Amidst continued inflation, weak dollar, escalating trade wars and weakening trust in fiat currencies, the two most frequently discussed assets today are gold and Bitcoin.

From fear of depreciation to the desire to retain purchasing power, the race to become a “safe” in the 21st century has never been more intense.

Gold and Bitcoin surge amid economic uncertainty

On April 22, spot gold prices exceeded $3,500 per ounce, marking a new all-time high. JPMorgan forecasts the average gold price in 2025 to be $3,675 per ounce, which could climb to $4,000 per ounce if high interest rates persist for a long time.

Data shows that China now holds more than 2,292 tons of gold, accounting for 6.5% of its total foreign exchange reserves. The People’s Bank of China has been steadily accumulating gold for several consecutive months, which has exacerbated global demand and accelerated the downgrade trend.

Source: UK Investment

Bitcoin has also made great progress. As of April 23, BTC’s trading volume was about $93,500, up more than 20% year-to-date. BlackRock’s spot ETF (IBIT) has attracted more than $39.7 billion, becoming a key driver of Bitcoin institutional adoption. Investment giants such as Fidelity, Ark Invest and Vaneck are also increasing BTC allocations in their long-term portfolios.

When cash is no longer attractive

At the policy level, Bitcoin’s role has been raised under the executive order of U.S. President Donald Trump, which established a “strategic Bitcoin reserve” in the Treasury Department. This move is not only symbolic, but also officially takes Bitcoin as part of U.S. reserve assets. Meanwhile, gold continues to act as a traditional pillar in global central bank reserves.

Both gold and Bitcoin act as effective hedges to prevent a decline in purchasing power in an inflationary environment, according to data released by Coinshares on April 22. As inflation rates rise, purchasing power, the ability of units to purchase goods and services to purchase goods and services has been eroded.

The Consumer Price Index (CPI) remains a common tool to measure this decline, and in such a landscape, gold and Bitcoin are two of the few assets that can retain real value.

