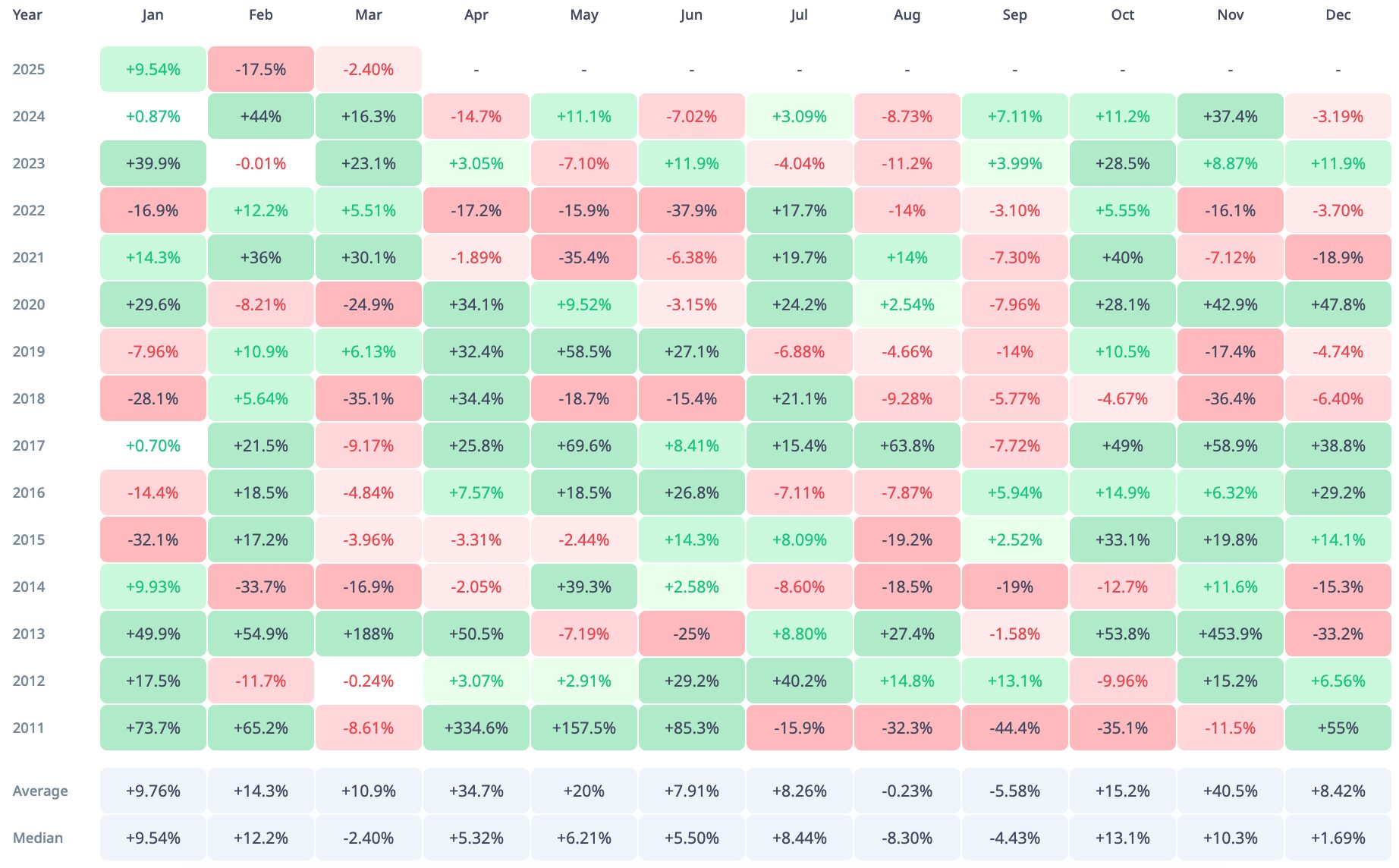

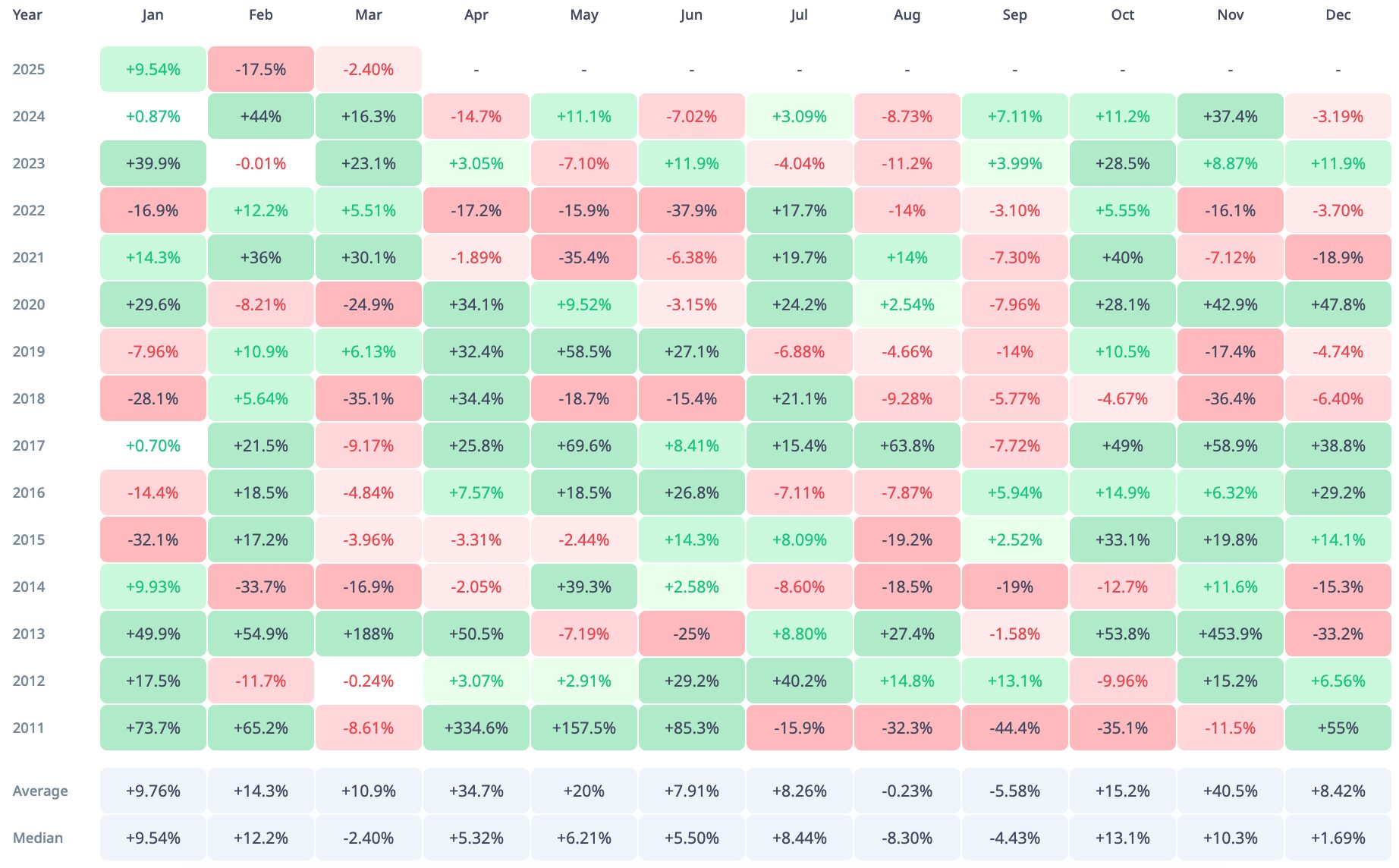

Historical data show that Bitcoin’s price usually increases by 12.98% on average in April. As a result, the cryptocurrency community often sees April as a particularly favorable and impressive month for Bitcoin – some humorously refer to it as “Upril.”

However, the market’s recent declines – despite multiple bullish developments, such as the new U.S. government stance on crypto-friendly, the recent Bitcoin halving and ETF approval, which has seriously undermined investor confidence. So many now question whether the market will truly rebound in April this year as historically expected.

April will be the focus of a new cycle

Looking deeper into historical data, Bitcoin’s average return rate in April was as high as 34.7%, second only to November. The evidence suggests that if investors buy bitcoin in late March or early April, they have a great chance of getting a considerable return.

Additionally, according to Cryptorank, the median Bitcoin return in April was about 5.32%, highlighting the possibility that the market will perform positively during this period.

Source: Cryptorank

Although using historical data to predict future market movements is not entirely accurate, periodic patterns remain an important indicator of crypto communities and the wider market.

“Seasonal factors are often unreliable. However, when combined with other market signals, historical data gains greater credibility.”

BlackRock CEO Larry Fink highlighted the debt burden facing the U.S. in his annual letter to investors, emphasizing that interest payments alone are now over $952 billion.

According to Fink, the U.S. may need to raise tariffs or corporate taxes to protect the strength of the dollar. However, such measures could damage confidence in the US dollar, pushing investors to assets like Bitcoin.

