This technical analysis report provides snapshots of current price actions for Hyper, Ondo, LTC, Ton, Ada, Dot and Kaito based solely on key levels and candlestick formations.

The analysis does not contain basic indicators or external macroeconomic factors, but focuses on immediate trading behavior and structural price patterns.

Price forecast 6/4

Super fluent price forecast

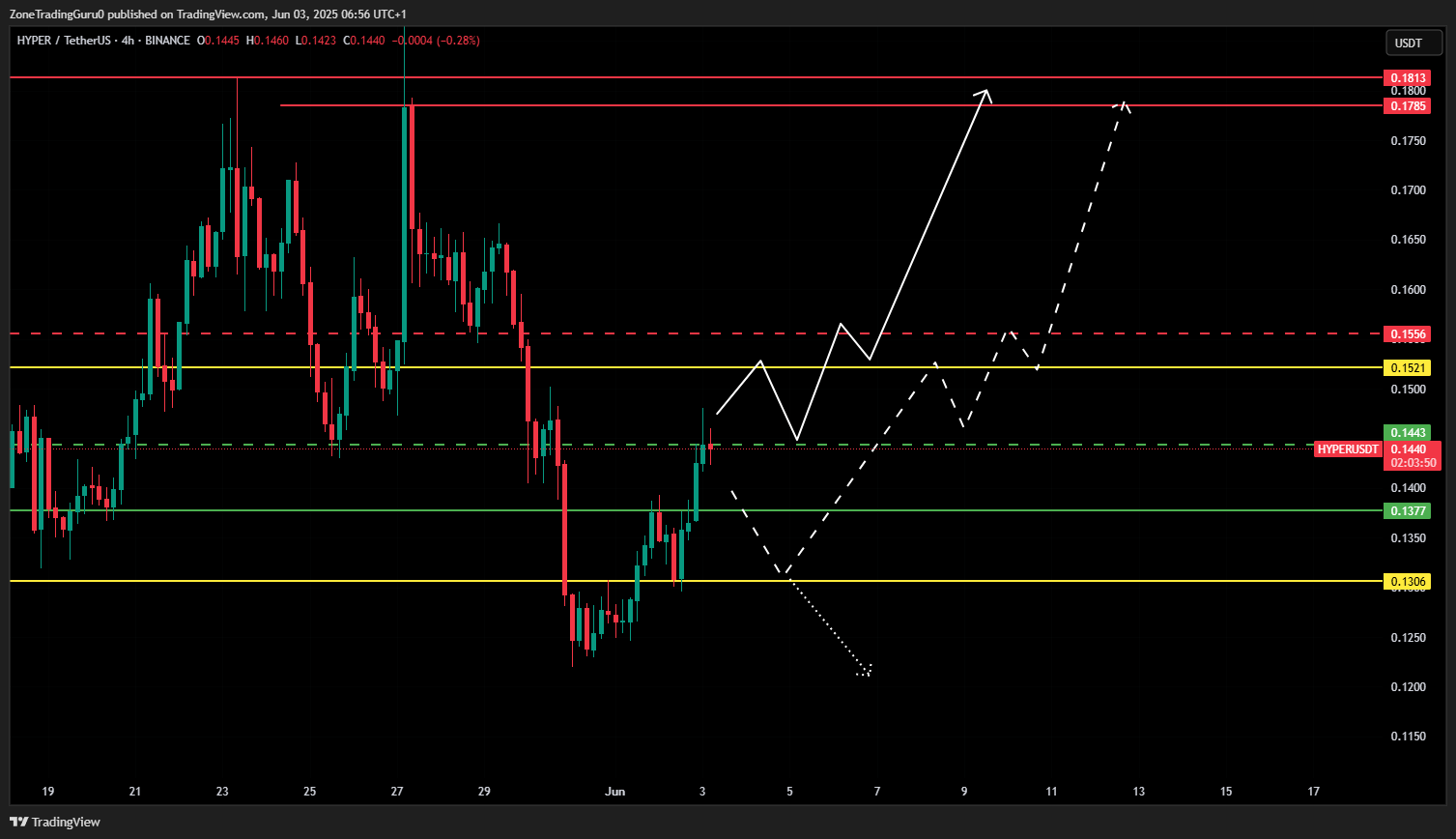

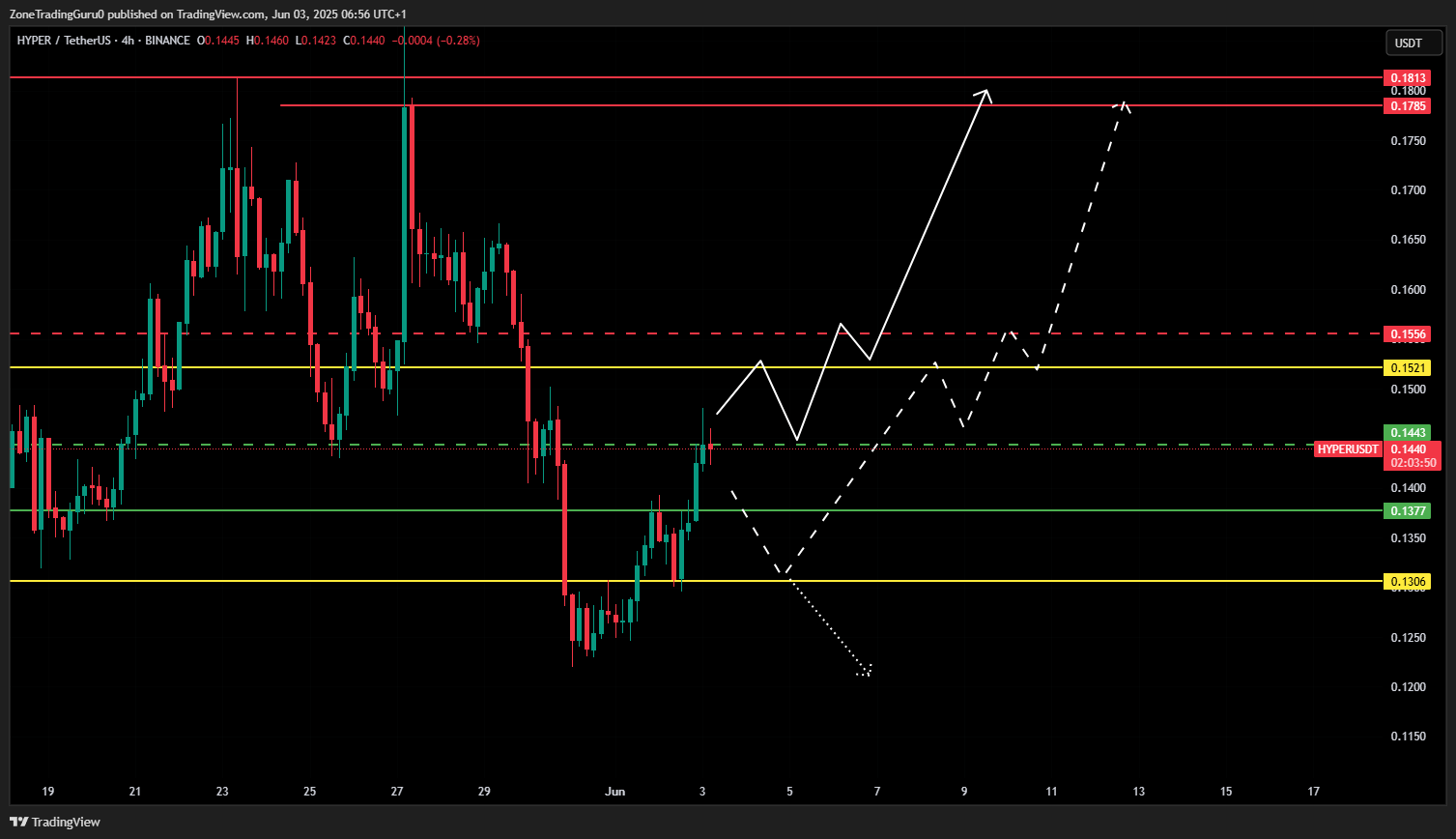

Hyper is currently testing resistance at $0.1443, with its potential up-down movement to the next resistance range selling for $0.1521. The wider resistance zone is expected to be 0.1521–$0.1556, which will trigger a price reaction, which may restore the price to test support levels of $0.1443 and $0.1377.

The confirmed H8 candle closed at $0.1521, which could mark a bullish breakout with the range of 0.1785–$0.1813 as its previous high.

However, the key level of surveillance is still $0.1306. A H4 candle below this level will indicate a failure of the current bullish momentum, which may lead to a retest of the formation of previous lows or new lows.