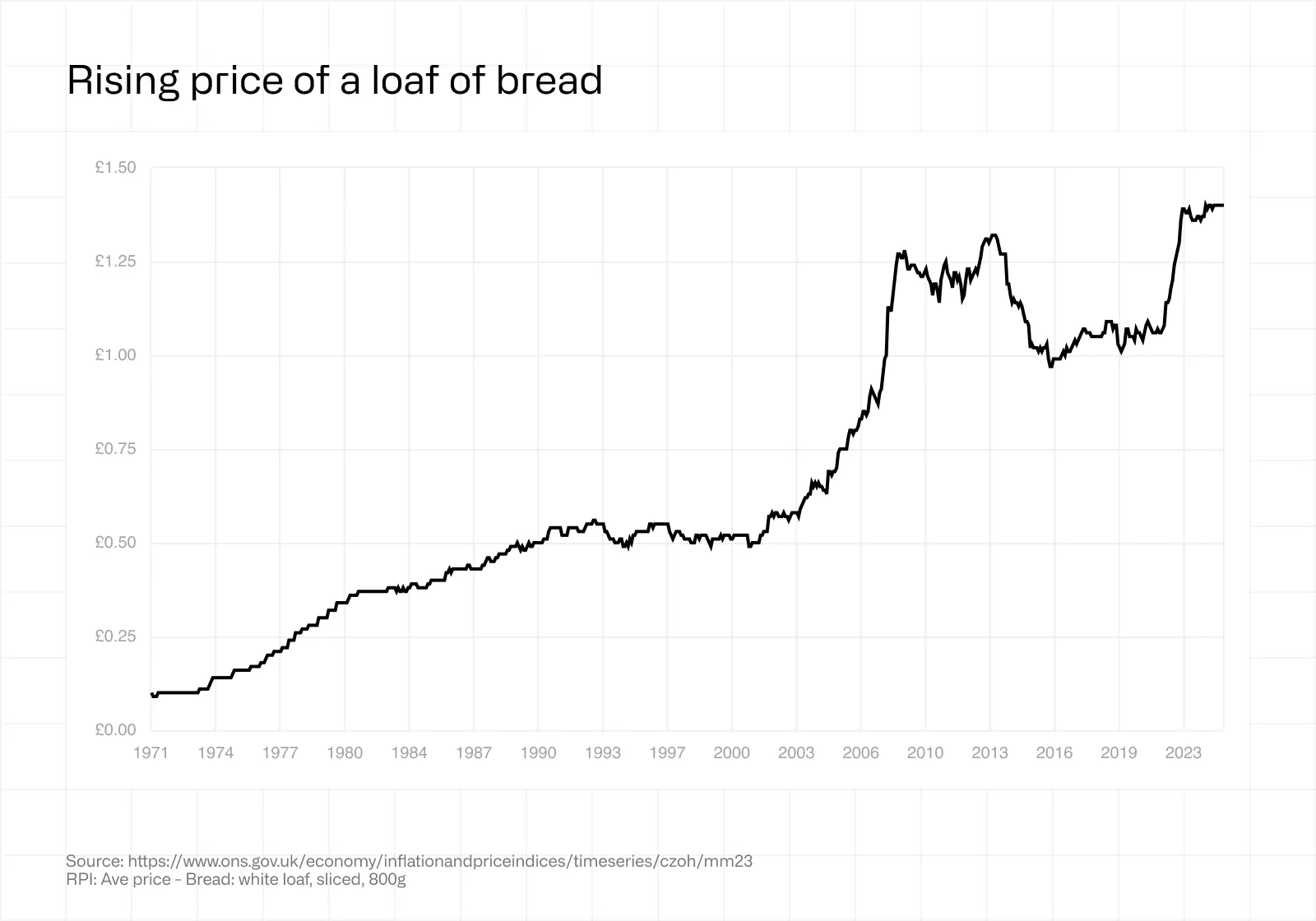

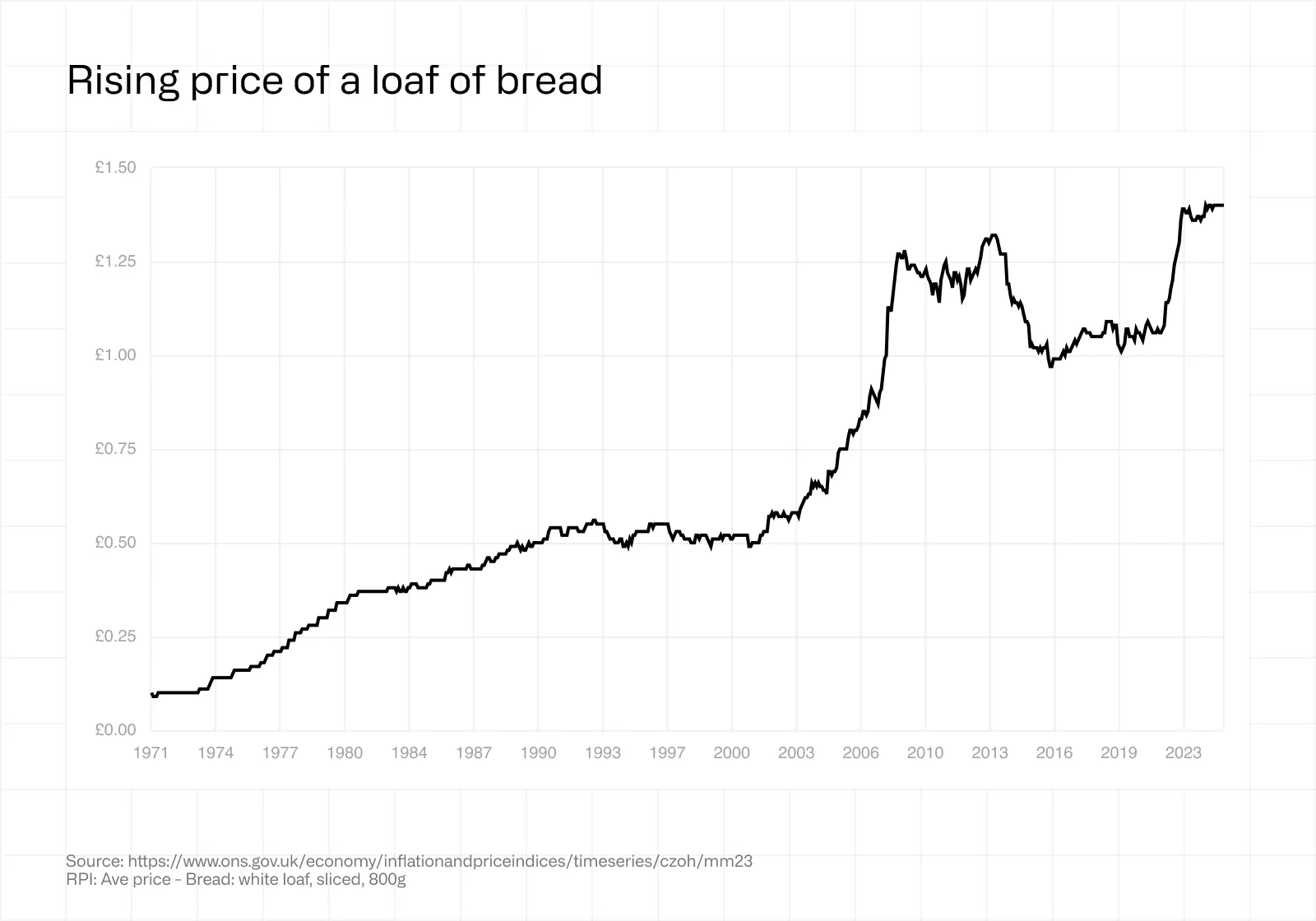

The report cites examples such as the UK, where the price of 800 grams of white bread has risen steadily since 1971, reflecting a significant depreciation of the pound. In Lebanon, inflation peaked at 268% in April 2023, and citizens were forced to abandon their local currencies in favor of gold and Bitcoin to protect purchasing power.

These clear indicators suggest that fiat currencies may fail their role as a store of value, prompting a shift to a “hard asset.” Bitcoin has become the digital successor of gold, especially among the younger generation and communities not included in the traditional banking system.

Bread Price – Source: UK Investment

In fact, Bitcoin has excellent flexibility in storage and transfer. Unlike gold, Bitcoin is stored in a cold wallet and moved around the world at a low cost in a few minutes. The rapidly evolving security infrastructure with multi-signature wallets, offline storage and digital asset insurance is also increasing its appeal.

Gold or Bitcoin: Which is better?

