Initia aims to provide developers with a highly customized environment and provide native support for multiple virtual machines, including MoveVM, WasMVM, and EVM, and position it at the intersection of Layer 1 infrastructure and Layer 2 summary execution.

Supported by leading investors such as Binance Labs and Delphi Digital and exposed to Token Generation Activities (TGE), Initia has already grown through its two-tier architecture, active TestNet engagement, and growing speculation about former market trading platforms.

About the beginning

Initia is a layer 1 blockchain platform built on the Cosmos SDK, integrated with layer 2 rolling solutions to create an “interleaved” multi-key ecosystem.

The project attracted large venture capital firms such as Hack VC, Delphi Digital and Binance Labs. Its Series A Funding Tour evaluates the project at about $350 million.

Currently, Initia is preparing for its mainnet launch – expected to take place in early 2025, after the two successful test networks attracted 194,294 qualified users’ token Airdrop.

In addition, Initia announced that two major exchanges, Bybit, Kraken, Mexc, Gate.io… will list INIT tokens when their Token Generation Activity (TGE).

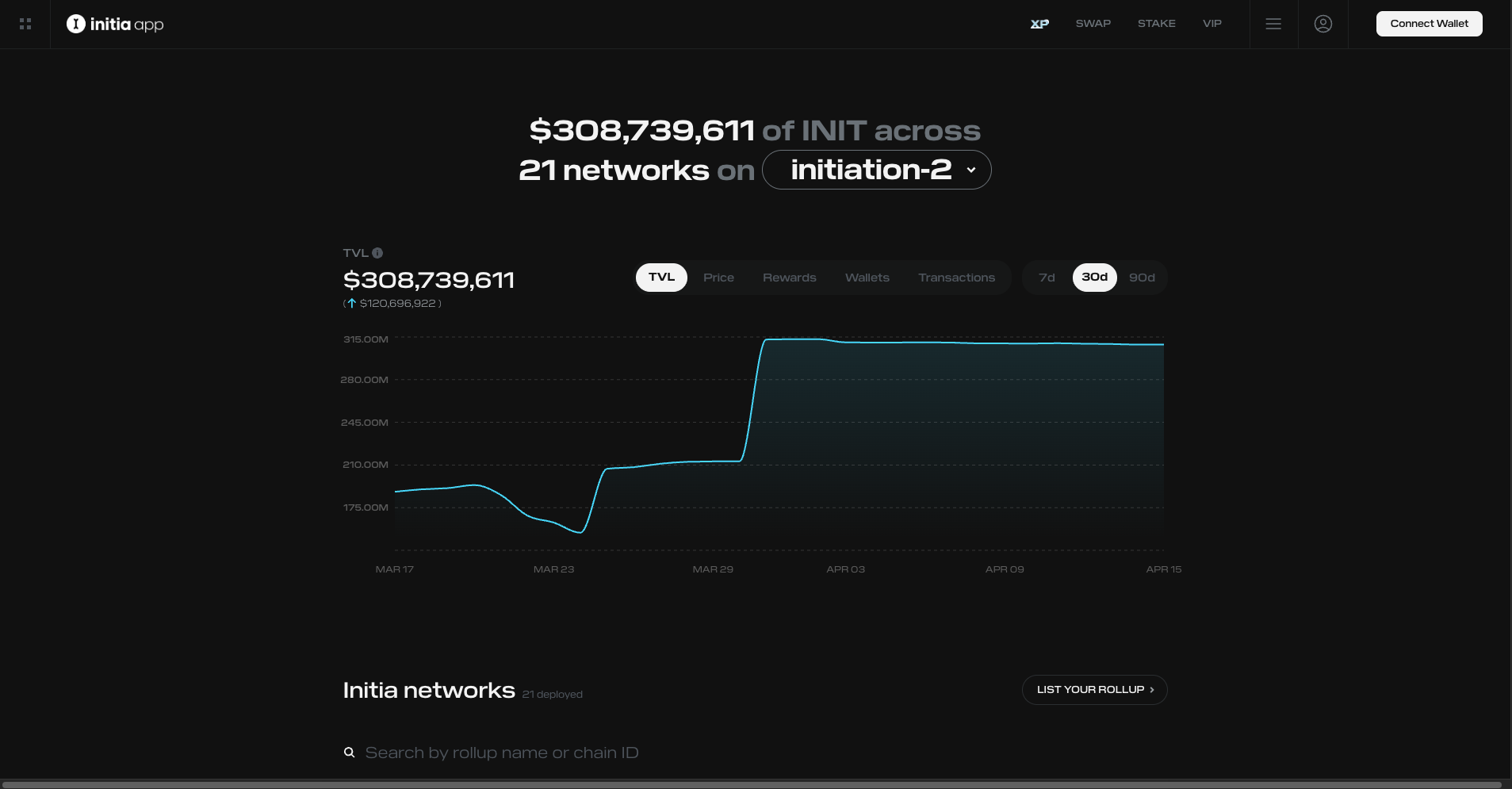

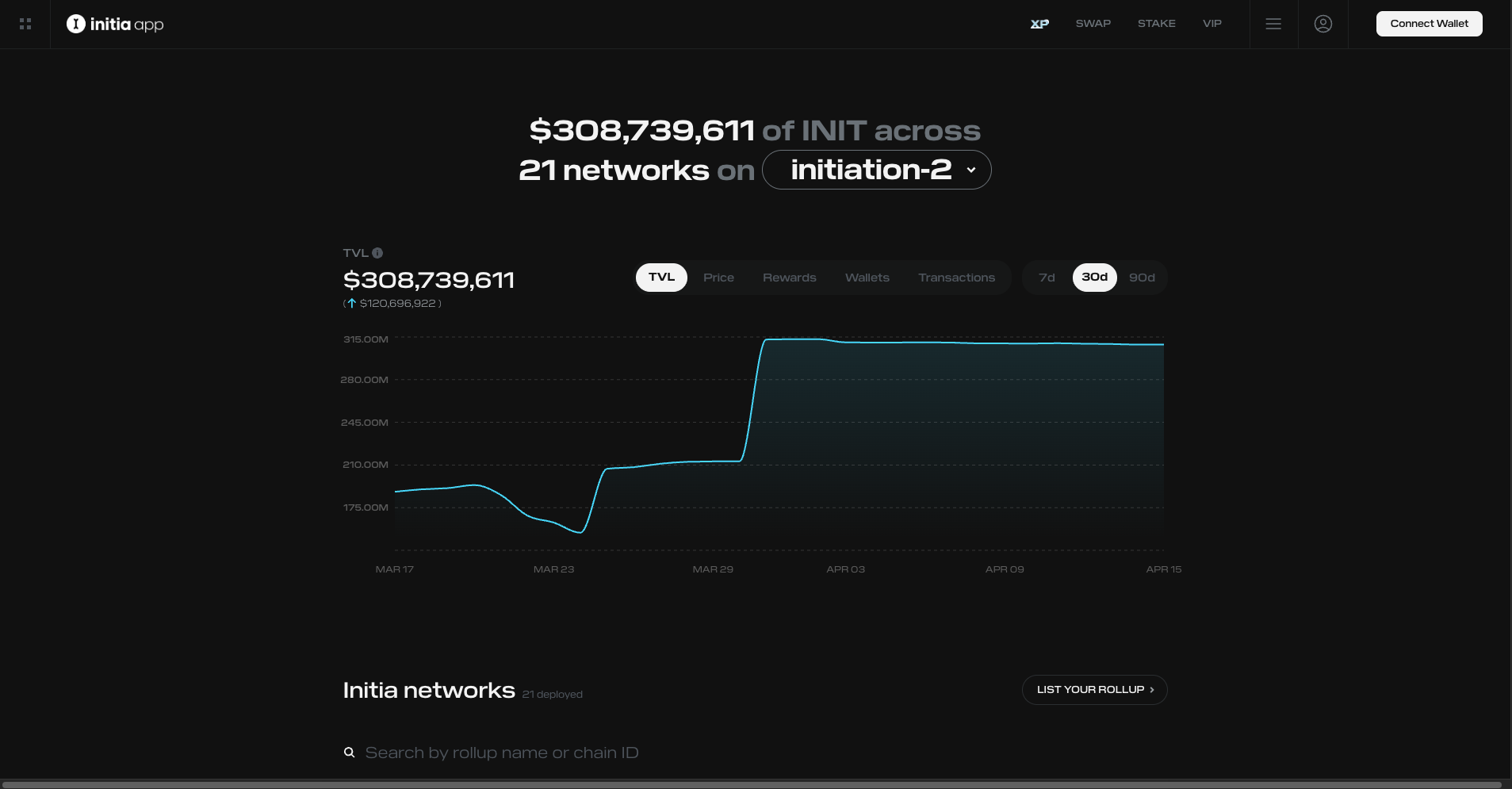

Indian Statistics – Source: India

Indian Token Studies

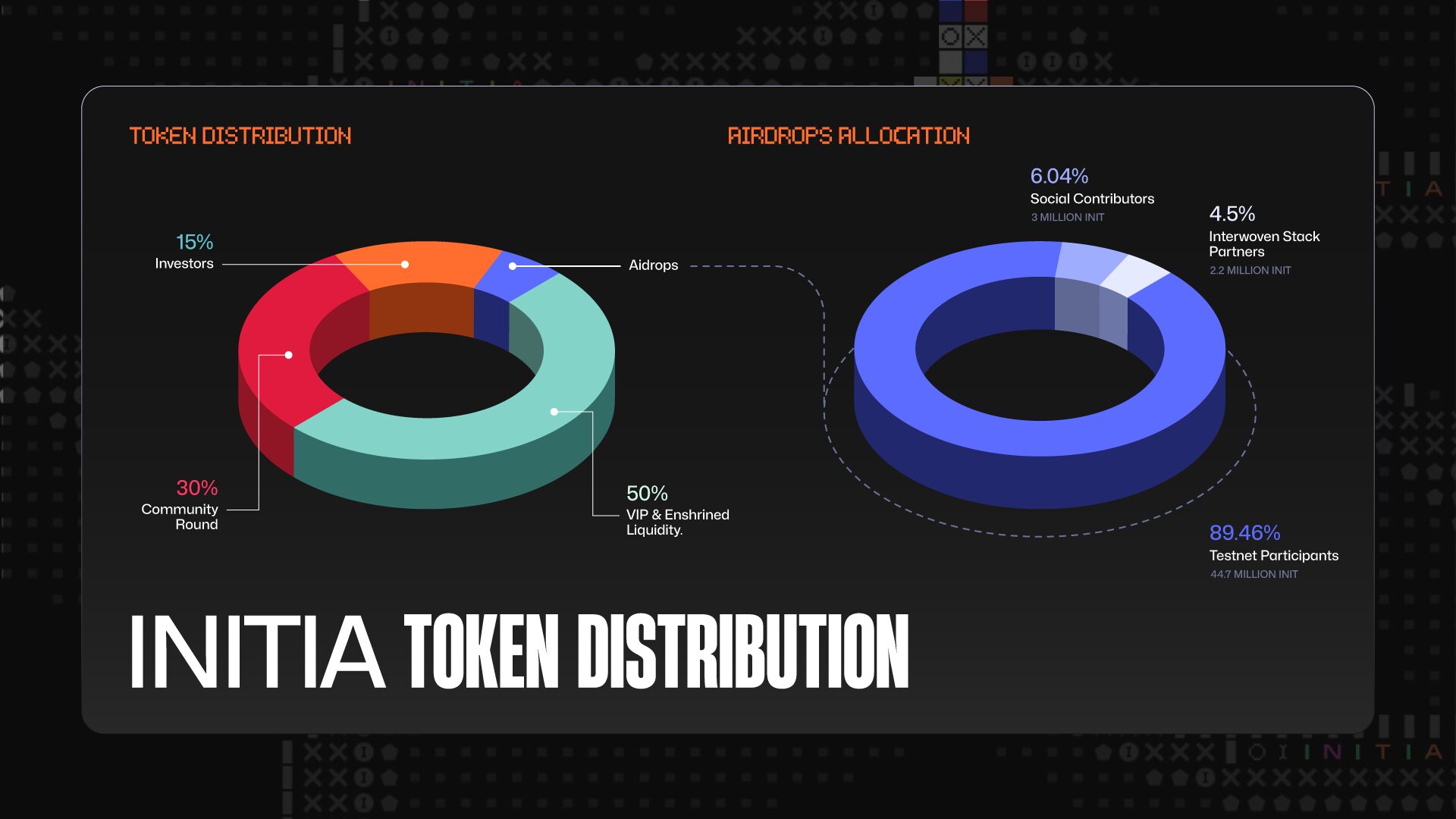

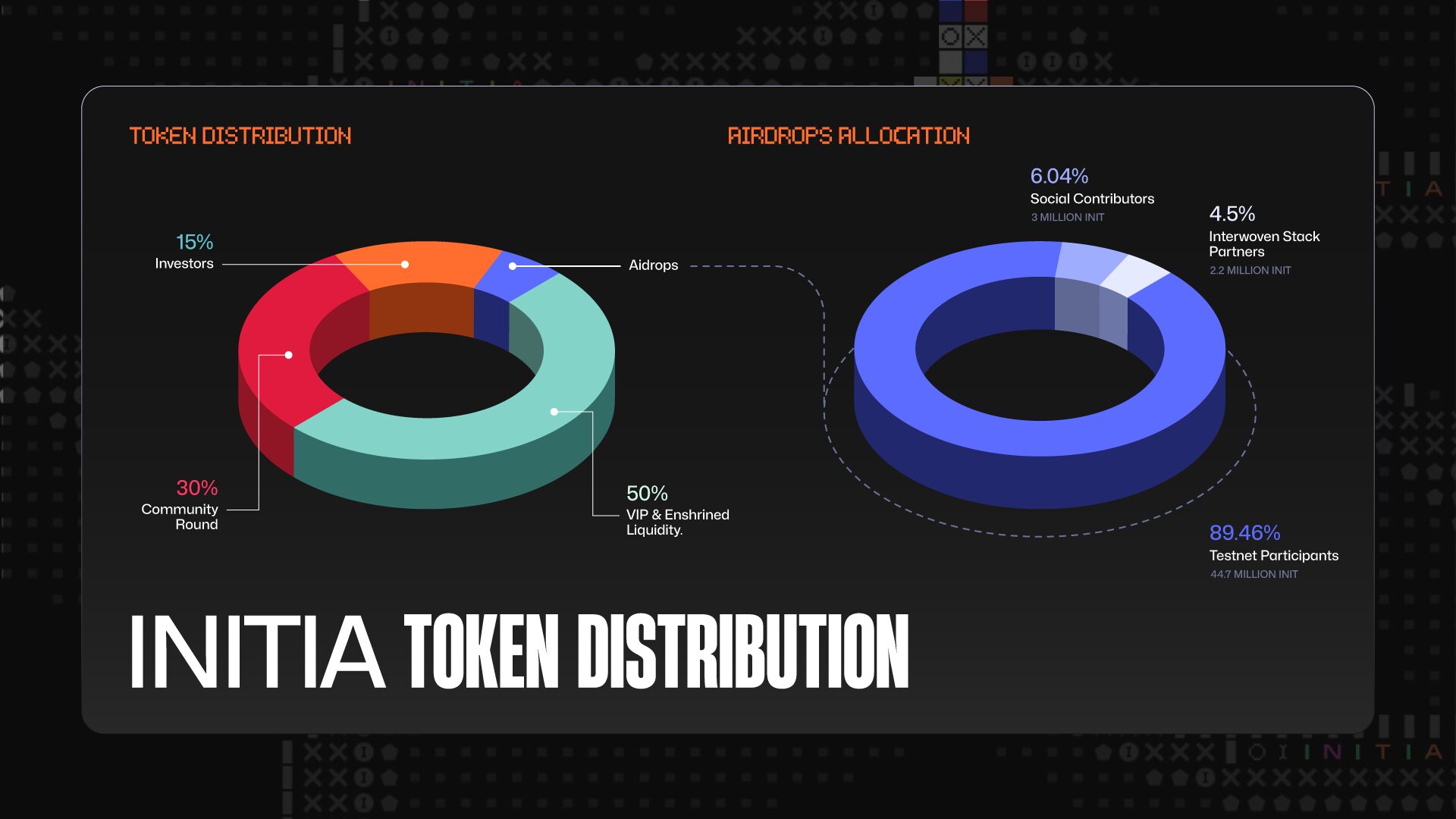

Token allocation

- VIP & Shrined: 50%

- Community Round: 30%

- Investors: 15%

- Airdrop: 5%

Initial allocation

Initialize air conditioner allocation

The team has allocated 5% of the total supply (equivalent to 50 million initial tokens) for airdrops, distributed in three groups:

- TestNet participants: 89.46% (44.7 million INITs)

- Social Contributors: 6.04% (3 million initialization)

- Braid Stack Partner: 4.5% (2.2 million Inits)

Overall, the airflow distribution of Initia is neither too large nor too small. Therefore, during the TGE period, initial tokens are unlikely to face huge sales pressure from airflow receivers.

