As Bitcoin BTC With its first transaction since March exceeding $102,000, the market raises the most pressing question of the cycle: What was Bitcoin’s height before its peak?

With the headwind of the macroeconomic, the inflow of ETFs and the halving effect are in full swing, the forecast ranges from conservative to extremely optimistic. But, besides guessing, institutions, chart patterns and data actually tell us the top of this cycle?

Institutional View: From JPMorgan to Standard Chartered Flights

Both Wall Street and crypto local companies are modifying their BTC forecasts. Earlier this year, JPMorgan released a report that suggests that Bitcoin could hit $110,000 by the end of 2025, due to increased institutional demand through spot bitcoin ETFs and a weaker dollar environment.

Meanwhile, standard franchising remains one of the more bullish traditional institutions. In an April note, the bank reiterated its $150,000 target, noting:

“We are seeing structural inflows into Bitcoin, especially from sovereign wealth funds and pension managers who are now able to allocate through regulated ETF vehicles.”

On a more extreme perspective, Ark Investment’s Cathie Wood reiterated her long-term forecast for $1 million per BTC by 2030, but also hints that if ETF inflows maintain the current rate, the cycle could test $200,000.

According to Farside Investors, net inflows of U.S. spot bitcoin ETFs have exceeded $13.1 billion since its launch in January, while BlackRock’s IBIT leads at $4.8 billion. These continued inflows, which averaged over $250 million per week, provide strong floors for BTC and may continue to fuel upward momentum.

Read more: JP Morgan: Investors prefer gold over Bitcoin

Source: TradingView

Additionally, Ki Young Ju – CEO CryptoQuant remains cautiously optimistic about the prospects of Bitcoin. He noted that while the market is currently “slowly digesting new liquidity,” recent price movements show a strong bullish momentum, which is largely driven by large inflows of ETFs and alleviating sales pressure. However, he also stressed that the market signals are still mixed and there is no clear indication of whether the profit phase has begun firmly.

Read more: CryptoQuant CEO: “A new era of Bitcoin has begun”

Chain signal: Is running space?

Starting May 12, 2025, Bitcoin disease data show that long-term holders are still in distribution mode, but this amplitude is moderate compared to previous peaks in 2017 and 2021.