Source: TradingView

Ondo Price Forecast

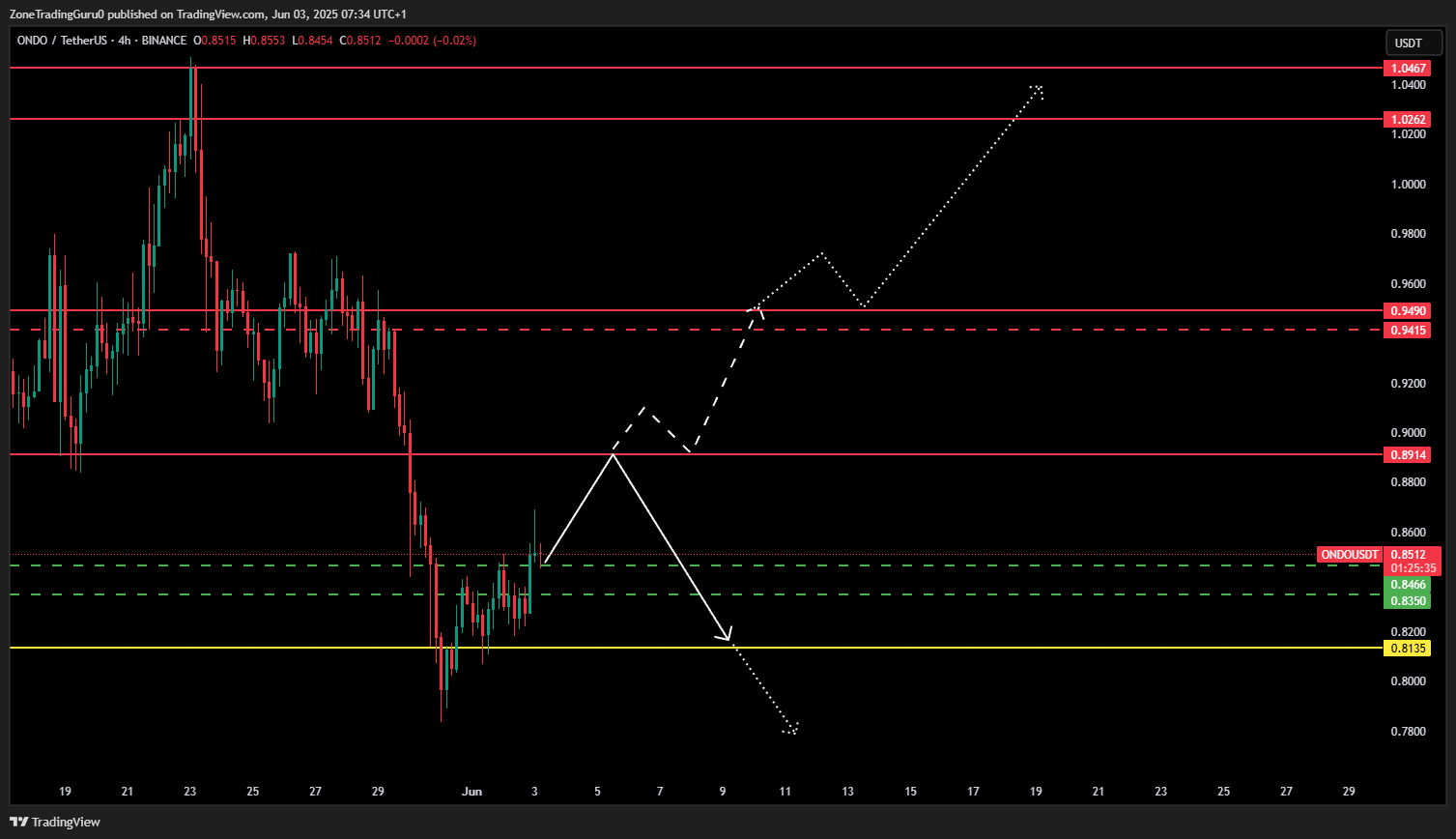

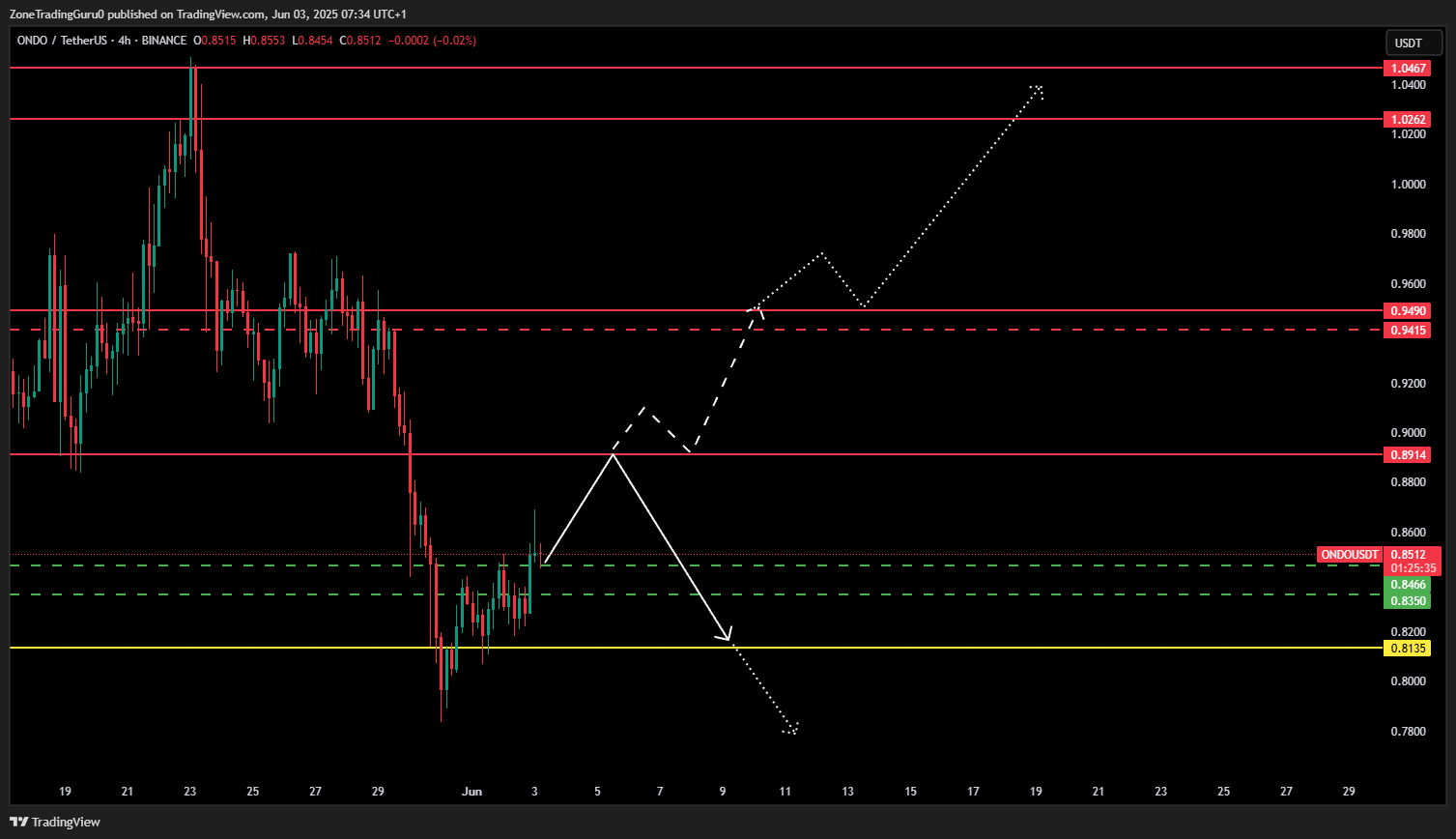

Ondo combines between two secondary support levels at $0.8466 and $0.8350. In the lower time frame, the token continues to trend upward and may move towards strong resistance at $0.8914. Price rejection here may delay Ondo to the following retest support levels.

Support for $0.8135 is crucial – H2 candles below this level are close, indicating a failure of the current uptrend and opening the door to return to previous lows. On the other hand, H2 above $0.8914 will be at 0.9415–$0.9490, possibly $1.0262–$1.0467 to establish a path to higher resistance.

