On Thursday, Hasbro announced its second-quarter numbers. Chris Cox, of course, was full of praise. Although consumer products were down another 20%, in terms of partner brands… poor performance. Click for a brief summary and overview!

Overall revenue fell 18%, much of which can be attributed to the sale of eOne, which still accounted for a 6% decline in revenue.

However, Digital and Wizards of the Coast grew 20%, and Hasbro was slowly transitioning from a toy company to a games company. In fact, Cox has publicly stated that Hasbro is now a gaming-first company. Toys are more of an afterthought to the company. From Hasbro’s perspective, it makes sense when Digital and WotC have such incredible profits.

The operating profit rate is 25%. So Hasbro is on track as far as margins are concerned. However, most of the profits come from the digital gaming space and WotC. Hasbro said that the full-year profit margin of WotC and digital business was 42%. After all, printing magic cards is cheap. People keep buying them. But what about consumer products (including action figures)? The full-year profit margin is expected to be only 4-6%. So it makes sense for Hasbro to get into digital and gaming.

Total revenue was $995.3 million. Digital and WotC now essentially account for nearly 50% of all Hasbro’s revenue. This division alone made $452 million, with an operating profit of $247.1 million, a profit margin of 54.7%! Even Apple’s profit margins aren’t that high. In comparison, consumer products (also known as “toys, including action figures)” lost $9.3 million. In other words: Magic and digital games have kept Hasbro alive, while traditional toys are now more of a millstone around Hasbro’s neck.

But now we get to Hasbro’s biggest concern. Consumer goods (also known as “toys”) fell 20%, with the segment continuing to lose money, continuing a previous trend of profits.

But the one thing we’re most interested in? The cooperative brand is also called “Star Wars”, “Marvel”, etc.?

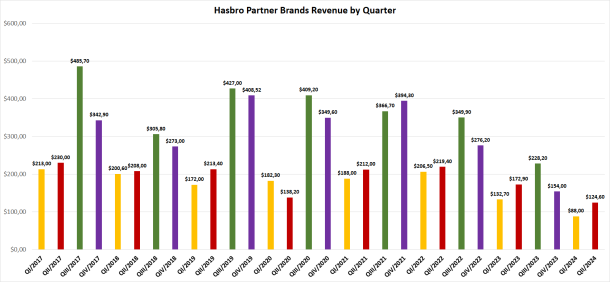

Revenue was $124.6 million. This is a new low for season two. That’s a 28% drop! Partner brands are even down 31% so far this year. Hasbro’s official explanation is “The decline was driven by the light entertainment segment and the impact of exited licenses”. This is the same thing Hasbro has been saying for several quarters. In a previous earnings call, they admitted that roughly 50% of the decline could be attributed to license exits.

Click to enlarge

As you can see, this was the worst second quarter for Hasbro Partner Brands in years, and unfortunately the numbers prior to 2017 are not really comparable as Hasbro restructured the business and dissolved the former Boys and Girls Toys division, and the introduction of a new Partner Brands division.

Hasbro remained the market leader in the action figure segment, but declined by 3.5 percentage points, but Hasbro still accounted for 23.6% of the overall action figure segment.

And Star Wars? There was no mention of it in the earnings report, slide presentation or earnings call. This is the current situation. Hasbro doesn’t talk about Star Wars at all anymore. Marvel was mentioned two or three times, certainly not with action figures, but apparently Hasbro hopes to release a Marvel-based Magic set in 2025, which “fans are eagerly awaiting.”

No one knows how much of the partner brand’s $124.6 million in revenue came from Star Wars.

Oh, and G.I. Joe was mentioned in the demo as one of the toy lines being developed for Hasbro.

Hasbro earnings report

Hasbro Revenue Demonstration (PDF)

Hasbro earnings call transcript from The Motley Fool