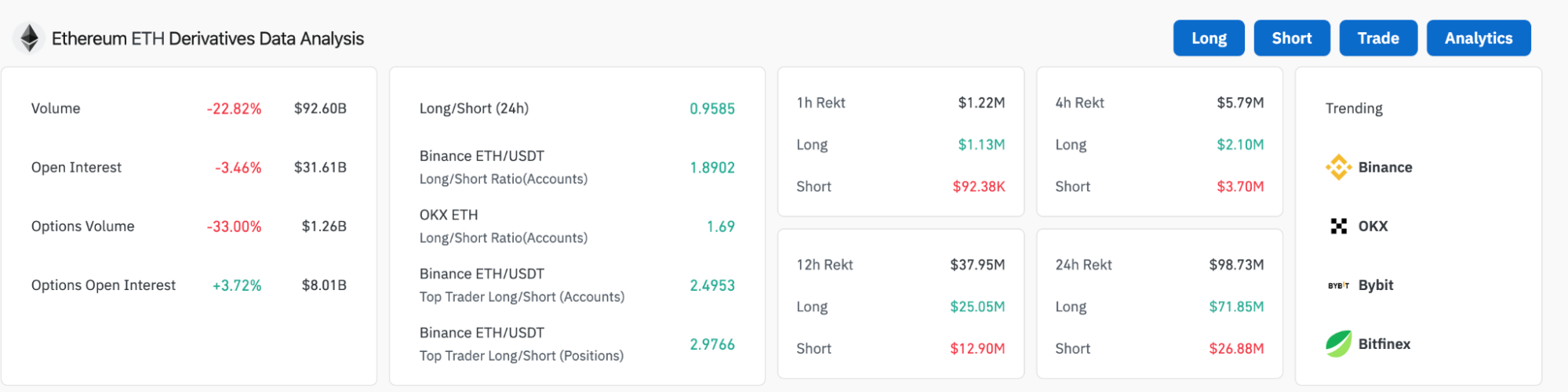

Data from Coinglass shows that Ethereum’s derivatives market positioning has undergone significant changes. The 24-hour long/short ratio is currently close to equilibrium (0.9585), while second-hand traders show a clear bias towards the long position of the nearly 3:1 ratio (2.9766).

In addition, over the past 24 hours, the total short-volume liquidation volume reached US$26.88 million, while the long-volume liquidation was significantly higher than US$71.85 million. In fact, the short-term positioning is weaker than February 2025, and it has soared more than 500% since November of the previous year.

This suggests that institutional participants may gradually abandon the bearish short-term outlook and instead wait for a stronger signal to confirm the continued bullish trend of ETH. The current market seems to be in the stage of positioning and recalibration, rather than another large shortwave.

Source: Xiaodian

Ethereum’s potential leading trend is still waiting to be activated

Ethereum remains the foundation platform for many of the most promising trends in this new cycle, including:

- recover: With the growth of Character, Carac and other re-engineering agreements, ETH has become an asset that can provide holders with multi-tiered value.

- Level 2: Networks such as arbitration, optimism, foundations and others continue to expand, reducing gas bills and improving accessibility to retail users.

- Next generation defi: Protocols such as Ethena, Pendle and Gearbox are recovering decentralized financing through innovative strategies, especially those that integrate LSD (liquid content derivatives).

- aldult: While not explosive yet, tokens like pepe, mog and ai-driph characters (like cookies or paal) (on Ethereum) are starting to attract speculative capital.

But what these trends have in common is that no one really explodes to the point where the entire ecosystem is elevated. This reinforces the idea that ETH is still in the final accumulation stage of the mid-term cycle, rather than reaching the top of the cycle.

in conclusion

The recent ETH price increase is a positive sign, but they are not enough to confirm that Ethereum’s growth cycle has reached its peak. ETH may still be in its pre-breaking phase due to low gas expenses, weaker Altseason index, silent ecosystem activity, and growth in institutional short-term locations.

This means that long-term investors may still have the opportunity to accumulate ETH at reasonable prices before they can really improve. At the same time, since the market is not fully “mature” in the current rally stage, we must act cautiously.

Once trends like Restaking, Tier 2 or Next Generation Defi get more power, and retail capital flows in, that’s when ETH can enter the real acceleration phase. In this case, $2,500 today may just be a temporary stop on a longer journey in the 2025 cycle.

Read more: Trading with free encrypted signals in the Evening Trader Channel