⚡️Larry Fink of Blackrock: If we can’t control our debt, the US dollar risk will lose the global reserve state. pic.twitter.com/kvwgcz61zs

– Bitcoin Archive (@btc_archive) March 31, 2025

Larry Fink recently revealed that major investment funds are actively considering allocating 2% to 5% of their portfolio to Bitcoin. Meanwhile, BlackRock Bitcoin ETF The impressive $50 billion inflow has been seen in just 15 months since its launch in January 2024, underlining strong demand from traditional financial institutions.

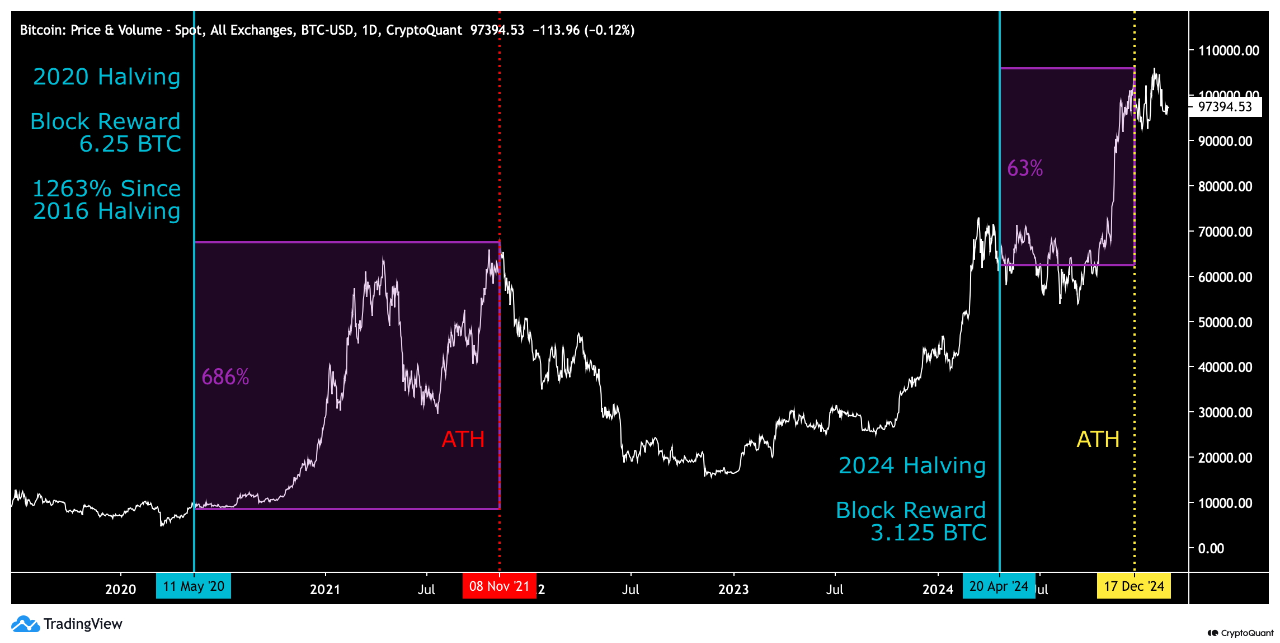

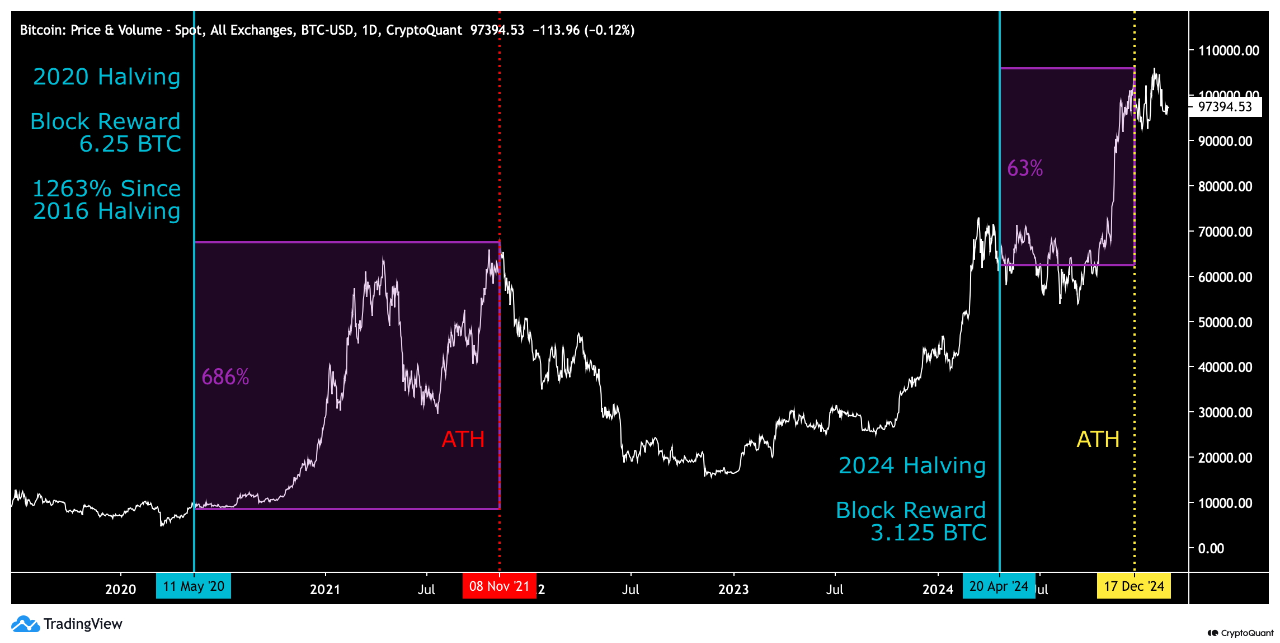

Additionally, the data on Bitcoin’s halving showed strong backup growth – including a 686% surge after the third halving. However, despite the recent halving, Bitcoin has only grown 63% – compared to the previous cycle, Bitcoin is modest. Therefore, several analytics companies and organizations including crypto and strategy show that BTC still has a lot of room for growth soon.

“Your lie in April”

Contrary to Larry Fink’s optimistic forecast, several experts urged caution. They suggest that the market outlook for April 2025 may not be as positive as expected.

According to Omkar Godbole, Bitcoin still maintains its bullish long-term outlook. However, the short-term risks of the MT.GOX situation continue to hit the market. Recently, the top of the mountain moved a large amount of Bitcoin to Kraken, which has raised concerns about liquidation and brought recent sales pressure to creditors.

Read more: POLMARKET: By April, most users bet on Bitcoin fell to $75k

If the impact of the MT.GOX case may negatively affect the sentiment of retail investors, it may escalate further. Arthur Hayes, former CEO of BITMEX, recently said that if the emergence of ETFs hits the key $30 billion threshold, the price of Bitcoin could plummet to around $70,000, an obvious indicator of widespread fear among retail and traditional investors.

GlassNode analysts respond to Hayes’ concernsstressing that a large amount of ETF outflows can indeed restore Bitcoin to $70,000.

Negative sentiment is becoming increasingly apparent among market participants, with some investors pointing out that the seasonal pattern is often referred to as “Selling in May.” Even if Bitcoin experienced substantial gains in April, it is still necessary to act cautiously.