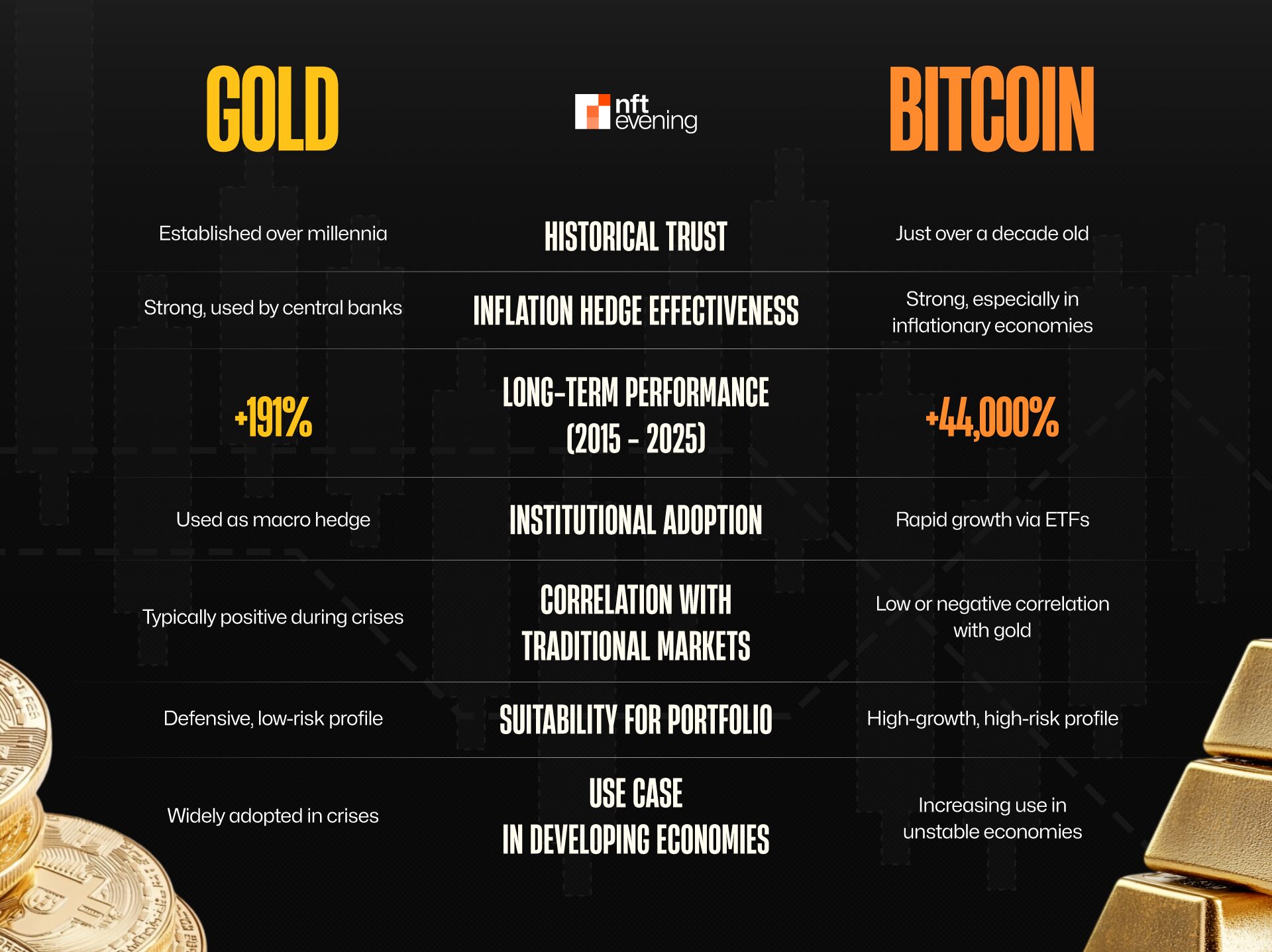

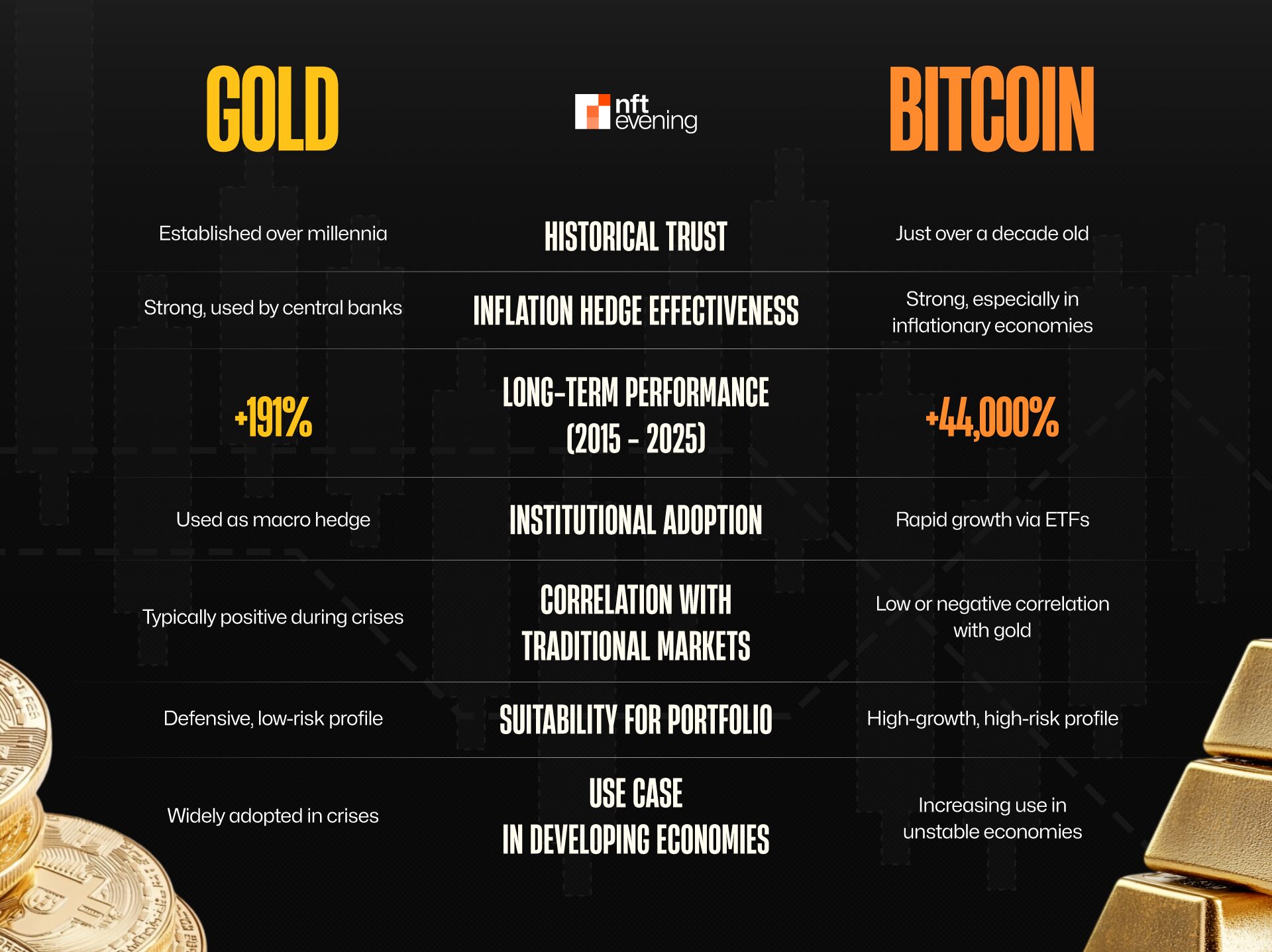

Volatility – Once considered as Bitcoin’s biggest drawback, this shows signs of stability. Bitcoin’s 30-day volatility is currently 46%, its level is the lowest in two years, according to Coinmetrics and Bloomberg. In contrast, the Gold Volatility Index (GVZ) climbed to its highest point since the pandemic, indicating a revival in short-term speculation.

The long-term trends provide a compelling view: Bitcoin has performed significantly better than gold in terms of electricity purchase growth since 2011. However, due to its high volatility, Bitcoin is more suitable for long-term investors with high risk appetite, and gold remains a defensive asset of choice.

