As we approach mid-2025, the convergence of macroeconomic indicators, institutional participation and technical signals has aroused optimistic interest among market observers. Can we be at the forefront of the next major encryption upgrade trend?

Macroeconomic factors shape market sentiment

One of the key drivers that may turn toward an upward trend is the evolving macroeconomic landscape. The latest signal from the Federal Reserve shows that a potential pause or drop in interest rates is intended to stabilize the economy’s efforts to cope with high inflation and volatility growth patterns.

Traditionally, lower interest rates have incentivized investors to seek risky assets, including cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), to push liquidity to these markets.

Further positive sentiment is a shift in global regulatory attitudes. It is worth noting that regulatory clarity in major economies such as the United States and Europe has gradually improved.

Recent developments, such as the US Securities and Exchange Commission’s (SEC) clear crypto assets guide and the EU’s market for the implementation of the crypto assets (MICA) framework, provide a stronger foundation for institutional capital inflows, reducing uncertainty and promoting confidence among retail investors.

Institutional Interest: Rising Catalysts

Institutional investment has repeatedly proven to be an important indicator of the upcoming market trends. Institutional interest increased significantly in the first half of 2025, characterized by increased investments such as asset management giants.

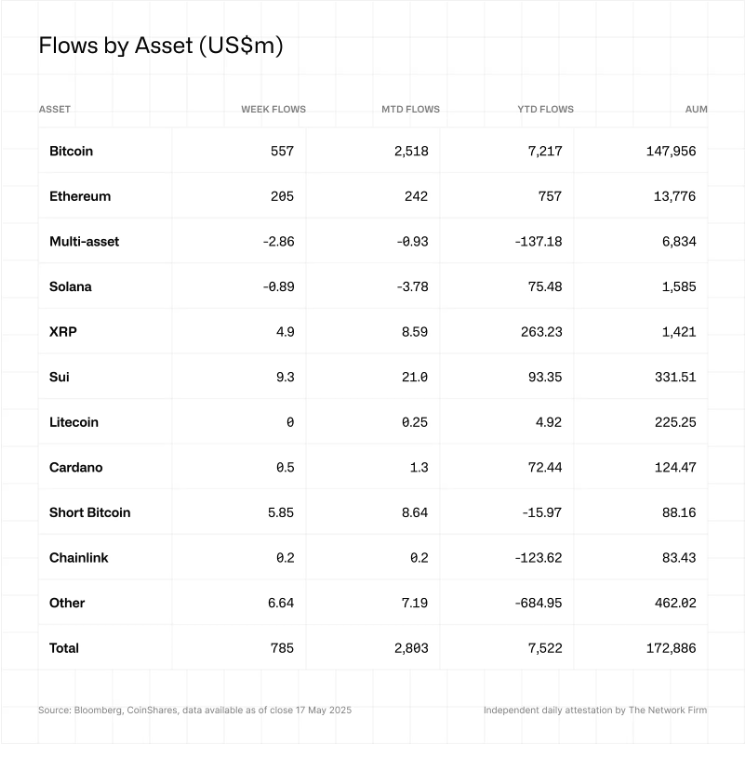

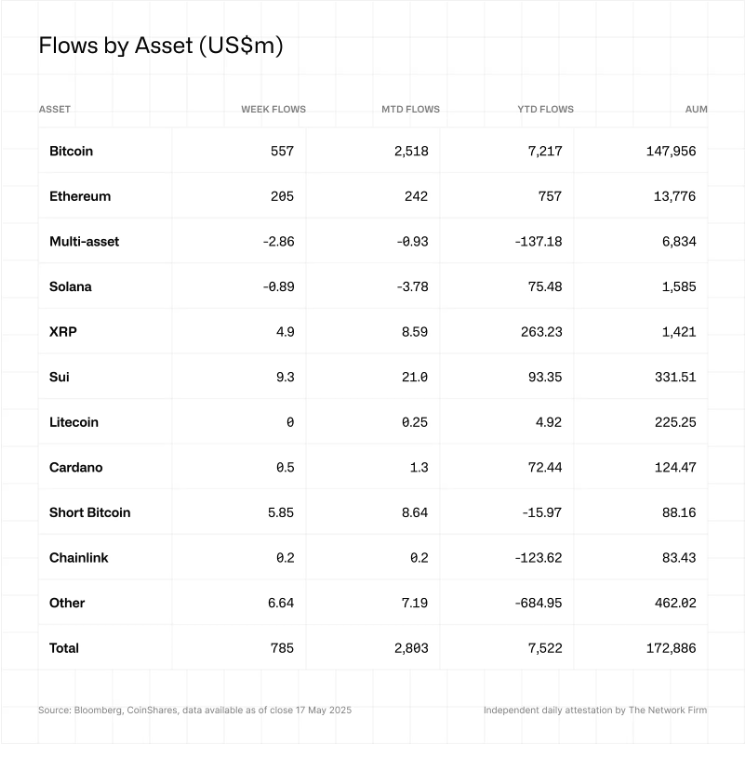

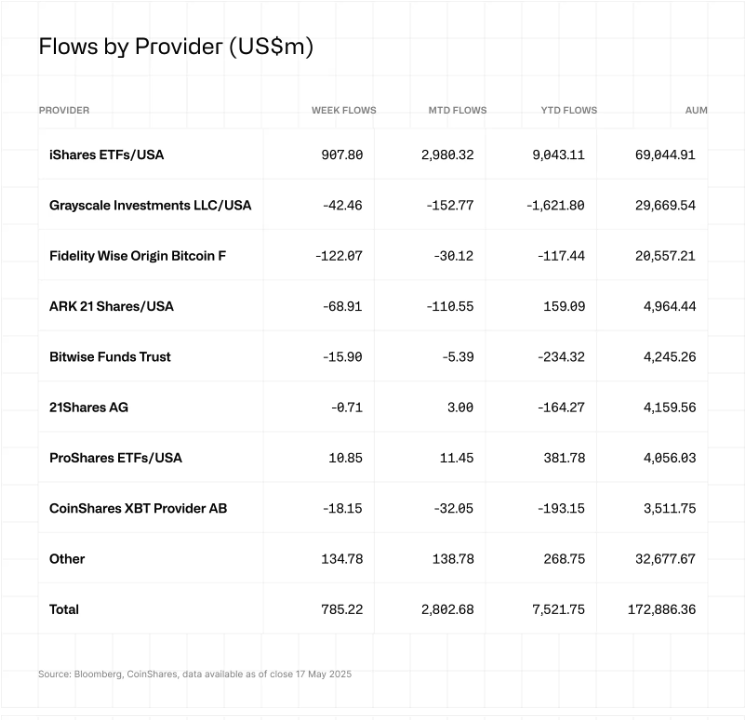

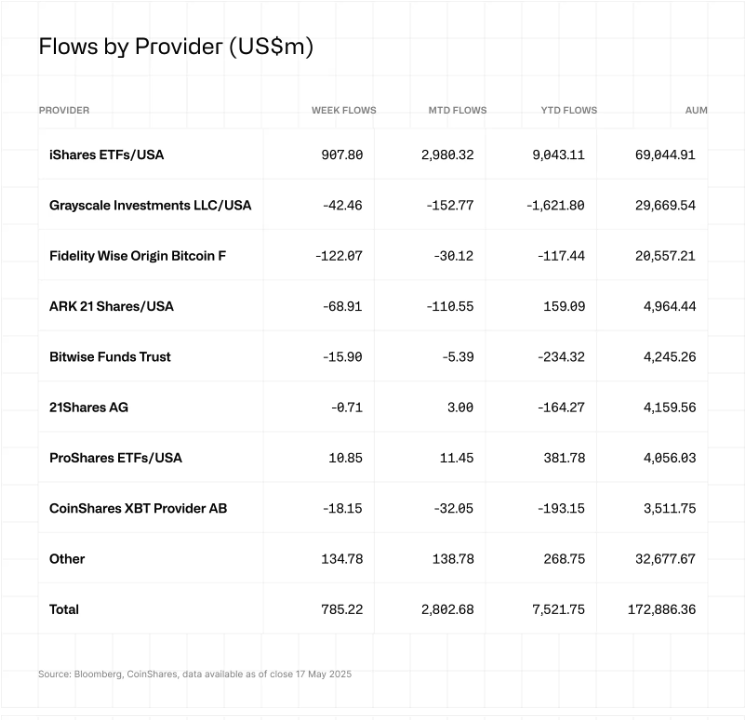

Coinshares’ latest data suggests that institutional crypto products will attract more than $4 billion inflows in the first half of 2025 alone, reflecting confidence in the long-term viability of hedging tools and strategic portfolio assets.