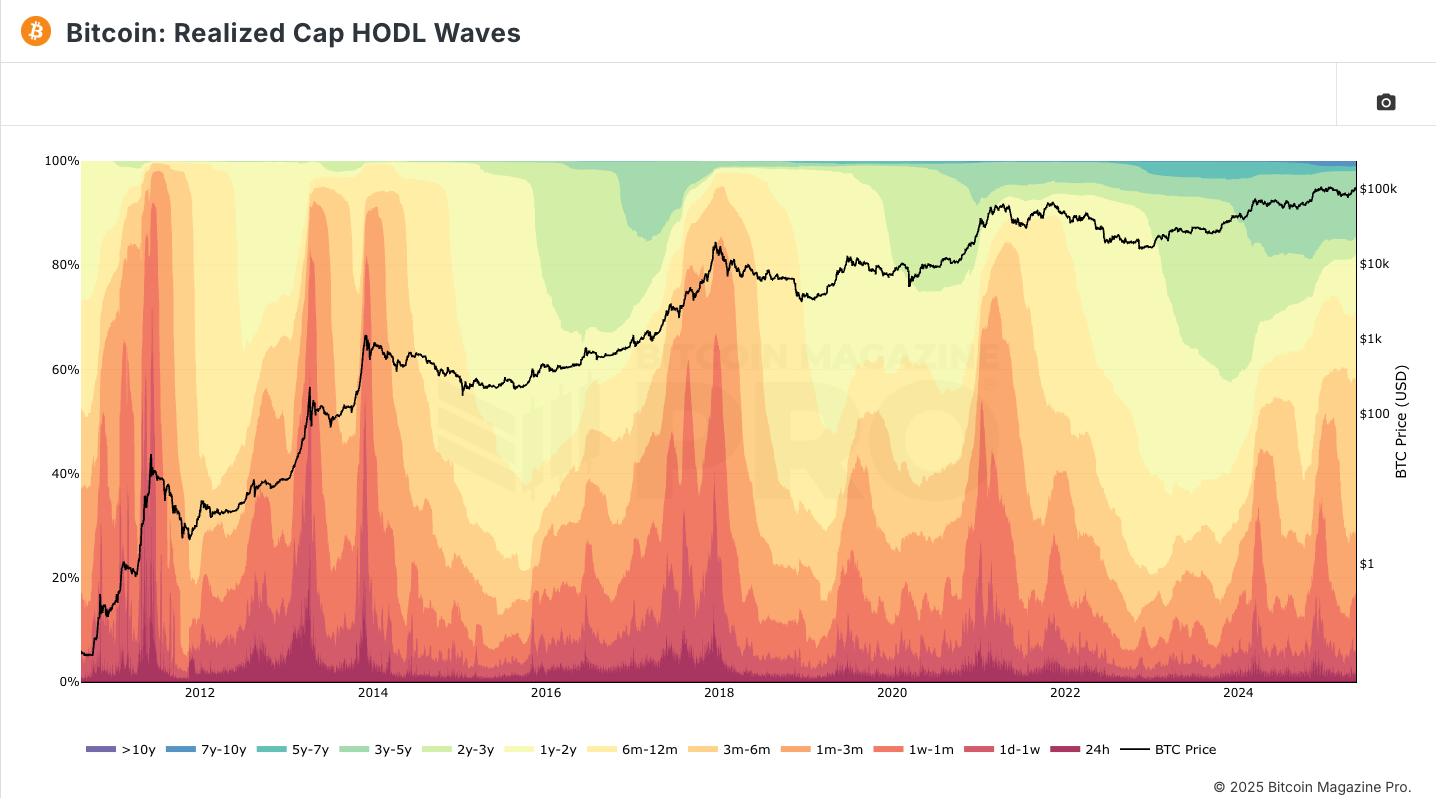

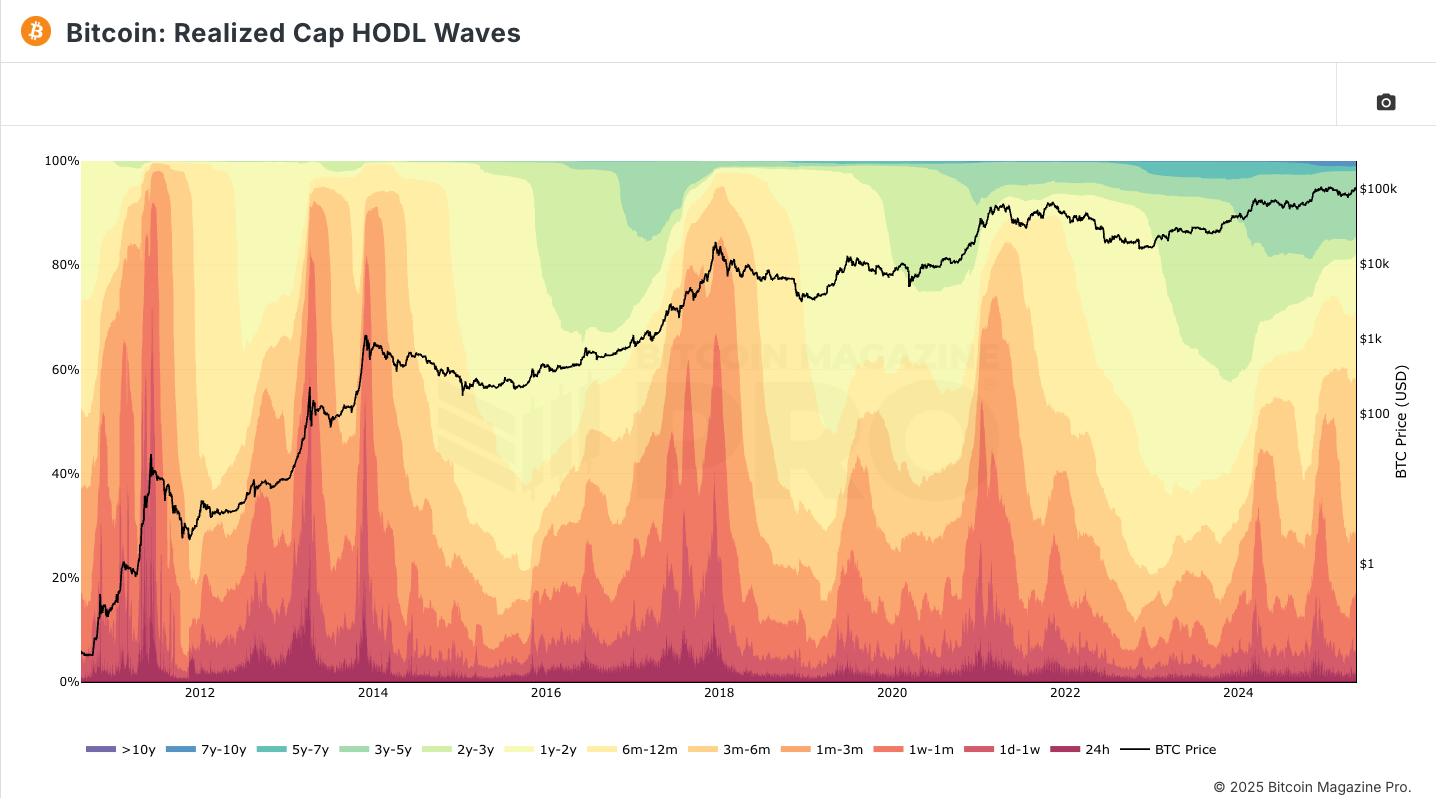

The implemented cap HODL wave metric is often used to visualize age-based distribution patterns, indicating that 3-6-month-old coins are rising, suggesting that the accumulation of early cycles is developing into medium cycle optimism.

Source: Bitcoin

Meanwhile, the MVRV Z score compared the popular indicators of market value with realized value, currently hovering around 4.3 – well below the 7 overheating threshold at the top of the previous cycle. This means that while BTC is certainly not underestimated, it also does not show the euphoric overcharging feature on the top of the blowing wind.

Technical Analysis: Price Structure Recommended $120K-$140K as Next Goal

From a technical standpoint, Bitcoin has recently broken into $86,000 to $97,000 from the merger range. This range has been a drag since the top in March, with the May 10 breakout accompanied by a strong volume indicating the next leg is higher.

Source: TradingView

According to pseudonym trader Rekt Capital, the breakup confirms a continuation pattern similar to the duration after the 2017 cycle:

“The merged structure reflects what we saw in May 2017. If the fractal plays similarly, $120K is the next resistance zone before the BTC tests the $140K zone.”

Fibonacci’s expansion levels are close to $128,000 from the bottom in November 2022 ($15,600) to the March 2024 high ($73,800), a historically reliable target for parabolic parasites.

Concodex’s algorithmic model also shows that while it is possible to pull back 12.35% in the near term, Bitcoin may rise to $151,000 by November 2025.