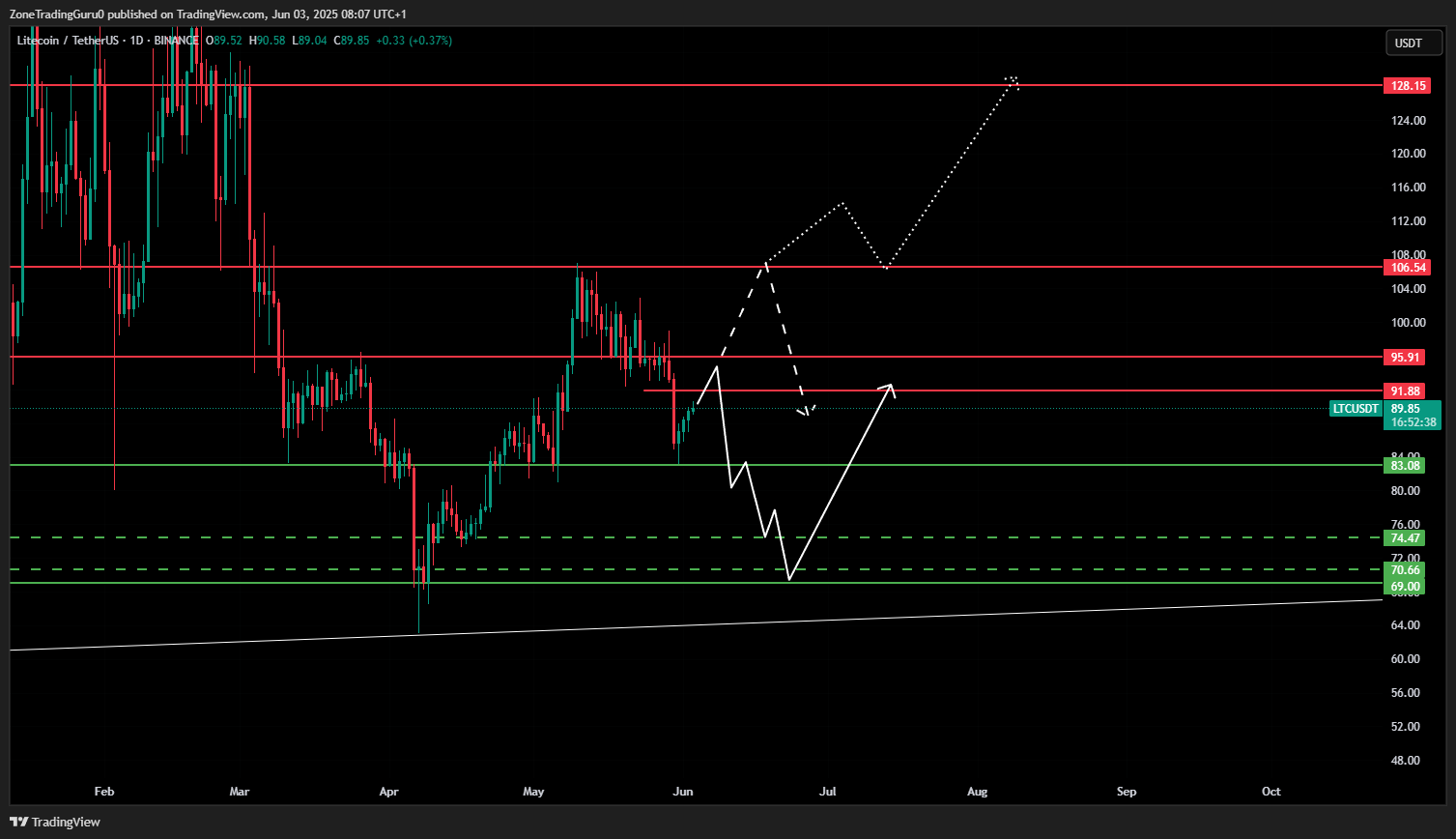

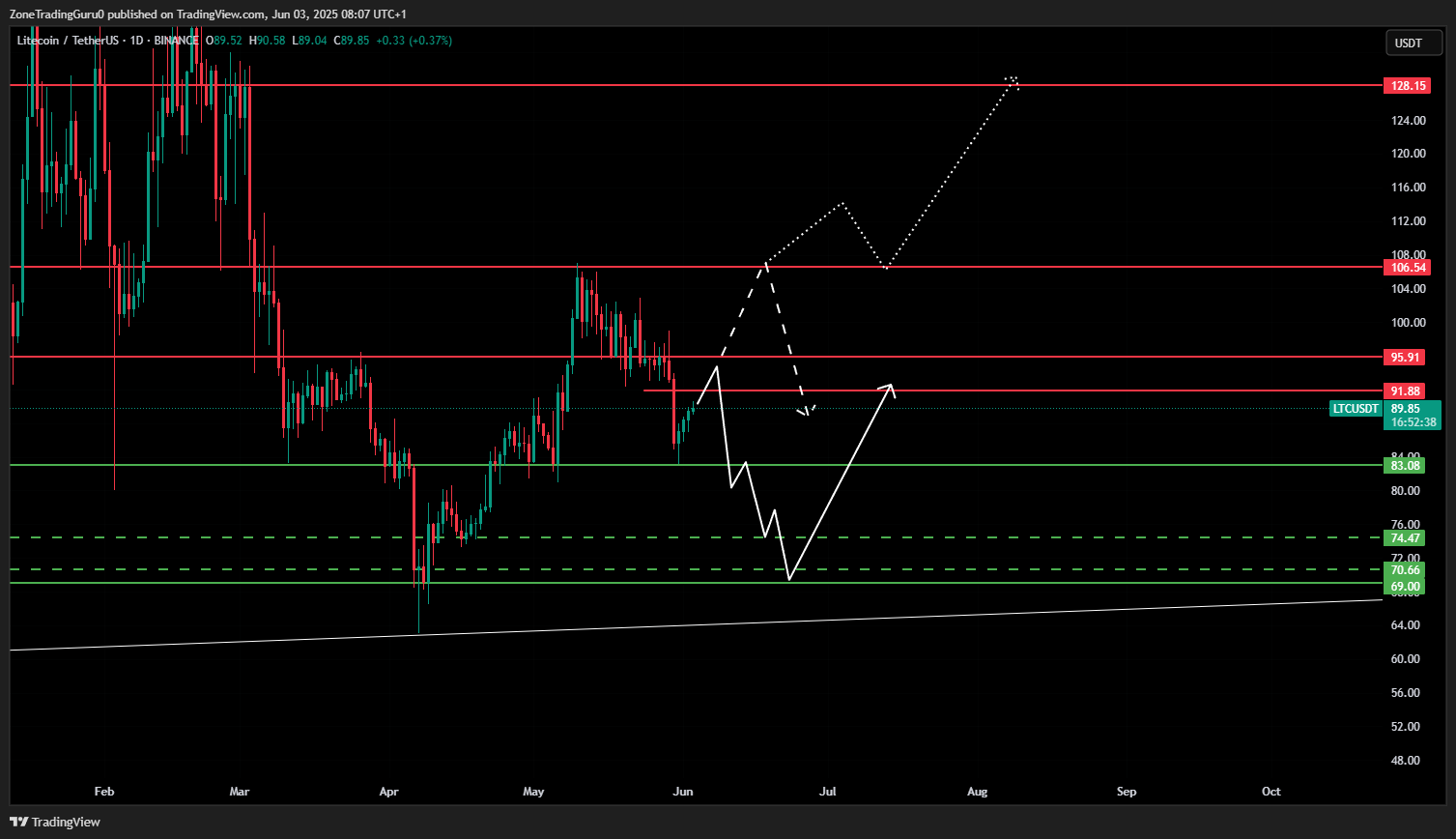

Litecoin price forecast

Litecoin (LTC) moves in the determined resistor band 91.88–$95.91 and holds short-term support for $93.08. This indicates the potential for lateral movement. If the bullish momentum is established, the price may reach strong resistance at $106.54, and then corrective measures will return to support.

A decisive 3D candle closes above $106.54 to close at $106.54, which will confirm a bullish breakout, which may retest the April high of about $128.15.

On the downside, a D1 candle below $83.08 will shift the focus to a deeper support area of $74.47, $70.66, and a strong convergence area of $69.00, which includes the uptrend of the trend line. The region could trigger a strong price rebound.

Ton price forecast

Ton posted a surprise rally from $2.9917-$2.9664 in support zones to resistors, to $3.5542. Currently, the price is driving slowly and may be heading towards the resistance area of $3.3165-3.4252.

A confirmed H8 over $3.4252 can set the stage for a test of $3.5542, followed by a $3.5542 shutdown of the H2 may push the upper resistor band to sell for $3.9-4.1072.

If the price fails to violate the $3.4252 area of $3.3165–$3.4252, it may be a retest of the lower support area at 2.9917-$2.9664. This area remains a strong rebounding point with the support of the trendline.