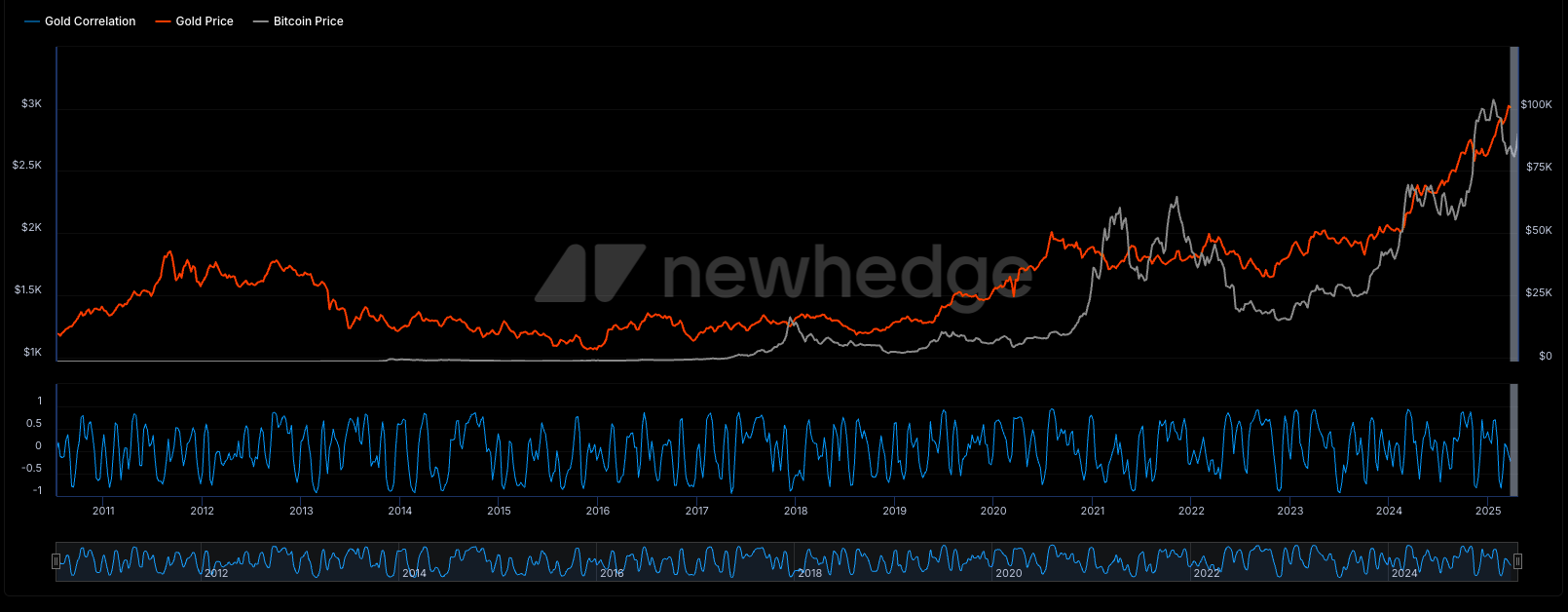

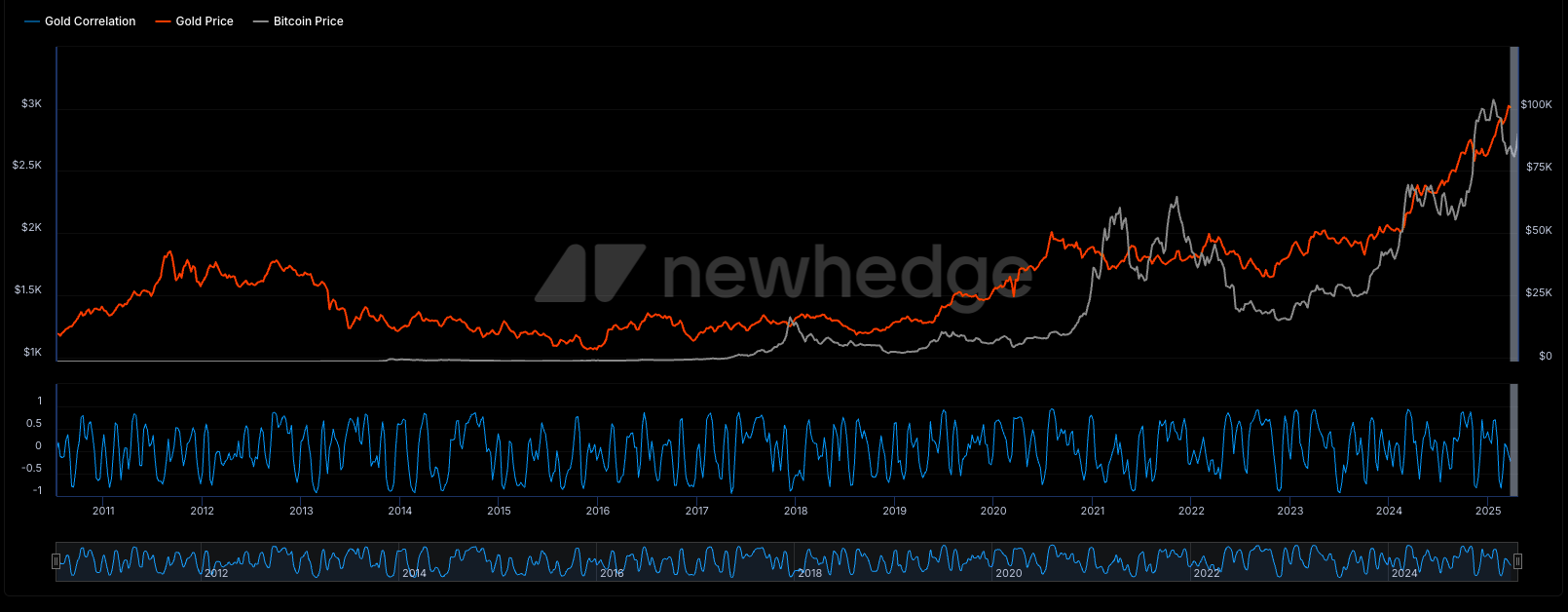

Research shows that Bitcoin and gold remain weak or negatively correlated, especially under market pressure. NewHedge data shows that the correlation between Bitcoin and gold rarely remains above 0.5 and usually becomes negative.

It is worth noting that in major Bitcoin shrinkages (2018, 2022) or sharp episodes (2021), its correlation with gold tends to decline. This evidence suggests that gold responds to risk, while Bitcoin responds to growth and liquidity transfers.

Bitcoin and Gold Relevance – Source: Newhedge

As a result, diversifying the risk-adjusted returns in the portfolio can improve risk-adjusted returns. Investors increasingly view Bitcoin and gold as supplementary assets in modern distribution strategies.

Now, major institutional players prefer double exposures: gold with macroeconomic stability and Bitcoin with asymmetric growth potential. ARK Invest uses gold as a hedge and raises Bitcoin exposure to 12% in 2024.

Skybridge Capital allocates 85% of gold and bonds to 15% of Bitcoin and tech stocks. This balanced strategy has proven to be effective in increasingly volatile market cycles.

in conclusion

While gold provides consistency and trust built over thousands of years, Bitcoin provides adaptability and scalability for the digital future. Historical performance, institutional momentum and evolving monetary policy show that investors’ best strategy is not to choose one side, but to be smart and diversified. Distribute a portion of your portfolio to two assets, balancing between gold’s defense and Bitcoin’s growth trajectory, which may be the best opportunity to maintain and expand wealth in the 21st century.

Read more: Day Trading Crypto: A Beginner’s Guide