Macro conditions: tailwind, but fragile

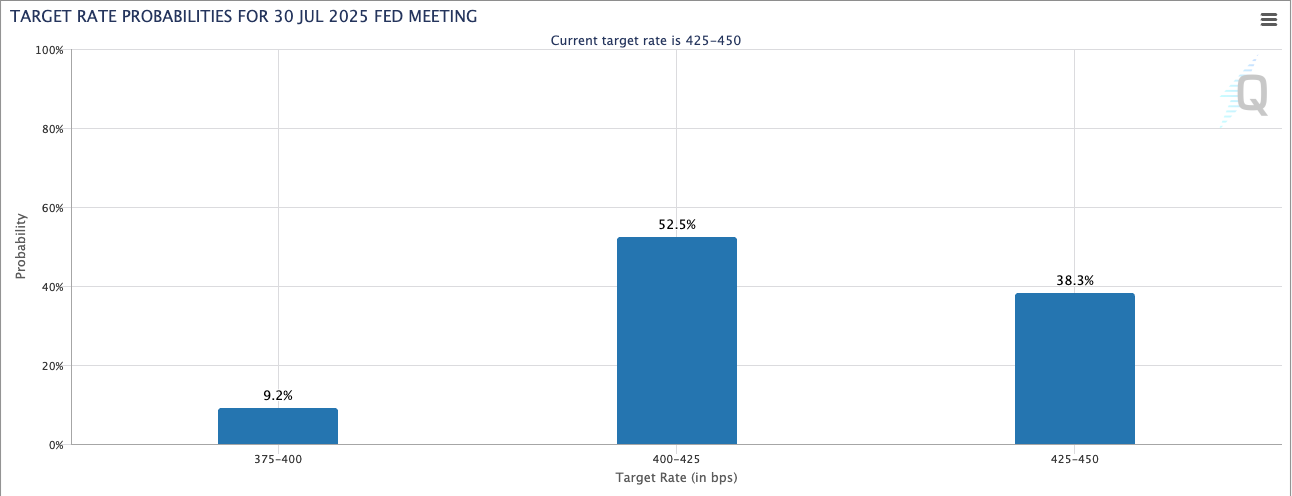

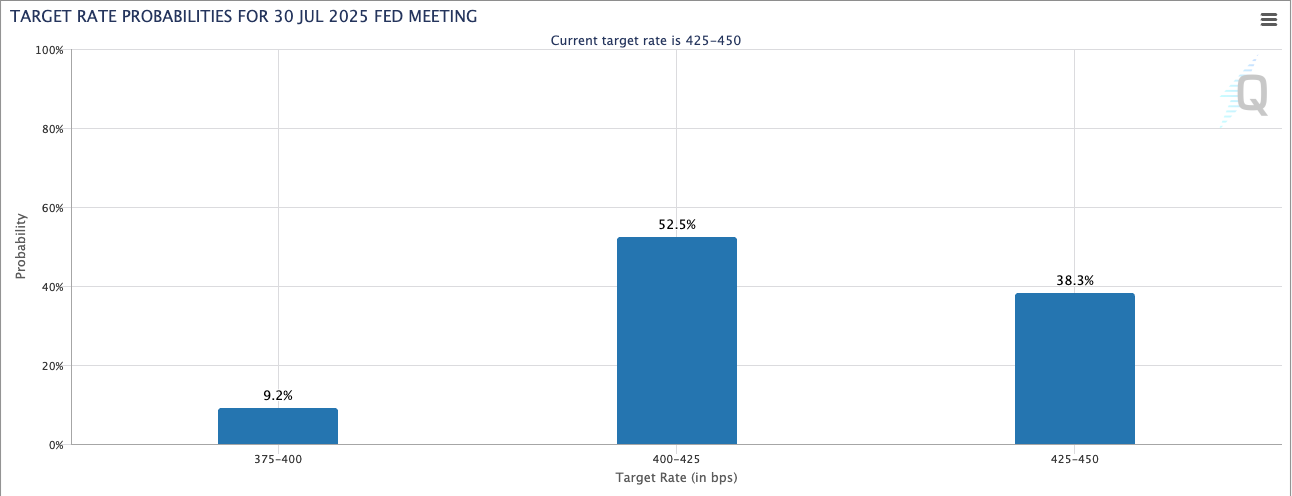

The U.S. Federal Reserve is expected to start lowering interest rates in the third quarter, while the price of the CME FedWatch tool is 75% likely to cut 25bps at its September meeting. Lower interest rates tend to benefit from risky assets, including Bitcoin.

Source: CME Group

Additionally, Gold’s recent surge to $2,550 per ounce driven by central bank purchases and global geopolitical instability, has updated Bitcoin’s narrative to “digital gold.” In this climate, Bitcoin’s restricted supply and resistance to inflation make it an attractive hedge.

However, there is still a tail risk. ETF liquidity suddenly reversed, tightening liquidity in Asia (especially Hong Kong and Singapore), or regulatory crackdowns in the United States could threaten bullish momentum. Some experts also warn that negative sentiment could be created globally if the U.S. or the EU imposes strict tax policies on crypto capital gains, or China strengthens restrictions on stabilizing stocks.

Crypto Twitter and trader sentiment

Influential people like Cryptokaleo and TheFlowhorse suggest BTC could hit between $135,000 and $160,000 before the end of this cycle, citing macro and on-chain support. Anbessa100 is an account centered on over 300,000 followers, noting:

“As long as we hold $98,000 in support, the bullish structure remains intact. The probability of BTC is high, i.e., it tends toward $140K and then rise again.”

However, derivatives data from coinglass show that several major exchanges have funding rates of more than +0.15% and longer/short ratios of more than 68% – if the price reverses sharply, it may trigger signs of overheating leverage in liquidation.

