Milkyway is a liquid-containing protocol from Celestia, a modular blockchain that specializes in data availability.

The project has not released detailed token studies, but the team recently announced the supply of 100 million milk to the community (10% of the total supply).

Due to the lack of complete information on the distribution mechanism, price analysis must rely primarily on a fully diluted valuation (FDV), that is, assuming that all supply and various price situations are checked.

Read more: Binance Wallet hosts Milkyway TGE on Pancakeswap

How does the generator work? Differentiation through celestia-native liquid evaporation model

Milkyway enables users to place and receive Milktia, a liquid containing token (LST) that can be used in a variety of Defi applications. Users can trade Milktia to use it as liquidity or reinvest, providing maximum flexibility. Milkyway’s core technology stack includes:

-

Built-in reproduction module:Milkyway can go beyond simple wins by allowing users to re-place their TIA into other security services in the Celestia ecosystem or eventually into other modular chains.

-

Verifier abstraction: Protocol design eliminates the need for users to manually select validators. Instead, the system will automatically optimize the performance and security of the validator, similar to Lido’s approach.

-

Celestia local architecture: Unlike the multi-bond combination protocol, Mirki directly utilizes Celestia’s data availability and modular execution layer. This allows the deployment of lightweight, gas-efficient Defi modules.

-

Modular first design: Milkyway aims to be the default stack infrastructure for summaries using Celestia as the DA layer – just as Eigenlayer becomes the secondary security layer for the Ethereum L2 ecosystem.

Milkyway’s technical advantage is that it is seamlessly integrated into a modular stack, providing not only a stacking amount, but also a middleware placement layer where existing, re-device, DA and security services can all run flexibly across layers. If Celestia’s summary ecosystem continues to expand, the limited company will become the basic component, not just “put into Dapp”, but the core fixed middleware for modular Web3 World.

Funding Source and Estimated Token Learning

Milkyway has raised about $6 million in its funding round so far. The April 2024 seed round raised $5 million, with $5 million raised by Binance Labs, Polychain Capital and other investors such as HackVC, Longhash and Crypto.com Capital.

Milkyway has not released its official token learning yet. However, based on the announced airdrop of 100 million milk, which accounts for 10% of the total supply, it can be inferred that the maximum supply will be about 1 billion marks.

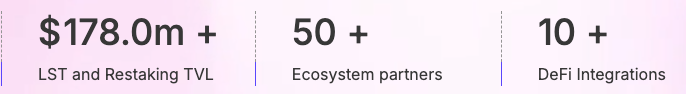

According to the latest data from the official Milkyway page, the total value of assets placed and rested through the platform is approximately $172 million.

Currently, the price of TIA is about $2.94, with an estimated amount of 58.5 million tokens stored.

Source: Milky

This shows a relatively strong and active participation from the Celestia and Milkyway communities.

Price analysis based on FDV scheme

The starting point assumes the total supply is 1 billion milk tokens. In this case, the token price and FDV have a linear relationship:

FDV = Total token power supply × price.

Conservative scene

FDV ≈50 million USD (price ~$0.05). At this price point, the value of milk only accounts for 15% of the initial milk FDV at the list.

This can happen if the market becomes cautious, or there is strong sales pressure. However, this is considered the most conservative and lower case for Milky.

Basic situation

FDV ≈$10-200 million USD (price ~$0.10-0.20). In this case, milk will trade around $0.10-0.20, in line with Kerneldao’s current FDV (about $180 million).

This is a reasonable baseline scenario that roughly matches Milkyway’s goal of liquid storage/reproduction projects such as Kerneldao.

If the milk reaches about $0.10 (FDV ~ $100 million), it will be considered “undervalued” compared to Kerneldao.

At about $0.20 (FDV ~ $200 million), it would be slightly higher, but it would still be acceptable if Mirki attracts healthy liquidity inflows.

Bull case

FDV≈$700+ million. To achieve this will require a lot of catalysts, such as major exchange lists and extreme speculative sentiment, rather than how ATH valuations have ever been achieved.

However, this also means that early selling pressure is high, which may lead to Milky’s FDV recovering to the current levels of Cornerdo.

The fair price range for milk may be between $0.10 and $0.30 (FDV ~ $10-$300 million), about the lineup or slightly higher than Kerneldao.

If there is an unexpected, highly bullish catalyst, only expected to be above $0.50.

Investors should closely monitor key metrics such as TGE’s circular supply, unlocking timelines, and token distribution between teams and community finance departments to better evaluate realistic valuations.

Comparison with Kerneldao and others

Coneldo

Comparing milk with other projects in the same department in the BNB chain helps to locate its relative potential. A good example here is Kerneldao (Kernel) – a recent TGE liquid remediation scheme supported by Binance Labs. The total supply of the kernel is 1 billion tokens, and the current FDV is about $179-18 million.

At the time of listing (April 14, 2025), only about 16.23% of the tokens were in circulation, with a price of $0.32 and the initial FDV was $320 million. The Kernel team raised about $10 million in several funding matches, including Binance Labs and other major investment funds.

In terms of scale, Kerneldao has grown significantly: They set up a $40 million ecosystem fund to support the development of the BNB chain’s reproduction project and reached a total value lockdown (TVL) of over $1.7 billion.

Source: Defillama

This highlights the enormous appeal of the strong capital appeal of the reproduction sector and kernel. As a result, the kernel holds about $180 million in FDV while managing billions of dollars in assets.

Meanwhile, Milkyway currently stores TIA worth less than $10 million in its platform. If Milk’s FDV exceeds the kernel range, which means about $15,000 to $200 million, it will need to attract more capital or rapidly increase its TVL to justify the valuation.

In terms of fundraising, Milky raised $5 million (seed round), down from the core’s $10 million, but still has Binance Lab’s support.

The kernel has a stronger base at launch, with its $180 million FDV converted to $0.20/token, which may look a bit overvalued and requires rapid expansion of its fixed assets to justify the valuation. Current TVL and fundraising levels show that Mirki must prioritize growth.

Pufferfish and swelling

Both Puffer and Swell are liquid re-recovery programs that run in the same stack/re-carry department as Milkyway. These two cases are related comparisons, as they both performed TGEs at the same time as Milkyway and Kerneldao.

At the time of its launch, Puff was launched at $0.53, equivalent to about $530 million in FDV. However, in just two weeks, the price fell by more than 68%. Similarly, Swell launched with a $300 million FDV, and its price fell by 55-60% shortly afterward, reflecting fierce post-launch sales pressure and a “low buoyancy FDV” structure.

Kerneldao’s FDV is $1.8 billion, but only about 16% of the tokens in circulation, followed this trend – its price dropped to around $0.17, losing nearly 80% of its initial value.

In this case, if milk (milk) is launched at a significantly lower FDV (about $10-300 million), it may be enjoyed with better price stability and buffered listings, which is $0.1-0.3.

However, given the current market model, investors should be cautious during the TGE phase, especially since Milkyway has not released its full token science and still locks up a large portion of the supply.

in conclusion

Based on the overall analysis, assuming that the market remains stable without a significant negative shock, the initial price of a milk token may be in the range of $0.10 to $0.30 (FDV of $10-300 million).

In the long run, Milky must prove its value by adding TVL (Staging Tia), expanding DEFI integration and increasing liquidity.

Current trends in the BNB chain focus on reproduction/LST and large liquidity support programs, providing a favorable environment for Staking-related projects such as Milkyway.

But in order for the price of milk to achieve sustainable long-term growth, the project must go beyond competitive solutions, especially Kerneldao, which already has a large ecosystem fund and a huge TVL advantage.

Read more: Could Grass be the next item listed on binary?