In high-leverage derivatives trading, it is crucial to understand market sentiment and identify areas with high-definition risk.

One of the most intuitive and effective tools to track these areas is to clear heat maps. This article will help you understand what a clearing heat map is, how to explain it and how to integrate it into a trading strategy to improve decision accuracy.

What is a liquidation heat map?

A clearing heat map is a data visualization chart that highlights the price level where a large number of leverage positions are at risk of liquidation in the derivatives market. The color intensity reflects the concentration of potential liquidation – the brighter the area, the greater the liquidation pressure.

The map is usually generated using order data data, as well as indicators such as financing rates, average leverage ratios, and long/short positioning on major exchanges such as Binance, Bybit and OKX. Popular platforms that provide liquidation heat maps include collocation categories, hybrid capital and decentralizers.

Why is liquidating heat map important?

In derivatives markets, especially when high leverage is usually used, positions can be liquidated if the price exceeds a certain threshold. It creates a high pressure zone when many traders place parking or clearing points close to the same price level. These areas usually target whales or trading algorithms to trigger large-scale liquidation, resulting in domino effects and sharp price fluctuations.

Key reasons why liquidation heat maps are valuable tools:

- Identify the non-traditional support/resistance zone: It not only relies on technical analysis, but combines actual leverage position data to highlight meaningful levels.

- Forecasting potential price fluctuations: When prices approach bright areas, the possibility of sharp movement increases due to liquidation triggers or intentional price manipulation.

- Optimize entry points: Traders can avoid entering locations near areas that may be scanned by clearing cascades initiated by large players.

Structure of clearing heat map

A standard liquidation heat map is usually composed of the following components:

- X-axis (horizontal): Displays real-time or historical data, segmented by hour or day.

- Y-axis (vertical): Represents the price level of the underlying asset (e.g., BTC, ETH).

- Color gradient: Indicates the intensity of potential liquidation. Brighter colors (yellow/red) suggest denser liquidation clusters, while darker shades (purple or dark blue) point to areas with lower risk.

- Current price indicators: It is usually displayed as a candlestick chart overlay, allowing users to visualize the relationship between price action and clearing area.

- Colorful Legend: The reference bar is usually located next to the map, showing the absolute or relative magnitude of the liquidation pressure (measured by number of positions or the nominal volume in USD).

