The People’s Bank of China added five tons of gold in March 2025 to a record 2,292 tons, while in February, Goldman Sachs secretly bought 50 tons. The whisper of an imminent trade war becomes even bigger as China dumps our treasury and stocks of gold. Will these developments shake the global financial order, and where is cryptocurrency amid chaos?

Shocking signs seem to be China’s support for the explosion of the trade war

China’s financial moves recently suggested preparing for economic turmoil in the form of a trade war.

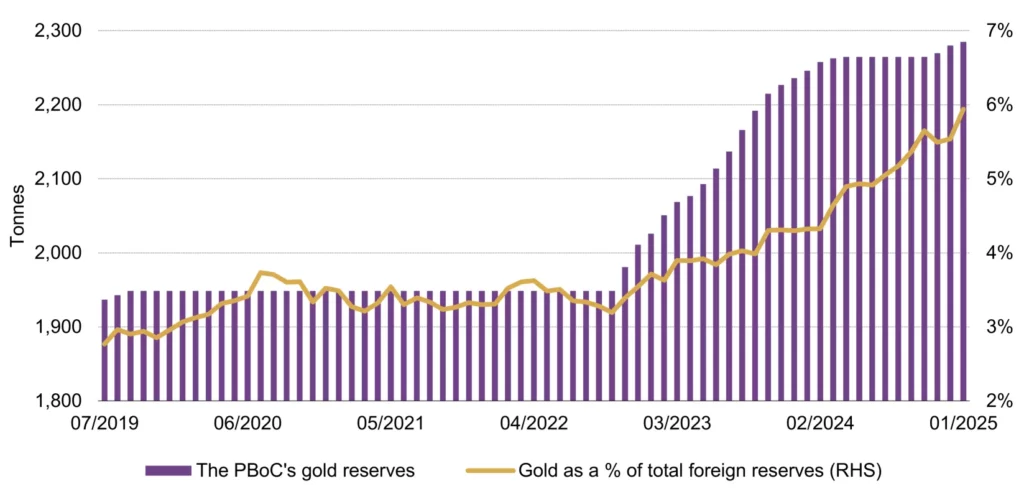

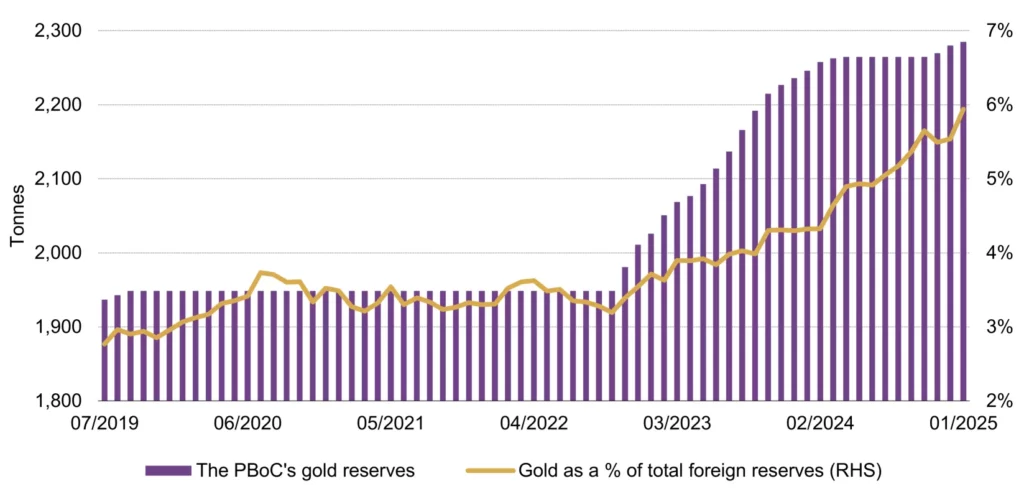

One of the most obvious signs is the country’s systematic reduction of U.S. Treasury stocks. According to FXStreet, China sold $22.7 billion in U.S. Treasury bonds in February alone, a move that raised questions about who would borrow the rave for the U.S. government as foreign investors like China took a step back. At the same time, China has been actively accumulating gold, and the central bank PBOC (People’s Bank of China) has increased its reserves by more than 300 tons since October 2022.

This trend in selling U.S. debt in storing gold shows intentional reliance on the U.S.-dominated financial system, possibly due to expected trade tariffs, sanctions or other economic retaliation.

PBOC reported its third consecutive monthly purchase of gold purchases in January – Source: Forex Management, World Gold Council

Another persuasive signal is China’s efforts to undermine the global hegemony of the dollar through gold. By accumulating gold, an asset that cannot be frozen or depreciated by foreign powers, China is positioning potential financial sanctions similar to assets imposed on Russia after the Ukraine conflict.

In addition, there are discussions about gold-backed BRICS currencies, which could challenge the dollar’s dominance in global trade. These actions show that China is preparing for a trade war and laying the foundation for a broader restructuring of the global financial order.

What does China’s bold move really mean to the world

China’s action tells a multifaceted strategy aimed at defense and crime in the global economy. Defensively, gold is a hedge against inflation, currency depreciation and geopolitical risks.

China’s gold accumulation helps protect its reserves from the erosion of weakened dollar, which may be due to escalating trade conflicts or wider economic instability. On the offensive, China seems to position the RMB as a viable alternative to the US dollar.

By increasing its gold reserves and potentially rematching the yuan to gold (even symbolic), China could make its currency more attractive to the global south and BRICS countries.

In addition, recent policy changes in China, such as allowing insurers to invest in gold, suggest domestic efforts to promote demand for gold. If expanded, this could lead to a demand for 500 tons of gold, further consolidating China’s control over the global gold market.

Cryptocurrencies are in a firefight – Will Bitcoin soar or collapse?

In this kind of economic turmoil, the crypto market, especially Bitcoin, is facing a critical juncture. According to Swan Bitcoin, global economic uncertainty (such as excessive debt levels, currency depreciation and geopolitical tensions) creates a favorable environment for Bitcoin.

As China and other countries reduce their dependence on the dollar, investors may increasingly turn to diversified assets, such as Bitcoin, as a hedge against the risk of the Fiat currency. Max Keizer’s prediction for Bitcoin to reach $200,000 in 2024 seems optimistic, but the basic logic remains: With trust in the swing of traditional financial systems, capital may flow to cryptocurrencies.

BTC has seen positive signals lately – Source: TradingView

However, the response in the crypto market may not be unified and positive. Bitcoin, commonly known as “digital gold”, may increase demand as a safe haven asset. On the other hand, smaller altcoins may face volatility. Regulatory uncertainty could lead to panic sales if the government responds to dynamics of transferring financial power.

Furthermore, if the trade war escalates, the sentiment of risk may initially detach investors from speculative assets, including alternative tokens, while favoring more established cryptocurrencies like Bitcoin.

Read more: JP Morgan: Investors prefer gold over Bitcoin

Capital inflows into cryptocurrencies may surge in the long run as countries and individuals seek alternatives to USD-based systems. BRICS currencies may even inspire stablecoins to create gold medals, thereby bridging traditional and digital financing. At present, the cryptocurrency market remains a speculative battlefield, with Bitcoin likely benefiting from uncertainty brought about by Chinese actions, while smaller tokens navigate through more turbulent waters.