The price of ETH has been like a stable price lately. 4 years ago, if you had invested $10,000 in Ethereum (ETH), you might expect a considerable return by now given the volatile reputation of the cryptocurrency market. However, as of March 31, 2025, the investment will hover around $10,000 to $11,000, reflecting the surprisingly lowest effect of ETH.

ETH’s modest fluctuations over the past 4 years

Back on March 31, 2021, the price of ETH is about $1,800. Fast forward to today, and it costs between $1,700 and $1,800, a trivial amount for four years. While ETH reached an all-time high of $4,878 in November 2021, it fell to about $1,000 in the 2022 bear market, just gradually returning to its current range.

Source: Coingecko

This roller coaster is in sharp contrast to other cryptocurrencies. Bitcoin BTCFor example, from $58,000 in 2021 to the peak of $109,000 in 2025, although it is now down to more than 30%, to around $82,000. Solana sol Soaring from $35 to $126 (+260%) while XRP XRP The results are different, but sometimes the ratio is better than ETH.

Going forward, the price of ETH usually reflects the trend of BTC. Historically, BTC dropped 30-50% after hitting ATH. During this period, BTC fell by about 25-30% after reaching $108,786 ATH in January 2025 to BTC today. In this case, some analysts predict that the price of BTC will drop further to $66,000. Then ETH can follow suit.

However, the ETH/BTC trading pair has also been greatly weakened, with BTC/ETH about equal to 45, indicating that ETH is constantly disconnected from the advantages of BTC. Furthermore, the recent Pectra update is unlike past upgrades such as Merge, which failed to elicit a positive price response, thus increasing the bearish outlook.

So if you invested $10,000 in ETH four years ago, you’re actually losing money this year.

Source: Coingecko

The price of ETH is stable

ETH’s bland performance can be traced back to wider economic fears and market dynamics. Traditional safe haven assets, such as gold, have hit record highs due to recession doubts. Since Trump took office earlier this year, gold has become the highest safe asset for investors, soaring to $3,122 an ounce amidst diplomatic tensions and an increasing global trade war. Or another option, BTC, cements its position as a “digital gold”, which is also a common way to retain assets for investors.

In contrast, the lack of strong enough use cases will lead to price stagnation. Investors hesitate to pour funds into assets in uncertain times, such as ETH or other digital assets.