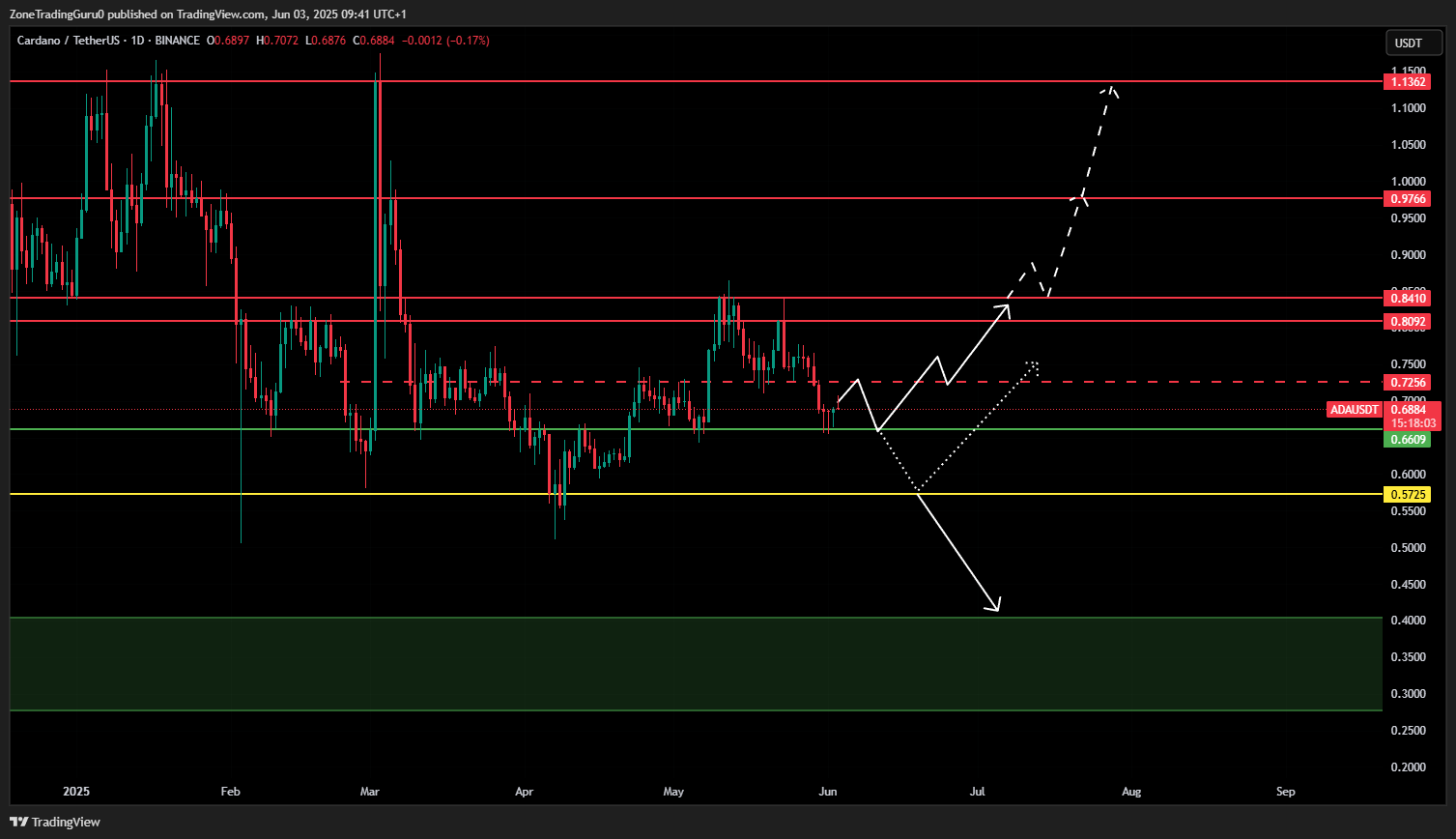

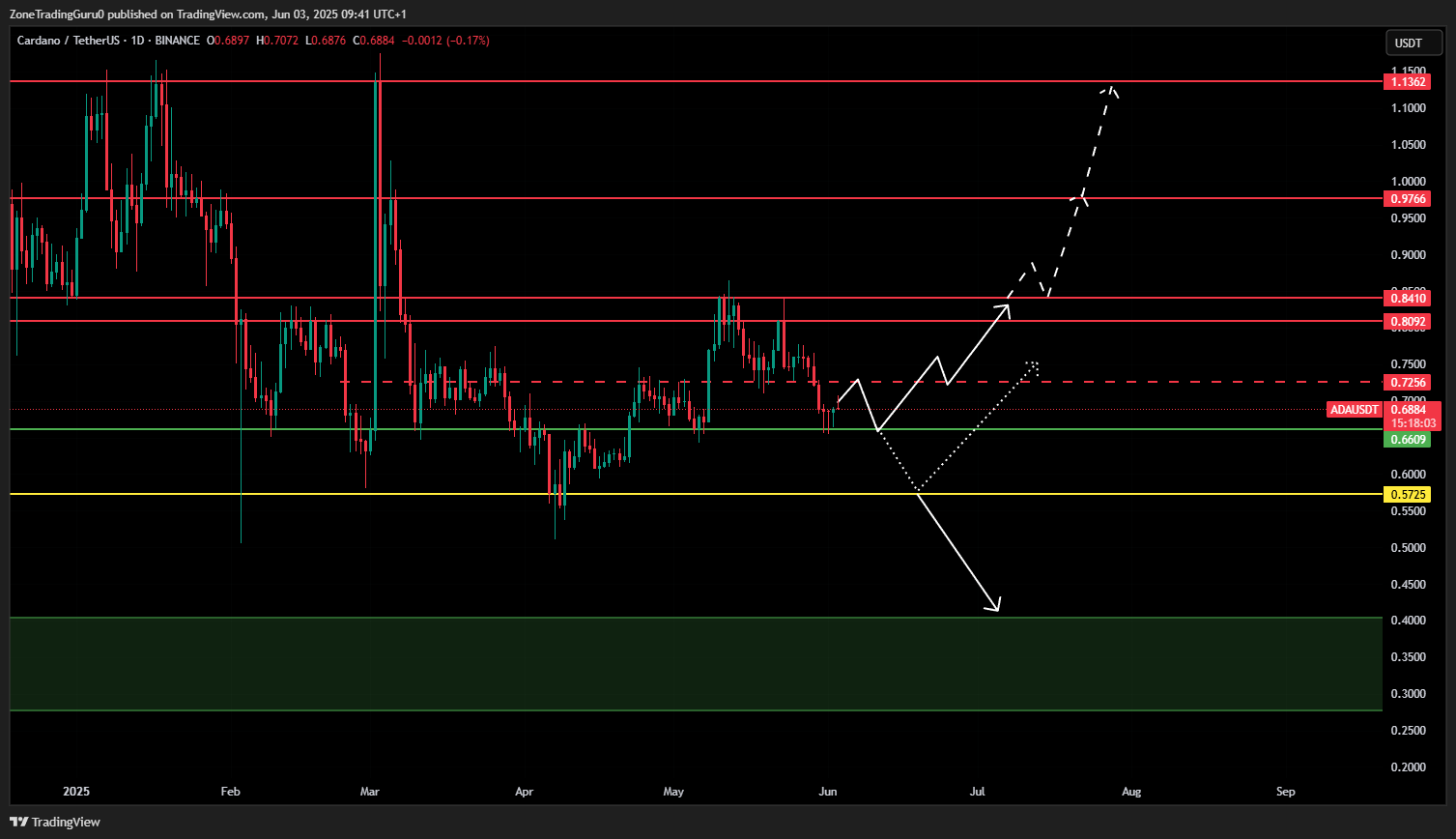

Cardano Price Forecast

Cardano (ADA) currently has resistance of $0.7256 and support is $0.6609. Prices are expected to continue moving sideways within this range until a breakout occurs.

A bullish breakout above $0.7256 is likely to target at a price of $0.8092–$0.841. D1 candle closing $0.841 will confirm further bullish momentum with an upward target of $0.9766, compared to the previous peak of about $1.1362.

Conversely, failures below $0.6609 may reduce the price to a weekly support of $0.5725. This level is a critical pivot, and if W1 is closed below, ADA may revisit the range of $0.4xx.

Polkadot price forecast

Polkadot (DOT) merged within a horizontal channel between resistance of $4.305 and support of $3.744. Prices are expected to remain within this range until a breakout occurs in any direction.

A breakthrough above $4.305 could lead to resistance advances, $4.594, $4.958 and $5.202 – the latter is strong weekly resistance. W1 candles above $5.202 will open the way for a $6.348 gathering.

On the other hand, failures below $3.744 will make the main support of $3.512 work. A 3D candle with $3.512 below $3.512 may trigger a new low.

Kaito Price Forecast

Kaito’s D1 chart shows the bearish difference, three rising peaks, indicating a potential shift from bullish to bearish momentum.