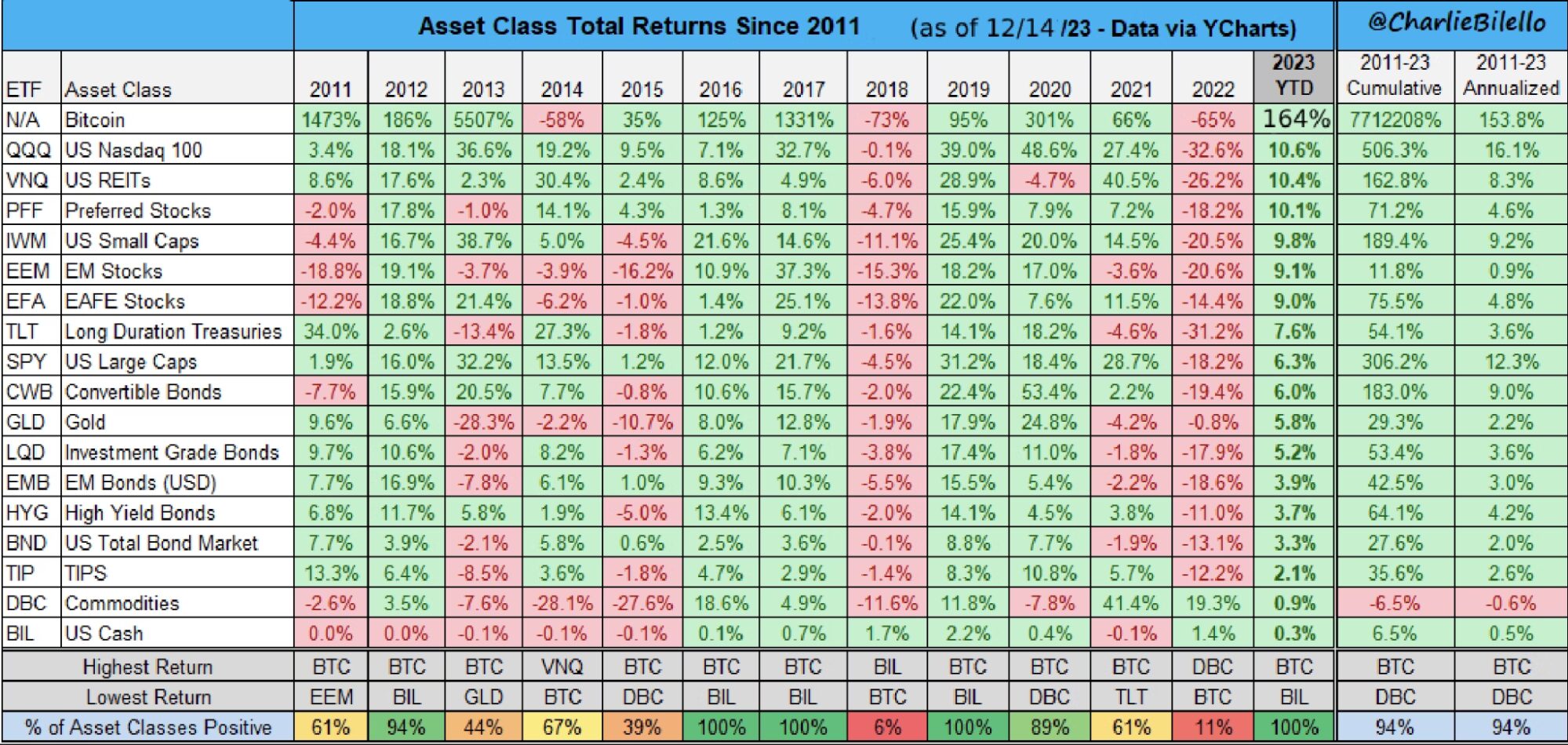

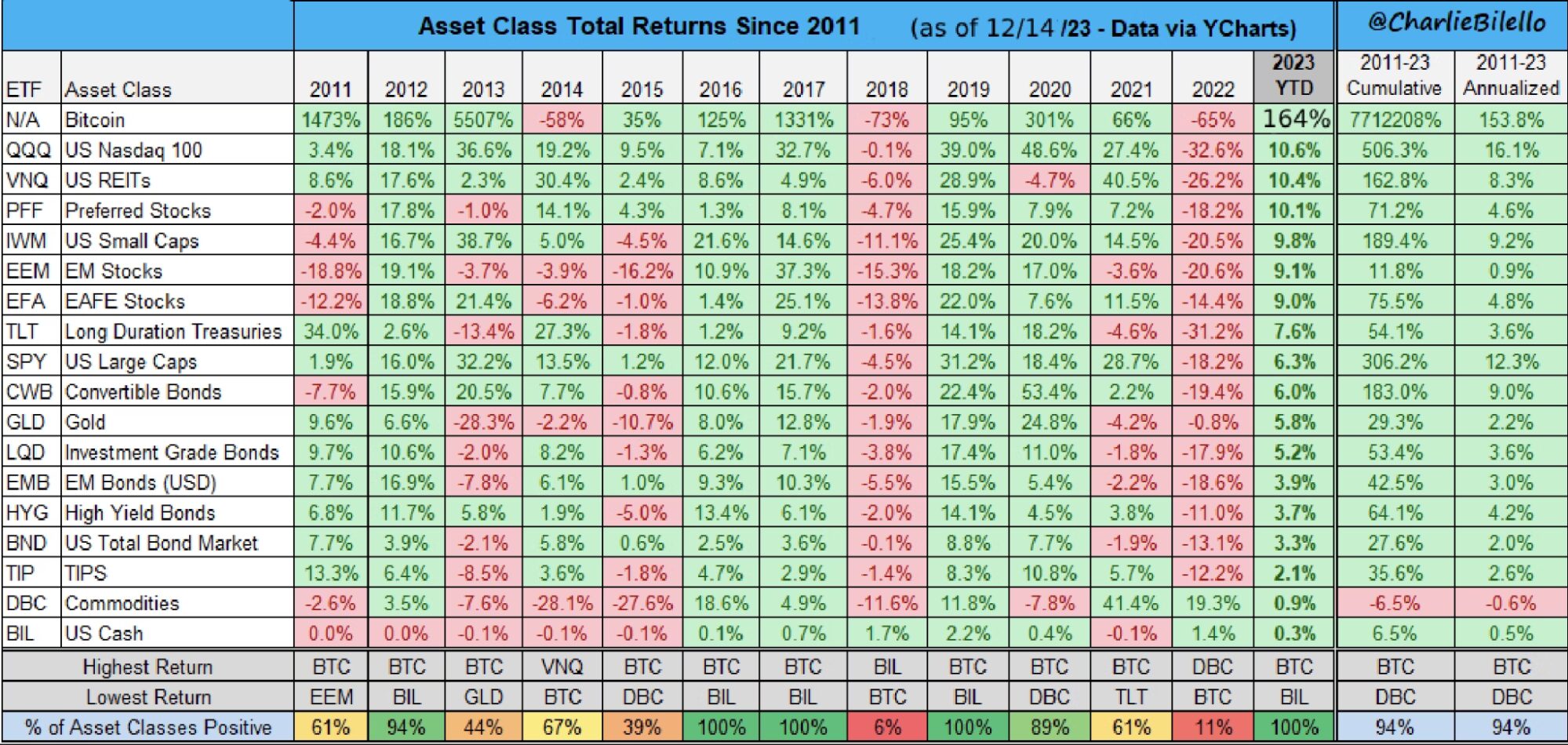

Comparing past cycles

Historically, Bitcoin reached a peak of 12-18 months after each halving. As the latest halving occurred in April 2024, many analysts believe the peak can arrive between the second and fourth quarters of 2025.

In 2013, BTC rose sharply by about 10 times; in 2017, the gatherings were about 20 times; in 2021, it was about 6 times. Starting from the $15,600 bottom in 2022, a 6x move will bring the cycle top to about $93,600, which is already over. A 10x move means $156,000.

Nevertheless, this cycle has unique characteristics: ETF inflows, increasing interests of nation-states (e.g., Argentina legalizes BTC as a payment method), and accelerated Defi layers on Bitcoin (e.g., runes, symbols, ordinal numbers, and tier 2).

DEFI protocols such as Stacks, Bison Labs and new sequence-based financial applications are turning bitcoin into more than just a store of value, potentially increasing demand for the assets themselves.

Retail FOMO: Not yet reached its peak

Google Trends “Buy Bitcoin” data accounted for a high 41% of all time in May 2021, suggesting that retail Frenzy has not yet fully returned. Similarly, Coinbase’s app ranks only 27th in the U.S. App Store Finance category, well below No. 1 in April 2021.

Read more: Trading with free encrypted signals in the Evening Trader Channel

These signals suggest that BTC may still have room for a last leg – a stage that is often driven by retail speculation and media delight.

But the lack of retail-driven signals can also be explained with a more cautious attitude: Bitcoin’s rally may not be strong enough to sustain itself without wider participation.

Historically, neither of which was fully realized with the last parabolic leg of the bull market accompanied by a surge in retail euphoria and a spike in search interest. This increases the possibility that BTC may face sharp corrections before any real blow-off occurs. When expectations are ahead of the actual inflow, the market often sees shaking to eliminate excessive leverage and reset support levels.

in conclusion

There is no consensus answer. But based on current data, most realistic forecasts – discount monthly forecasts, such as $500,000, the cluster is about $120,000 to $160,000.

If ETF liquidity remains strong, macro conditions remain good, and retail Euphoria starts, it seems reasonable to have a peak between $140,000 and $150,000. However, traders should remain vigilant about signs of overheating, such as MVRV exceeding 7, parabolic RSI movement, or excessive leverage in futures markets.