Read more: Trading with free encrypted signals in the Evening Trader Channel

How to read and analyze clearing heat maps

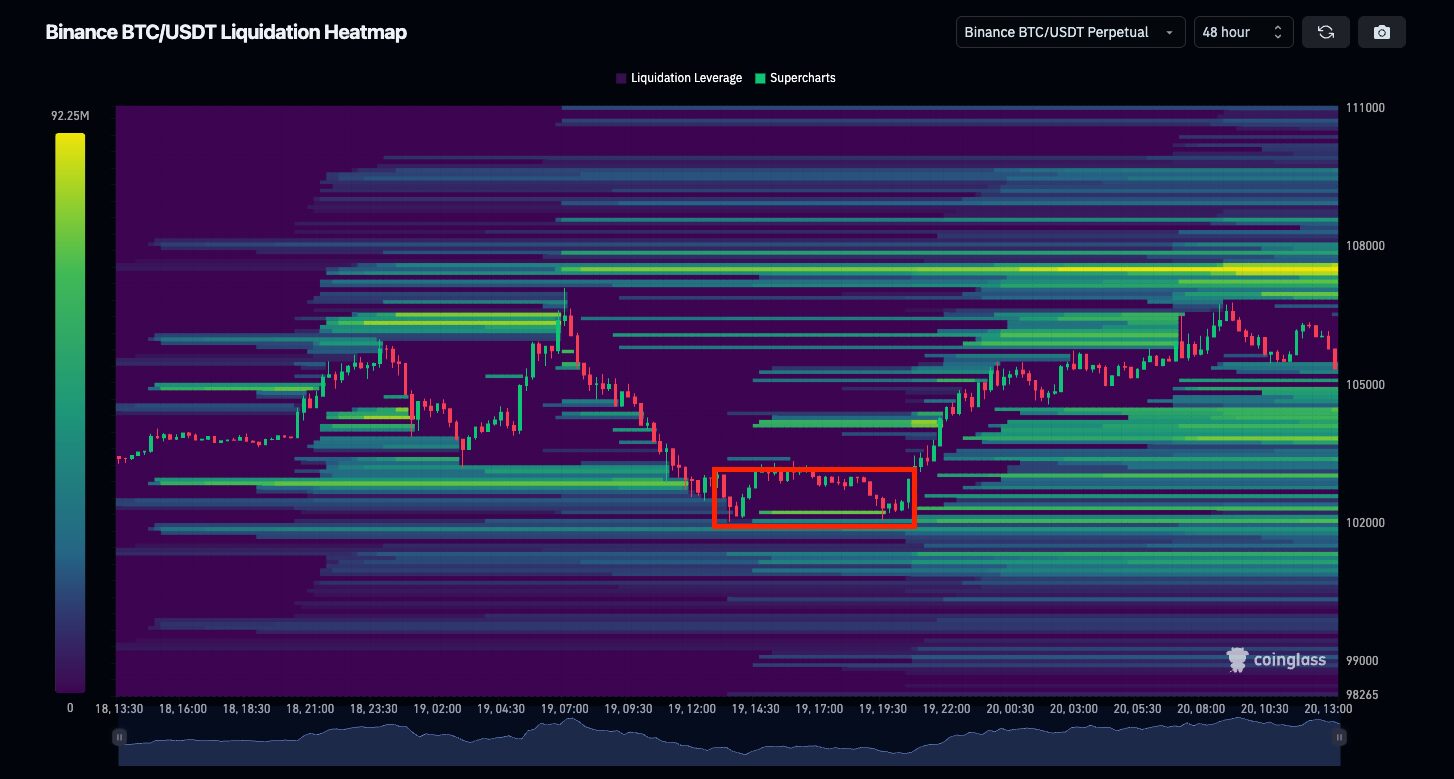

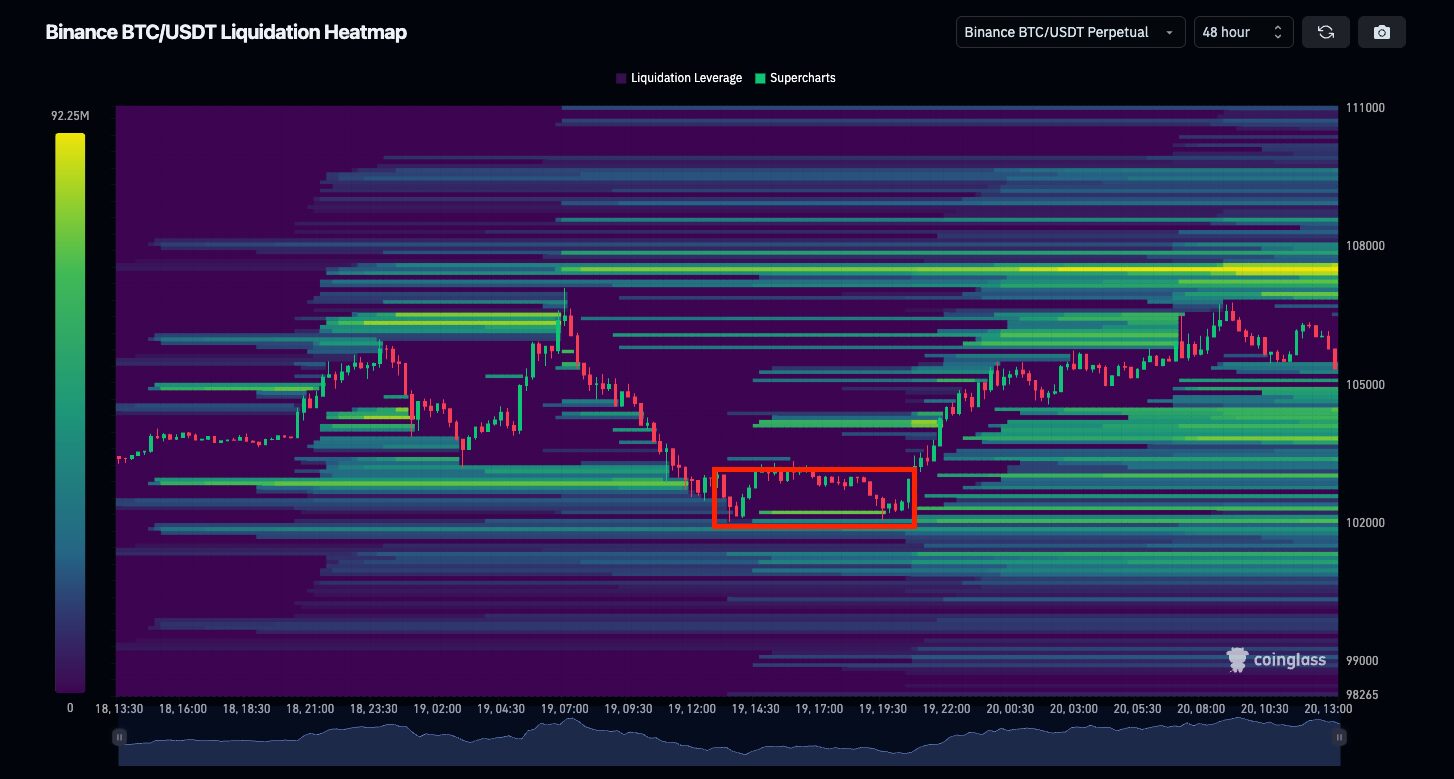

Identify the clearing cluster

Bright yellow, light blue or light red areas usually indicate areas where there are a large number of leverage positions at risk of being liquidated. These clusters are key areas closely monitored when analyzing heat maps.

Source: Xiaodian

For example, on the Coinglass chart, we observe a prominent yellow cluster at a price level of about $108,000. This indicates a short open position with high concentrations in the area. If the price is close to and above this level, a series of short cascades may occur, which may accelerate upward price momentum.

Distinguish between upward and downward clearing zones

The area above the current price is usually considered a resistor formed by a short open position. If prices continue to upgrade to the area, those short positions are subject to risk liquidation. This could trigger a wave of buybacks – known as short squeezes, making the price higher.

On the contrary, areas below the current price tend to be concentrated long positions. If the price drops to this lower area, these desires can be liquidated, thereby increasing downward sales pressure (long liquidation) and pushing the price further downward.

When prices approach these areas, the market usually reacts sharply due to a sudden shift in liquidity and trader sentiment.

Relevance to price list

Monitoring the candlestick chart covered on the heat map allows you to evaluate whether the price is close to the high-risk liquidation zone or has been moved through it. Such insights are particularly valuable for predicting potential withdrawals or identifying false breakthroughs.

Trading strategies using clearing heat map