Source: Coinshares

In addition, the approval of several Bitcoin Spot Exchange Trade Funds (ETFs) around the world has strengthened market confidence. In the United States, the recognition of the long-awaited Bitcoin field ETF by famous financial institutions including BlackRock and Fidelity marks a key turning point.

Following approval, these ETFs’ assets under management (AUM) quickly exceeded $10 billion in the first month, highlighting strong institutional demand. The release of ETFs greatly reduces entry barriers to traditional investors, thereby directly, regulated Bitcoin price changes, thus greatly expanding potential market participation.

Money is quietly back – but not everyone sees it

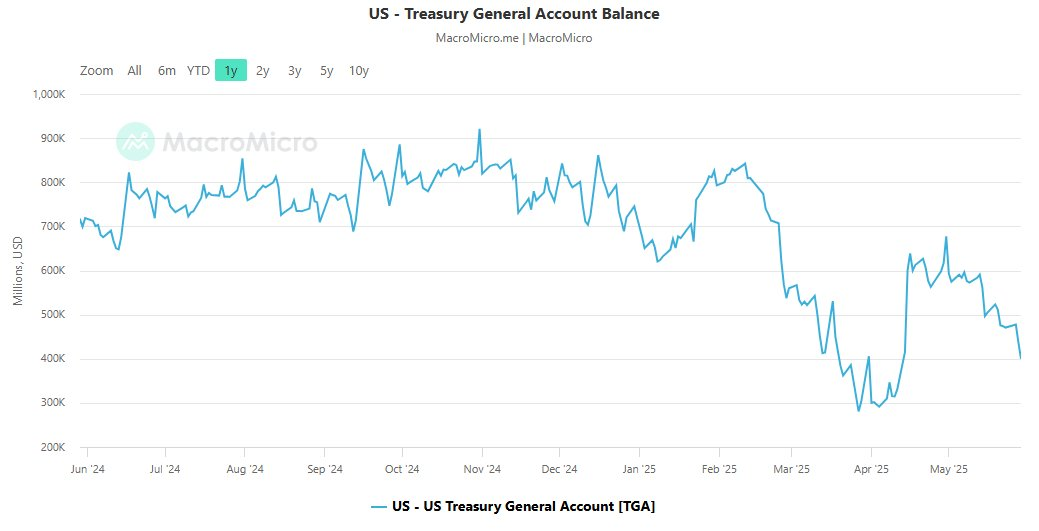

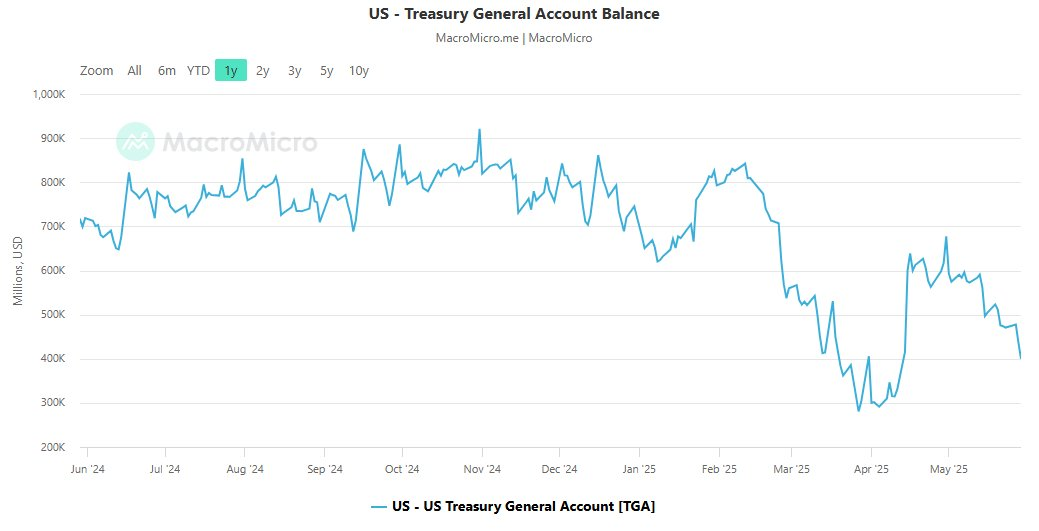

Interestingly, despite the Fed’s continued cautious remarks about monetary easing, subtle signals suggest liquidity is quietly returning to global markets. In the U.S., the Treasury General Account (TGA) has returned $500 billion in commercial banks, the result of fiscal spending during debt ceiling negotiations.