The 2021 market cycle provides a historical precedent: Bitcoin’s price plummeted in May after reaching its peak in April. CryptoQuant analyst Oinonen also warned that early 2025 summers may see softer or longer correction periods as investors take advantage of previous months of earnings.

BTC may experience a short-term callback before preparing for a stronger rally – Source: Onionen.

Furthermore, bearish analysts highlighted the ongoing geopolitical tensions and global economic uncertainty as major threats. For example, Worry about escalating trade war between the United States and its international partners The first quarter ended after the new Washington administration proposed a proposal to raise higher tariffs.

These developments triggered a sharp “risk” sentiment. In the days ending March, the crypto city lockdown that would exceed $160 billion was eliminated.

If geopolitical tensions continue into April, Bitcoin’s recovery could stagnate as investors get rid of risk-taking assets.

in conclusion

The market outlook for the second quarter of 2025 remains complex. By the end of the first quarter, cryptocurrency was quickly corrected – Bitcoin fell nearly 15%, marking its worst first quarter since 2018.

The economic downturn was driven primarily by macro shocks, including inflation problems and panic sales triggered by proposed U.S. tariffs. However, as early April, some signs of optimism have begun to appear. The market is slowly “digrating” tariff concerns. Bitcoin exhibits elasticity, despite constant volatility, Bitcoin holds a range above the $85,000-$87,000 range.

This resilience and hope for a Fed policy shift are helping to restore investor confidence. Some believe that Q2 2025 may be similar to Q2 2019, when Bitcoin rebounded steadily from lows, a driving force behind new capital inflows.

Despite this, volatility is still high. Sudden economic or political events may change emotions. Now, most investors feel “cautiously optimistic”, which is full of confidence in long-term short-term risks.

Read more: A large number of tokens are unlocked this week in April.