One of the most effective ways to leverage a clearing heatmap is to integrate it into a real-time trading strategy. When prices approach a major clearing cluster and trading volume peak, traders may consider scalping in the direction of the breakthrough.

However, such strategies require strict risk management, as price fluctuations after liquidation events can be intense and unpredictable.

Another common method is “Failout” Strategy – Transactions with initial price surge caused by liquidation. The premise is that short-term trends often reverse to absorb liquidity after large-scale liquidation events. This method requires patience and precise analysis of potential recovery points.

Fade into mobile – Source: coinglass

Traders should be cautious too “Trail Zone” – Areas where long and short clearing clusters are close to each other. These areas are easily pretended, where prices swept both sides before they resume the original trend. It is strongly recommended to avoid trading in these areas or wait for clear confirmation signals.

Trap area – Source: coinglass

In addition, combining the liquidation heat map with fund rate data enhances its effectiveness. Highly aggressive financing rates with upper liquidation clusters and are often pioneers of short-term squeezes. Conversely, negative funding rates for large clusters below the level may mark a short trap and then a sharp upward reversal.

in conclusion

The liquidation heat map has become an important tool for professional traders to drive the increasingly competitive derivatives market. Reading heat maps correctly not only helps avoid sudden clearing scans, but also allows you to bill entries more effectively.

That is, like any tool, it is not a silver bullet. The real trade advantage comes from combining the liquidation heat map with other market data and indicators. Most importantly, maintain discipline and adhere to stable risk management practices.

Read more: What is the market capitalization of cryptocurrencies? Why is it important to investors?