Even without clear quantitative easing (QE), this indirect liquidity injection significantly improves market liquidity.

Source: Macromicro

China has also secretly enhanced liquidity by reducing the reserve ratio, expanding corporate credit lines and cleverly depreciating the gold that depreciates the RMB.

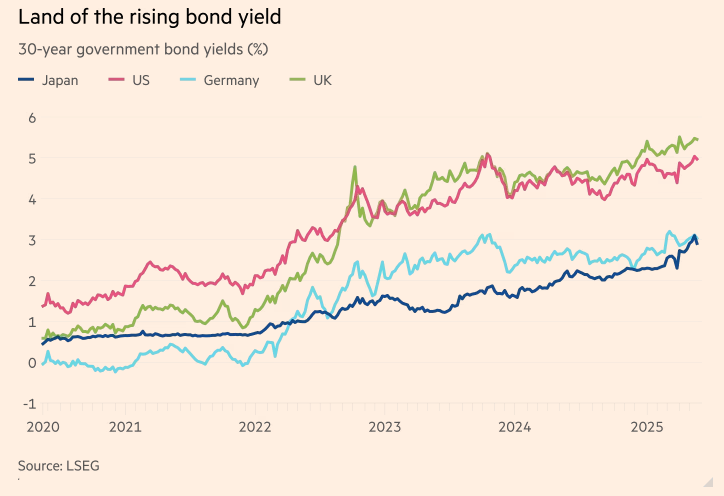

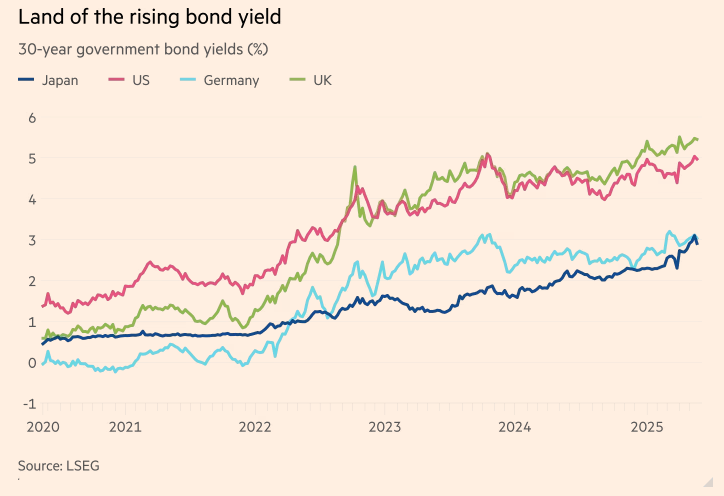

Similarly, Europe and Japan have quietly interfered in the bond and money markets through repurchase operations and bond repurchases and indirectly restored market liquidity.

Source: LSEG

Crossborder Capital CEO Michael Howell believes that the shift is structural rather than cyclical, pointing to continuous liquid flows. Historical models show that such liquidity was initially targeted at low-risk assets such as Bitcoin and then eventually dripped into high-risk advanced sales, repeating the pattern of previous market cycles.

Market sentiment and investor confidence

Investor sentiment is often a valuable pioneer in trend reversal or continuity. Latest data from blockchain analytics platforms such as Glass Festival and Santiment highlights a significant increase in the accumulation behavior of whales and institutional addresses, especially among Bitcoin and Ethereum Holdings.

Large investors who accumulated during price stability showed increased confidence in potential upward movements.

Source: Glass Festival

However, market sentiment remains different. Although bullish signals are obvious, retail investors’ caution continues due to recent volatility and historical reversals.

Social sentiment indicators indicate growing but cautious optimism, which suggests retail investors are waiting for more decisive bullish confirmation before investing further funds.