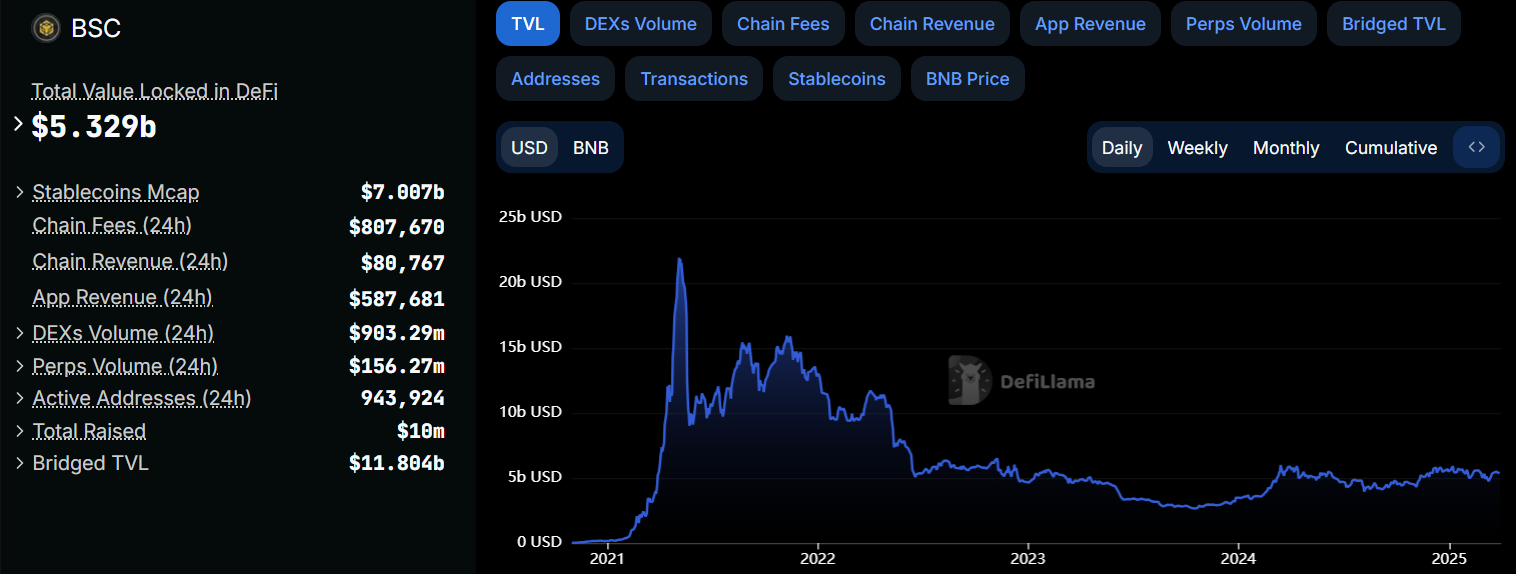

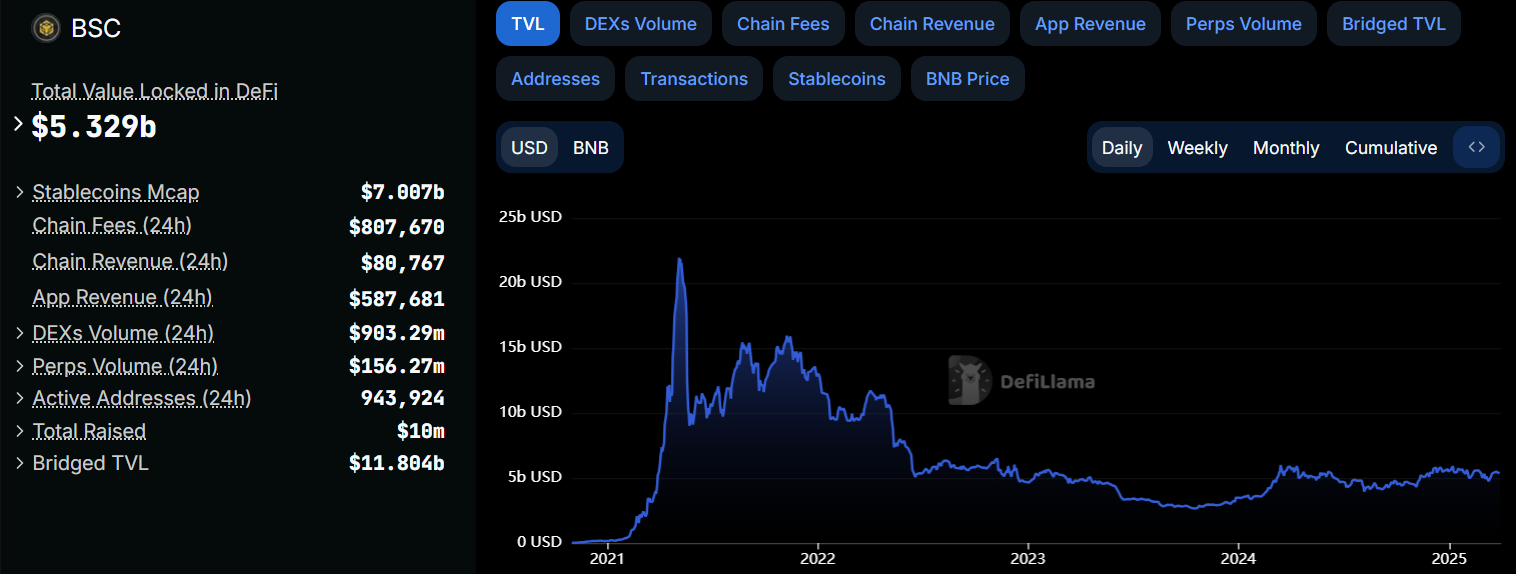

Meanwhile, competitors like Binance Coin (BNB) have grown through positive measures. BNB’s ecosystem has launched projects such as the Third Liquidity Program, CZ’s Memecoin Stimulus, and Wio and Binance Alpha. These efforts have allowed BNB’s price buoyancy to rise from $300 in 2021 to over $600 (100%+ gain) in 2025, while the total value of its chain’s chain is locked in (TVL) rival Ethereum’s competitor in Defi event.

Source: Defillama

In contrast, Ethereum lacks this dynamic catalyst. Despite being technically impressive, its upgrades did not translate into direct market excitement. Although the merger greatly reduces energy consumption, Pectra’s emphasis on increased scalability has not yet produced significant results.

Without the bold push similar to BNB’s multi-pronged strategy, or even Solana’s ruthless marketing of its high-speed blockchain, ETH remains in a dilemma, mimicking Stablecoin’s predictability rather than the volatility of growing assets. This inertia highlights a broader challenge: ETH’s maturity may be stifling its ability to compete with hungry competitors.

Read more: ETH suddenly drops to $1,900

Despite its shortcomings, ETH still has great potential

Even with these challenges, ETH remains the cornerstone of the crypto world. As the largest and most established Layer 1 blockchain, it has a robust community and a vast ecosystem including Layer 2 solutions and a wide range of applications. Driven by top developers and market-leading upgrades, its technology continues to lead the industry.

Beyond that, there are several rumors in the community that the real world of Ethereum is growing. For example, discussions surrounding ETH’s use in payments and its growing recognition suggest a promising future. Trump has had a huge impact on ETH, with 70% of his portfolio on BTC.

The banks have now greened to list ETH as green, and Blackrock has bet on their sole tokenized draft pick, indicating that Eth quietly won its victory. While the market may not reflect it now, the fundamentals of ETH (its scalability, developer activity and ecosystem strength) place it in long-term success. Patience can also bring rewards to ETH believers.

5/➮ Strangely, despite everything I mentioned, our Trump bought more ETH than BTC and held 70% of his portfolio

🕷 There is also a fact that banks are allowed to accumulate using ETH

🕷 and BlackRock, ETH has become the only option for…

– Symbiosis (@cryptosymbiiote) March 15, 2025