The key support level for this uptrend is $1.6925. Bounces from this level may start the momentum again. If D1 closes above $2.3055, further bullish targets include resistance levels of $2.4626 and $2.7392.

However, D1 candle closing below $1.6925 will invalidate the uptrend and may move to the support zone at $1.45, $1.3665, with a strong support zone of $1.0489. The last area may be a strong rebounding area, but the breakdown below will indicate the risk of a new low.

How to buy these tokens

You can buy Hyper, Ondo, LTC, Ton, Ada, Dot and Kaito on major crypto exchanges. For popular assets such as LTC, ADA, TON and DOT, platforms such as Binance, Coinbase and Bybit provide deep liquidity. For newer tokens like Hyper, Ondo, or Kaito, check availability on Uniswap, Mexc or by searching for Coingecko.

Just create an account, complete KYC, deposit funds, then search for the token and place an order. After purchase, consider moving your assets to a secure wallet like Metamask or Ledger.

in conclusion

The current technical structure shows a market in search of directions where multiple assets test key resistance and support areas. The candlestick closure at the critical level will be confirmed as a continuation of trend continuation or reversal.

Traders are advised to closely monitor the action and quantitative response of prices at these levels, as they may determine the next major move in the cryptocurrency market.

Read more: Trading with free encrypted signals in the Evening Trader Channel