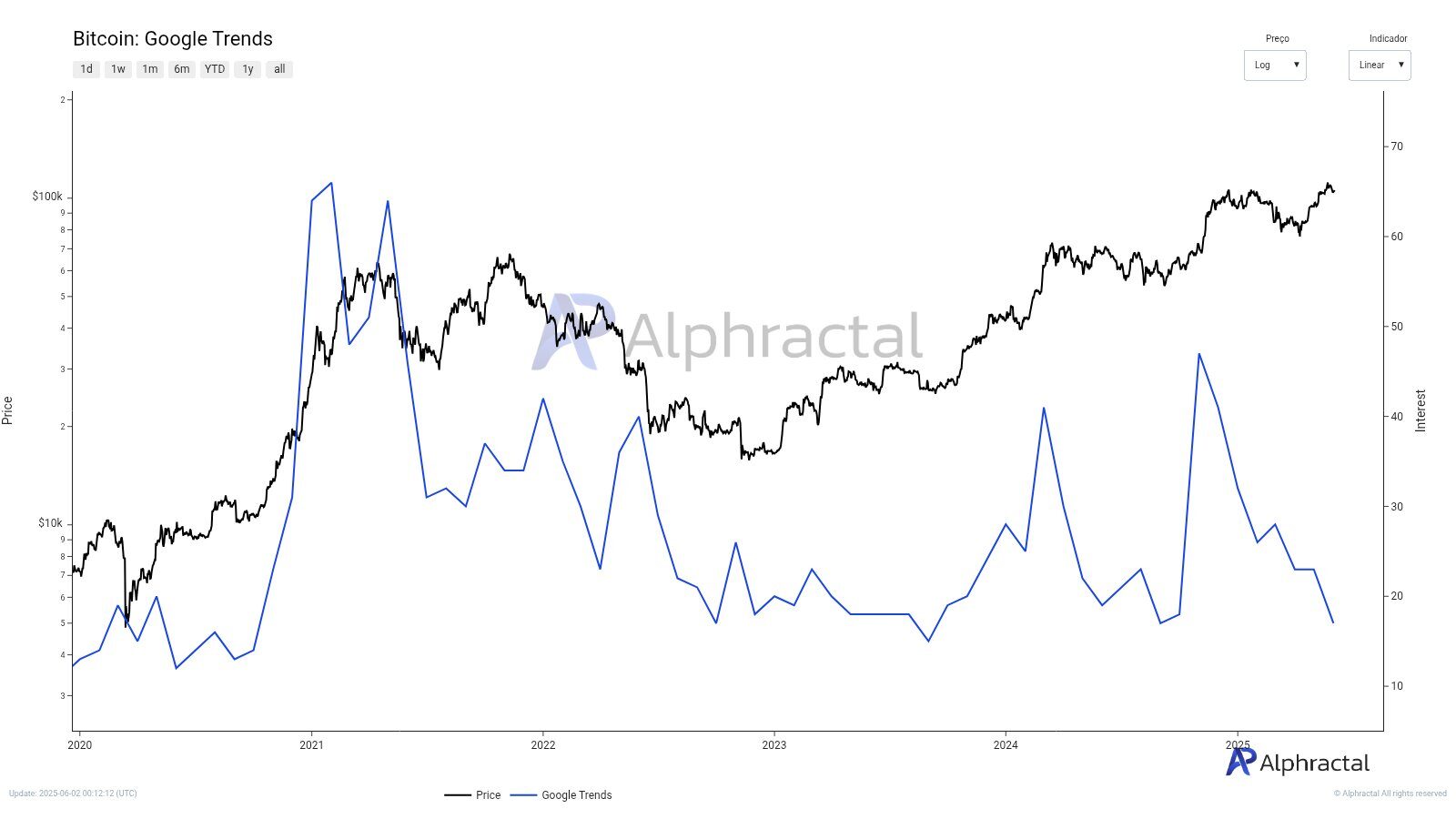

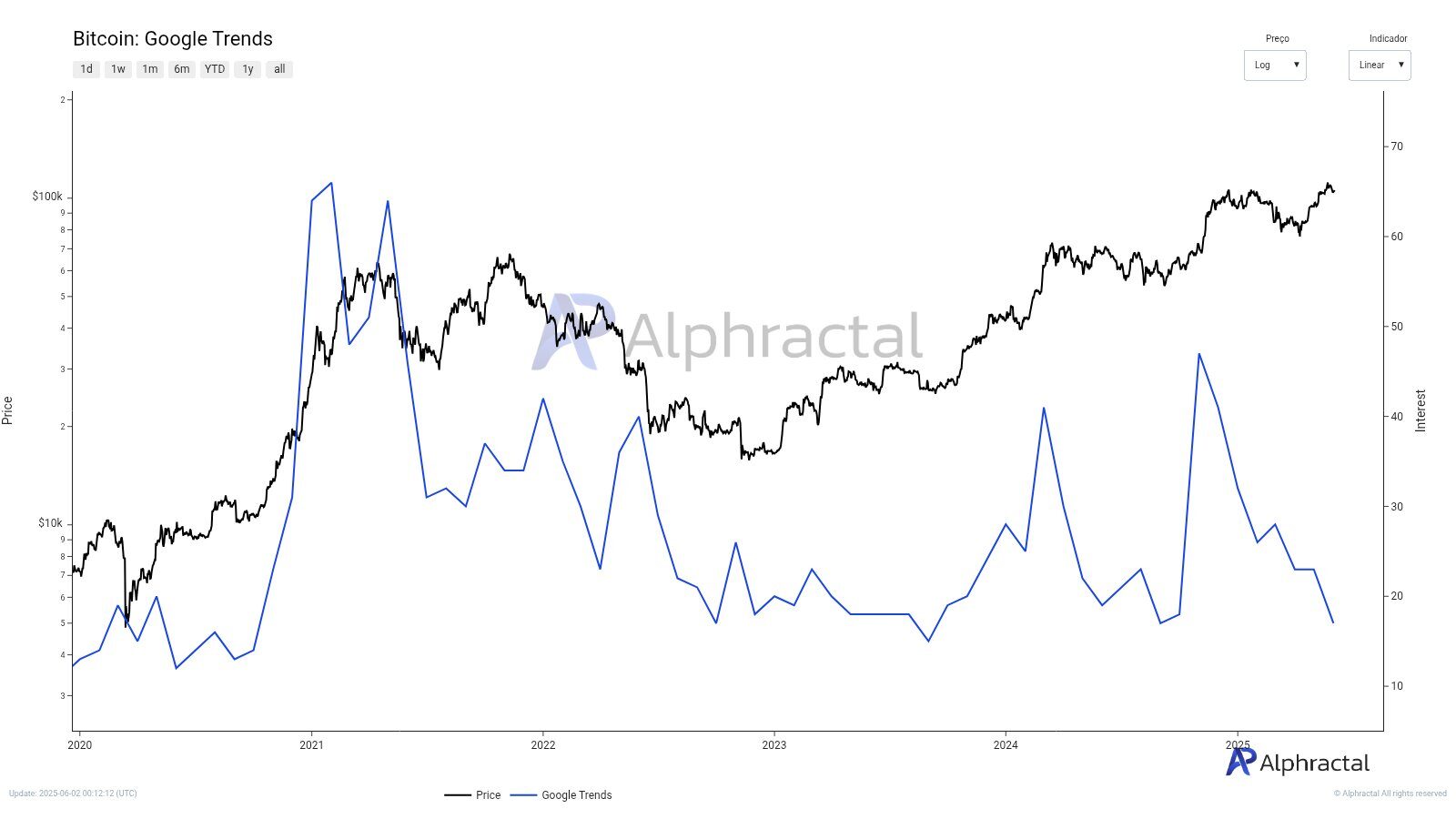

Interestingly, the latest data from Google Trends provides more insights into current market engagement levels. Google’s search for Bitcoin has dropped to 17 points – levels previously observed when Bitcoin traded at $54,000 (September 2024) and $26,000 (August 2023).

Source: Letters

Although Bitcoin is currently trading over $100,000, this matches the interest level at the bottom of the market by the end of 2022. Relatively low public search interest indicates a lack of adequate participation, which means that in the coming weeks, the market may need a lot of volatility to reignite the curiosity and interest of a wide range of investors.

in conclusion

Taking into account current macroeconomic factors, the convergence of institutional adoption, technical indicators and measuring investor sentiment, there is compelling evidence to support the potential outbreak of the upward trend in the cryptocurrency market. However, in view of historical market volatility and ongoing external risks, prudence remains recommended.

Investors are encouraged to closely monitor key indicators such as regulatory developments, institutional investment flows, and levels of technical support and resistance to make informed decisions. Despite the need for optimism, a comprehensive risk assessment is crucial to effectively navigate the complexity of the crypto market cycle.

Read more: Trading with free encrypted signals in the Evening Trader Channel