In addition, the total supply of MEXC and AEVO is 1 billion tokens, currently trading on Bitget. Currently, Initia is currently worth from $0.60 to $0.70, and the value of FDV is about $60 billion.

| Airdrop allocation | standard | |

| Testnet participants | 89.46% | Users who participated in two Initia test networks |

| Social Contributor | 6.04% | Community members have a specific role in discord, actively socialize X |

| Intertwined stack partners | 4.5% | Active users of partners: lyezero, ibc and Milktia |

Initialize price forecast

Market comparison

The price comparison table in this article will include projects with similar technologies and strategic directions with Initia. Specifically, the two famous items selected for comparison are Celestia (TIA) and Movement (Mobile).

initia vs celestia

From a technical point of view, both Initia and Celestia pursue modular blockchain architectures that separate core layers such as consensus, execution and data storage.

The key difference is their direction of development:

- Celestia’s goal is to be the foundation layer of all types of blockchains, focusing specifically on data availability (DA) solutions.

- On the other hand, Initia attempts to build a comprehensive multi-key ecosystem that serves both as an infrastructure layer and a comprehensive development environment for decentralized applications (DAPPS).

As of this writing, Celestia (TIA) has a market capitalization of approximately $1.5 billion, a fully diluted valuation (FDV) of approximately $2.7 billion, and its token trading ranges between $2.4-2.5. Shortly after TIA launched in late 2023, its local peak was nearly $20 and then corrected in line with broader market trends.

Meanwhile, Initia is still upfront, with a pre-sale price of $0.60 to $0.70, meaning the FDV is about $60 billion to $700 million. Although the project has not yet had a functional mainnet or any deployed Minitia chain in production, this has positioned Init as more than 25% of the Celestia FDV. The fact that Init valuations are approaching Celestia suggests speculation is driving its pricing rather than being proven to adopt.

Initia faces significant short-term risks due to macro uncertainty and high pre-issuance pricing. To avoid price shocks after use, the team may be cautious about listings to a more conservative range $0.30 – $0.40especially if the transaction conditions are still weak – thus creating a more organic path to growth similar to the opening after arbitration.

That is, these two projects provide different parts of the modular blockchain stack. If Initia realizes its multi-key vision, it can support dozens of scalable, interoperable, application-specific rollups.

It can justify the valuation with Celestia’s. $2.5 billion FDV will mean a symbolic price of about $2.5.

Initial movement and movement

Both Initia and Sports follow the Appchain model, allowing applications to launch customizable chains independently.

The campaign uses the “mobile services” model, which relaxes deployment of mobile-based projects of the infrastructure. Initia, by contrast, supports multiple technology stacks with shared security and liquidity in a unified network.

The FDV moving deal with a market cap of $745 million and ~3B $3B is about $0.30. Of these, 2.45 billion tokens have entered circulation, accounting for 24.5% of the total supply.

Move’s highest point is close to $1.45 $1.45 before correcting the market in 2025.

In terms of technology and investment, Initia rivals sport, but its FDV is only one-fifth (about $630 million). Therefore, Init may achieve $3matches the current FDV of the motion.

This is a realistic situation if Initia leverages its technology and attracts a strong community of developers.

Initial price forecast

No major exchange list, Init May May Mairs Dym’s path – Medium FDV and TLAT TGE PRISS PRISE action.

If listed on Binance, Init can debut with a higher FDV similar to Move and Tia. Init can be closer $1-1.5 With an upward dynamic range, providing post-market activities to support ongoing demand.

in conclusion

Based on the above analysis, Initia has strong potential to become the core infrastructure center of Appchains in the future.

Although it has not yet experienced its TGE, its current valuation is completely diluted (about $63-700 million), corresponding to the price of the token $0.63–$0.70has reflected high market expectations.

Initia may hit FDV $3B, pushing Init Proper to close $3.

Read more: April ETH price forecast: short-term and medium-term analysis.